Get the free Employers Return for Payroll Tax Withheld

Get, Create, Make and Sign employers return for payroll

How to edit employers return for payroll online

Uncompromising security for your PDF editing and eSignature needs

How to fill out employers return for payroll

How to fill out employers return for payroll

Who needs employers return for payroll?

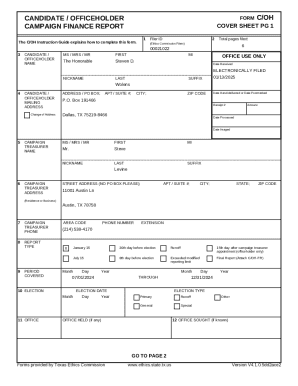

Employers' Return for Payroll Form: A Comprehensive How-to Guide

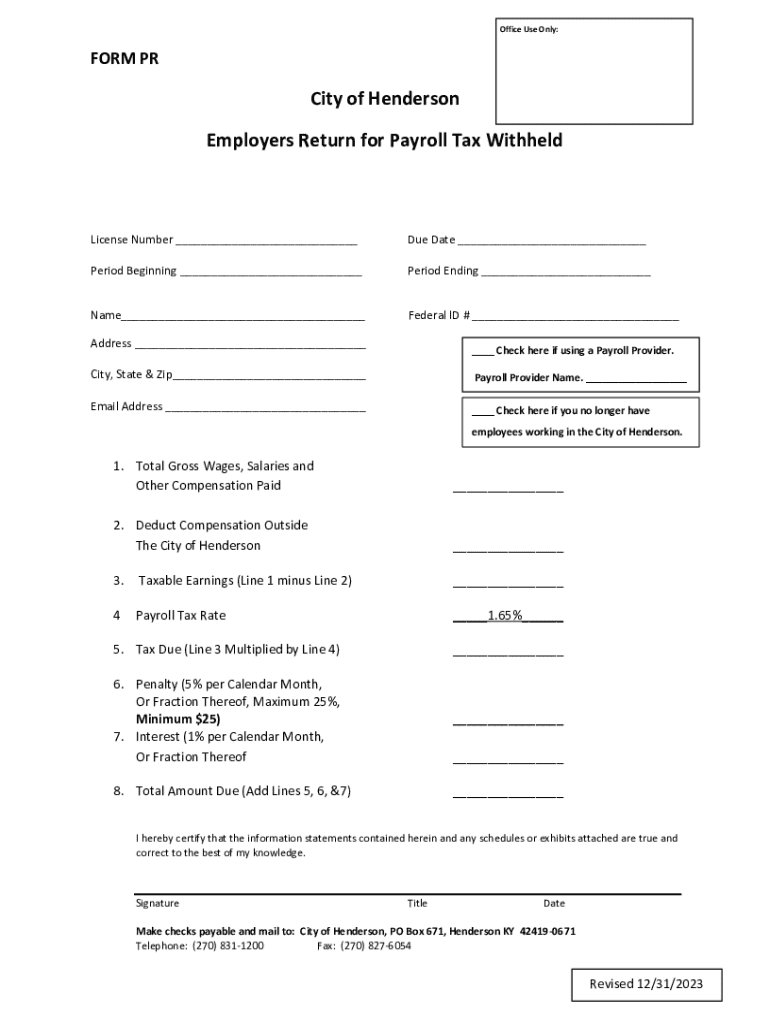

Understanding the Employers' Return for Payroll Form

The Employers' Return for Payroll Form serves as a critical tool for businesses to report and manage payroll-related information. This form is designed to ensure that employers accurately account for the taxes deducted from employees’ wages, fulfilling their obligations under federal and state tax laws. The form plays a dual role; it not only helps employers maintain compliance with tax regulations but also affects employees’ income taxes and tax credits.

The significance of the Employers' Return for Payroll Form extends beyond mere compliance. For employees, accurate reporting can mean the difference between a smooth tax filing process and facing complications during tax season. Moreover, this form is integral in determining eligibility for various tax benefits that employees might rely on. Thus, understanding this form is essential for both employers and employees.

Key components of the form

This form includes various critical fields that must be completed accurately. Key components typically involve the employer’s information, a breakdown of employee compensation, and calculations related to tax withholdings. Understanding crucial terminology like ‘withholdings’—the portion of income withheld for taxes—and ‘tax credits’—deductions that reduce the total tax owed—is indispensable for filling out this form correctly.

Why proper completion of the payroll form matters

Accurate completion of the Employers' Return for Payroll Form is vital to avoid potential penalties, fines, and legal repercussions. If the form submitted contains inaccuracies, employers might face financial liability during audits, and employees could encounter tax implications that complicate their federal and state tax returns. This often leads to additional bureaucracy and frustration for both parties.

