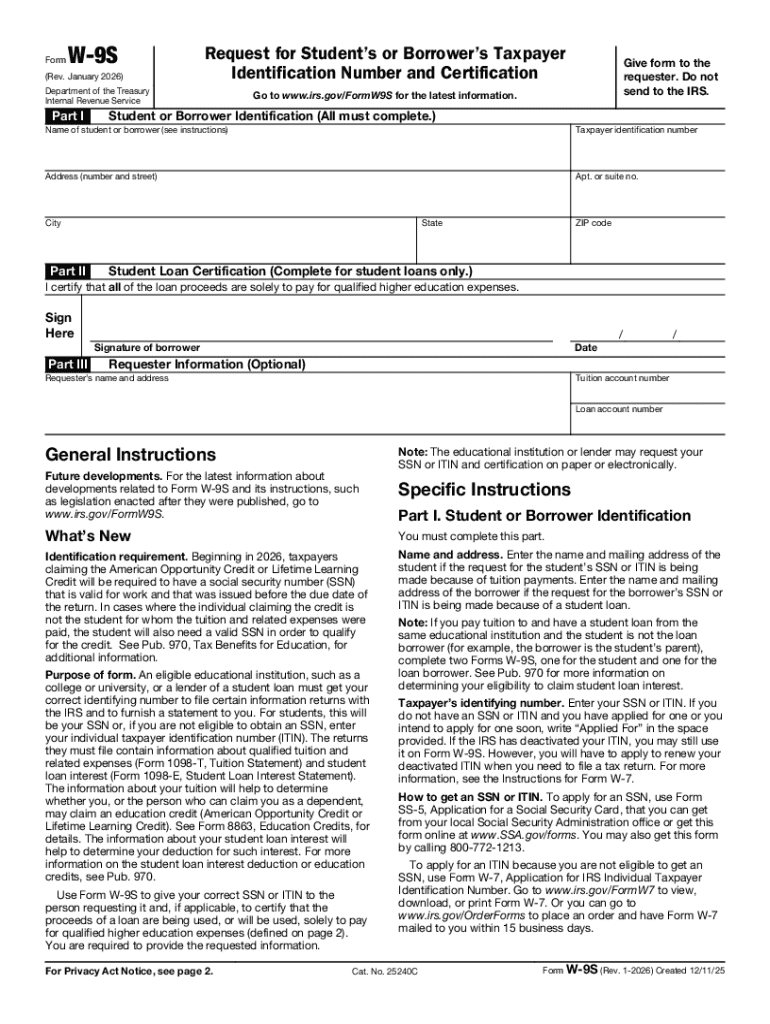

IRS W-9S 2026 free printable template

Get, Create, Make and Sign IRS W-9S

How to edit IRS W-9S online

Uncompromising security for your PDF editing and eSignature needs

IRS W-9S Form Versions

How to fill out IRS W-9S

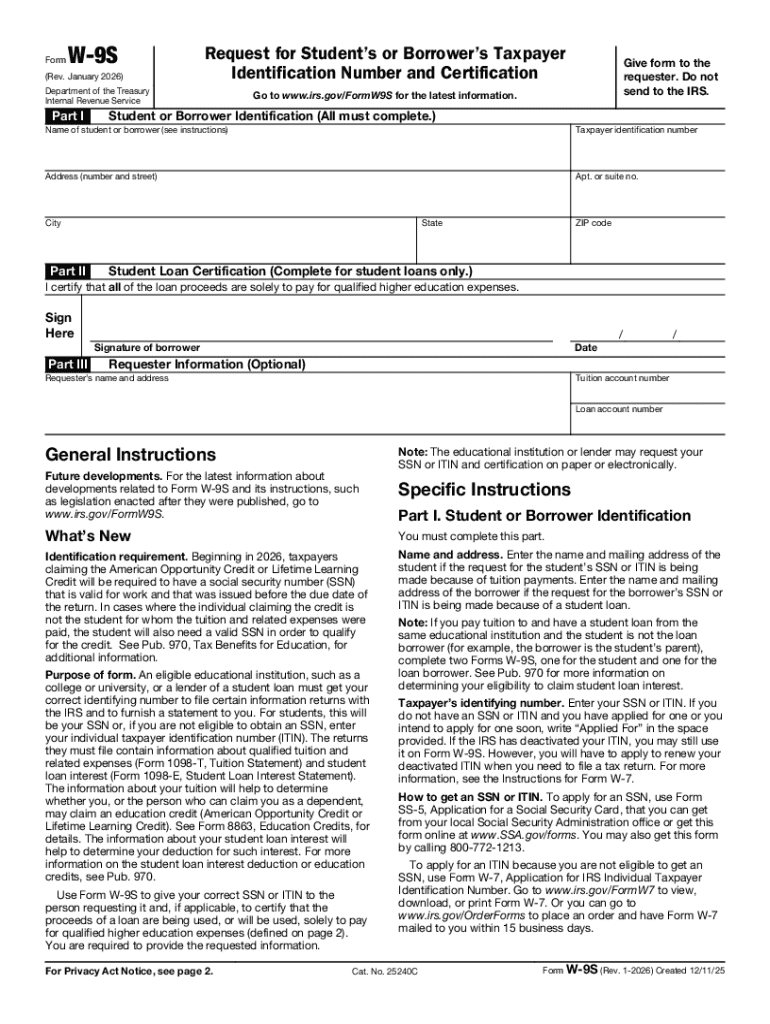

How to fill out form w-9s rev january

Who needs form w-9s rev january?

Understanding Form W-9s Rev. January Form

Overview of Form W-9

Form W-9, also known as the Request for Taxpayer Identification Number and Certification, is a critical document used for tax reporting purposes in the United States. Its primary function is to collect the correct taxpayer information necessary for entities that are required to report various types of income to the IRS.

This form is essential for individuals and businesses alike, as it ensures accurate income reporting and compliance with tax laws. When a business pays an independent contractor or freelancer, they typically request a completed W-9 to obtain the recipient's Taxpayer Identification Number (TIN). Without this information, businesses risk facing penalties during tax season.

Understanding the January Revision

The January revision of Form W-9 represents an update aimed at refining taxpayer interaction with documentation and requirements. The IRS periodically revises forms to improve clarity, enhance privacy protections, and address any previous ambiguities. This particular revision can often introduce new features or clarify existing fields, making the form easier to navigate.

In the Rev. January version, significant changes may include clarified regulations regarding disclosure requirements, as well as enhanced privacy protections designed to better secure taxpayers' sensitive information. Understanding these changes is critical for both individuals and businesses who need to ensure compliance and avoid any fines associated with incomplete or incorrect filings.

Filling out Form W-9: Step-by-step guide

Filling out Form W-9 accurately is crucial, as errors can lead to delays and complications in tax processing. The form consists of several sections that collect specific information, and each must be completed with care.

