Get the free Taxing AuthoritiesNon-Ad Valorem

Get, Create, Make and Sign taxing authoritiesnon-ad valorem

How to edit taxing authoritiesnon-ad valorem online

Uncompromising security for your PDF editing and eSignature needs

How to fill out taxing authoritiesnon-ad valorem

How to fill out taxing authoritiesnon-ad valorem

Who needs taxing authoritiesnon-ad valorem?

Taxing Authorities Non-Ad Valorem Form: A Comprehensive Guide

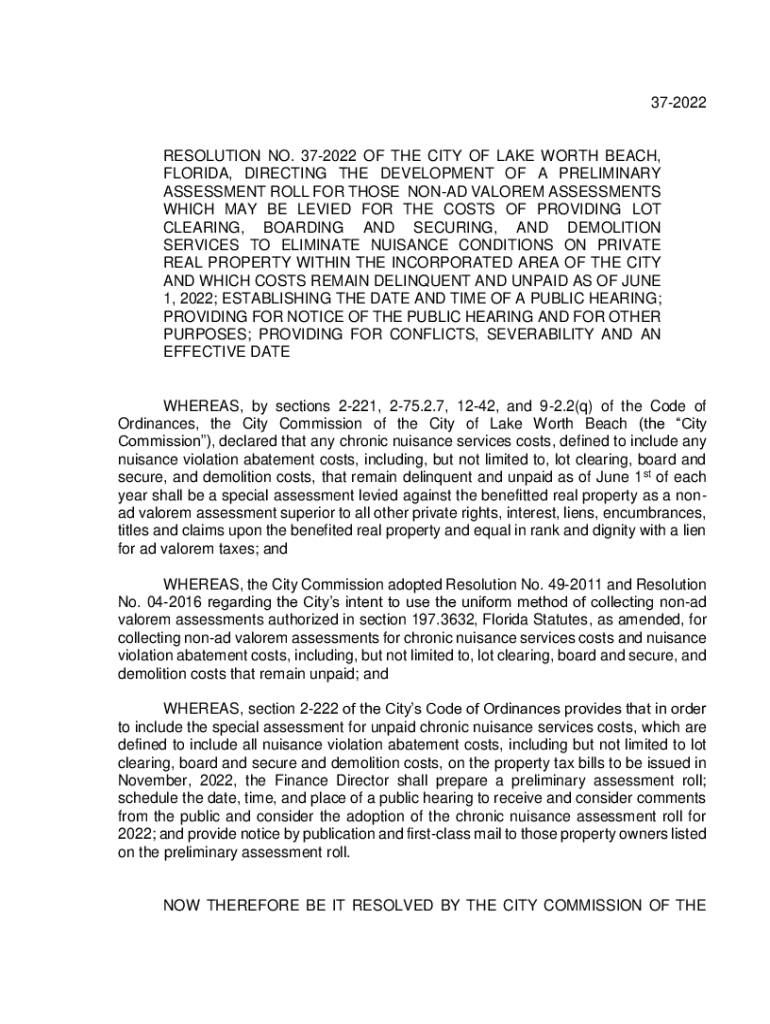

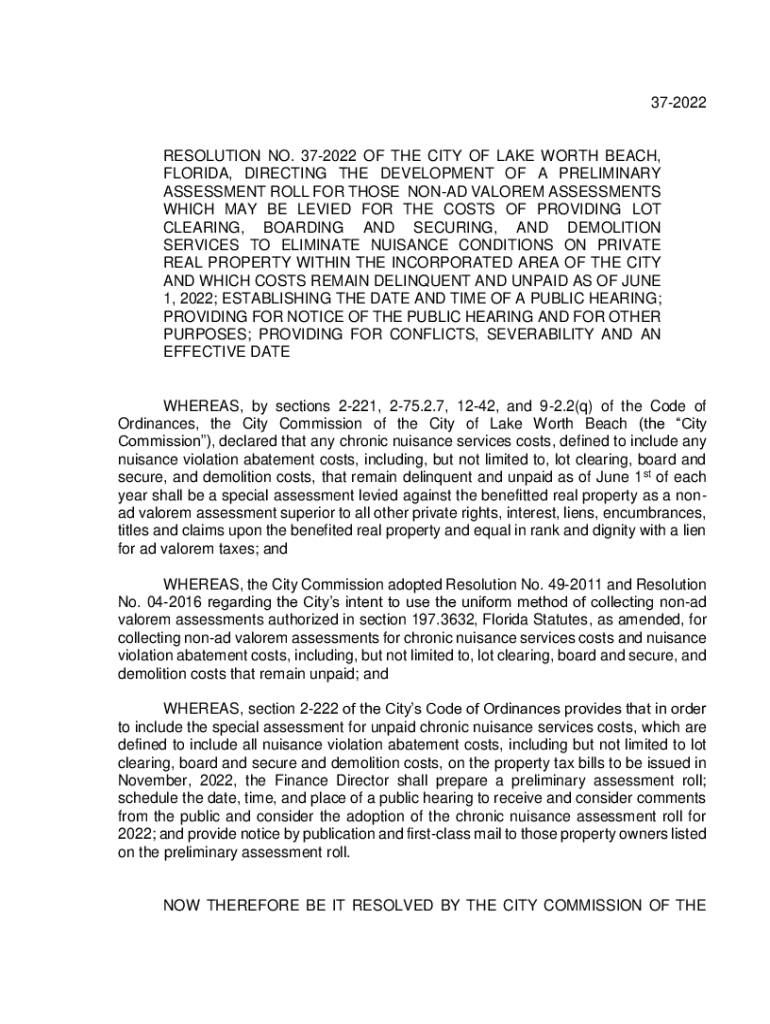

Understanding non-ad valorem assessments

Non-ad valorem assessments are charges levied by local governments to fund specific services unrelated to the property's assessed value. Unlike ad valorem taxes, which are based on property appraisals, non-ad valorem assessments are fixed fees for services provided, such as trash disposal, infrastructure maintenance, and emergency services.

