Get the free 2526 Parent Non-Tax Filer Statement

Get, Create, Make and Sign 2526 parent non-tax filer

Editing 2526 parent non-tax filer online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2526 parent non-tax filer

How to fill out 2526 parent non-tax filer

Who needs 2526 parent non-tax filer?

2526 Parent Non-Tax Filer Form: A Comprehensive How-To Guide

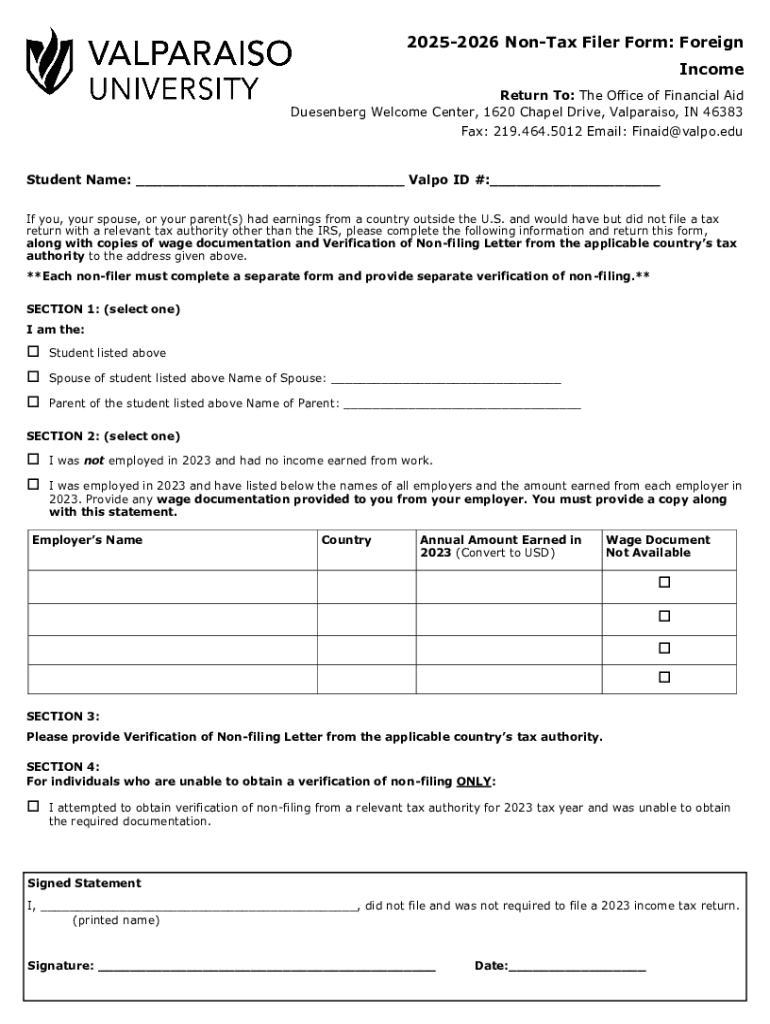

Understanding the 2526 parent non-tax filer form

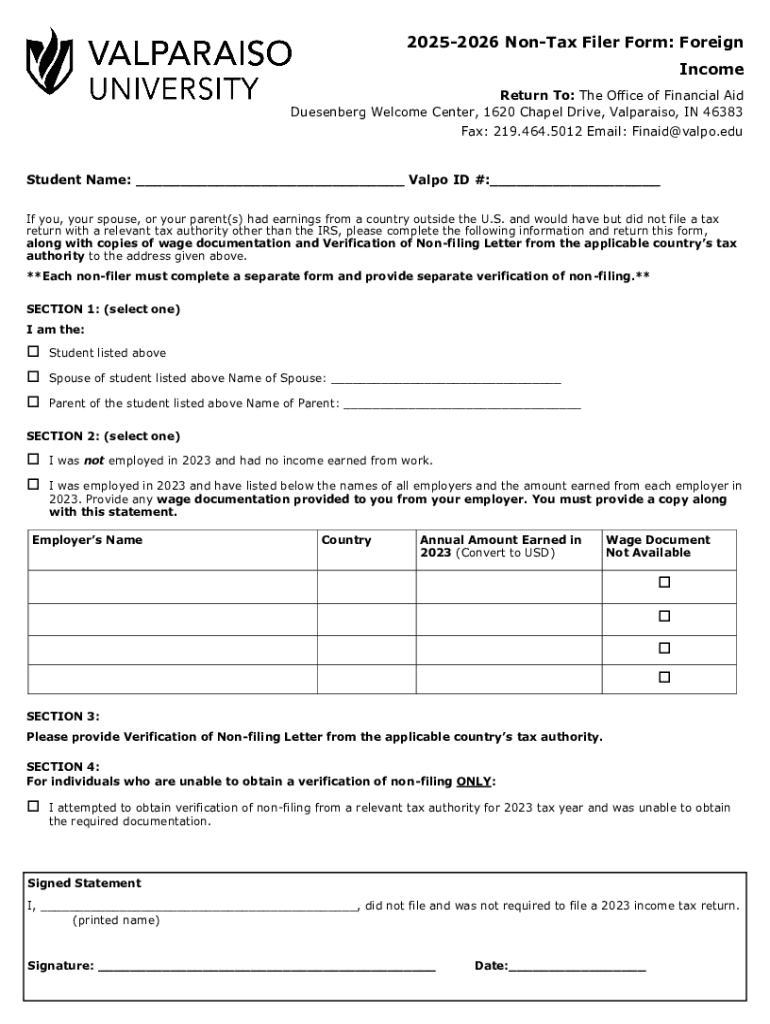

The 2526 Parent Non-Tax Filer Form is a crucial document for families navigating the financial aid process, particularly when applying for federal student aid through the Free Application for Federal Student Aid (FAFSA). This form serves as evidence that a parent has not filed a federal tax return for the relevant tax year. Its primary purpose is to ensure that the financial aid offices can fairly assess the financial situation of students from non-filing households.

Filling out the 2526 form is essential for families who either genuinely did not earn enough income to require filing taxes or whose income was derived from sources that don’t require tax reporting. By completing this form, parents provide the necessary documentation to help determine their child’s eligibility for need-based financial aid and college funding.

Who needs to fill out the 2526 form?

The 2526 Parent Non-Tax Filer Form is required for specific families, especially those in unique financial situations. Parents who do not meet the income threshold for tax filing, which is established annually by the IRS, are primary candidates for this form. Situations where this form is particularly applicable include low-income households, parents who have experienced unemployment, and families receiving Social Security benefits or other government assistance.

Determining eligibility for the 2526 form can be relatively straightforward. Parents should evaluate their financial situation in comparison to the IRS’s filing requirements. If parents earned below the minimum income to file taxes or were only receiving non-taxable income, they are encouraged to complete the 2526 form during the FAFSA application process.