Section 1: Personal identification

The first section requires your full name, as it appears on your tax return. If you have a business name, you should also include it in the designated field. Make sure to use your legal name to avoid discrepancies. Failure to provide the correct name can lead to issues with the IRS.

Section 2: Federal tax classification explained

In this section, you need to indicate your federal tax classification. This may include options like Individual/Sole Proprietor, Corporation, Partnership, or Limited Liability Company (LLC). Each classification has different implications for tax liabilities and filing responsibilities, which makes it crucial to select the correct one.

Section 3: Taxpayer identification number (TIN)

This section asks for your Social Security Number (SSN) or Employer Identification Number (EIN). If you work as an independent contractor, usually, you'll provide your SSN. If you are an LLC, you may need to use your EIN. Choosing the correct TIN is essential to ensure proper tax reporting.

Section 4: Certification process

This final section requires your signature and the date of completion. Signing the form certifies that the provided information is accurate and that you are aware of your responsibilities regarding tax regulations. Avoid common mistakes such as signing or dating the form incorrectly, which can invalidate it.

Interactive tools for form W-9 management

Managing your Form W-9 efficiently can save time and prevent errors. pdfFiller offers a robust set of tools that allow users to fill out, edit, and manage the W-9 form online. The platform ensures each user has access to an intuitive interface with interactive features that streamline the process.

PDF editing features on pdfFiller

One of the standout features of pdfFiller is the ability to access and edit the form online. You can easily navigate through fields, ensuring that no information is missed. Furthermore, adding digital signatures on the form is as seamless as a few clicks, helping to maintain compliance and legal standing.

