Get the free Stop-loss disclosure form Instructions for completion HIPAA Privacy ...

Get, Create, Make and Sign stop-loss disclosure form instructions

How to edit stop-loss disclosure form instructions online

Uncompromising security for your PDF editing and eSignature needs

How to fill out stop-loss disclosure form instructions

How to fill out stop-loss disclosure form instructions

Who needs stop-loss disclosure form instructions?

Stop-loss disclosure form instructions: A comprehensive guide

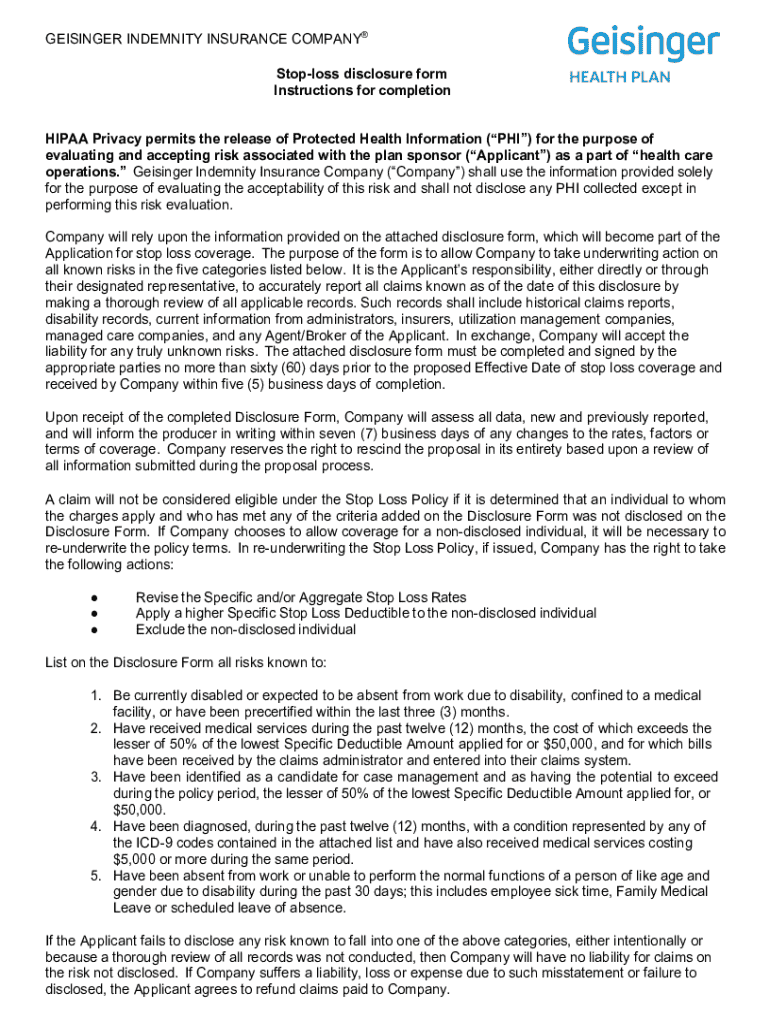

Understanding the stop-loss disclosure form

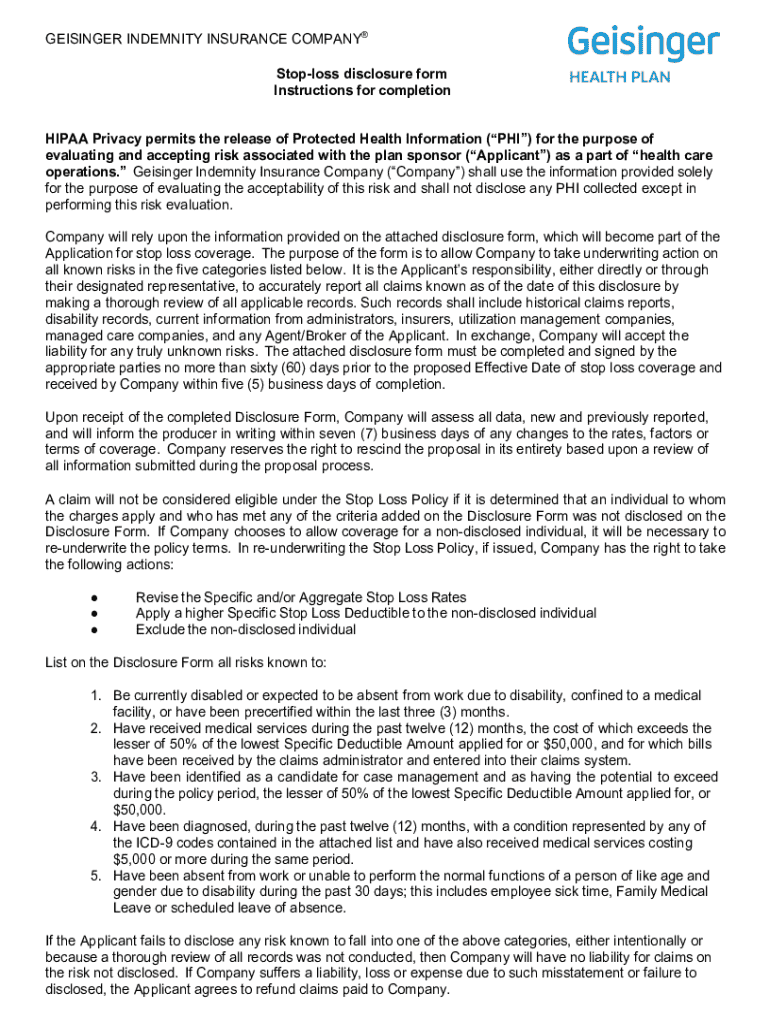

A stop-loss disclosure form is a critical document used within the insurance industry, particularly in self-insured health plans. This form outlines the protections and limits put in place to safeguard against excessive claims that could potentially devastate an organization's budget. Understanding the stop-loss disclosure form is essential for businesses and individuals engaging with stop-loss insurance policies.

