Get the free Liability Coverage Waiver Form

Get, Create, Make and Sign liability coverage waiver form

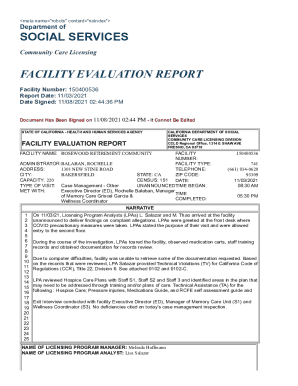

Editing liability coverage waiver form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out liability coverage waiver form

How to fill out liability coverage waiver form

Who needs liability coverage waiver form?

Liability Coverage Waiver Form - How-to Guide Long-Read

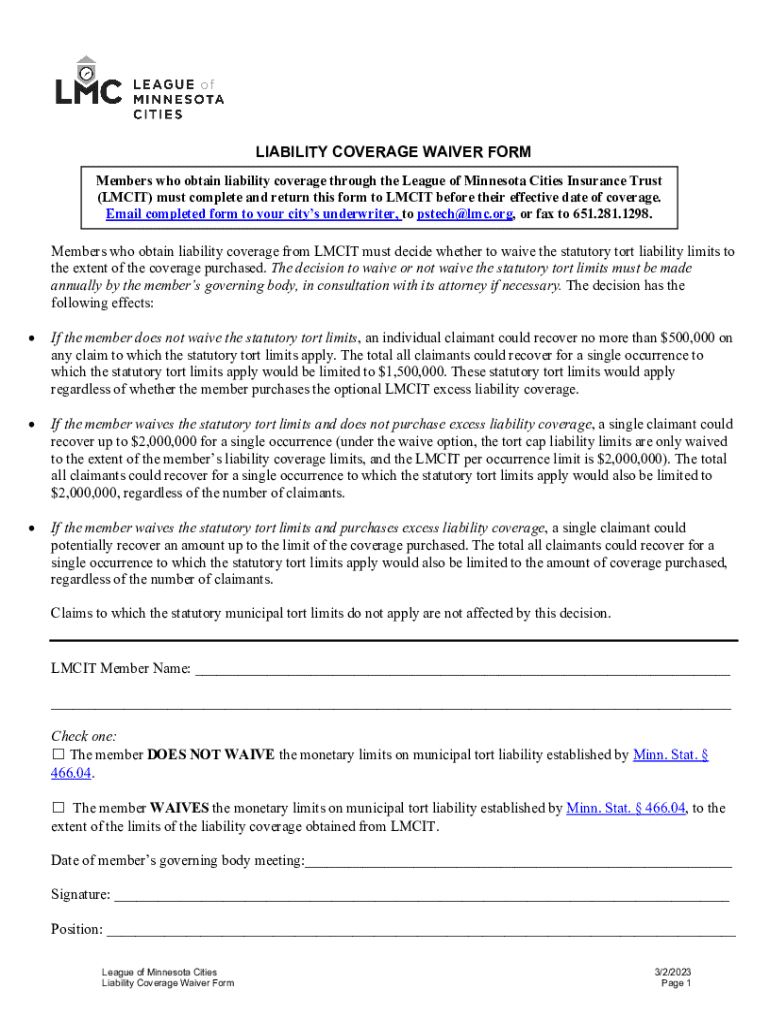

Understanding liability coverage waiver forms

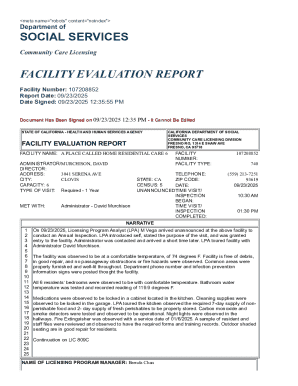

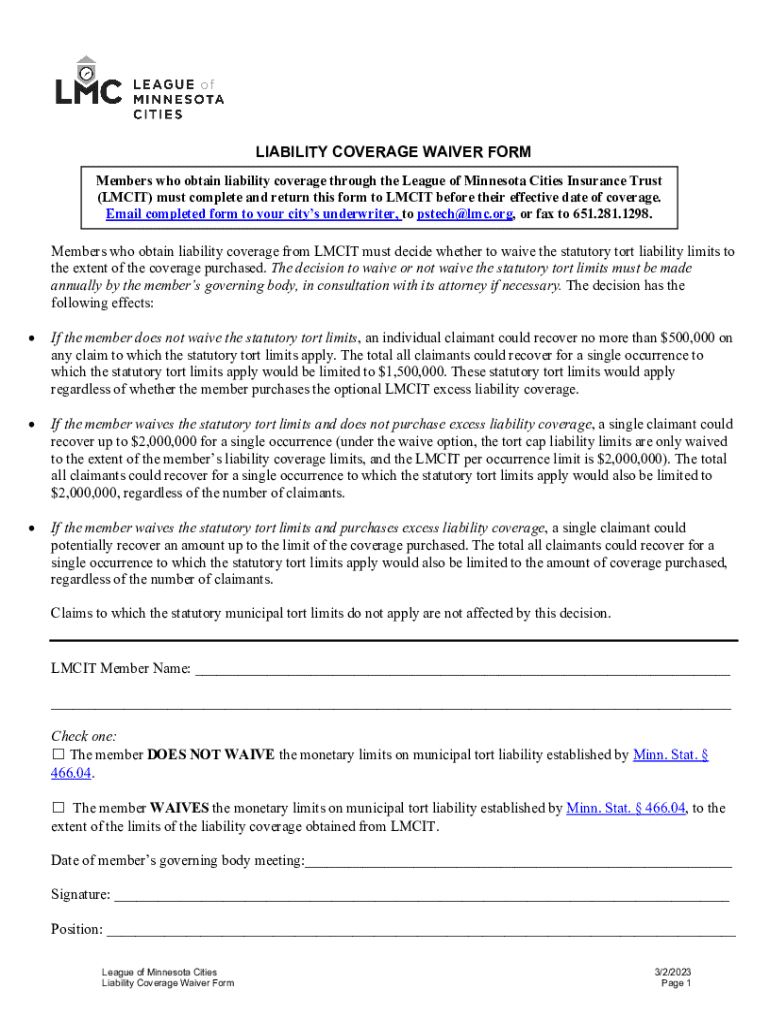

A liability coverage waiver form is a legal document that individuals or organizations use to relinquish their right to make a claim against a party or entity for negligence that results in injury or damage. This form serves as an acknowledgment of the risks associated with a specific activity and often aims to protect the entity providing the activity from potential lawsuits. Liability waivers are particularly important in industries such as sports, entertainment, and services where participants engage in activities that carry inherent risks.

The necessity of liability coverage waiver forms cannot be overstated. For organizations, these waivers enhance risk management strategies and can help minimize potential financial losses stemming from lawsuits and claims associated with injuries. They play a crucial role in protecting the interests of businesses, ensuring that participants are fully aware of the risks before partaking in activities.

Importance of waiving liability

Waiving liability is a fundamental aspect of risk management for both individuals and organizations. It allows athletes, clients, or participants to understand the risks associated with an activity while enabling businesses to operate more securely. In scenarios such as high-contact sports, event organization, or providing professional services, waivers help convey potential hazards and release the organization from future legal consequences.

Consider a sports club where waivers serve a pivotal role. Each participant in physically demanding activities, such as contact sports or climbing, must be aware that they might encounter injuries. When a participant signs a waiver, they effectively acknowledge that they have been informed and accept the risks involved. If an injury occurs, the waiver can serve as a defense against claims, underlining the organization's efforts to be transparent about the risks.

Step-by-step guide to filling out a liability coverage waiver form

Filling out a liability coverage waiver form requires careful attention to detail to ensure all necessary information is provided accurately. Before you dive in, consider the information you will need to complete the form successfully. Specifically, identify all parties involved, clarify the event or activity, and understand what responsibilities you’re assuming when signing the form.

The following sections outline the detailed instructions you should follow when filling out the form:

Double-check each section to ensure accuracy, as errors could invalidate the waiver or expose an organization to liability.

