Get the free Substantially Equal Periodic Payments To Establish, Change or ...

Get, Create, Make and Sign substantially equal periodic payments

Editing substantially equal periodic payments online

Uncompromising security for your PDF editing and eSignature needs

How to fill out substantially equal periodic payments

How to fill out substantially equal periodic payments

Who needs substantially equal periodic payments?

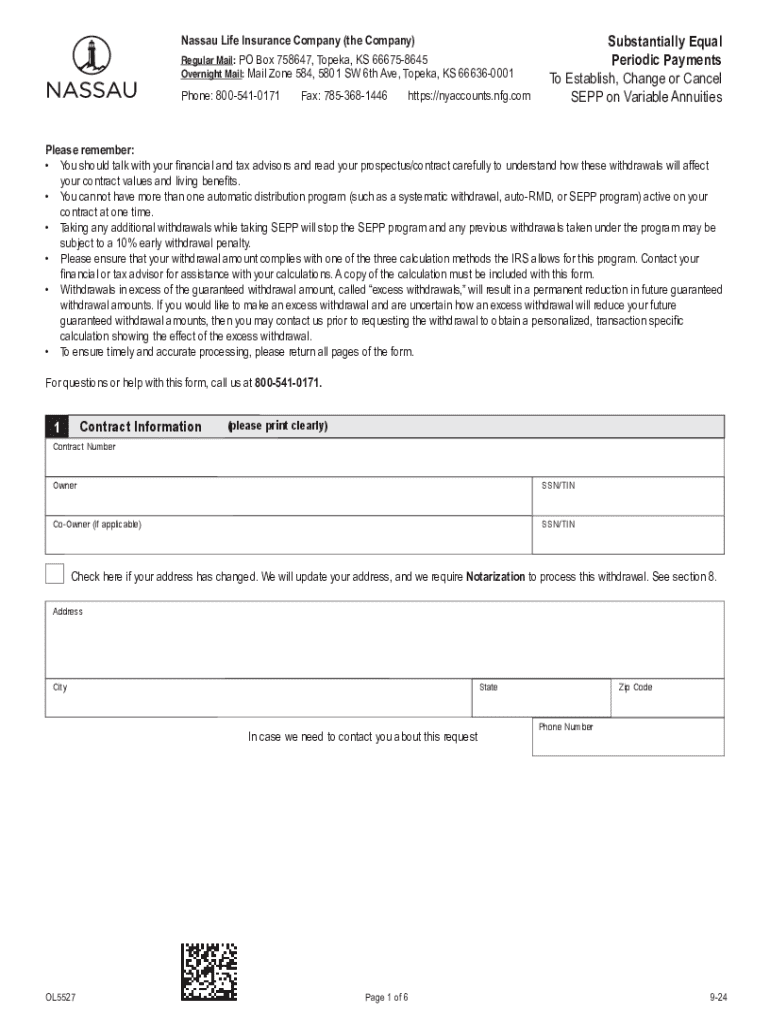

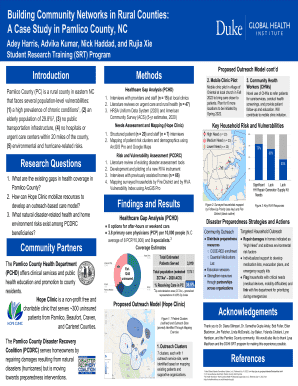

Understanding the Substantially Equal Periodic Payments Form

Understanding substantially equal periodic payments (SEPP)

Substantially Equal Periodic Payments, commonly referred to as SEPP, is a method approved by the IRS for early withdrawal of funds from retirement accounts without incurring the typical 10% penalty. The primary aim of SEPP is to allow retirees or those who have reached a financial need to access their savings while adhering to guidelines that prevent tax penalties. This process is particularly significant in tax planning and allows individuals to withdraw funds from traditional IRAs, 401(k)s, and other tax-deferred accounts.

Utilizing SEPP can offer substantial financial flexibility to those who find themselves needing cash for living expenses, healthcare costs, or other urgent financial obligations. By following the IRS guidelines meticulously, individuals can glean the benefits of early withdrawals while minimizing penalties. Moreover, understanding the stipulations surrounding eligibility is vital, as improper use of SEPP can lead to significant tax ramifications.

The basics of the substantially equal periodic payments form

The SEPP form is an essential document that outlines the specifics of your planned withdrawals. It's designed to detail how much you intend to withdraw, the intervals at which these withdrawals will occur (monthly, quarterly, or annually), and the calculations backing these decisions. Completing the SEPP form accurately is critical since any inconsistency can lead to complications with the IRS, resulting in tax penalties.

This document requires comprehensive financial and personal information, including the total amount in your qualified retirement accounts and any previous withdrawals. It’s crucial that the SEPP form is prepared meticulously to ensure compliance with IRS regulations and avoid potential financial losses. Individuals should take time to gather their information systematically before initiating the filling process.