These assessments are crucial because they ensure the provision of essential local services. For property owners, understanding the implications of these assessments is essential, as they can directly affect overall property costs.

The taxing authority's role

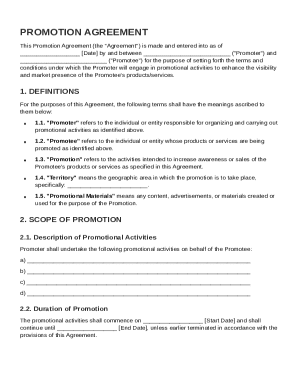

Local taxing authorities are responsible for implementing and collecting non-ad valorem assessments. These authorities can range from city councils to special districts created for specific purposes, such as fire protection or neighborhood improvement districts. The regulations governing these assessments can vary significantly from region to region.

The process of calculating these assessments often involves several factors, including the type of service provided, the geographical area served, and the cost of delivering that service. For instance, a community with extensive outdoor services might see higher assessments.

Detailed insights into the non-ad valorem form

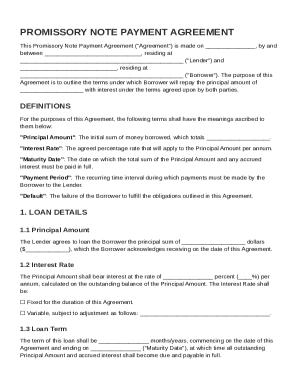

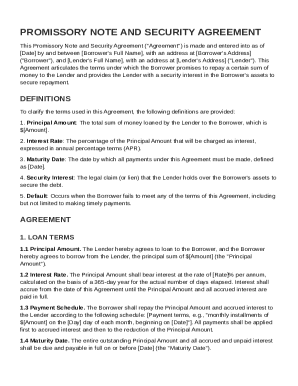

The non-ad valorem form serves as an official document that summarizes various property assessments and is utilized by taxpayers and authorities alike. Its primary purpose is to provide clarity on the assessments owed by property owners for specific services rendered to their properties.

Understanding the components of the form is key. Typically, it includes sections for property information, assessed values, and the breakdown of services charged. Familiar terms found on the form include 'assessed value'—the dollar value assigned to the property, and 'parcel identification'—a unique identifier designated for the property within the local database.

Step-by-step instructions for completing the form

Filling out a non-ad valorem form requires accuracy and attention to detail. Begin by gathering necessary information, which typically includes property details, assessed values, and personal identification information. Having these elements prepared will streamline the process.

To complete the form, follow these steps:

To avoid mistakes, double-check the form for accuracy, ensure all documentation is attached, and verify all signatures are present before submitting.

Editing, signing, and managing your non-ad valorem form with pdfFiller

pdfFiller offers an efficient platform for managing the non-ad valorem form. Its features allow users to easily edit PDFs, making it straightforward to correct any errors or update information directly on the form.

In addition, pdfFiller facilitates eSigning, enabling users to create legally binding signatures without the hassle of printing or scanning. These capabilities ensure that the form can be filled out, signed, and shared swiftly, fostering a seamless workflow.

Online services available for non-ad valorem assessments

Most local taxing authorities provide online platforms where property owners can access their non-ad valorem assessment information. These websites serve as valuable resources for checking assessment amounts, payment statuses, and upcoming due dates.

In addition to assessment details, these platforms often offer convenient payment options, including various electronic payment methods. Paying online can save time and sometimes provides discounts for early payment.

Exemptions and benefits related to non-ad valorem assessments

Exemptions to non-ad valorem assessments can significantly impact financial responsibilities for property owners. Common exemptions apply to specific groups, such as senior citizens and veterans, reducing their overall tax burden.

Understanding these exemptions can lead to considerable financial benefits. By capitalizing on available exemptions, property owners can save money, which, in turn, may influence property values positively due to lower operating expenses.

Additional tools and resources

pdfFiller provides a multitude of interactive tools and resources to assist users with their non-ad valorem form needs. With templates and pre-filled forms available, completing the necessary documents becomes much more straightforward.

Moreover, users seeking guidance or facing technical issues can easily access support services. The pdfFiller platform includes FAQs and a dedicated support team to assist users in navigating any questions they may have.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my taxing authoritiesnon-ad valorem in Gmail?

How can I send taxing authoritiesnon-ad valorem to be eSigned by others?

How do I make edits in taxing authoritiesnon-ad valorem without leaving Chrome?

What is taxing authorities non-ad valorem?

Who is required to file taxing authorities non-ad valorem?

How to fill out taxing authorities non-ad valorem?

What is the purpose of taxing authorities non-ad valorem?

What information must be reported on taxing authorities non-ad valorem?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.