Get the free GPS employer ID - dcrb dc

Get, Create, Make and Sign gps employer id

How to edit gps employer id online

Uncompromising security for your PDF editing and eSignature needs

How to fill out gps employer id

How to fill out gps employer id

Who needs gps employer id?

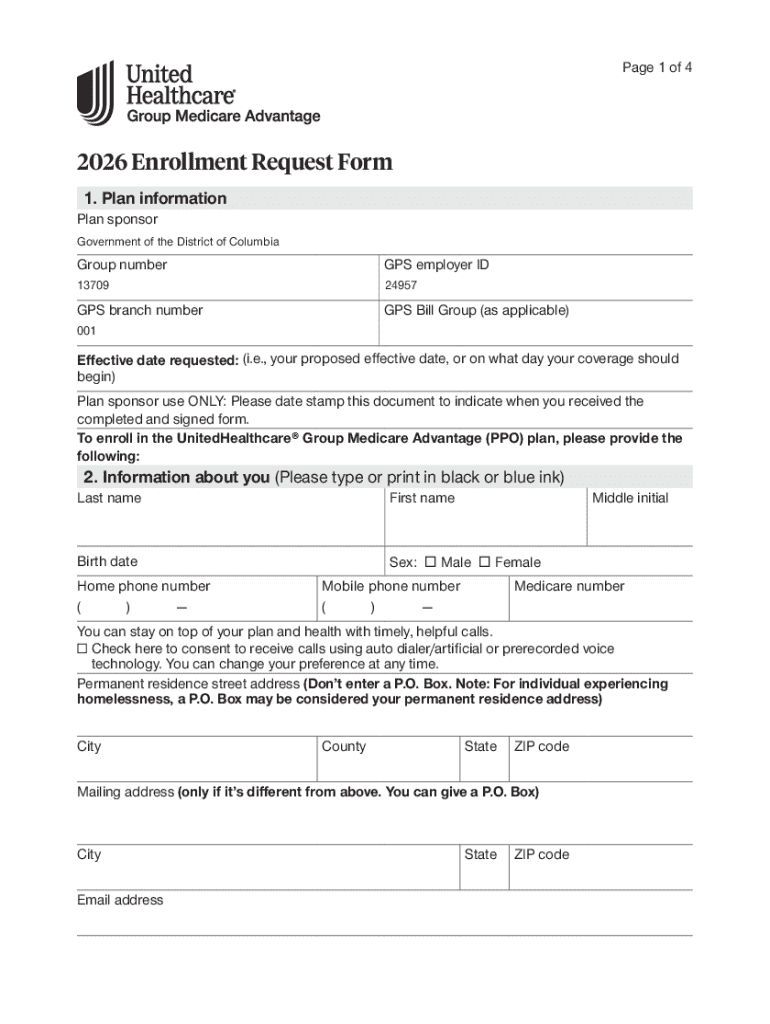

Comprehensive Guide to the GPS Employer Form

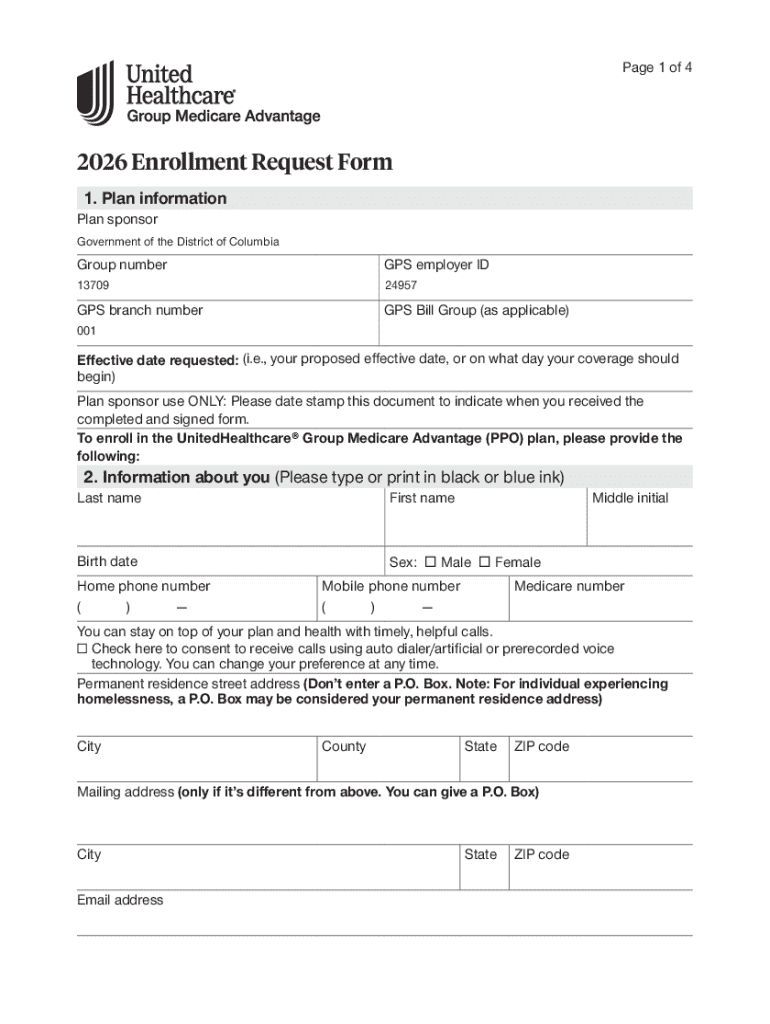

Understanding the GPS Employer Form

The GPS Employer ID Form is a crucial document for employers, designed specifically to assist in the registration of employers for tax purposes. This form collects key information from businesses, facilitating effective communication between employers and government agencies regarding tax obligations. The significance of the GPS Employer ID Form cannot be overstated as it plays a vital role in ensuring compliance with employment tax reporting requirements.

By accurately completing this form, employers not only contribute to the nation's economic health but also avoid potential penalties associated with tax liabilities. Proper filing aids in maintaining updated records for the IRS and state taxing authorities, ensuring seamless operation for businesses and employees alike.