Key components of the 2526 parent non-tax filer form

The 2526 Parent Non-Tax Filer Form primarily consists of several key sections that collect necessary information regarding the family's financial situation. The personal information section includes identifiers such as names, addresses, and Social Security numbers, which ensures that the application is correctly linked to the FAFSA process. This section must be detailed and accurate, as it facilitates the assessment of the family's financial background.

In terms of income reporting, the form instructs parents on how to disclose non-taxable income sources. This includes wages from jobs that do not require filing a tax return, benefits from the government, or any other form of income. Clarity in this section is vital, as inaccuracies can lead to delays or complications in financial aid processing.

Documentation needed for the 2526 form

Before filling out the 2526 Parent Non-Tax Filer Form, it’s crucial to gather the necessary documentation. Parents should have a valid identification document, such as a driver’s license, and their Social Security number at hand. Furthermore, they will also need to provide proof of income forms, such as pay stubs or official letters detailing Social Security benefits or other non-taxable income sources.

To establish non-filing status, parents must submit relevant paperwork demonstrating their income sources or lack thereof. This might include affidavits or signed statements confirming non-filing status or an IRS verification of non-filing letter. Collecting these documents upfront can simplify the process and reduce the likelihood of errors when filling out the form.

Step-by-step guide to completing the 2526 form

Completing the 2526 Parent Non-Tax Filer Form involves a systematic approach to ensure accuracy and thoroughness. The first step is gathering all necessary information and documentation. Parents should compile essential documents like Social Security numbers, income proof, and any other forms that signify non-filing status to avoid having to backtrack during the filling-out process.

