Get the free Form 945-V, Payment Voucher Payment Voucher

Get, Create, Make and Sign form 945-v payment voucher

Editing form 945-v payment voucher online

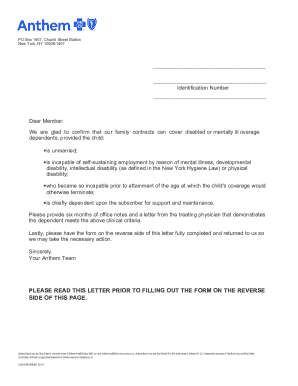

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 945-v payment voucher

How to fill out form 945-v payment voucher

Who needs form 945-v payment voucher?

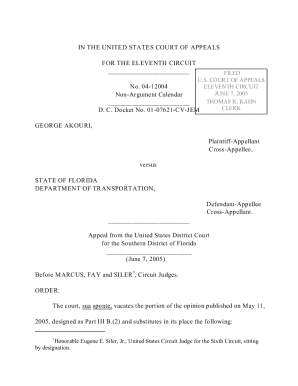

Understanding the Form 945- Payment Voucher Form

Understanding Form 945-

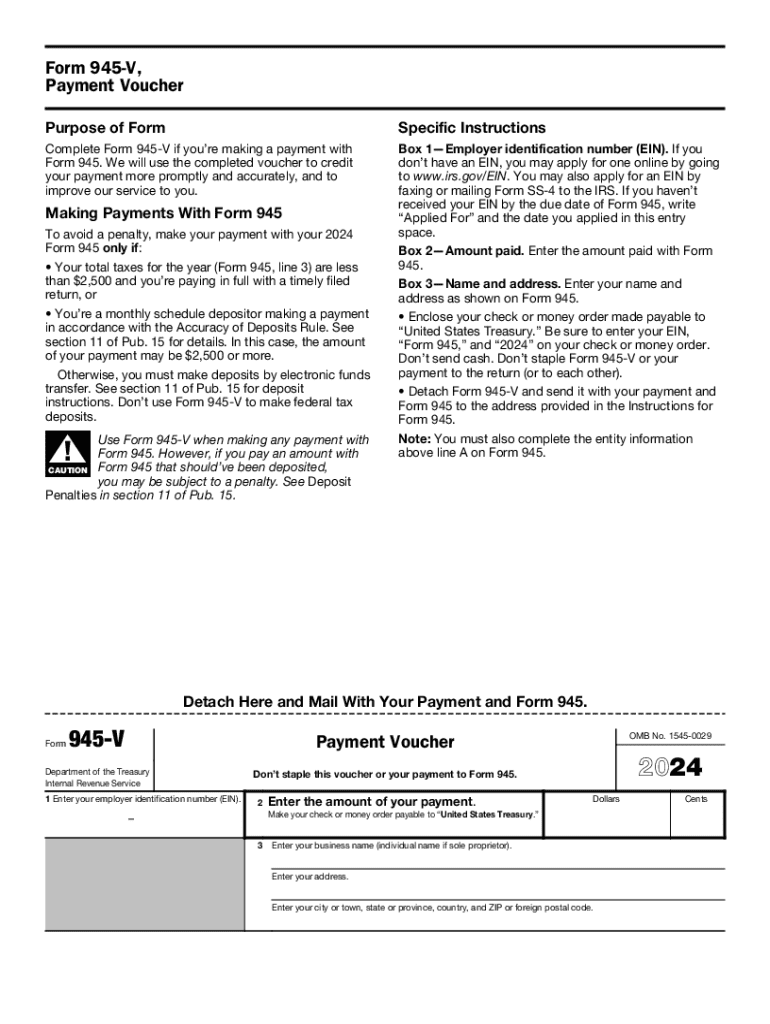

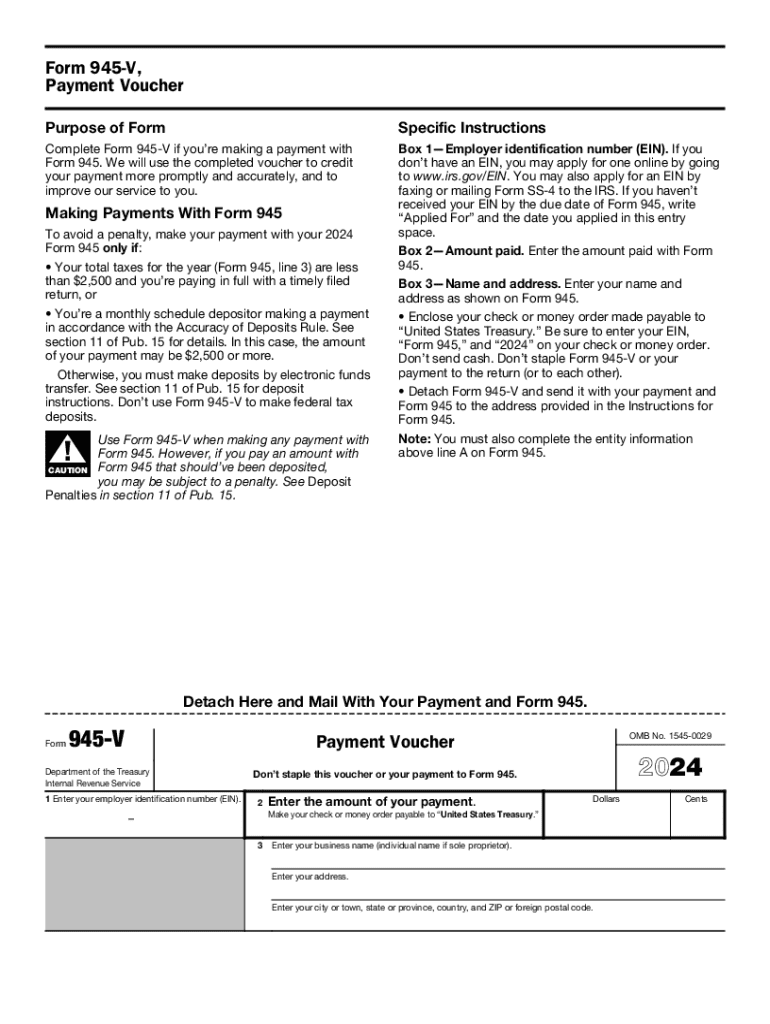

Form 945-V is the payment voucher used by taxpayers to submit their federal tax payments specifically for non-payroll withholding taxes, such as federal income tax withheld from pensions, annuities, and other sources. This form serves a crucial role in ensuring compliance with IRS regulations. By submitting this voucher along with their payments, individuals and businesses can provide the IRS with necessary information that ties the payment back to their tax obligations.

The significance of the Form 945-V lies in its ability to streamline tax payments. Inaccurate or missing payments can lead to penalties and interest, making it essential for taxpayers to use the form correctly. By properly completing and submitting the Form 945-V, taxpayers contribute to accurate tracking of their tax responsibilities and help avert potential discrepancies that can lead to audits.

Who should use Form 945-?

Form 945-V is primarily relevant for individuals and organizations that make federal tax deposits for non-payroll income. Specifically, the target audience includes:

These groups are crucial in the operations of the economy, providing essential payments to the federal government. Having a clear understanding of when and how to use Form 945-V can prevent potential pitfalls in the tax compliance process.

Key components of Form 945-

Completing Form 945-V accurately is paramount to ensure proper crediting of payments. The key components required include:

Additionally, there may be optional sections, like a statement of any underpayment, that can provide the IRS with more context regarding your payment. These details foster transparency and can assist in easier reconciliations if questions arise about the payment.

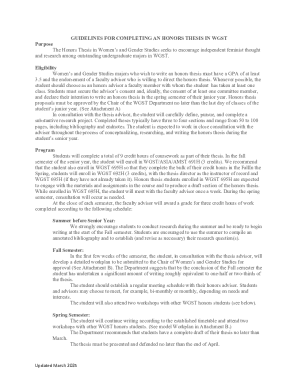

Step-by-step instructions for completing Form 945-

Step 1: Gathering necessary information

Before starting the completion process, gather essential documents such as previous tax returns, your TIN, and records of income that will be taxed. It’s critical to ensure personal information is secured during this process to protect against identity theft.

Step 2: Completing the form

Begin filling out Form 945-V by accurately entering your TIN, the payment amount, and the payment period. Make sure to follow the IRS instructions closely for each field, as missing information can lead to payment delays.

Step 3: Reviewing your form

Once you have filled out the form, review it thoroughly. Common mistakes include typos in your TIN or payment amounts. A checklist can help ensure you haven’t overlooked anything: validate your TIN, double-check the payment amount, and confirm the payment period corresponds to the earnings.

Submitting your Form 945-

After completing Form 945-V, it's vital to understand your submission options. Payments can be submitted in a variety of ways:

