Get the free Tom Mason Topic: Corporate Governance in Agricultural Co- ...

Get, Create, Make and Sign tom mason topic corporate

Editing tom mason topic corporate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tom mason topic corporate

How to fill out tom mason topic corporate

Who needs tom mason topic corporate?

Tom Mason Topic Corporate Form: A Comprehensive Guide

Understanding the corporate form

A corporate form is a framework that determines how a business is structured, governed, and operated. This structure is not merely a formal legal designation but encompasses critical aspects of liability, taxation, and operational flexibility. Choosing the right corporate form is foundational for entrepreneurs, as it affects both legal protections and tax obligations for the business and its owners.

There are several types of corporate forms, each serving distinct purposes. The most common are C-Corporations (C-Corps), S-Corporations (S-Corps), and Limited Liability Companies (LLCs). C-Corps allow for unlimited ownership and easier access to capital, while S-Corps and LLCs offer beneficial tax advantages and flexible management structures. Understanding these options helps in selecting the appropriate structure to fit business goals.

The role of Tom Mason in corporate form discussions

Tom Mason has made significant contributions to the discussions surrounding corporate forms, bringing a wealth of knowledge from his extensive background in corporate law. He advocates for a nuanced approach to choosing corporate structures, emphasizing the need for alignment between business objectives and legal frameworks. Mason's insights help business owners navigate complexities that could lead to improved compliance and strategic decision-making.

With a focus on practical applications, Mason has shared various case studies illustrating the consequences of failing to select the appropriate corporate form. His published articles and speeches have encouraged entrepreneurs to prioritize an informed approach tailored to their business environment.

Evaluating the right corporate form for your business

When choosing a corporate form, several key considerations come into play. First and foremost, the legal implications of liability must be assessed. Different corporate structures provide varying levels of protection against personal liability for business debts and legal actions. This analysis should be complemented with a comprehensive evaluation of taxation types, as businesses can face different tax treatments based on their corporate form.

Management flexibility and ownership structure are also critical factors. For example, C-Corps may involve formal management requirements and external shareholder considerations, while LLCs can provide greater operational flexibility without extensive regulations. Evaluating these elements accurately will empower business owners to choose a form that aligns with their operational goals and market strategies.

Comparative advantages of common corporate forms

Differentiating between C-Corps and S-Corps is crucial for entrepreneurs. C-Corps are subject to double taxation—once at the corporate level and again at the personal income level for dividends distributed to shareholders. In contrast, S-Corps allow profits to pass through directly to the shareholders' individual tax returns, thereby avoiding double taxation. The implications of these tax structures significantly influence long-term business planning.

On the other hand, LLCs offer a hybrid structure that merges aspects of both C-Corps and sole proprietorships. LLCs protect owners from personal liability while also allowing for pass-through taxation. This combination makes LLCs a popular choice for small to medium-sized businesses looking for protection without the formalities associated with corporations.

Interactive tools for corporate form selection

Utilizing corporate form decision-making tools can simplify the selection process significantly. Online platforms often feature smart comparators that help assess which corporate structure suits your specific business needs. These interactive tools guide users through a series of questions related to their business model, financial outlook, and operational preferences, ultimately suggesting the most appropriate corporate forms.

For instance, pdfFiller offers intuitive resources, allowing prospective business owners to engage with interactive comparators that lead to informed decisions. These tools help deconstruct complex legal language and clarify the implications of each type of corporate form.

Case studies: Successful corporate form decisions

Real-world examples underline the importance of selecting the right corporate form. For instance, a tech startup may initially choose an LLC to maintain flexibility and avoid the burdens of corporate taxation. As the company progresses and approaches public offerings, converting to a C-Corp may become essential to access greater capital markets. Another case might involve a family-owned business operating as an S-Corp, which allows them to retain earnings while distributing dividends efficiently.

These examples highlight lessons learned. Entrepreneurs should actively assess whether their chosen corporate structure aligns with their growth strategy, ensuring that decision-making is evidence-based and forward-thinking.

