Get the free Credit Card Authorization Form for Secure Payments (56)

Get, Create, Make and Sign credit card authorization form

How to edit credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Credit Card Authorization Form - How-to Guide Long-Read

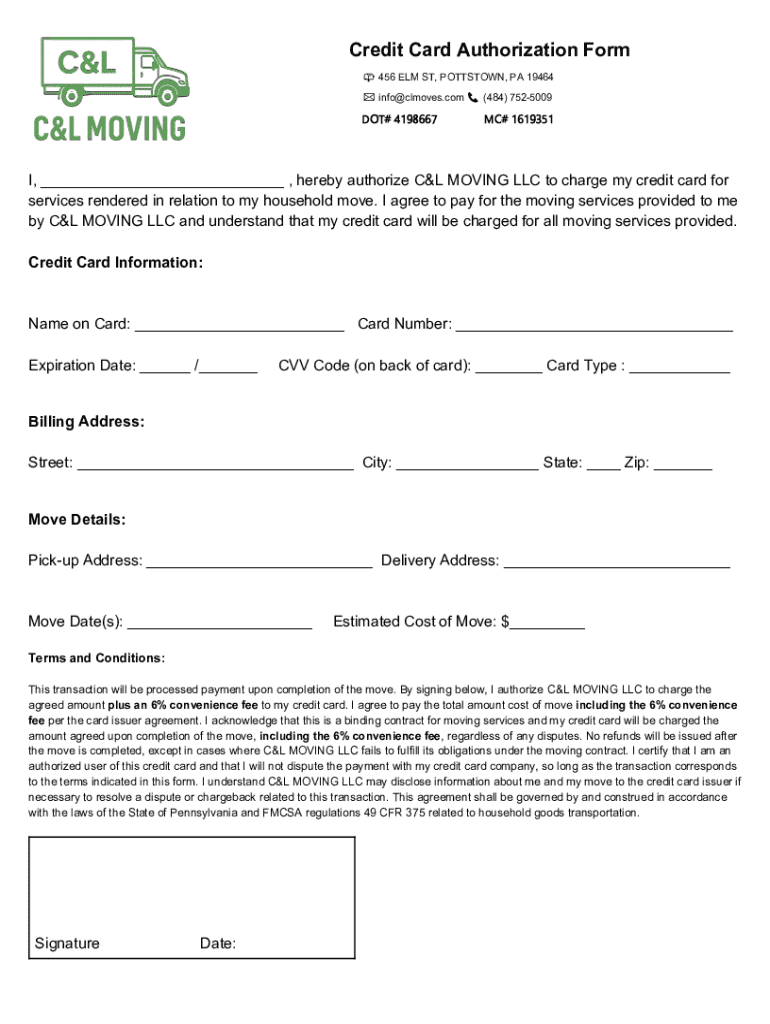

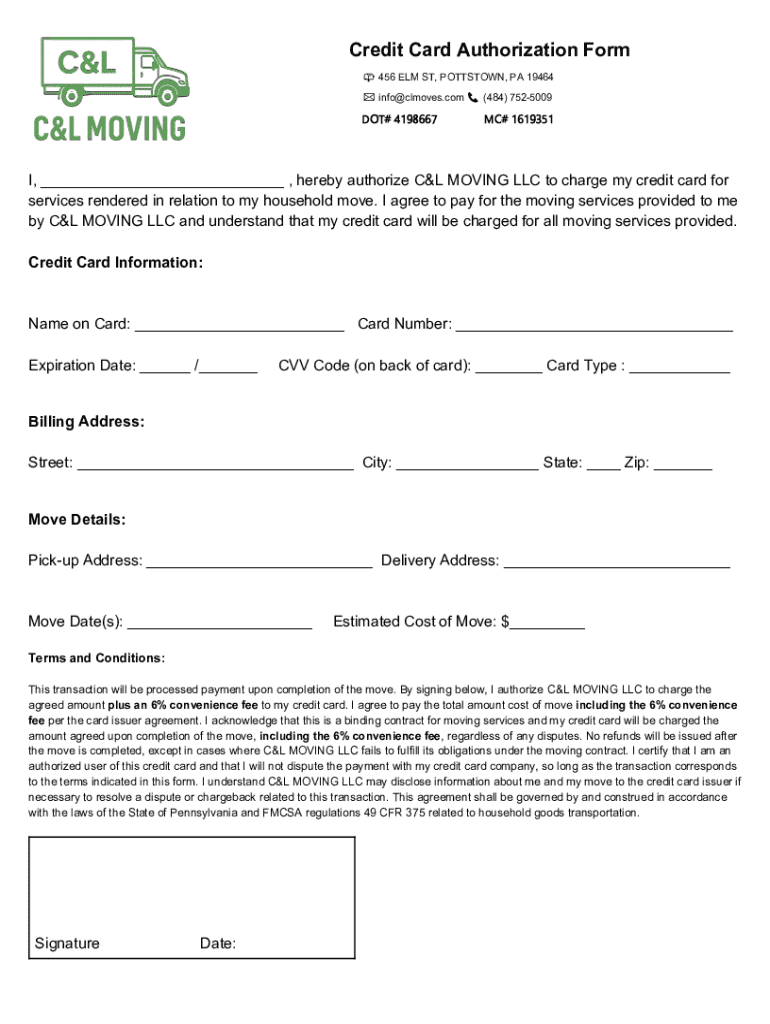

Understanding credit card authorization forms

A credit card authorization form is a vital document allowing businesses to securely process payments using a customer's credit card. Its primary purpose is to obtain explicit consent from the cardholder for a transaction, ensuring both parties understand the terms involved. This directly contributes to the transaction's perceived safety, as both businesses and customers can avoid potential disputes.