On the flip side, accurate submissions foster trust between employers and employees. When payroll processes run smoothly, employees are more likely to perceive their employers as diligent and responsible, which can improve overall workplace morale. Furthermore, the simplification of payroll tasks allows for more efficient processing. Both employer and employee satisfaction hinges significantly on the accuracy of this form.

Step-by-step guide to filling out the employers' return for payroll form

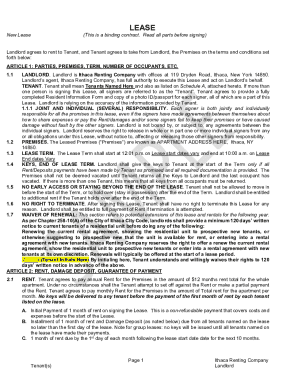

To ensure correctness, thorough preparation is necessary before filling out the Employers' Return for Payroll Form. Begin by gathering essential information. Collect relevant employee data, such as names, Social Security numbers, and compensation details. Additionally, have your financial records handy, including payroll reports and any tax documents that support your entries.

When you're ready to fill out the form, progress section-by-section. Start with the personal details of the employer, including the legal entity name, address, and employer identification number (EIN). Next, provide detailed employee compensation information—specific wage information is paramount. Accurately calculate tax withholdings based on employee classifications and ensure all special allowances, such as bonuses or commissions, are included.

Editing and modifying the payroll form

With pdfFiller, you have access to a suite of tools designed to simplify and enhance the editing process for payroll forms. The platform offers intuitive features that allow you to upload the Employers' Return for Payroll Form easily and make real-time edits. Secure storage is also a fundamental feature, ensuring that sensitive payroll data is protected from unauthorized access.

Collaboration is vital in payroll processing, and pdfFiller facilitates this through its real-time collaboration tools. Engage your team members directly on the platform to verify data accuracy. Utilize comments and feedback mechanisms to communicate effectively about any required changes or clarifications, fostering a team dynamic that prioritizes correctness.

Signing and securing the payroll form

Once the Employers' Return for Payroll Form is filled out, the next step is securing it through eSigning. With pdfFiller, the integration of electronic signatures is seamless and straightforward. Follow the step-by-step process outlined on the platform to ensure that all parties involved can sign the document digitally, which is both legally valid and secure.

Proper storage of your payroll form is equally vital. Utilize cloud storage best practices to keep your documents organized and accessible only to authorized personnel. Implementing roles and permissions for stakeholders can ensure that sensitive payroll information remains confidential while still providing necessary access for those who need it.

Managing payroll documentation over time

As payroll forms are crucial for tax compliance and employee records, establishing a systematic approach to archiving and retrieval is essential. Develop efficient document organization strategies such as categorizing forms based on tax years or employee classifications. Creating easy access points for historical payroll forms can streamline future audits and financial reviews.

Compliance with local regulations also demands ongoing vigilance. Ensure that all payroll-related documents adhere to federal, state, and local guidelines by reviewing them periodically. This proactive approach allows for timely updates and helps mitigate the risks associated with potential compliance breaches.

Troubleshooting common issues

Even with careful attention, errors can occur when filling out the Employers' Return for Payroll Form. If you encounter mistakes, there are clear steps you can take for correction. Assess the specific sections where errors occurred and make any necessary adjustments. If required, consult payroll advisors or legal teams for expert guidance on how to amend your form properly.

It’s equally essential to maintain open lines of communication with affected employees. Should discrepancies arise, employ clear communication strategies to address concerns effectively. Transparency is crucial in payroll matters to foster trust and mitigate confusion, ensuring that all parties remain informed throughout the process.

Additional considerations for employers

Certain employment situations, such as those involving freelancers or 1099 contractors, require particular attention when completing the Employers' Return for Payroll Form. Employers have unique responsibilities for managing the payroll and tax implications concerning these workers, separate from traditional employees. Moreover, seasonal employees or interns might necessitate different reporting procedures, impacting how payroll is handled.

Finally, staying updated with future changes in payroll filing requirements is crucial. Payroll regulations can evolve, necessitating that employers keep informed about new tax laws and compliance requirements. This ongoing education helps businesses effectively manage payroll responsibilities and avoid compliance pitfalls, supporting both employers and their respective workers.

Conclusion: Empowering your payroll process with pdfFiller

Embracing cloud-based document management solutions, such as pdfFiller, unlocks the potential for seamless handling of payroll tasks. This platform not only simplifies form editing, signing, and collaboration but also enhances overall efficiency during payroll processing. By utilizing pdfFiller’s innovative features, employers can ensure accuracy and timeliness in their payroll form submissions—critical factors in maintaining compliance and fostering positive employee relations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the employers return for payroll in Chrome?

How do I edit employers return for payroll straight from my smartphone?

Can I edit employers return for payroll on an Android device?

What is employers return for payroll?

Who is required to file employers return for payroll?

How to fill out employers return for payroll?

What is the purpose of employers return for payroll?

What information must be reported on employers return for payroll?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.