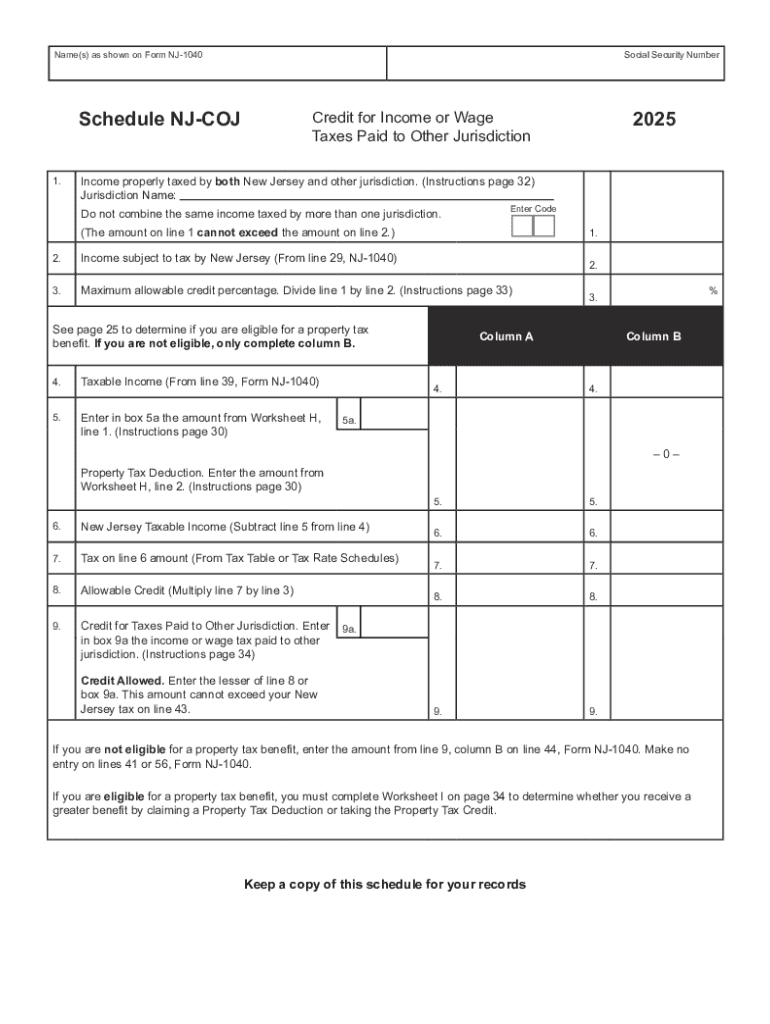

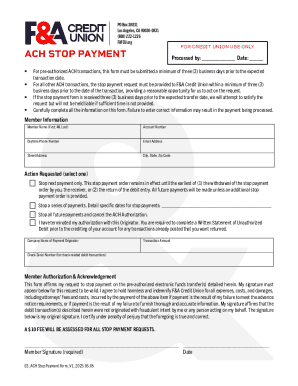

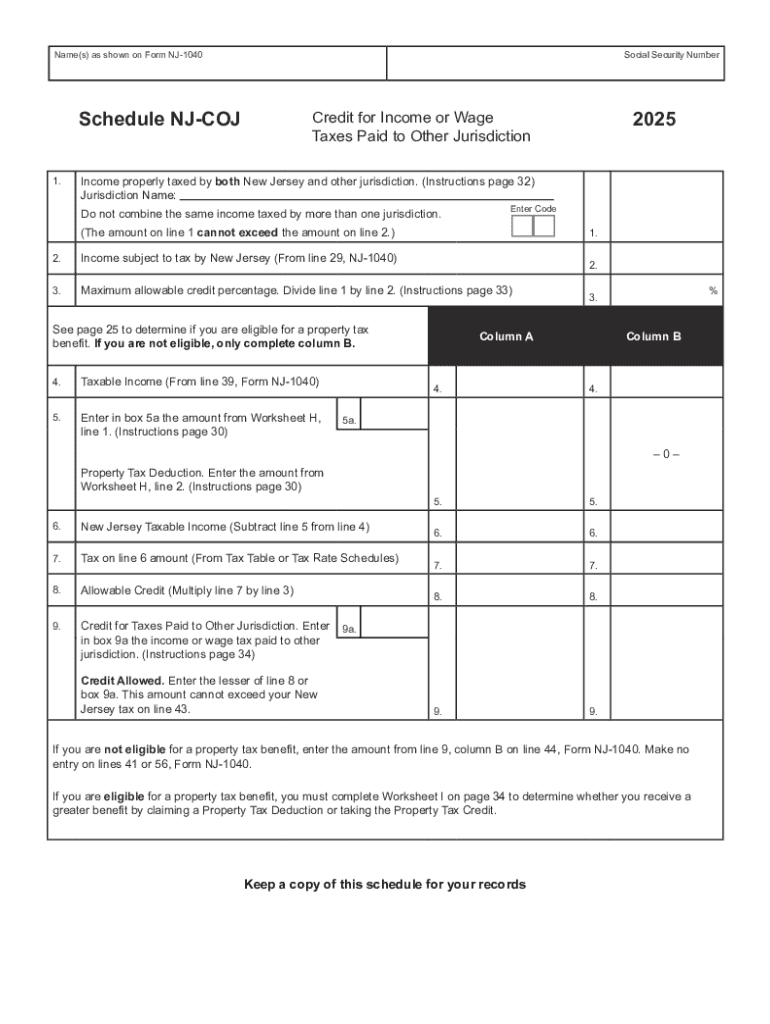

NJ NJ-1040 Schedule NJ-COJ 2025-2026 free printable template

Get, Create, Make and Sign NJ NJ-1040 Schedule NJ-COJ

How to edit NJ NJ-1040 Schedule NJ-COJ online

Uncompromising security for your PDF editing and eSignature needs

NJ NJ-1040 Schedule NJ-COJ Form Versions

How to fill out NJ NJ-1040 Schedule NJ-COJ

How to fill out 2025 nj-1040 resident income

Who needs 2025 nj-1040 resident income?

2025 NJ-1040 Resident Income Form - How-to Guide

Overview of the 2025 NJ-1040 Resident Income Form

The 2025 NJ-1040 form is a critical document for New Jersey residents to report their income and calculate state taxes. Designed by the New Jersey Division of Taxation, this form is tailored to record various income sources, calculate tax liabilities, and claim any applicable deductions or credits. Filing the NJ-1040 accurately is essential, as it ensures compliance with state tax laws and avoids penalties.

Filing the NJ-1040 is not just a legal requirement; it plays a significant role in maintaining the state's revenue system, which supports public services such as education and infrastructure. The 2025 version of the form will likely include significant updates reflecting changes in the tax code, economic conditions, and available credits/deductions.

Eligibility requirements for filing the NJ-1040

To determine the eligibility for filing the 2025 NJ-1040 form, residents must consider their residency status and income thresholds. Generally, all New Jersey residents with income must file this form if their income meets the minimum requirement set by the New Jersey Division of Taxation. This includes individuals who have earned income through employment and self-employment.

