Get the free Form CT-941 Connecticut Quarterly Reconciliation of ...

Get, Create, Make and Sign form ct-941 connecticut quarterly

How to edit form ct-941 connecticut quarterly online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form ct-941 connecticut quarterly

How to fill out form ct-941 connecticut quarterly

Who needs form ct-941 connecticut quarterly?

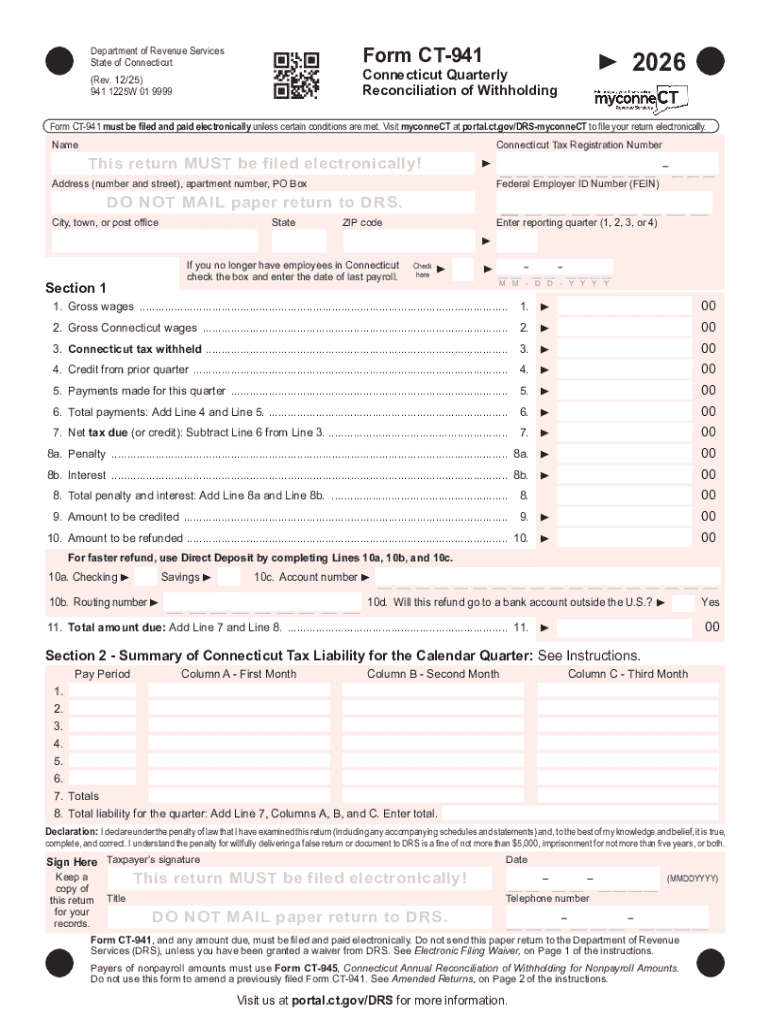

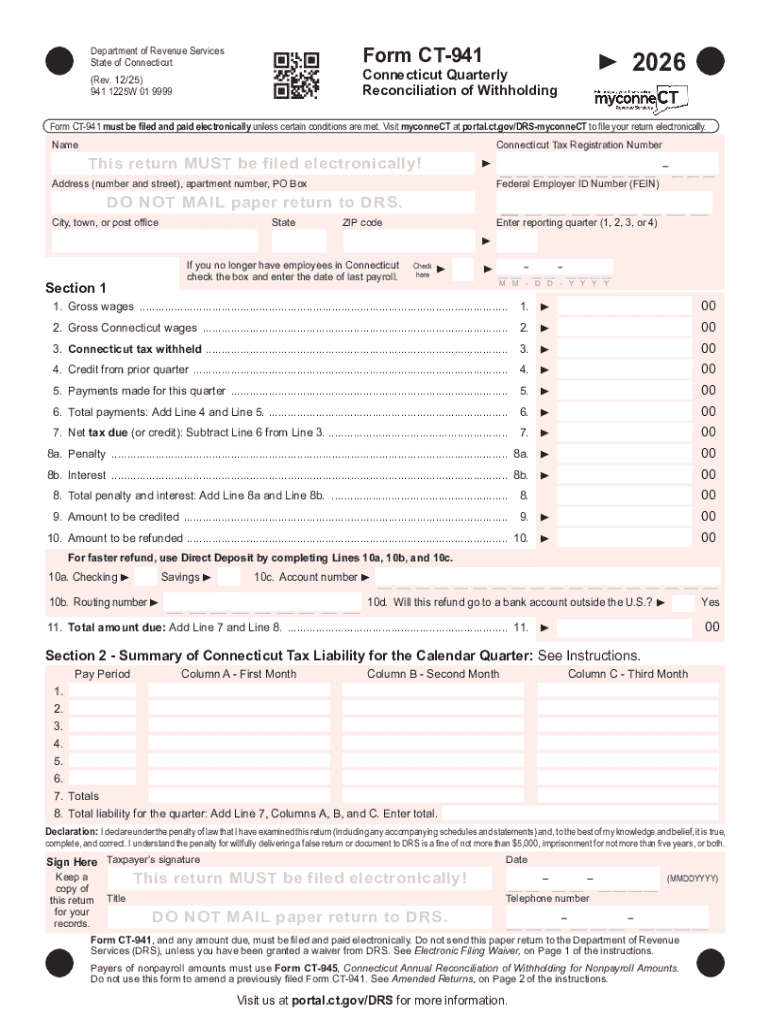

Form CT-941: A Comprehensive Guide to Connecticut's Quarterly Filing

Understanding Form CT-941: What You Need to Know

Form CT-941 is a critical document for employers in Connecticut, designed to report state income tax withheld from employees' wages. This quarterly form provides crucial data that state authorities use to monitor compliance with tax regulations and to maintain accurate records on revenue generated from withholding taxes. As an employer, understanding the purpose of Form CT-941 ensures you meet your tax obligations effectively.

Accurate reporting is crucial; it fosters trust between employers and tax authorities while aiding in the smooth functioning of state tax revenue systems. Failing to provide precise details can lead to various complications, including penalties or additional scrutiny from the Connecticut Department of Revenue Services.

Key aspects of Form CT-941 filling process

Filling out Form CT-941 requires a thorough understanding of the information needed. Initially, you'll need to gather your employer identification details, which include your Federal Employer Identification Number (EIN) and the Connecticut Tax Registration Number. These identifiers are essential to link your filings to your business.

Secondly, you must compile employee wage and tax data for the quarter. This information typically consists of total wages paid, the amount of state tax withheld, and any exemptions or deductions applicable to your employees. The basis on which taxes are calculated also needs careful contemplation, as mistakes in this area can lead to inaccurate filings, which might spur an audit.

Filing frequency for CT-941 is quarterly, meaning you are required to submit the form four times a year. The deadlines for submissions are typically the last day of the month following each quarter's end (i.e., January 31, April 30, July 31, and October 31). Delaying filings beyond these deadlines could result in penalties, including fines or interest on owed amounts.

