Get the free Geneva Ohio Tax Department

Get, Create, Make and Sign geneva ohio tax department

How to edit geneva ohio tax department online

Uncompromising security for your PDF editing and eSignature needs

How to fill out geneva ohio tax department

How to fill out geneva ohio tax department

Who needs geneva ohio tax department?

A Comprehensive Guide to Geneva Ohio Tax Department Forms

Overview of Geneva Ohio Tax Department Forms

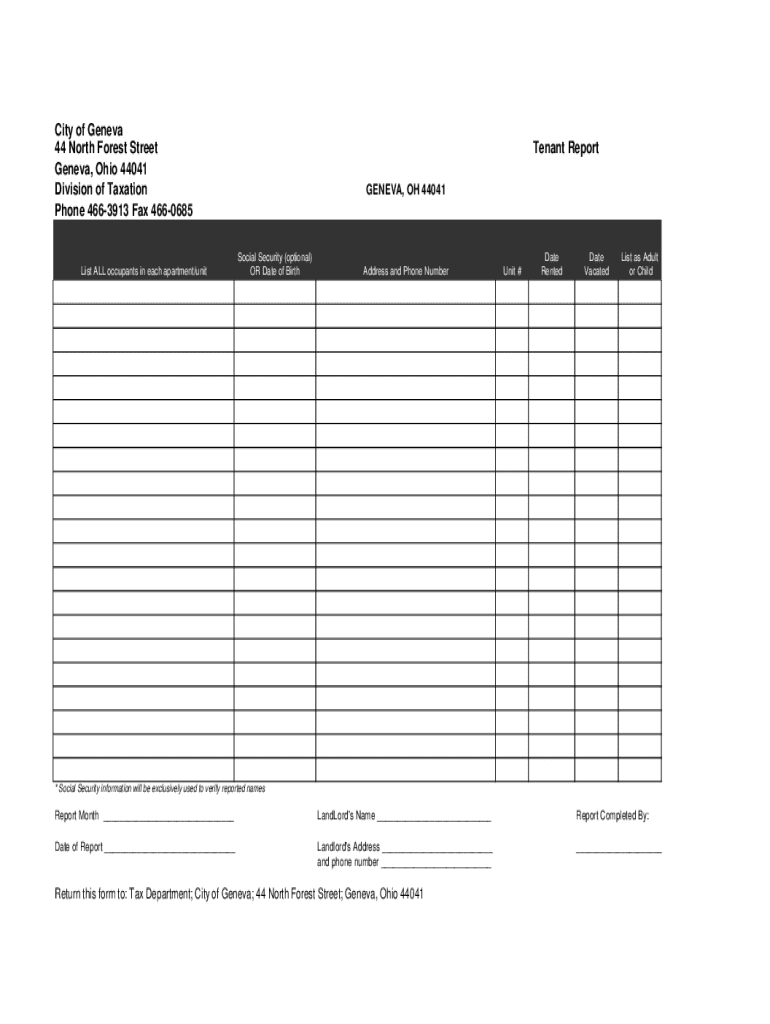

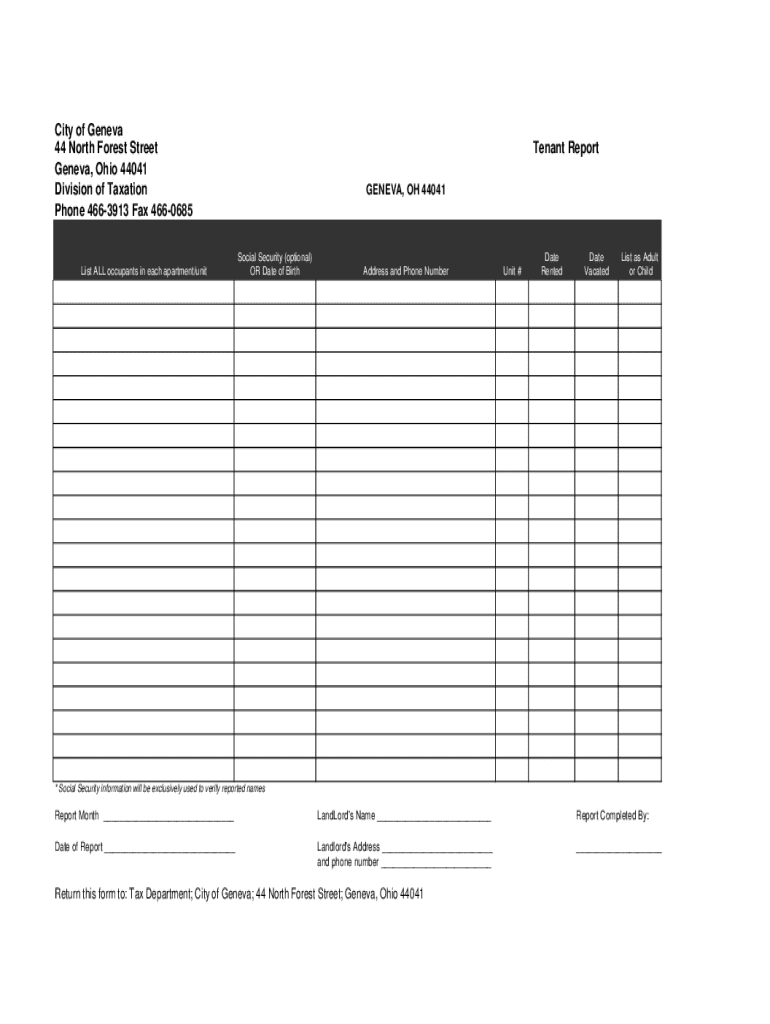

Geneva, Ohio, has specific tax requirements that residents and business owners must navigate carefully. The Geneva Tax Department provides various forms that facilitate the proper reporting of taxes owed to the city. Accurate completion and submission of these forms are crucial, as they directly affect the city's revenue and ensure compliance with local tax laws.

Different types of tax forms serve unique purposes, including individual income tax returns, business tax registration, and property tax exemption applications. Each form plays an essential role in maintaining the integrity of the local tax system, making it vital for filers to understand their significance fully.

Accessing the Geneva Ohio Tax Department Forms

To access the Geneva Ohio Tax Department forms, residents and business owners can visit the official city website, where they will find downloadable PDF versions of each required form. The ease of online access aims to simplify the process for users.

An efficient way to manage these documents is through pdfFiller, which provides features specifically designed to streamline form access and completion. Users can navigate through a user-friendly interface to locate the tax forms section, where all relevant forms are neatly organized for convenient access.

Detailed breakdown of key forms

The Geneva Tax Department provides various critical forms vital for individuals and businesses alike. Understanding their requirements and processes is essential for compliant tax filing.

Individual Income Tax Return Form

The Individual Income Tax Return Form is the foundational document for local residents to report their income and calculate their tax obligations. Eligibility generally includes all residents of Geneva earning taxable income. This form ensures that the city collects an accurate amount of revenue based on the city's tax rate.

Completing the form involves itemizing income, deductions, and determining tax credits. Failure to do so accurately can lead to complications, including underpayment or fines.

Business Tax Registration Form

For local businesses, the Business Tax Registration Form is crucial for reporting earnings and registering with the city. This form includes information about the business structure, anticipated revenue, and contact information. Accurate reporting is critical to avoid potential fines or legal issues.

Completing this form involves clear communication about the nature of the business, operational details, and any unique tax considerations that may apply based on the business's activities.

Property Tax Exemption Application

The Property Tax Exemption Application is pertinent for homeowners seeking relief on their property tax obligations. Various exemptions are available, ranging from homestead exemptions for seniors to those for veterans or disabled individuals. Each exemption has specific criteria that must be met.

