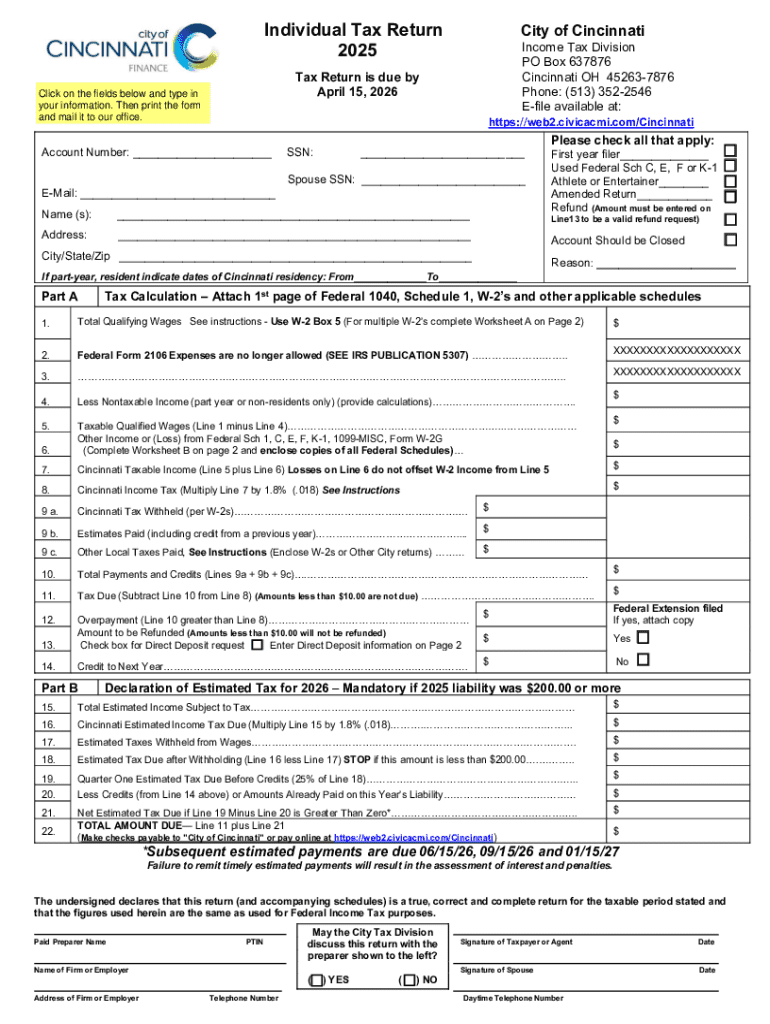

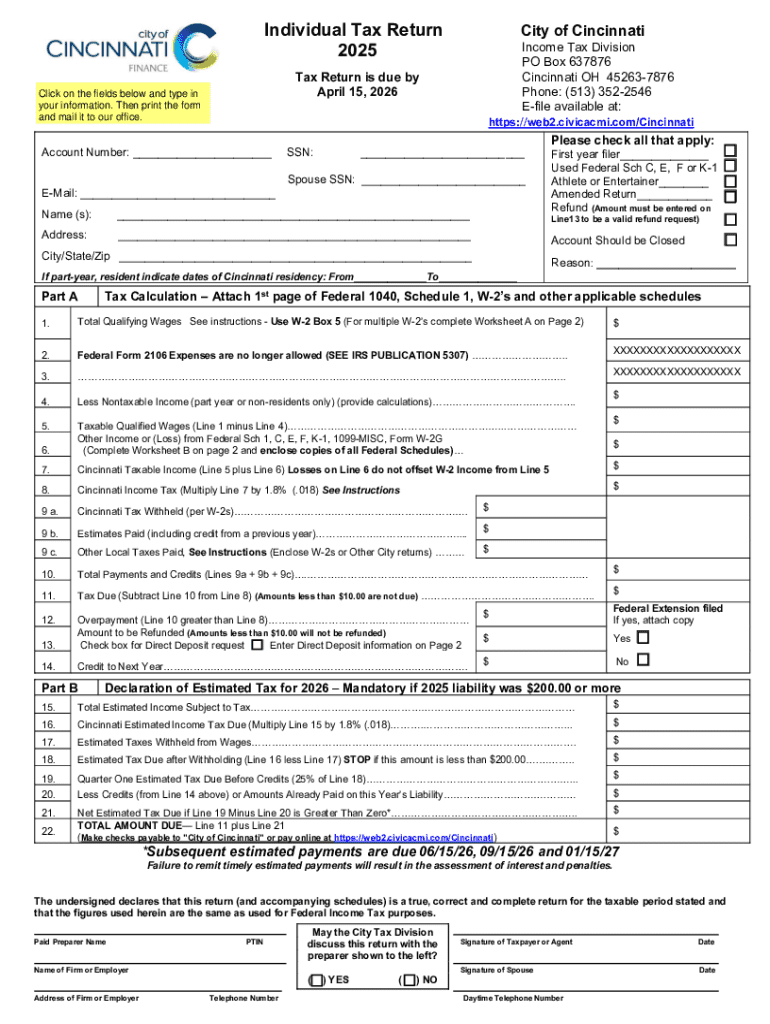

OH Individual Tax Return - Cincinnati 2025-2026 free printable template

Get, Create, Make and Sign OH Individual Tax Return - Cincinnati

Editing OH Individual Tax Return - Cincinnati online

Uncompromising security for your PDF editing and eSignature needs

OH Individual Tax Return - Cincinnati Form Versions

How to fill out OH Individual Tax Return - Cincinnati

How to fill out this space is for

Who needs this space is for?