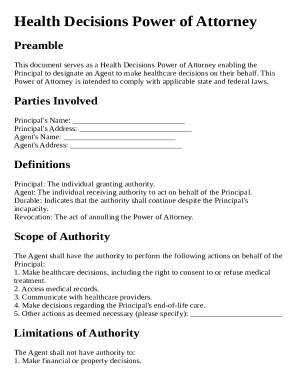

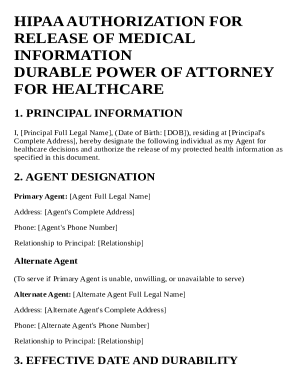

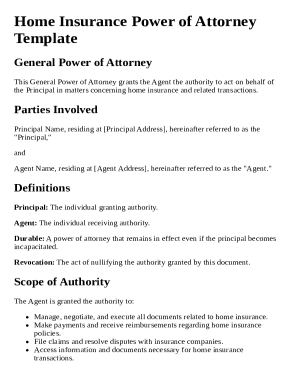

Who needs to use the GPS Employer Form?

Employers in various industries, particularly those with paid employees, are required to utilize the GPS Employer ID Form. Eligibility typically includes businesses operating in sectors such as retail, hospitality, and professional services. Any organization with employees must file this form to stay compliant with tax regulations.

Particular focus should be placed on understanding the specific requirements relative to your industry, as some sectors may have additional stipulations or timelines for submission. Businesses also engaging in strenuous activities or those employing independent contractors must ascertain their responsibilities surrounding the form.

Preparing to fill out the GPS Employer Form

Before attempting to fill out the GPS Employer ID Form, it's essential to gather all necessary information. Employers should compile relevant documents such as the Employer Tax Identification Number (EIN), employee data, and previous tax records. This gathering process ensures that the information provided is consistent and accurate, minimizing errors during submission.