Step-by-step guide to filling out Form CT-941

Filling out Form CT-941 can seem daunting, but breaking it down into manageable steps can simplify the process. Start by gathering all necessary documentation, which may include paystubs, your tax identification number, and employee records. These documents will provide accurate figures required for the form.

Begin with entering your employer information. Ensure you fill in the business name, address, and identification numbers carefully. Accuracy at this stage makes a significant difference in your filing's legitimacy.

Next, calculate employee wages and the corresponding taxes withheld. It's essential to follow the guidelines set by the Connecticut Department of Revenue Services to ensure your calculations are correct. Compile all aggregate wages and the amount withheld, making sure this aligns with what has been reported in your payroll system.

When completing the form, pay attention to each line. The CT-941 is structured to guide you through the necessary data input. After filling in all required sections, take time to review your entries carefully. Mistakes can lead to complications, especially if they lead to inaccurate tax payments.

Finally, review and confirm all information provided before submission. Best practices include cross-referencing with your payroll records or consulting colleagues for an additional check to ensure nothing is overlooked.

Common mistakes to avoid when filing CT-941

When preparing Form CT-941, certain errors tend to recur. One of the most prevalent mistakes is incorrect wage calculations. Employers often miscalculate due to input errors or misunderstanding how to sum different types of employee compensation. Always verify your calculations against each employee's pay records to ensure accuracy.

Another frequent oversight includes misreporting employee information, such as social security numbers or withholding exemptions. An inaccurate employee record could lead to compliance issues or delayed processing by the state. Document verification before submission can mitigate these risks significantly.

Failing to file by the deadlines can incur significant consequences. Connecticut imposes penalties on late filings, which can escalate quickly based on the duration of the delay. Allocate time well in advance of the deadline to complete your filings and familiarize yourself with state regulations to maintain compliance.

