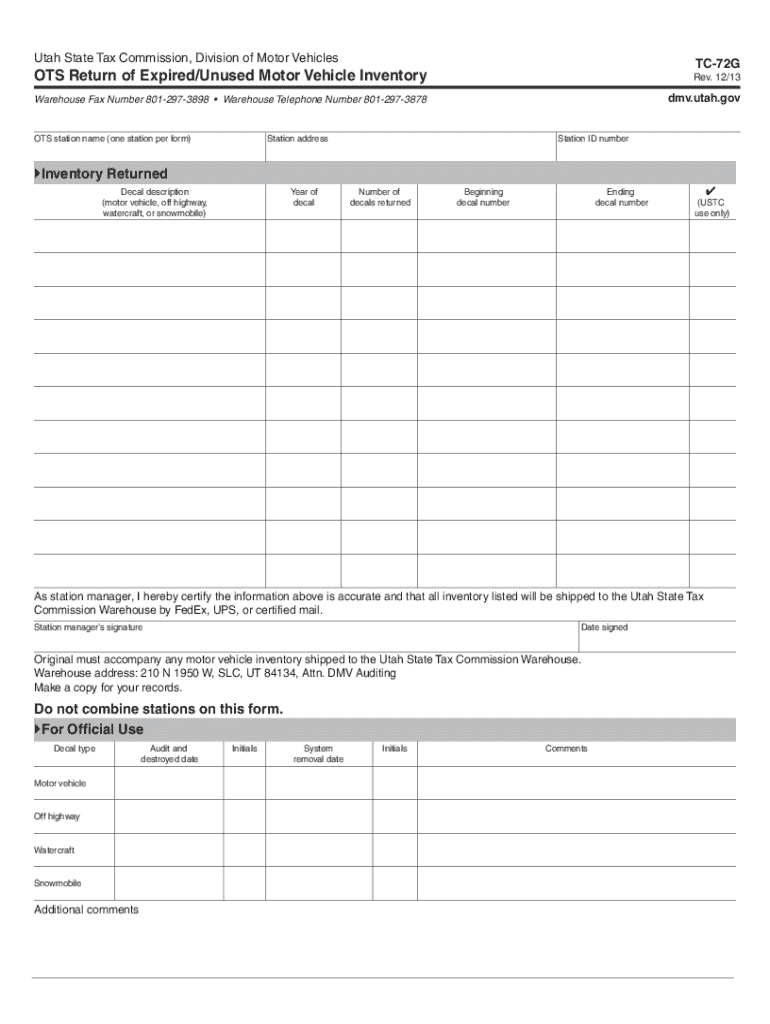

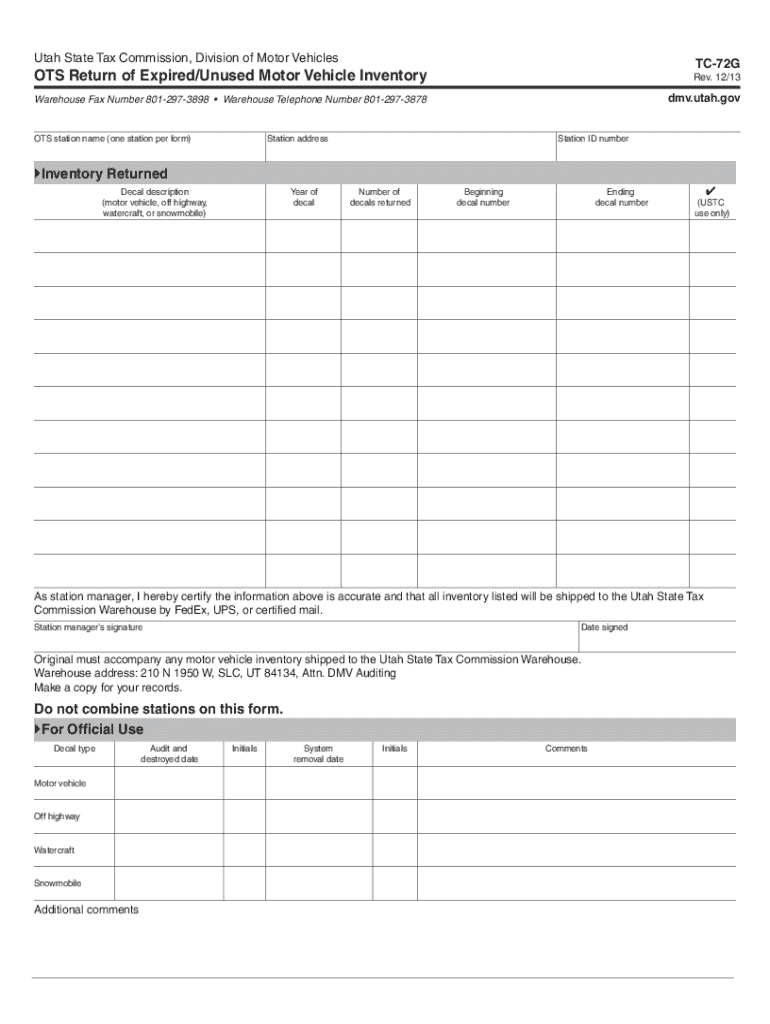

Get the free TC-72G OTS Return of Expired/Unused Motor Vehicle Inventory. Forms & Publications

Get, Create, Make and Sign tc-72g ots return of

How to edit tc-72g ots return of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tc-72g ots return of

How to fill out tc-72g ots return of

Who needs tc-72g ots return of?

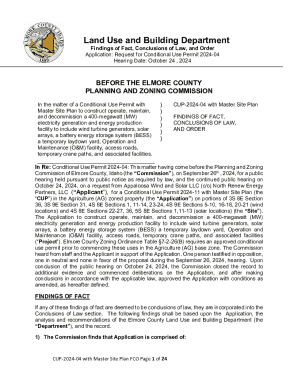

Comprehensive Guide to TC-72G OTS Return of Form

Understanding the TC-72G form

The TC-72G form, often referred to in the context of Utah tax obligations, is a critical document for taxpayers who must report certain financial activities to remain in compliance with state tax laws. This form serves as a means for individuals and entities to declare their income and fulfill withholding requirements mandated by the Utah state administration.

Filing the TC-72G is essential not only for legal compliance but also to ensure taxpayers avoid penalties associated with incomplete tax filings. For employees working within or outside of Utah, it is crucial to ascertain whether their income falls under the stipulations of this form. Additionally, businesses operating in Utah must also take TC-72G into account, particularly regarding employee withholding.