Next, fill out the personal information section carefully. It’s important to double-check the entries to avoid mistakes. The income section is where parents report non-taxable income. For instances of unique financial situations, providing additional explanations in an attachment may be helpful to clarify any complexities in income sources. Finally, after completing the form, both parents should review and sign it before submitting it through the appropriate channels, keeping in mind the submission deadlines.

Common mistakes to avoid when filling out the 2526 form

When completing the 2526 Parent Non-Tax Filer Form, parents should be vigilant to avoid common mistakes that could lead to complications. Incorrect income reporting is among the most frequent errors. Accurately documenting all sources of non-taxable income is essential; misreporting even minor amounts can raise red flags during the FAFSA review process.

Omitting necessary supporting documents is another pitfall. Parents often overlook including proof of non-filing status or income statements, which are important for validating the information presented on the form. Additionally, signature errors—such as missing signatures or incorrect dates—can invalidate the submission. It is critical to ensure that all signatures are present and correctly dated to prevent delays in processing.

Frequently asked questions (FAQs) about the 2526 form

Several common questions frequently arise concerning the 2526 Parent Non-Tax Filer Form. For instance, a common query is: 'What if my parent has no income?' In such cases, the form can still be submitted, indicating zero income, along with appropriate documentation such as a signed statement clarifying the circumstances. Another inquiry revolves around correction processes, such as how to correct an error after submission; in this instance, contacting the financial aid office at the relevant institution for guidance is advisable.

Additionally, many wonder whether the 2526 form can be filed electronically. While the form itself must often be submitted via specific means designated by the financial institution, many schools accept a scanned copy for email submission. It's prudent to verify the requirements with the respective school’s financial aid office to ensure compliance with their procedures.

Using pdfFiller for your 2526 parent non-tax filer form needs

pdfFiller offers a streamlined platform for managing the 2526 Parent Non-Tax Filer Form, enhancing the user experience through its extensive features. With pdfFiller's seamless PDF editing tools, users can effortlessly fill out, edit, and save their documents online. The electronic signature capabilities also mean that parents can sign their forms directly within the platform, ensuring a quick and efficient completion process without the hassle of printing.

This cloud-based solution allows users to access their documents from any location and work collaboratively with family members or financial advisors. This is particularly beneficial for families who may need to coordinate information or get advice on filling out the form correctly. The convenience and accessibility provided by pdfFiller make it an ideal choice for busy families navigating the complexities of financial aid applications.

Tips for successfully navigating the FAFSA with the 2526 form

Efficiently integrating the 2526 Parent Non-Tax Filer Form into the FAFSA submission can significantly enhance the chances of a smoother financial aid process. It's essential to closely follow the FAFSA submission guidelines, ensuring that all deadlines are adhered to. Parents should familiarize themselves with key FAFSA deadlines, as late submissions could hinder financial aid eligibility.

Additionally, keeping a checklist of all required documents—including the 2526 form and supporting documentation—can minimize the risk of missing critical items during the application process. To further improve the process, consider working with a financial aid advisor or utilizing resources provided by pdfFiller to ensure all forms and documentation are completed accurately and submitted on time.

Additional considerations for special circumstances

There are unique cases where the 2526 Parent Non-Tax Filer Form must be adapted for special circumstances. For example, when dealing with dependents of divorced or separated parents, navigating the financial disclosures can become complicated. In these situations, it is crucial that both parents appropriately document their financial status to accurately represent the household income.

Additionally, non-citizen families may face unique challenges regarding documentation and eligibility for federal financial aid. They should carefully review the FAFSA guidelines along with the requirements for the 2526 form to ensure proper submission. Families navigating special education considerations must be sure to disclose additional support needs on the form as they may affect financial aid eligibility.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2526 parent non-tax filer for eSignature?

How do I edit 2526 parent non-tax filer on an iOS device?

Can I edit 2526 parent non-tax filer on an Android device?

What is 2526 parent non-tax filer?

Who is required to file 2526 parent non-tax filer?

How to fill out 2526 parent non-tax filer?

What is the purpose of 2526 parent non-tax filer?

What information must be reported on 2526 parent non-tax filer?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.