Amending Form CT-941: What to do if you make an error

In the event you discover an error after filing Form CT-941, prompt action is necessary to correct it. Understanding the amendment process is crucial. The Connecticut Department of Revenue Services allows you to file an amended form, commonly referred to as CT-941X, to update any incorrect information. This may include making corrections to wage amounts, tax withheld, or even employer details.

To file an amended form, obtain the original CT-941 form, identify the mistakes clearly, and provide the corrected data on the CT-941X form. It’s essential to provide an explanation of the changes made to aid in processing the amendment without unnecessary delays.

Common scenarios that warrant amendments include errors in reported wages due to miscalculations or changes in employee tax statuses that affect withholding amounts. Be proactive in addressing these issues, as timely amendments can prevent additional penalties or audits.

Tools and resources for efficiently managing your CT-941 filing

To facilitate the filing of Form CT-941, several tools and resources can enhance your experience. Platforms like pdfFiller offer interactive tools, enabling you to create, edit, and submit forms effortlessly. These resources save you time and reduce the likelihood of human error through easy-to-follow templates.

Moreover, pdfFiller provides eSign features, allowing for quick approvals from team members or stakeholders, streamlining the review process. This functionality becomes particularly useful as multiple individuals may need to verify information before submission, emphasizing collaboration and accuracy.

Leveraging these tools can transform the typically tedious process of tax form filing into a more manageable task, ultimately helping you maintain compliance while minimizing stress.

The advantages of using pdfFiller for your CT-941 submission

Utilizing pdfFiller for your CT-941 submission enhances the document management experience significantly. Being a cloud-based platform, users can streamline document management from virtually anywhere. This flexibility is particularly beneficial for teams that operate remotely or require real-time access to tax filing documents and data.

Moreover, the editing and signing processes on pdfFiller are simplified, allowing for quick modifications and adjustments to forms. As you work through Form CT-941, you can easily make changes and ensure everything is current before submission. This reduces the likelihood of filing errors that could result in financial repercussions.

The real-time collaboration features enable teams to work together on the form, ensuring that all necessary data is accounted for and verified before the final submission. This feature fosters transparency and teamwork, vital for accurate tax reporting.

Frequently asked questions about Form CT-941

Many employers have questions regarding the nuances of Form CT-941. One common query is, 'Can I file CT-941 online?' Yes, filing online is possible and encouraged, as it speeds up processing times and can help avoid postal delays. Online submissions allow for instant confirmations, giving peace of mind that the form has been received.

Another concern is, 'What if I don’t have all employee details?' In such cases, it is essential to gather as much information as possible and report it. For any missing details, indicate on the form that it’s pending, and rush to complete the record. Finally, employers often ask, 'How to retain records after filing?' Keeping copies of all submitted forms, filings, and employee information is paramount for future reference and compliance audits.

Additional insights: Beyond CT-941 - managing payroll taxes in Connecticut

While Form CT-941 covers the reporting of state withholding taxes, other forms are relevant for comprehensive payroll tax management in Connecticut. Employers may also need to familiarize themselves with related documents such as Form CT-941X for amendments, and Form CT-588, which pertains to Connecticut's estimated personal income tax payments.

Staying in compliance with Connecticut payroll regulations requires ongoing education and awareness of evolving tax laws. Keeping abreast of changes will help prevent unexpected surprises during filing times and lead to smoother operations.

How pdfFiller enhances your document management experience

pdfFiller fundamentally transforms document management by offering a suite of features directly integrated into its platform. Users can create and edit documents as needed, simplifying the interaction with various forms, including CT-941. Integration capabilities with other accounting or payroll software streamline data sharing, minimizing repetitive data entries.

Additionally, the user-friendly interface allows for effortless navigation through complex forms, enhancing the overall user experience. Businesses benefit from real-time editing and collaboration features, enabling authorized colleagues to have input on the document before its submission, ensuring all necessary checks and balances are in place.

User testimonials often highlight the ease of use and the reduced stress associated with filing forms through pdfFiller, proving its effectiveness as a vital tool for document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form ct-941 connecticut quarterly in Gmail?

How do I complete form ct-941 connecticut quarterly online?

How do I edit form ct-941 connecticut quarterly in Chrome?

What is form ct-941 connecticut quarterly?

Who is required to file form ct-941 connecticut quarterly?

How to fill out form ct-941 connecticut quarterly?

What is the purpose of form ct-941 connecticut quarterly?

What information must be reported on form ct-941 connecticut quarterly?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.