The importance of credit card authorization forms cannot be overstated. These forms play a crucial role in establishing trust in financial transactions. Organizations rely on these documents not only to confirm payments but also to protect their own interests against fraudulent activities.

The importance of credit card authorization forms

One of the primary benefits of utilizing a credit card authorization form is the ability to prevent chargeback abuse. When a customer disputes a transaction, it can lead to costly chargebacks for businesses. By possessing a signed authorization form, companies have a robust defense against these disputes, showcasing that the transaction was indeed approved by the cardholder.

For instance, imagine a scenario where a restaurant undergoes repeated chargebacks from a single customer. With a well-documented authorization form, the restaurant can refute the claims, ensuring their financial protection while maintaining their reputation in the community.

Additionally, credit card authorization forms enhance transaction security. By requiring cardholders to verify their identity and explicitly authorize a transaction, businesses are actively mitigating the risk of fraud. Compared to other authorization methods, such as simply collecting verbal consent over the phone, a signed form offers verifiable evidence of transaction approval.

Crafting your credit card authorization form

Creating an efficient credit card authorization form is simpler than ever, especially with ready-made templates available online. At pdfFiller, we offer a variety of templates suitable for different industries, such as retail, services, and hospitality. For example, you can choose between PDF, Word, or even customizable formats to fit your specific needs.

When selecting a template, consider the nature of your business and the specific information you need to gather. Simple forms may suffice for small transactions, whereas larger organizations might require more extensive information to be filled out.

Filling out the authorization form

Filling out a credit card authorization form accurately is essential for preventing misunderstandings and potential disputes. Always double-check the information provided, ensuring that every detail is correct. Common pitfalls include misspelling the cardholder’s name or inaccurately recording the card number, which can lead to payment processing issues.

To assist users, here’s a step-by-step guide to help with completing the form. Start with the cardholder's name, followed by essential details like the card number and expiration date. Finally, provide a clear space for the signature, which ultimately serves as proof of consent. Ensuring compliance with industry standards can significantly reduce the likelihood of fraud and misunderstandings.

eSigning and finalizing your form

In today’s digital era, utilizing electronic signatures has become standard practice. Platforms like pdfFiller offer secure and legally-binding eSigning options, making the process seamless. Using electronic signatures not only saves time but also allows for swift document processing without the need for physical paperwork.

Once the form is complete and signed, consider the best method to distribute it to stakeholders. Whether you choose to send it via email or print physical copies, prioritize secure delivery methods to protect sensitive information from unauthorized access.

Storing and managing your credit card authorization forms

Managing credit card authorization forms effectively is crucial for any business. Best practices dictate that forms should be stored securely in the cloud, utilizing platforms like pdfFiller. This ensures that they are accessible anytime, anywhere while maintaining high levels of document security.

Organizing documents for easy access is equally important. Establish a naming convention and folder structure that makes sense for your team’s workflow. Furthermore, if you’re using these forms in a collaborative setting, consider instituting access management protocols that determine who can view and edit specific documents.

Frequently asked questions (FAQ)

Many users have inquiries regarding credit card authorization forms, from the differences between templates to legal considerations. Addressing these questions can help clear up confusion and guide users toward a deeper understanding of their rights and responsibilities.

Clarifications regarding the transaction processes involving authorization forms are also critical. Businesses should communicate these aspects clearly to customers to foster transparency and build trust.

Gathering feedback and improving your process

Collecting feedback from users—whether team members or clients—is essential for improving the credit card authorization form process. These insights can help uncover areas of struggle and highlight user needs, allowing businesses to refine their documentation.

Continuous improvement in document management is vital in an ever-evolving digital landscape. By staying informed about trends in digital forms, businesses can adapt their practices and ensure that they meet user needs daily.

Additional tools and resources

Utilizing interactive tools available on pdfFiller enhances the experience of creating and managing credit card authorization forms. Features like fillable fields, auto-save, and eSigning make the process straightforward, equipping users to handle transactions efficiently.

Furthermore, those looking to expand their knowledge about document management can benefit from subscribing to our newsletter. It provides updates and valuable insights that can assist in improving your business’s documentation practices.

User testimonials and success stories

Many individuals and teams have successfully transformed their transaction processes using credit card authorization forms. Real-world examples highlight how pdfFiller has facilitated smoother financial interactions, minimizing errors and enhancing overall customer satisfaction in various sectors.

These success stories underscore the practical benefits of effective document management, showcasing how proper use of authorization forms can lead to increased efficiency and better business outcomes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my credit card authorization form directly from Gmail?

Can I create an electronic signature for signing my credit card authorization form in Gmail?

How do I edit credit card authorization form on an Android device?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.