Step-by-step instructions for filling out the SEPP form

Before you fill out the SEPP form, it's essential to gather the necessary personal financial information including your total retirement account balances, historical withdrawals, and other relevant details. You may necesitar supporting documents such as tax returns or statements from retirement accounts to back your information. This ensures that all data provided on the form is accurate, reducing the risk of processing delays or IRS penalties.

To complete the SEPP form, carefully follow these steps: 1. **Personal Information**: Fill in your name, address, Social Security number, and contact details. 2. **Calculation of Payment Amounts**: Choose the method for calculating your payment amounts—whether through the Required Minimum Distribution (RMD) method, the Fixed Amortization method, or the Fixed Annuitization method. Each has different implications for your withdrawals. 3. **Choosing a Payment Schedule**: Define how frequently you wish to receive payments. This could be monthly, quarterly, or annually based on your financial needs. 4. **Additional Considerations**: Review the section for any supplementary information or signatures required to validate your request.

Editing and customizing the SEPP form

pdfFiller provides robust tools for editing your SEPP form to ensure that it meets your specific requirements. The platform enables users to upload their SEPP forms easily and make necessary adjustments directly online, ensuring accuracy and compliance with IRS regulations. Users can access a variety of editing tools, allowing them to input data, highlight important information, or even add comments for clarification.

Collaborative editing features offered by pdfFiller are particularly beneficial for users who might be working with financial advisors or family members. The ability to share and collaborate in real-time means you can discuss modifications or concerns as they arise without needing to print or email documents back and forth. This fosters a streamlined and efficient editing process, making it much easier to prepare your SEPP form accurately.

Signing the SEPP form securely

In today's digital landscape, securely signing documents like the SEPP form has become easier with electronic signatures. pdfFiller supports the use of eSignatures, simplifying the signing process while also enhancing security. This feature is not just convenient; it conforms to legal standards governing electronic documents, ensuring that your signed SEPP form is valid and can be processed without issue.

Completing an eSignature on pdfFiller is straightforward. After you've finished filling out your SEPP form and made all necessary edits, you can smoothly transition to the signing process. Simply follow these steps: 1. Use the eSignature tool available on the platform. 2. Indicate where you need to sign on the document. 3. Follow the prompts to create and place your electronic signature, ensuring accuracy and clarity. 4. Save the signed document and distribute it as needed.

Managing your SEPP form and related documents

Once your SEPP form is complete and signed, it's crucial to manage it effectively along with any related documents. Digital storage solutions, especially cloud-based document management systems like pdfFiller, offer numerous benefits. Storing your SEPP form in the cloud ensures that it is accessible from any device and can be retrieved quickly when needed. Additionally, such platforms typically include organization tools to categorize your documents efficiently.

Moreover, tracking changes and updates to your SEPP form can save you from potential disputes regarding your financial strategy. By systematically recording edits and modifications, you can maintain a clear history of your interactions with this vital document. Setting up reminders for important deadlines, such as withdrawal schedules or tax deadline dates, can help you stay on top of your financial planning without stress.

Frequently asked questions about the substantially equal periodic payments form

When filling out the SEPP form, individuals often have questions regarding possible changes after submission. If you need to alter your form post-submission, it’s essential to understand that any changes can lead to complications with the IRS, particularly concerning penalties. It’s crucial to consult a tax advisor if you find yourself in this situation to manage any repercussions effectively.

Additionally, users should be aware of specific circumstances that may influence their eligibility for SEPP. Life events such as health issues, unemployment, or changes in financial status might affect how you are treated under IRS guidelines. Having a strategy to address potential IRS issues related to SEPP, such as compliance and documentation, becomes exceedingly important. Consulting with a financial planner can help clarify these intricacies.

Additional tools and resources for SEPP management

Utilizing online interactive calculators can significantly ease the process of determining your payment amounts for SEPP withdrawals. These tools are designed to help you project how much you can withdraw without facing IRS penalties, guiding your retirement planning decisions more effectively. Various platforms offer these calculators, and integrating them into your planning strategy can lead to more informed financial choices.

Additionally, pdfFiller provides access to a variety of related forms and templates that can support your overall financial journey. From tax documents to budgeting templates, having these resources readily available can enhance your preparation and organization process. By leveraging all available resources and tools, you can navigate the complexities of retirement and SEPP more confidently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit substantially equal periodic payments online?

Can I sign the substantially equal periodic payments electronically in Chrome?

How do I edit substantially equal periodic payments on an iOS device?

What is substantially equal periodic payments?

Who is required to file substantially equal periodic payments?

How to fill out substantially equal periodic payments?

What is the purpose of substantially equal periodic payments?

What information must be reported on substantially equal periodic payments?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.