Filling out the application requires providing essential documents that validate eligibility, including tax returns or proof of disability. The submission must be timely to ensure that exemptions are applied in the current tax year.

Step-by-step guide to filling out forms

Preparing your information

Before filling out any tax form, it is crucial to gather the necessary documents and records. This preparation could include identification numbers, previous year tax returns, details on income sources, and documentation supporting any claims for deductions or exemptions. Having this information readily available can significantly speed up the completion process.

Avoiding last-minute scrambles by preparing in advance will also help ensure that the forms are filled out accurately and completely.

Using pdfFiller for form completion

Utilizing pdfFiller to fill out forms offers numerous advantages. The platform includes features that allow users to fill out forms seamlessly online, leveraging tools that auto-fill data based on previous entries. This feature dramatically reduces time spent on repetitive tasks.

Additionally, calculation tools are available, simplifying the process of tax estimation. This ensures that users can accurately gauge their tax liabilities before getting to the submission phase.

Editing and customizing forms

After completing a form, users may find the need to edit or customize specific details. pdfFiller makes this easy, allowing users to change specific entries without starting from scratch. Moreover, the platform offers features to add eSignatures and collaborate with teammates, ensuring that all necessary parties can contribute to the document prior to final submission.

Common mistakes to avoid

When filling out Geneva Ohio Tax Department forms, there are frequent errors that can lead to complications in the processing of tax returns. Overlooking sections, erroneously calculating income, and incorrect personal information are among the most common mistakes.

To mitigate these errors, checklists can be incredibly helpful. Here are some common pitfalls to watch out for:

Submission process for Geneva Tax Department forms

Options for submission

For residents and businesses filing their forms, the Geneva Tax Department offers two primary options for submission. Firstly, forms can be submitted online through platforms like pdfFiller, allowing for swift completion and immediate routing to the relevant department.

Alternatively, individuals may choose to mail their completed forms. It is essential to carefully follow the mailing instructions provided with the forms to ensure timely and secure delivery.

Tracking your submission status

After submission, confirming receipt of your documents is crucial. Many residents often wonder how to track their submissions effectively. The Geneva Tax Department typically provides feedback through confirmation emails or by allowing users to check their status online.

In the occurrence that a form is rejected or requires corrections, guidance is provided detailing necessary amendments, preventing confusion during the resubmission process.

Assistance and support

For individuals needing help with tax forms, the Geneva Tax Department offers several support avenues. Residents can reach out directly via phone to get answers to specific questions or concerns. The city's website also features a range of resources to guide users through the form completion process.

In addition to the resources provided by the Geneva Tax Department, pdfFiller offers specialized tutorials and FAQs that focus on Geneva tax forms, making it easier for users to navigate common issues and inquiries.

FAQs about Geneva Ohio Tax Department forms

Understanding the specifics of filling out and submitting Geneva Ohio Tax Department forms can sometimes be overwhelming. To help alleviate some of that confusion, here are frequently asked questions concerning the process.

These questions frequently arise and are essential for ensuring that both residents and business owners adhere to local tax regulations.

Benefits of using pdfFiller for tax forms

Choosing pdfFiller to handle Geneva Ohio Tax Department forms comes with significant advantages. The first and foremost benefit is the ease of use associated with online, cloud-based document management. Users can access their documents anywhere at any time, ensuring that they have the capability to handle their tax obligations on the go.

Additionally, pdfFiller's collaborative tools allow teams to work together seamlessly, enhancing the workflow. This capability is essential for businesses that need to ensure compliance across multiple employees or departments, particularly during the busy tax season when timely submissions are critical.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the geneva ohio tax department electronically in Chrome?

Can I edit geneva ohio tax department on an iOS device?

How do I edit geneva ohio tax department on an Android device?

What is geneva ohio tax department?

Who is required to file geneva ohio tax department?

How to fill out geneva ohio tax department?

What is the purpose of geneva ohio tax department?

What information must be reported on geneva ohio tax department?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.