Editing and customizing your waiver

To address unique needs, modifying a standard liability coverage waiver form is essential. While templates provide a foundational structure, adding specific details can make a waiver more effective. Customizations may include industry-specific language, additional clauses relevant to particular activities, or sections that more precisely outline responsibilities. However, when editing legal documents, it's crucial to ensure the waiver complies with relevant laws to maintain its enforceability.

Using pdfFiller's interactive features allows users to collaborate effectively. Team members can contribute suggestions, make comments, and ensure the document meets all required legal standards, which is especially helpful in larger organizations with multiple stakeholders involved.

Managing liability coverage waiver forms effectively

After creating a liability coverage waiver form, effective management is essential. Cloud-based document management solutions, such as those offered by pdfFiller, allow for easy storage and retrieval of these forms. Leveraging cloud technology offers users convenience and enhances accessibility while ensuring that documents are secure.

By employing a centralized system, organizations can streamline sharing among team members, monitor changes to documents, and maintain an audit trail of modifications. Security measures, including encryption and password protection, help safeguard sensitive information. This way, businesses can ensure compliance with privacy regulations while managing risks effectively.

Frequently asked questions about liability coverage waiver forms

Various myths surround liability coverage waiver forms, leading to confusion about their validity. One common misconception is that waivers completely absolve organizations of all responsibility. In reality, the enforceability of a waiver depends on its language, compliance with local laws, and the clarity of risks involved. Depending on the jurisdiction, some courts may not recognize waivers that are deemed overly broad or that involve gross negligence.

Individuals should also understand when it's prudent to consult legal professionals. Seeking legal advice before distributing a waiver can clarify potential pitfalls and enhance defensibility against claims. Additionally, it's essential to consider whether waivers need periodic updates or renewals to remain compliant with changes in laws or organizational policies.

Explore additional features on pdfFiller

pdfFiller offers tools designed to integrate seamlessly with your existing workflows. Users can access a variety of features that enhance document management, such as easy eSigning, form creation, and options for feedback from team members. Dynmaic capabilities allow users to streamline the process of generating and managing waiver forms, ensuring they can meet all compliance requirements without extra hassle.

The platform also gives users access to customer support and ongoing assistance. Testimonials from users highlight the efficiencies created by using pdfFiller for liability waivers, underscoring its role as a comprehensive risk management tool.

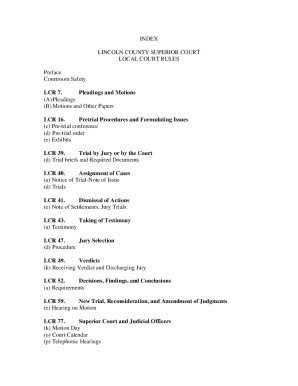

Legal considerations

When drafting a liability coverage waiver form, understanding the relevant laws is vital. Different jurisdictions may have varying regulations regarding waiver enforceability, impacting their legality. It's essential to recognize not only the legal framework but also specific limitations on liability associated with different activities. Establishing waivers that reflect current laws can fortify your ability to defend against potential claims.

Having legal review before distributing waivers ensures compliance and mitigates risks effectively. Legal professionals can help organizations align their waivers with objectives while addressing potential shortcomings that may expose them to liabilities.

Resources and tools for creating waivers

Creating effective liability coverage waiver forms can be a straightforward process with the right tools and resources. Various software solutions provide templates and customizable options, including pdfFiller. Users can develop professional-looking waivers swiftly, ensuring they address grounds for potential liability while facilitating efficient management and storage.

In addition to software applications, participants seeking to learn more about waivers can access reading materials, webinars, and workshops that provide an in-depth understanding of waiver laws and best practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send liability coverage waiver form to be eSigned by others?

How do I complete liability coverage waiver form online?

How do I complete liability coverage waiver form on an Android device?

What is liability coverage waiver form?

Who is required to file liability coverage waiver form?

How to fill out liability coverage waiver form?

What is the purpose of liability coverage waiver form?

What information must be reported on liability coverage waiver form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.