Get the free Public Y-6 Reports - Banking

Get, Create, Make and Sign public y-6 reports

How to edit public y-6 reports online

Uncompromising security for your PDF editing and eSignature needs

How to fill out public y-6 reports

How to fill out public y-6 reports

Who needs public y-6 reports?

Understanding the Public Y-6 Reports Form

Overview of public Y-6 reports form

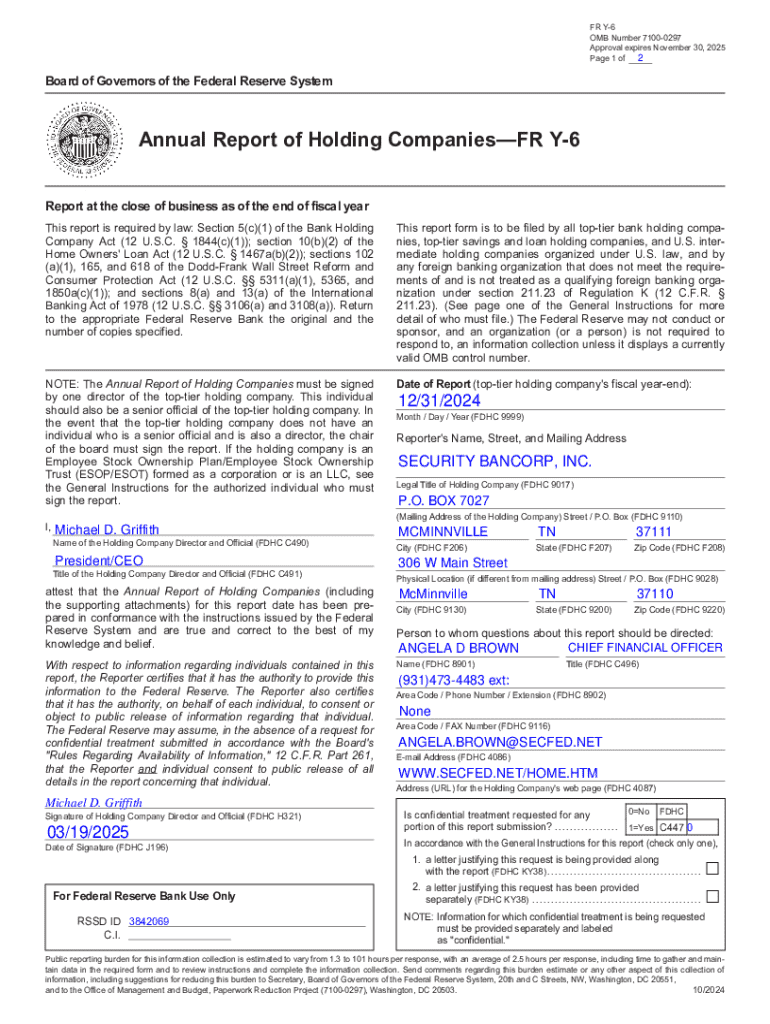

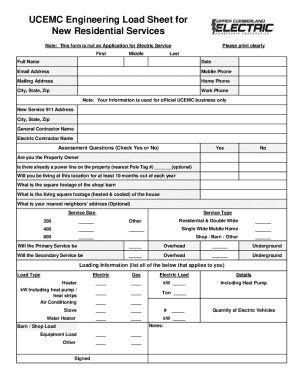

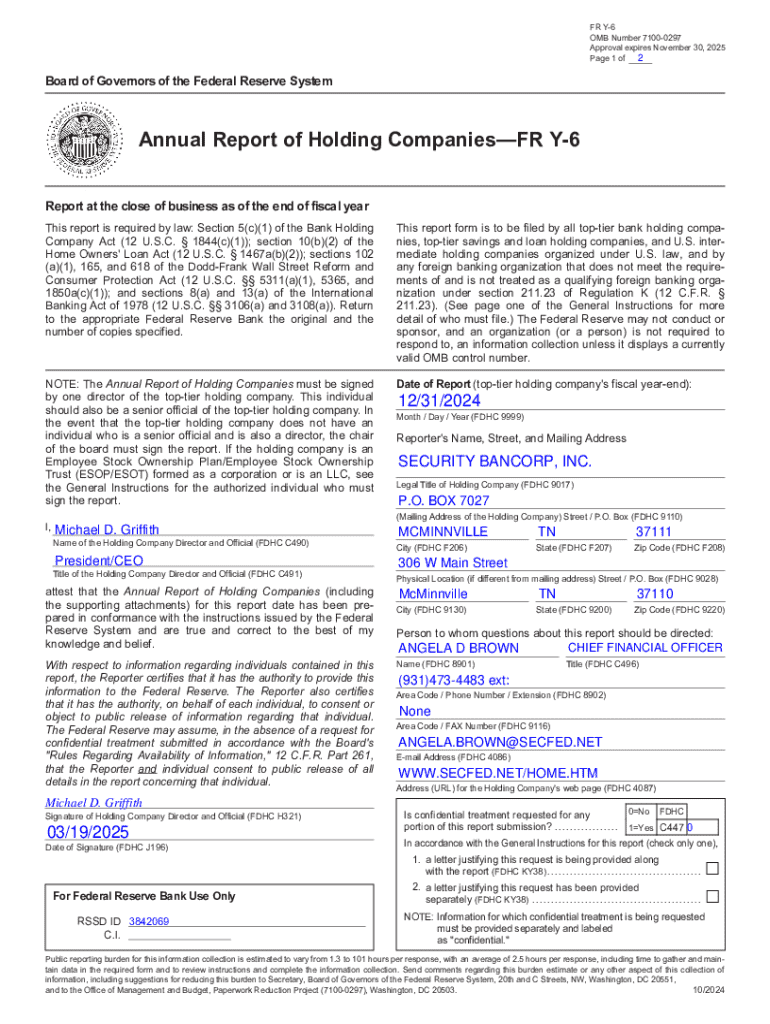

Public Y-6 Reports are standardized forms required by the Federal Reserve, serving as essential tools for financial reporting by banking organizations. They collect comprehensive data related to financial statistics and operational metrics crucial for both regulatory oversight and market transparency. This document is designed to ensure that financial activity is appropriately monitored, enabling better risk management within the banking system.

The significance of the Public Y-6 reports lies not only in legal compliance but also in promoting transparency among stakeholders—investors, regulators, and the public. These reports function as a snapshot of a banking organization's financial condition, making them invaluable for strategic decision-making and market analysis.

Key features of the Y-6 reports form

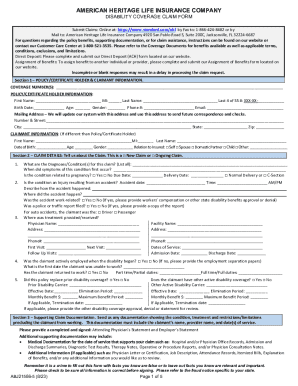

The structure and layout of the Y-6 reports form are designed to facilitate clear and concise submission of data. Each section is strategically organized to cover vital areas such as company information, financial statements, risk assessments, and operational metrics. Understanding this structure is essential for accurate completion.