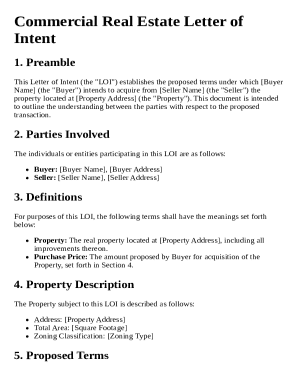

Filling out corporate forms: Step-by-step instructions

Establishing a corporate structure requires specific documents, crucial for legal recognition. The Articles of Incorporation or Organization are fundamental documents outlining the basic information about your corporate identity, including names, addresses, and the number of shares issued, if applicable. These essential details create the framework upon which your business will operate.

Bylaws and Operating Agreements are also crucial elements. These documents define the internal management structures and operational procedures, thereby ensuring clarity and compliance with industry regulations. It’s essential to clearly outline decision-making processes, responsibilities of team members, and methods for handling disputes. Such clarity fortifies team cohesion and promotes efficient operations.

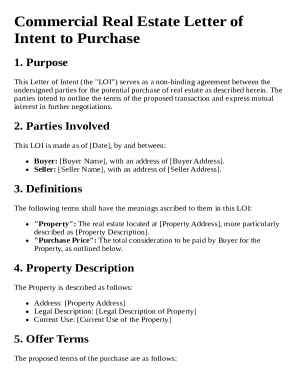

Navigating the filling process

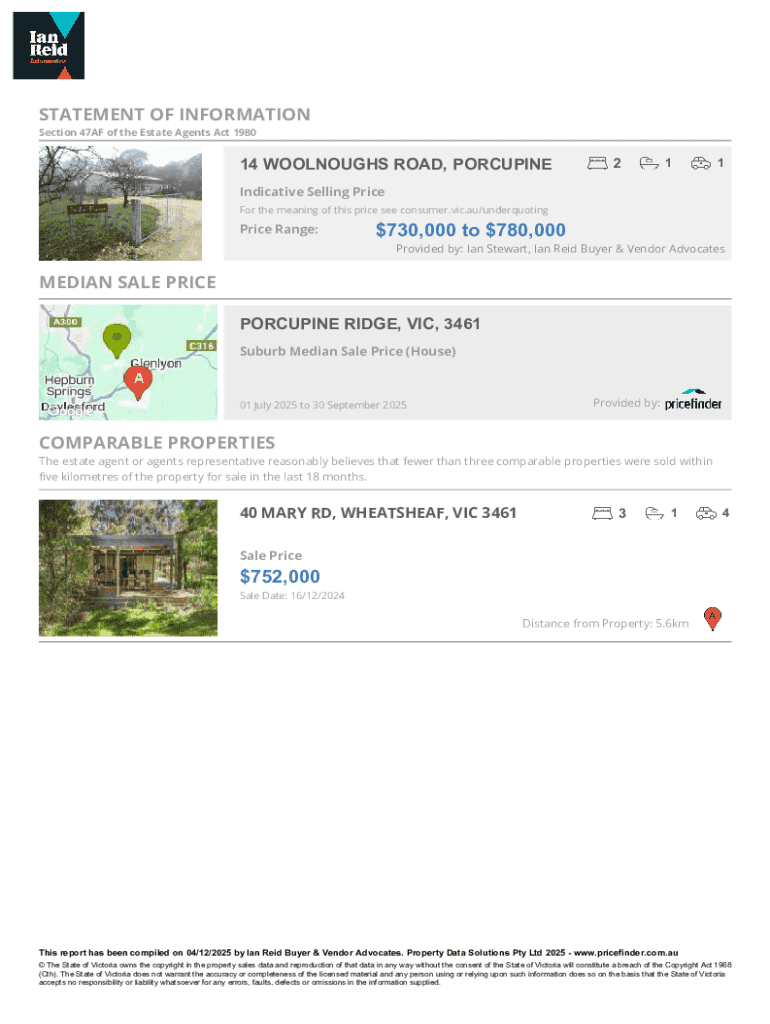

Filing necessary corporate documents with local authorities demands precision and accuracy. Determine the appropriate agency handling corporate filings in your jurisdiction to avoid delays. PDFs of required forms can be typically downloaded or filled out online. When using platforms like pdfFiller, users can edit and complete these forms digitally, ensuring a neat and professional presentation for submission.