Collaboration features for teams

For teams managing multiple W-9s, pdfFiller offers collaboration features that make it easy to share forms for review and approval. With built-in tracking changes capabilities and a version history, users can easily keep track of updates and revisions. This collaboration tool is invaluable for businesses that frequently handle numerous W-9 forms.

Common pitfalls when handling Form W-9

When dealing with Form W-9, there are several common pitfalls that can cause unnecessary issues. One of the most significant errors is inaccurately reporting the Taxpayer Identification Number (TIN). Reporting an incorrect TIN can lead to fines and complications during tax time. It’s essential to double-check this information before submission.

Additionally, failing to update W-9 information can cause headaches down the line. Whenever there’s a change in your identification or entity structure, it’s vital to submit a new W-9 form. Not doing so may result in discrepancies between reported income and the IRS’s records, leading to potential audits or fines.

Best practices for storing and managing Form W-9

Properly managing and storing your Form W-9 is crucial to maintain compliance and security. Using secure storage solutions, such as cloud platforms like pdfFiller, can help keep your documents organized and easily accessible. This is particularly important for businesses handling multiple forms that need to be easily retrievable.

To further enhance organization, consider implementing a filing system that categorizes forms by date, type, or any other relevant criteria. This can streamline retrieval and ensure you can provide the necessary documentation when requested. When it comes to sharing, ensure that you send W-9 forms securely to clients and partners to protect sensitive information and maintain confidentiality.

W-9 vs. other tax forms: understanding your options

Understanding the differences between Form W-9 and other tax forms is essential for proper compliance. The two forms often compared are the W-9 and the 1099. While the W-9 is used to provide identifying information, the 1099 is used to report payments made to freelancers or contractors.

A clear understanding of when to use each form is vital for tax compliance. For instance, Form W-9 should be obtained before making a payment, while the 1099 form is issued at year-end to report total payments. Both forms serve different but complementary roles in the tax reporting process.

FAQs about Form W-9 Rev. January

There are several common questions that individuals and businesses have regarding Form W-9, particularly in relation to the January revision. One common query is, 'What if a client refuses to provide a W-9?' This situation should be handled delicately, as having this form is crucial for tax compliance.

Another frequently asked question is about how long to keep a W-9 on file. Generally, businesses should retain this form for at least five years after the last payment is made to the individual or company. Understanding changes in tax laws and how they affect W-9 filing requirements is also essential for compliance.

The future of Form W-9: what to anticipate

With ongoing changes in tax laws and advancements in technology, the future of Form W-9 may see several updates. The IRS has been working on embracing more digital solutions to streamline tax documentation processes. We can anticipate that future revisions will continue to focus on enhancing security and clarity for users.

As digital trends continue to evolve, users may expect features that facilitate easier access and management of the W-9 form. Those who utilize platforms like pdfFiller may benefit significantly from these changes as the platform adapts to future documentation needs.

User testimonials and success stories with pdfFiller

Users have shared their positive experiences with pdfFiller in managing Form W-9. Many individuals and teams appreciate the platform for its ease of use, allowing them to fill out, eSign, and store their forms seamlessly. The user-friendly interface has made a significant difference, particularly for businesses handling a large volume of documents.

Teams have reported that using pdfFiller streamlines their workflow, making it easier to collaborate on document reviews and approvals. With features that enhance productivity and minimize errors, pdfFiller stands out as a preferred solution for managing Form W-9 and other documentation needs.

People Also Ask about

Do you have to claim a 1098-T form on your taxes?

Can I fill out 1098-T online?

How do I get my 1098-T form from UTA?

What happens if I don't report my 1098-T?

Is there a penalty for not filing a 1098-T?

Do I have to claim my 1098-T?

How do I claim my 1098-T on my taxes?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get IRS W-9S?

Can I create an eSignature for the IRS W-9S in Gmail?

How do I complete IRS W-9S on an iOS device?

What is form w-9s rev january?

Who is required to file form w-9s rev january?

How to fill out form w-9s rev january?

What is the purpose of form w-9s rev january?

What information must be reported on form w-9s rev january?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.