Requirements for filing the TC-72G form

To successfully file the TC-72G form, certain eligibility criteria must be met. Primarily, any taxpayer—whether an individual or business—that earns income within Utah is required to consider the TC-72G for tax reporting. This includes those working in Salt Lake City or with income sources that play a role in Utah’s tax ecosystem.

In addition to understanding eligibility, preparers need to gather essential documentation before filling out the form. Key documents include proof of income, which can come in various forms such as W-2s, 1099s, or relevant business income reports. Identification documents such as a valid driver’s license or government-issued ID are required for verification purposes. Depending on individual circumstances, additional forms related to deductions or credits may also be necessary.

Filling out the TC-72G form

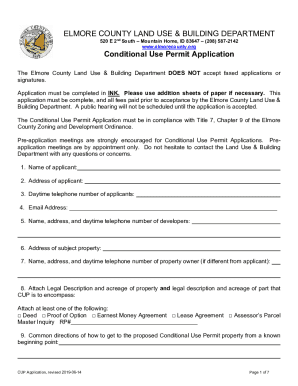

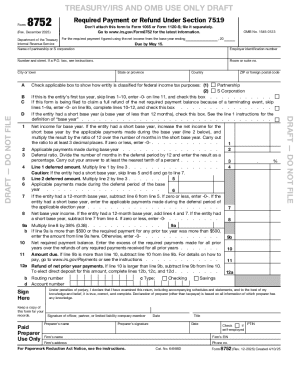

Completing the TC-72G form involves several detailed steps, ensuring accuracy in reporting all required information. Begin with Section A, where basic personal information such as your name, address, and Social Security number is reported. It’s vital to ensure this information is current and correctly formatted.

