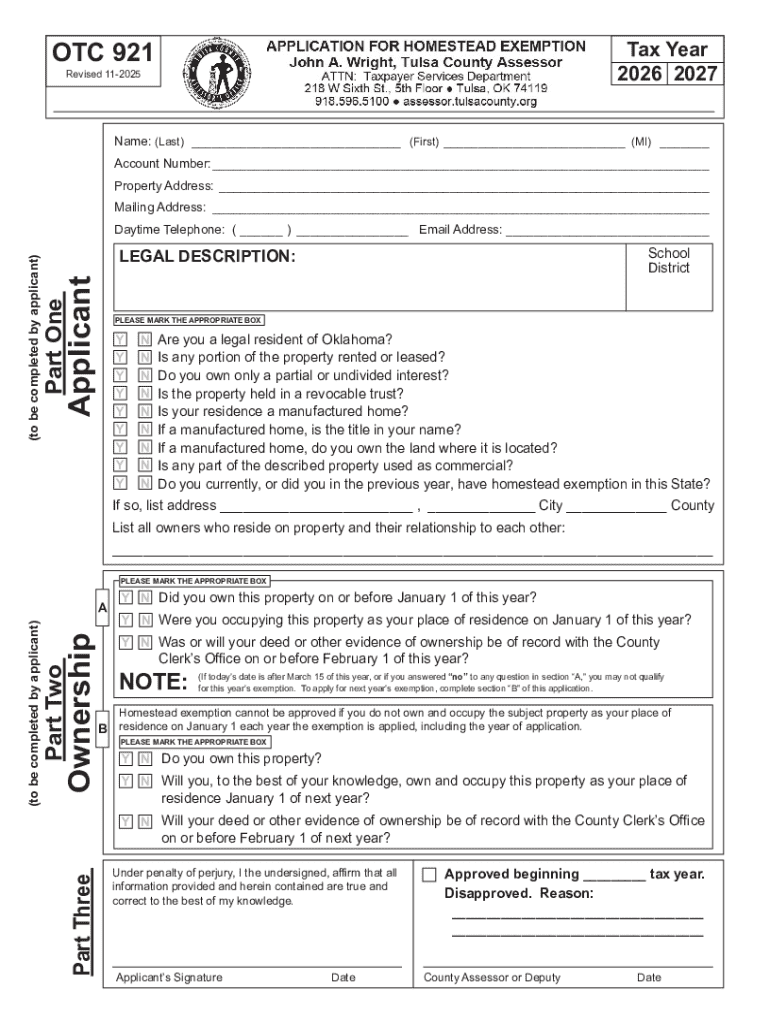

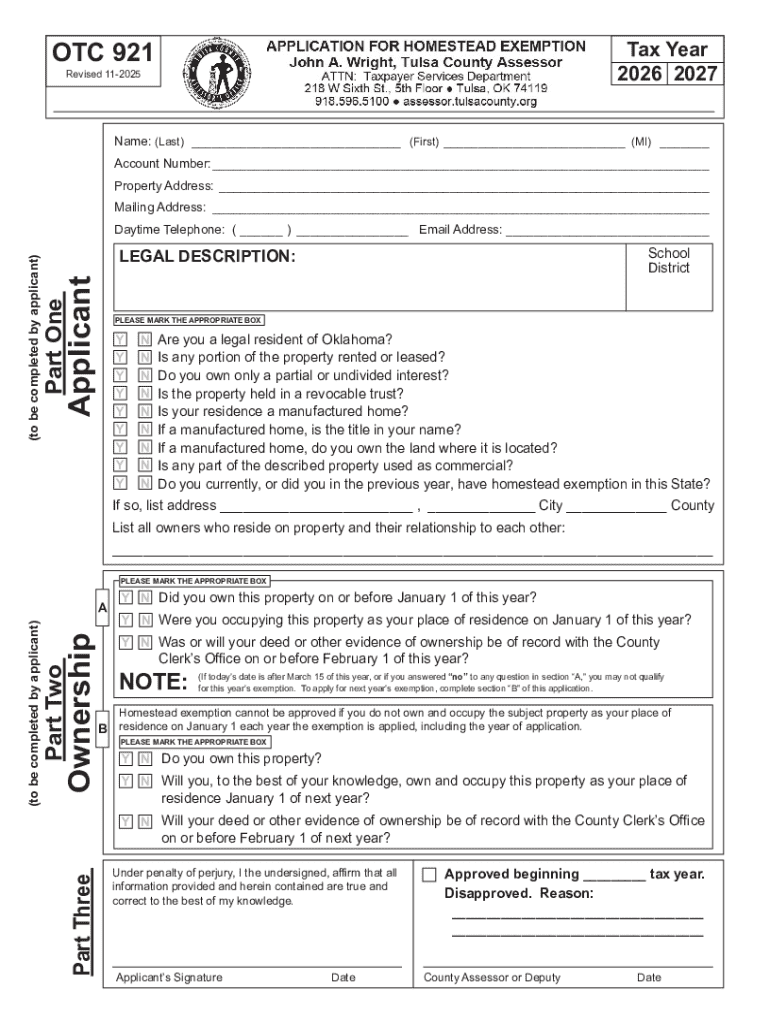

OK OTC 921 - Tulsa County 2026 free printable template

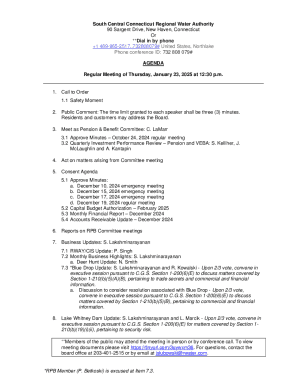

Get, Create, Make and Sign OK OTC 921 - Tulsa County

Editing OK OTC 921 - Tulsa County online

Uncompromising security for your PDF editing and eSignature needs

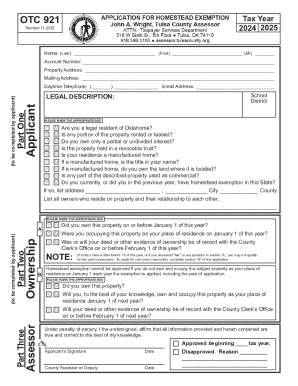

OK OTC 921 - Tulsa County Form Versions

How to fill out OK OTC 921 - Tulsa County

How to fill out 2026-2027 form 921 application

Who needs 2026-2027 form 921 application?