Understanding the various sections of the GPS Employer ID Form will also facilitate a smoother filling process. Each section typically encompasses vital aspects such as Purpose, Employer Information, Employee Details, and Additional Information. Key focus areas include checking for updated guidelines and verifying data accuracy.

Step-by-step instructions for completing the GPS Employer Form

Section 1: Employer Information

Begin by accurately filling out the Employer Information section. This includes not only the business name but also the legal structure of the organization (such as LLC, Corporation, etc.) and the primary business address. Providing correct details here is crucial, as errors may lead to complications later during tax processing.

Section 2: Employee Details

In this section, you will be required to provide detailed information on each employee. This includes their names, Social Security Numbers, and respective pay rates. Double-checking this information is vital, as any discrepancies can cause delays in processing and potential tax liabilities.

Section 3: Additional Information

Finally, navigate to additional information fields which may have optional or mandatory designations. Understanding which fields require information is essential for compliance, and not exceeding allowed restrictions can keep the process efficient. If there are special circumstances noted, such as unique employment agreements, additional documentation may be required.

Editing the GPS Employer Form

After filling out the GPS Employer ID Form, using a tool like pdfFiller can enhance the efficiency of editing and rectifying any errors before submission. Begin by uploading the completed form to pdfFiller's platform, which offers a user-friendly experience for making changes and adjustments.

In addition to individual edits, pdfFiller's collaborative tools allow you to invite team members to review the document. Using commenting features, team members can leave feedback easily, ensuring a comprehensive review and reducing the risk of oversights.

Signing the GPS Employer Form

Before submitting the GPS Employer ID Form, adding electronic signatures is a necessary step for both compliance and authenticity. pdfFiller makes this process straightforward—simply navigate to the eSignature tool and follow the prompts provided. Ensure that your signature meets electronic signing requirements as dictated by your jurisdiction.

Tracking the status of signatures can also be monitored through pdfFiller, ensuring all necessary approvals are secured before proceeding with submission.

Submitting the GPS Employer Form

Once the GPS Employer ID Form has been fully completed and signed, the next step is submission. It’s important to familiarize yourself with the different submission methods available, such as online filing or mailing a physical copy. Ensure that you meet any deadlines associated with your sector or local regulations to avoid penalties.

After submission, it’s critical to confirm that your form has been received. Using tracking numbers or confirmation emails can assist in verifying that your submission was processed correctly. If required, don’t hesitate to reach out to relevant authorities for follow-up.

Managing the GPS Employer Form post-submission

After successfully submitting the GPS Employer ID Form, it’s essential to manage and store it for future reference. Utilizing pdfFiller's secure storage options can provide peace of mind that your important documents are safe and organized. This platform allows easy retrieval for any necessary updates or inquiries.

Certain scenarios may require amendments to the submitted GPS Employer ID Form. Understand when updates might be necessary, such as changes in business structure or employee information. pdfFiller simplifies this process, allowing for easy adjustments and resubmission without starting from scratch.

Troubleshooting common issues with the GPS Employer Form

While filling out the GPS Employer ID Form, you may encounter common issues that can hinder the process. Problems may include lack of clarity in the form fields, incorrect information leading to unforeseen penalties, or technical difficulties with submission. Addressing these issues promptly is essential for compliance.

For individuals experiencing persistent difficulties, resources are available to assist in navigating these challenges. Contacting customer support or using online resources related to the GPS Employer ID Form can provide valuable insights and solutions tailored to individual needs.

Leveraging pdfFiller for ongoing document needs

pdfFiller is not just a platform for the GPS Employer ID Form; it serves as a comprehensive document management solution. Its suite of features provides an effective means of handling various document types, ensuring that users can streamline their overall workflow. Capabilities like editing, signing, and securely sharing documents mean you can focus more on your business and less on administrative tasks.

With testimonials from satisfied users and numerous case studies that highlight increased efficiency, pdfFiller empowers teams and individuals to navigate their document needs seamlessly and confidently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit gps employer id from Google Drive?

How can I get gps employer id?

Can I edit gps employer id on an Android device?

What is gps employer id?

Who is required to file gps employer id?

How to fill out gps employer id?

What is the purpose of gps employer id?

What information must be reported on gps employer id?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.