This space is for form: A comprehensive guide to effective form management

Understanding the importance of forms

Forms serve as a crucial element in both personal and professional environments. They facilitate the collection and dissemination of information, ensuring that processes run smoothly and efficiently. For individuals, forms can help with everything from tracking expenses to applying for jobs. For teams, they enhance collaboration through standardized data collection, making decision-making processes more structured.

Across various industries, forms play pivotal roles. In healthcare, patient intake forms gather essential information. In finance, client onboarding forms are vital for compliance and risk assessment. This space is for form highlights how these structures can streamline operations, ensuring that each step processes information meaningfully.

Navigating the pdfFiller platform

pdfFiller stands out as a comprehensive document management solution that enhances form handling. Its intuitive features enable users to edit forms, eSign documents, and collaborate effortlessly. Whether you are at home or on the move, pdfFiller ensures that this space is for form is accessible anywhere, supporting a fluid workflow for individuals and teams.

The platform's integration capabilities with popular tools such as Google Drive and Dropbox also enhance user experience. It ensures that forms are not only created but managed effectively within the ecosystem of existing digital tools, fostering collaboration among team members.

Creating a form from scratch

When embarking on creating a form, it is vital to define its purpose and understand your audience. The goals of your form will determine its structure, whether it’s aimed at gathering data, collecting opinions, or facilitating transactions. Tailoring content for the intended users—ensuring language is appropriate, and instructions are clear—enhances efficacy.

pdfFiller's extensive library of form templates is a valuable resource for anyone looking to create a compelling form. By searching for relevant templates, you not only save time but also ensure that professional standards are met. Leveraging pre-designed forms can significantly streamline the design process, allowing you to focus on personalization where it matters most.

Detailed steps for filling out and editing your form

Filling out a form accurately is vital for capturing the information needed for decision-making. Before you begin, gather all necessary information to ensure a seamless process. This preparation includes collecting documents and data points that the form will require, thus reducing time spent searching for details mid-way through.

For clarity and conciseness, keep your language straightforward and your queries structured. pdfFiller offers various editing tools to enhance existing forms, such as adding or modifying text, inserting images, and adjusting visual elements to better ensure that this space is for form is used optimally.

Signing and securing your form

eSigning has become an integral part of modern document management, conferring legal validity equivalent to traditional signatures. Various situations may necessitate a signature, such as official contracts, agreements, or consent forms. Utilizing eSignatures not only facilitates speed but also fosters security, ensuring that documents remain protected.

With pdfFiller, eSigning your form is a straightforward process. The platform allows users to sign forms digitally, add multiple signers, and manage permissions effectively. This way, this space is for form evolves from a static document into a dynamic, interactive element of business workflows.

Collaborating on forms with teams

Effective collaboration is one of the foremost advantages of using a platform like pdfFiller for forms management. Users can create shareable links, assign permissions, and enable real-time editing. This interactive workspace encourages team involvement, allowing members to provide input, making the document creation process more inclusive.

Utilizing comment features allows teams to give feedback directly on the document, making this space is for form not just a solitary task but a collaborative effort. Tracking changes and versions further ensures that everyone is on the same page, thus enhancing overall document accuracy and cohesion.

Managing completed forms

Once forms are completed, organizing and storing them correctly is essential for easy retrieval later. Using folders and tags helps maintain order, allowing users to categorize completed documents intuitively. This systematic approach reduces the time spent searching for critical files and enhances operational efficiency.

When it comes to sharing or presenting forms, pdfFiller allows exporting in various formats. Ensuring that your printed forms maintain high quality is also essential—whether it’s for physical distribution or filing purposes. Mastering these aspects of form management ensures that this space is for form serves its intended functions seamlessly.

Advanced options for form users

To enhance productivity, pdfFiller provides users with automation features that streamline repetitive tasks. Automating document workflows reduces manual input, minimizes errors, and enhances overall efficiency. Setting up such workflows allows users to save valuable time and focus on more strategic aspects of their projects.

Furthermore, leveraging analytics can provide insights into how forms are used. By tracking metrics such as response rates and user engagement, teams can make data-driven decisions to improve form designs and enhance the user experience. Thus, this space is for form extends beyond mere functionality to encompass performance optimization.

Troubleshooting common issues with forms

Even after implementing strong form management processes, challenges can arise. Common issues may include incorrectly filled fields or confusion over eSigning procedures. Having an FAQ section readily accessible helps address these concerns quickly and enhances user confidence.

For persistent issues or complex questions, pdfFiller’s support channels are always available. Engaging with their support team ensures that users can resolve problems efficiently, allowing them to return to this space is for form with renewed confidence.

People Also Ask about

Where do you pay property Taxes in Cincinnati Ohio?

When can I expect my refund 2022?

How do property taxes work in Cincinnati?

How long does it take for tax refund direct deposit 2022?

How are property taxes billed in Ohio?

What is the Ohio income tax rate 2022?

How do I pay my taxes in Cincinnati?

What is Ohio's income tax rate?

Where do I pay my Ohio property taxes?

Did Ohio taxes go up in 2022?

How long does it take to get a tax refund in Cincinnati?

Who has to pay city of Cincinnati taxes?

Are tax refunds delayed 2022?

Can you pay Cincinnati taxes online?

What is Ohio's state income tax rate?

What will the tax rate be in 2022?

What is Ohio tax rate 2022?

What months are property taxes due in Ohio?

What are the current tax brackets 2022?

How much is 75k after taxes in Ohio?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send OH Individual Tax Return - Cincinnati to be eSigned by others?

Where do I find OH Individual Tax Return - Cincinnati?

How do I execute OH Individual Tax Return - Cincinnati online?

What is this space is for?

Who is required to file this space is for?

How to fill out this space is for?

What is the purpose of this space is for?

What information must be reported on this space is for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.