Included in the report are various types of data points, including balance sheet items, income statements, and capital ratios. Additionally, the Y-6 reports are updated and filed quarterly, allowing for timely oversight. The deadlines for submission are critical; organizations must adhere to these timelines to avoid penalties and ensure ongoing compliance.

Purpose of the Y-6 reports

The primary purpose of the Y-6 reports revolves around understanding regulatory compliance. These filings are crucial platforms for banking organizations to illustrate their adherence to federal statutes and regulations. Furthermore, Y-6 reports play a significant role in fostering transparency within the financial sector. By publicly sharing this information, banking entities contribute to an informed marketplace where stakeholders can make decisions based on reliable data.

Beneficiary groups include not only the organizations filing the reports but also investors, regulators, and the public at large. For investors, the information disclosed helps assess the financial health and risks associated with a banking institution. For regulators, these reports are tools for periodic assessments of systemic risk and regulatory adherence.

Step-by-step instructions for completing the Y-6 reports form

Preparing your data

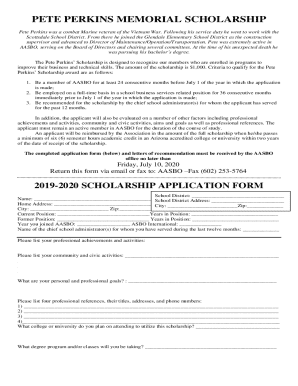

Before starting to fill out the Public Y-6 reports form, it is crucial to gather all required information. This includes current financial records, operational summaries, and internal audits. Using suggested documentation such as quarterly performance reviews and previous submissions can streamline the process significantly.

Filling out the form

The next step involves detailed guidance on filling out each section of the form. For instance, Section A typically requires comprehensive company information, including the legal name, address, and contact details. Subsections should include specifics on the primary activities of the organization.