Comprehensive Guide to the 2 Form 921 Application Form

Understanding Form 921

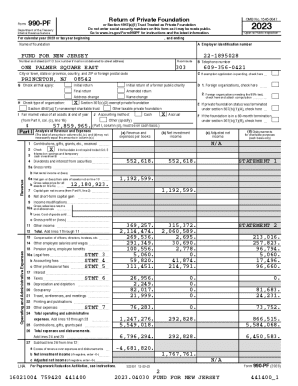

Form 921, the standard application form for the 2 period, serves as a critical document for various individuals and organizations. It is designed to assess eligibility for specific benefits, programs, or financial assistance that may be available in that time frame. Understanding this form's purpose is essential for successful application and compliance with relevant regulations.

Who needs to fill out Form 921?

The Form 921 is necessary for a broad audience, including individuals seeking financial aid, organizations applying for government grants, and any party needing to verify eligibility for specific programs. Students, business owners, and low-income families commonly utilize this form, showcasing its wide-ranging applications.

Key features of the 2 Form 921

The 2 Form 921 is structured to facilitate an organized application process. Its layout includes essential sections that must be meticulously filled out, ensuring clarity and completeness in the application. Changes made in this year’s iteration have refined the process, focusing on user experience and accurate information collection.

Changes from previous years

This year's Form 921 has undergone several significant updates compared to previous versions. These updates relate not only to the format but also to the information requested, reflecting adjustments in the classification of eligible programs.

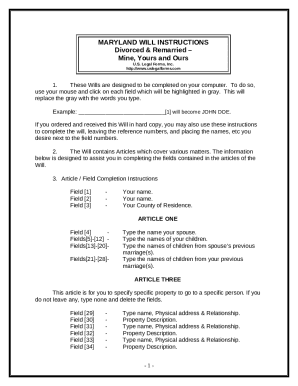

Step-by-step guide to completing Form 921

Completing the 2 Form 921 requires careful preparation and attention to detail. Begin by organizing all necessary documents. This preparation helps streamline the filling out of the form, avoiding unnecessary delays.

Detailed filling instructions

Filling out Form 921 involves several essential sections that require specific information. Let's break it down for clarity.

Common mistakes to avoid

Mistakes in filling out Form 921 can lead to delays or even rejection of your application. It is vital to be vigilant and meticulous in your completion of the form. A few common pitfalls include skipping required fields, providing inconsistent information, or neglecting to attach necessary documentation.

Editing and managing your Form 921

Using pdfFiller to manage your Form 921 not only streamlines the editing process but also makes collaboration seamless. Begin by accessing editing tools directly on pdfFiller’s platform, which offers an array of features to enhance your experience.

Collaborating with others

Collaboration is essential when completing the Form 921, especially when input from multiple sources is necessary. Through pdfFiller, you can easily share your document with teammates or family for feedback and suggestions, ensuring a comprehensive approach to the application.

eSigning the Form 921

eSignatures have become a reliable and legally valid method for signing documents, including Form 921. Following the proper steps ensures that your eSignature is not only intuitive but also complies with all necessary regulations.

Submitting your Form 921

Submitting the completed Form 921 is the final step in the application process. Understanding the various submission options available, whether digital or physical, allows for flexibility and efficiency.

Frequently asked questions about Form 921

Encounters with confusing aspects of Form 921 are common, and having a resource to address these topics can alleviate uncertainty. Here are some frequently asked questions that provide clarity.

Troubleshooting issues

While completing Form 921, applicants may face various challenges. Understanding common issues and their solutions can expedite the application process.

Optimal resources for assistance

For those needing additional support, various resources are available. Knowing where to find assistance can streamline the process significantly.

Leveraging pdfFiller beyond Form 921

Beyond managing Form 921, pdfFiller offers a comprehensive suite of document management solutions. This cloud-based platform supports a range of document types and facilitates organization, collaboration, and secure storage, making it ideal for both individuals and teams.

Benefits of a cloud-based document management system

Adopting a cloud-based document management system like pdfFiller brings numerous benefits. It enables users to access and manage documents from anywhere and at any time, fostering greater flexibility and efficiency in handling important paperwork.

People Also Ask about

When can I file homestead exemption Oklahoma?

Is there a property tax freeze for seniors in Tulsa County?

How do I file for homestead exemption in Tulsa?

What is a homestead exemption Tulsa County Oklahoma?

What are the requirements for Oklahoma Homestead Exemption?

What is the purpose of Homestead Exemption Oklahoma?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in OK OTC 921 - Tulsa County?

How do I fill out the OK OTC 921 - Tulsa County form on my smartphone?

How do I edit OK OTC 921 - Tulsa County on an iOS device?

What is 2026-2027 form 921 application?

Who is required to file 2026-2027 form 921 application?

How to fill out 2026-2027 form 921 application?

What is the purpose of 2026-2027 form 921 application?

What information must be reported on 2026-2027 form 921 application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.