It’s crucial to ensure all information provided is thorough and accurate to prevent rejections or legal complications down the line. Utilizing pdfFiller not only facilitates editing but also incorporates digital signing and interactive features that streamline the entire process, making document management efficient.

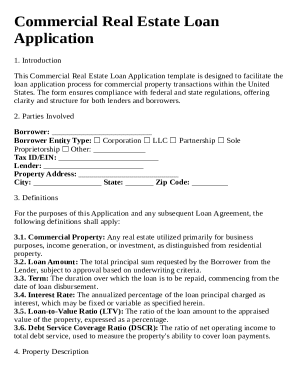

Editing and signing corporate documents

Maintaining accurate document management is essential for businesses, especially when it relates to corporate forms. Errors in these documents can lead to delays or legal challenges, undermining the business's credibility. Common mistakes include incorrect names, numbers, or failure to signatures. Therefore, a meticulous review process should accompany every document.

Digital editing tools like pdfFiller enhance the accuracy of corporate documentation by allowing real-time edits that maintain compliance with legal standards. This capability is essential for ensuring that all documents align with current laws and regulations. Moreover, pdfFiller’s electronic signing features enable timely collaboration, ensuring all stakeholders can review and sign documents effectively and securely.

Managing and maintaining your corporate form

The journey doesn't end once a corporate form is established. Ongoing compliance requirements are vital for maintaining corporate status. Different jurisdictions have various obligations, such as annual reports and tax filings that must be submitted on time to avoid penalties. Failure to meet these obligations could jeopardize the protection a corporate form offers.

It's also crucial to routinely assess whether your corporate structure still meets your business needs. Changes may warrant a transition to a different corporate form, especially as businesses grow or shift in focus. This includes evaluating how your current structure relates to tax liabilities and liability protection, allowing for timely adjustments as circumstances evolve.

Tom Mason’s insights on future trends in corporate forms

Emerging trends, heavily influenced by technology, are reshaping corporate structures. Remote work and virtual businesses are necessitating adaptions to traditional corporate forms. Businesses may need to consider how their structure impacts remote work environments, access to global talent pools, and compliance with international laws. This evolution signifies that corporate forms aren’t static but rather dynamic, shaped by ongoing changes in the business landscape.

Tom Mason advocates for businesses to remain proactive, suggesting that they incorporate flexibility into their corporate structures. Companies that anticipate changes are better positioned to pivot when market conditions shift, particularly in the context of regulatory challenges brought on by technological advancement.

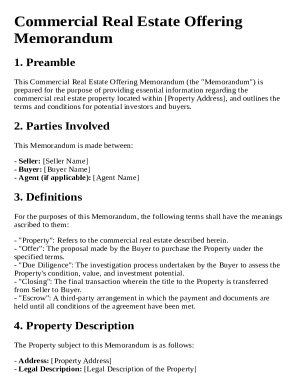

Conclusion: Empowering your corporate journey with pdfFiller

Understanding the complexities surrounding corporate forms is essential for any entrepreneur. This guide has provided insights into selecting the appropriate corporate structure, the documentation process, and strategies for ongoing management. Streamlining these processes with pdfFiller ensures that your experience is efficient, allowing you to focus on growing your business rather than being mired in paperwork.

The benefits of accessing a comprehensive document management solution cannot be overstated. pdfFiller empowers users to edit PDFs, electronically sign documents, collaborate with teams, and manage corporate files seamlessly, all from a cloud-based platform, positioning businesses for success in a competitive landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my tom mason topic corporate in Gmail?

How do I edit tom mason topic corporate straight from my smartphone?

How do I edit tom mason topic corporate on an iOS device?

What is tom mason topic corporate?

Who is required to file tom mason topic corporate?

How to fill out tom mason topic corporate?

What is the purpose of tom mason topic corporate?

What information must be reported on tom mason topic corporate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.