The importance of stop-loss disclosure lies in its role in providing transparency and understanding of an insurance policy's coverage limits, exclusions, and the extent of financial protection offered. Knowing what is included in the policy can significantly affect the financial planning and decision-making processes of both individuals and organizations.

Key terminologies like 'attachment point' and 'policy limits' are crucial in this context. The attachment point is the predetermined threshold at which the stop-loss coverage begins to pay for claims, while policy limits dictate the maximum amount the insurer will pay during a coverage period. Understanding these terms is vital for accurately filling out and utilizing the stop-loss disclosure form.

Who needs to fill out the stop-loss disclosure form?

Individuals typically need to complete a stop-loss disclosure form when they are participating in a self-funded insurance plan. This includes scenarios where they wish to assess their potential liabilities regarding high-cost medical events. Understanding the specifics of the plan's coverage is essential for individuals to ensure adequate financial protection.

Teams and organizations managing group insurance plans are also required to fill out this form to facilitate the enrollment process in stop-loss insurance. This is crucial for companies looking to protect their employee benefits plan from unforeseen high medical costs. Employers should carefully review and complete the form to ensure they meet compliance regulations and fully understand their coverage.

Accessing the stop-loss disclosure form

Finding the stop-loss disclosure form is straightforward, especially through platforms like pdfFiller. Users can navigate directly to pdfFiller's site, where they can easily search for the stop-loss disclosure form, ensuring they have the most current version available for use.

In addition to its PDF format, pdfFiller allows users to access the form in various other document formats, making it easier to integrate into existing workflows. This versatility ensures that users can adapt the documentation to fit their needs, whether for digital submissions or printed copies.

Step-by-step instructions for completing the stop-loss disclosure form

Completing the stop-loss disclosure form involves careful preparation. Start by gathering necessary information, including your personal details and specifics about your current insurance policy. It's also essential to identify any required supporting documents that may accompany the form, ensuring a smooth completion process.

Let’s break down the form step-by-step:

Common mistakes to avoid include omitting important details or misinterpreting terms, which can lead to inaccuracies during the submission process.

Once completed, review your entries thoroughly to ensure all information is accurate. A recommended review checklist can help catch any potential errors before submission, validating that everything is in order.

Editing and customizing the stop-loss disclosure form

After filling out the stop-loss disclosure form, you might want to make changes or updates. pdfFiller offers an array of editing tools that allow users to modify their documents seamlessly. Whether you need to adjust specific details or complete the form with new information, these capabilities ensure you can keep your document up-to-date.

If you've already submitted the form but need to make changes, know that pdfFiller caters to these needs, enabling edits post-submission. Additionally, electronic signatures can be added easily, helping to streamline the approval and submission process.

Collaboration is also made easy with pdfFiller, allowing team members to provide input directly on the document. This collaborative approach enhances accuracy and ensures that everyone involved is on the same page.

Additional features of pdfFiller for managing your stop-loss disclosure form

pdfFiller is designed with user-friendly features that assist in managing documents like the stop-loss disclosure form effectively. Users can save their documents and access them anytime, anywhere, alleviating concerns about lost paperwork or misplaced files.

Version control is another critical feature that helps users keep track of changes made over time. This function is particularly valuable when multiple stakeholders are involved in the review and approval process, providing clarity and accountability.

Security is paramount when handling sensitive information associated with insurance forms. PdfFiller incorporates robust security measures to protect your data, ensuring peace of mind as you navigate the documentation process.

Common questions and troubleshooting tips

Navigating the stop-loss disclosure form can raise questions. Some frequently asked questions involve understanding what information is required on the form and how to submit it correctly. Moreover, potential issues during submission may arise, but having a grasp of common troubleshooting tips can ease the process.

Key troubleshooting tips include the following:

Utilizing pdfFiller for future document management tasks

Looking beyond the stop-loss disclosure form, pdfFiller provides options to explore other related forms and templates, making it a comprehensive solution for document management needs. Whether you require additional insurance forms or entirely different documents, most options are readily available at your fingertips.

Leveraging the platform allows users to streamline their document creation processes, enabling individuals and teams to manage all paperwork within one cloud-based environment. This integrative approach enhances efficiency and helps in reducing the chaos surrounding document management.

Contacting support for further assistance

If additional assistance is needed while managing the stop-loss disclosure form, pdfFiller offers a dedicated support team accessible for inquiries and technical support. Users can reach out to them through the platform for prompt help or clarification.

Furthermore, community resources and forums provide helpful insights and solutions shared by other users. Engaging with these resources can supplement your understanding and offer additional tips for effective document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my stop-loss disclosure form instructions in Gmail?

How do I complete stop-loss disclosure form instructions online?

How do I make changes in stop-loss disclosure form instructions?

What is stop-loss disclosure form instructions?

Who is required to file stop-loss disclosure form instructions?

How to fill out stop-loss disclosure form instructions?

What is the purpose of stop-loss disclosure form instructions?

What information must be reported on stop-loss disclosure form instructions?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.