In Section B, report all sources of income. This may include wages, bonuses, or interest income, which should be clearly delineated to avoid misunderstandings later on. Moving on to Section C, deductions and credits can greatly impact the overall tax liability. Common deductions include healthcare payments and educational expenses, and understanding how to apply these effectively can lead to significant tax savings.

Finally, in Section D, ensuring that the form is signed accurately is crucial. An e-signature is now widely accepted and offers a layer of security and convenience. During this process, it is also important to be aware of common mistakes that can arise, such as mathematical errors in income calculations or forgetting to include necessary documents.

Editing and adjusting TC-72G form data

Editing your TC-72G form is crucial if you need to make adjustments after your initial completion. A user-friendly tool like pdfFiller allows you to modify your TC-72G with ease. Start by uploading your document to the platform, where all fields are easily accessible for editing.

Once uploaded, you can make changes to existing fields, ensuring all information is current and accurate. Additionally, pdfFiller offers the capability to add annotations and comments, which is particularly useful for collaborative reviews among team members. This ensures that everyone involved in the filing process is on the same page, reducing the risk of discrepancies.

Submitting the TC-72G form

After ensuring that your TC-72G form is accurate and complete, the next step is submission. With digital submission options available through pdfFiller, you can seamlessly send your form directly to the appropriate tax authority. It's crucial to be aware of any key deadlines associated with the TC-72G filing. These deadlines can vary annually and must be monitored closely to ensure timely submissions—especially for taxpayers based in Salt Lake City.

For those who may prefer alternative filing methods, mail-in submissions are also an option, though they may involve longer processing times. Understanding the pros and cons of each method can help streamline your filing process and keep your tax obligations in good standing.

Tracking your TC-72G submission status

After submitting your TC-72G, tracking its status is important to confirm whether it has been accepted or if any issues have arisen. With pdfFiller, users can track submissions directly via the platform. Clarity in this matter provides peace of mind; knowing the status helps maintain a proactive approach to resolving potential disputes or complications.

Understanding the difference between accepted and rejected filings is equally essential. Accepted filings typically indicate a successful submission, while rejections may prompt a need for correction or resubmission. Being proactive in tracking this status can save you time and effort in resolving issues with the tax authorities.

Frequently asked questions (FAQs) about TC-72G

A common concern among taxpayers is what happens if a mistake is made after filing. Generally, the procedure for addressing errors involves filing an amendment to your TC-72G. This ensures that any discrepancies are corrected promptly and enables you to file any necessary adjustments with the tax authority.

Another frequently asked question revolves around the timeline for processing a TC-72G form. While times can vary based on workload at the tax authority, it's prudent to expect a processing timeline that can be several weeks. Staying informed through pdfFiller and monitoring the submission status ensures that you remain updated on your filing’s progress.

Additional features and tools on pdfFiller

pdfFiller goes beyond mere form completion; it presents a suite of collaborative tools designed for efficient teamwork. If your team is involved in the TC-72G filing process, leveraging collaborative features such as shared access can significantly enhance productivity. Users can collaborate in real-time, making comments, suggestions, and edits independently or as a group.

Security is a key aspect of document management, particularly regarding sensitive tax information. pdfFiller guarantees secure cloud storage, ensuring that your TC-72G and other tax forms are safely stored and can be easily accessed when needed. This level of organization and security is invaluable for managing multiple tax forms efficiently throughout the filing year.

Conclusion: The importance of staying updated with TC-72G requirements

Remaining informed about the annual updates and changes to the TC-72G is crucial for both individual taxpayers and businesses. Errors or outdated information can lead to complications during tax season. Utilizing reliable resources such as pdfFiller ensures you have access to the latest information and guidance around TC-72G and Utah's tax laws.

Emphasizing ongoing education about tax responsibilities not only fosters compliance but also potentially maximizes deductions and credits, ultimately benefiting taxpayers financially. By keeping abreast of updates and utilizing tools at your disposal, you can navigate the TC-72G filing process with confidence and efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit tc-72g ots return of straight from my smartphone?

How do I fill out the tc-72g ots return of form on my smartphone?

How can I fill out tc-72g ots return of on an iOS device?

What is tc-72g ots return of?

Who is required to file tc-72g ots return of?

How to fill out tc-72g ots return of?

What is the purpose of tc-72g ots return of?

What information must be reported on tc-72g ots return of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.