Be aware of deadlines associated with Form 945-V to avoid late payment penalties. Familiarize yourself with the IRS calendar to ensure timely submissions.

Managing payments with Form 945-

Once you have submitted your payment using Form 945-V, managing that payment history becomes important. Keep records of your submitted forms and payments to provide verification if needed. Make sure to track when payments were made and the amounts for your records.

If you discover errors after submission, there are methods available for amending your payments. Correcting mistakes quickly can prevent complications, and knowing how to properly amend submissions can save you from future issues. Furthermore, be prepared with a plan for handling rejected submissions, such as verifying the initial details before resubmission.

Editing and signing Form 945- using pdfFiller

pdfFiller offers powerful interactive tools that streamline the process of completing Form 945-V. Users can take advantage of pre-filled templates that ease the entry of repetitive information, significantly saving time.

The e-signature feature allows for quick digital signing, ensuring that the form is ready for submission without the need for printing or mailing. This digital process aligns seamlessly with compliance, making it easier for users to meet deadlines.

Collaboration features for teams

pdfFiller’s cloud-based solution empowers team collaboration through shared access to documents. Colleagues can comment and provide revisions directly on the document, facilitating smooth workflow among teams managing tax submissions.

Benefits of using pdfFiller for Form 945-

Utilizing pdfFiller for completing Form 945-V brings several advantages. The cloud-based system enables users to access their documents from anywhere, providing flexibility that aligns with today's remote working needs.

Moreover, the seamless editing and comprehensive document management capabilities of pdfFiller make it easy to maintain an organized filing system for tax payments. Security features are also robust, ensuring that sensitive information remains protected throughout the submission process.

FAQs on Form 945-

Many users inquire about the specifics of filling out Form 945-V. Common questions include:

Clarifying these common concerns can help taxpayers navigate the process more effectively, minimizing the risk of oversight and confusion.

User experiences and testimonials

Users of pdfFiller have shared their experiences with Form 945-V, highlighting ease of use and efficiency. Many appreciate how pdfFiller simplifies the completion process with intuitive interfaces and helpful customer support.

Case studies have demonstrated successful submissions where users were able to manage their tax payments efficiently and without incident. The testimonials speak to the overall reliability of pdfFiller in handling essential forms like the Form 945-V.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 945-v payment voucher to be eSigned by others?

How do I execute form 945-v payment voucher online?

How do I edit form 945-v payment voucher straight from my smartphone?

What is form 945-v payment voucher?

Who is required to file form 945-v payment voucher?

How to fill out form 945-v payment voucher?

What is the purpose of form 945-v payment voucher?

What information must be reported on form 945-v payment voucher?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.