It's crucial to distinguish between residents and non-residents, as this directly impacts tax obligations. Residents are subject to New Jersey state taxes on all income earned, while non-residents only pay taxes on income sourced in New Jersey. Income thresholds for filing vary annually, so checking current guidelines is vital. Notably, different regulations often apply to dependents and joint filers, impacting their filing decisions.

Required documentation for the NJ-1040

Before filling out the NJ-1040, it's important to gather all necessary documentation to ensure an accurate filing. Key documents include W-2 forms from employers, 1099 forms showing various types of income, and any records related to deductions and tax credits. This may include mortgage interest statements, property tax receipts, or charitable contributions.

Moreover, accurate documentation is not just about compliance; it significantly affects the ease of processing your return and the speed at which you receive any refunds or resolutions regarding your payments. Keeping organized records helps prevent errors and simplifies the entire process of completing the NJ-1040.

Step-by-step instructions for filling out the NJ-1040

Filling out the NJ-1040 can be straightforward if you follow a structured approach. Start with the personal information section, where it’s crucial to provide accurate personal details, including your Social Security number and any identification necessary for processing. This initial step sets the foundation for your application, so make sure everything matches your official documents.

Next, you'll move to income reporting. Here, you’ll report various types of income, distinguishing between earned income from job activities and unearned income from investments. Income can come from multiple sources such as wages, business revenue, pensions, and rental income.

When it comes to deductions and credits, identify common deductions you may qualify for; examples include medical expenses, property taxes, and contributions to retirement plans. Claiming tax credits effectively, such as the Earned Income Tax Credit, can significantly lower your tax liability.