Reviewing your submission

After filling out the Y-6 report, it is essential to conduct a thorough review. A checklist for ensuring completeness can help verify that all required sections are completed and all necessary documentation is attached. The importance of accuracy in reporting cannot be overstressed, as discrepancies might lead to regulatory scrutiny and potential penalties.

Editing and managing your Y-6 report with pdfFiller

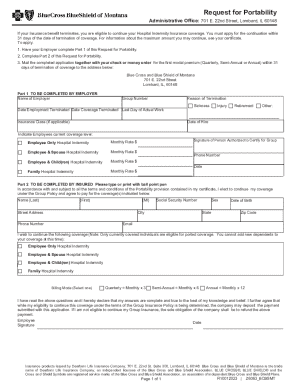

Accessing the public Y-6 reports form through pdfFiller

Accessing the Y-6 reports form through pdfFiller offers an easy and streamlined process. Users can locate the form directly on the pdfFiller website, taking advantage of cloud-based access that facilitates document creation and management from virtually anywhere.

Tools available for editing

Once the form is accessed, pdfFiller provides a range of tools for editing. Users can annotate, highlight, and format the document to enhance clarity and add necessary notes. Furthermore, utilizing pdfFiller’s e-signing features enables quick approvals and signatures without the need for physical meetings.

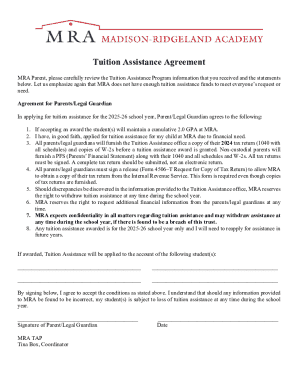

Collaborating on your report

Collaboration is pivotal, especially when multiple team members are involved in preparing the Y-6 report. pdfFiller allows users to share the document securely for feedback, ensuring that various perspectives are considered in the final submission. Managing different versions of your report can also minimize errors and streamline the review process.

Common challenges and solutions

Filing Y-6 reports can come with challenges, particularly with data discrepancies and understanding evolving regulatory requirements. Troubleshooting common errors such as incorrect numerical entries or missing information is key to a successful filing. Engaging resources, such as the Federal Reserve’s website, can be beneficial for keeping abreast of any regulatory changes that impact how Y-6 reports should be completed.

Building a proactive approach to monitoring regulatory updates can mitigate these challenges. Regular training sessions for staff in charge of report preparation may also serve as an effective strategy to reduce mistakes and enhance overall compliance.

Interactive tools for Y-6 report filers

In addition to accessing the Public Y-6 reports form, pdfFiller provides interactive tools that enhance the filing process. Templates and sample reports available on the platform serve as excellent references for users, streamlining their efforts when filling out the necessary information. Additionally, interactive checklists and calculators help ensure that all pertinent data is captured.

These tools simplify the preparation phase, increasing efficiency and minimizing the possibility of errors that could delay filing.

Best practices for future submissions

To ensure a smooth reporting process for future Y-6 submissions, maintaining accurate financial records year-round is critical. This consistent practice not only ensures that information is readily available but also facilitates a better understanding of financial trends within the organization.

Staying updated with changing regulatory requirements through regular audits and training will empower organizations to make informed decisions when preparing Y-6 reports, thereby reducing last-minute scrambles and enhancing the quality of submissions.

Case studies: Successful Y-6 reporting

Successfully filed Y-6 reports have been observed across various banking institutions, highlighting the diverse strategies employed by banks to achieve compliance. For instance, Company A implemented an integrated financial management system that streamlined data collection and reporting, resulting in timely and accurate submissions to the Federal Reserve.

Lessons learned from successful Y-6 reporting initiatives include the importance of cross-department collaboration and utilizing technology for efficient data handling. By adopting these best practices, organizations can enhance their overall reporting capabilities and maintain healthy relationships with regulators.

Frequently asked questions (FAQs)

As with any regulatory requirement, questions arise frequently regarding the Public Y-6 reports form. Common queries include topics like eligibility to file, how to correctly input financial data, and frequency of updates. Addressing these questions robustly can aid first-time filers in navigating the complexities of the process.

Providing tips for first-time filers, it is critical to emphasize the need to understand each section of the form thoroughly and consult relevant guidance materials from the Federal Reserve. Early preparation and leveraging tools like pdfFiller can considerably ease the filing experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send public y-6 reports to be eSigned by others?

Can I create an eSignature for the public y-6 reports in Gmail?

How do I fill out public y-6 reports on an Android device?

What is public y-6 reports?

Who is required to file public y-6 reports?

How to fill out public y-6 reports?

What is the purpose of public y-6 reports?

What information must be reported on public y-6 reports?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.