Interactive tools for completing your NJ-1040

Leveraging digital tools can simplify the completion of the NJ-1040. For example, pdfFiller offers interactive forms that guide users step-by-step through the filing process. By using these tools, you can fill out the form electronically, reducing errors often associated with handwritten submissions. Additionally, e-signatures allow you to sign your form electronically, making the submission seamless and efficient.

Utilizing features such as built-in validation checks ensures that you don't overlook essential fields, thereby expediting processing and reducing the likelihood of delays in refunds or tax adjustments. With cloud-based access, you can complete your NJ-1040 from anywhere, anytime, as long as you have an internet connection.

Submitting your NJ-1040: Options and guidelines

Once your NJ-1040 is completed, the next step involves submission. You have several options available: the most efficient is e-filing through platforms like pdfFiller, which allows you to submit your form directly to the New Jersey Division of Taxation securely. E-filing typically speeds up processing times and enhances communication with tax authorities.

If you prefer traditional methods, mailing the form is an option too. Follow the guidelines provided on the NJ-1040 instructions regarding the mailing address based on your circumstances. Be aware of important deadlines for both filing and paying any owed taxes to avoid penalties.

What to expect after submitting your NJ-1040

After submission of your NJ-1040, it is important to understand the timeline for refunds or payments. Generally, if you expect a refund, you could see it within 4 to 6 weeks if filed electronically, whereas mailed returns may take longer due to processing times. To track the status of your tax return, you can visit the New Jersey Division of Taxation website, where you may find dedicated tools for tracking your refund.

In case of discrepancies or issues, the state will typically reach out via mail for clarification or to resolve disputes. Staying proactive and monitoring your return's status can help understand and rectify any potential issues swiftly.

Frequently asked questions about the NJ-1040

Common misconceptions about state taxes can often lead to confusion during the filing process. One prevalent question concerns the residency status for tax purposes; many assume that simply owning property in New Jersey qualifies them as residents. However, actual residency is determined by more factors, such as where you spend the majority of your time and where your primary residence is established.

Further, first-time filers often wonder about the implications of filing as a dependent. It's essential to clarify that dependents may need to file if their income exceeds specified thresholds, which can vary from year to year. A detailed understanding of these aspects helps streamline the filing process and avoid pitfalls.

How pdfFiller supports your tax filing process

pdfFiller provides unique benefits that facilitate a stress-free tax filing experience. Its cloud-based features enhance document accessibility, allowing users to work on their NJ-1040 at their own pace while having crucial documents readily available. The platform's collaboration tools also offer the ability for individuals and teams to work together seamlessly, ensuring all necessary information is integrated before submission.

Moreover, the ability to store and manage your tax documents in a single location simplifies the process for future years. Many users have shared testimonials highlighting how pdfFiller has transformed their tax filing experience, making it straightforward and less time-consuming.

Final thoughts on the 2025 NJ-1040 Resident Income Form

Navigating the 2025 NJ-1040 Resident Income Form can be a manageable task if approached methodically. As tax laws evolve each year, leveraging technology such as pdfFiller can eliminate common barriers, ensuring all forms are filed correctly and on time. Staying organized with documentation will provide peace of mind for future tax years, ultimately making the entire process smoother.

Embracing these available technologies not only enhances individual filing experiences but also prepares users for changes in tax regulations in subsequent years. Regularly reviewing updates from the Division of Taxation, coupled with maintaining organized financial records, creates a proactive approach to tax management.

People Also Ask about

Is NJ getting a rebate check 2022?

What are the NJ state tax brackets?

What is the tax schedule?

What are the schedules of a tax return?

When can I expect my NJ state taxes?

Do all tax returns have a schedule A?

What is the 22 tax bracket for 2022?

What is schedule a form?

Is schedule 1 the same as 1040?

Why is my NJ tax refund taking so long 2022?

Are NJ state taxes delayed this year?

What is the NJ tax rate for 2022?

What is the tax rate schedule?

What are the three main categories of a tax return?

What will the tax rate be in 2022?

Why have I not received my NJ Tax Refund?

What is a Schedule 1?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the NJ NJ-1040 Schedule NJ-COJ in Chrome?

Can I create an electronic signature for signing my NJ NJ-1040 Schedule NJ-COJ in Gmail?

How do I edit NJ NJ-1040 Schedule NJ-COJ straight from my smartphone?

What is 2025 nj-1040 resident income?

Who is required to file 2025 nj-1040 resident income?

How to fill out 2025 nj-1040 resident income?

What is the purpose of 2025 nj-1040 resident income?

What information must be reported on 2025 nj-1040 resident income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.