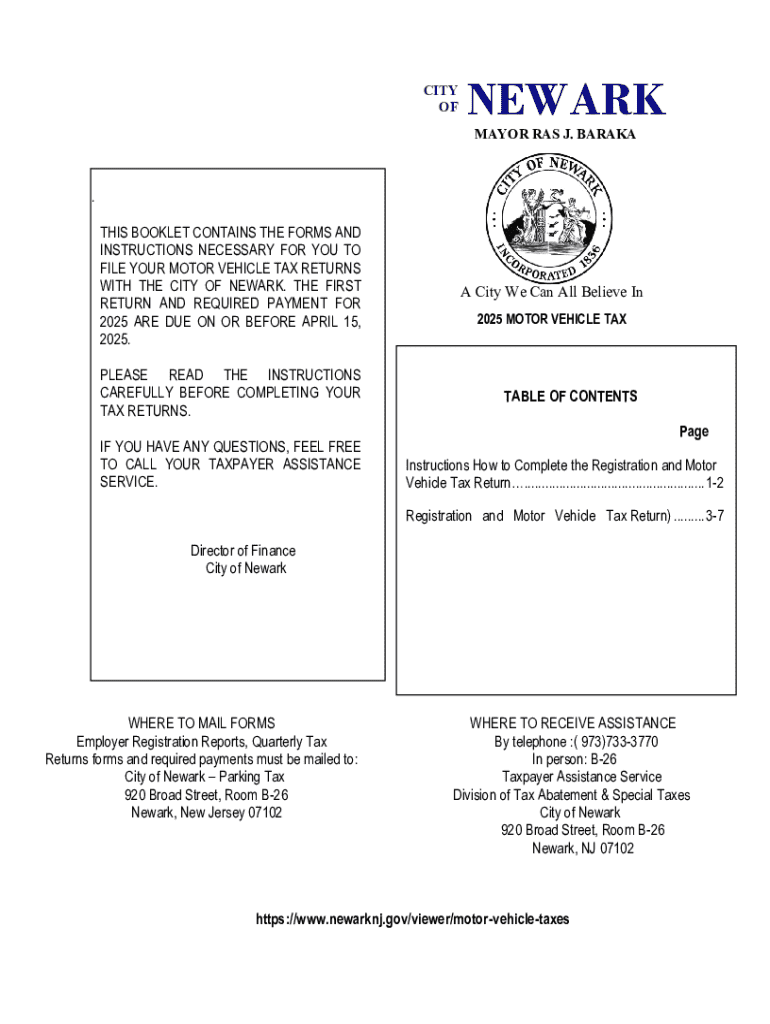

Get the free THIS BOOKLET CONTAINS THE FORMS AND

Get, Create, Make and Sign this booklet contains form

Editing this booklet contains form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out this booklet contains form

How to fill out this booklet contains form

Who needs this booklet contains form?

This booklet contains form: Your comprehensive guide to filling, editing, and managing your documents

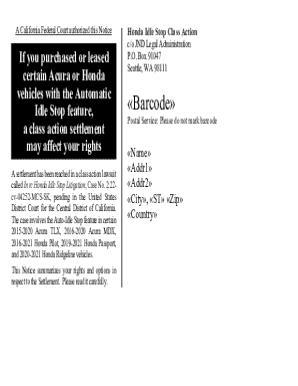

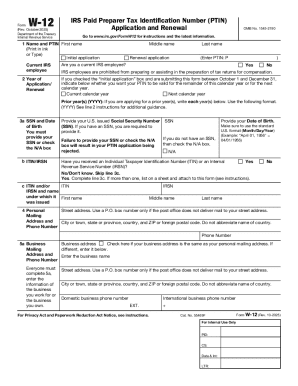

Overview of the form

This booklet contains form serves as a crucial document for individuals and teams engaging in various administrative processes, especially around tax returns and the filing of governmental documents. The primary purpose of this form is to streamline the collection of necessary information, ensuring that all required data is captured efficiently, facilitating compliance with laws and regulations.

Individuals who need to use this form include residents preparing their income tax return, filing status declaration, and even businesses that have guidelines to follow. This form is particularly important at tax season when accuracy and completeness of filing can prevent delays and penalties.

Situations where this form becomes necessary include filing your annual income tax return, applying for financial aid, or submitting a request for a tax refund. Failing to use the correct form increases the risk of errors leading to complications.

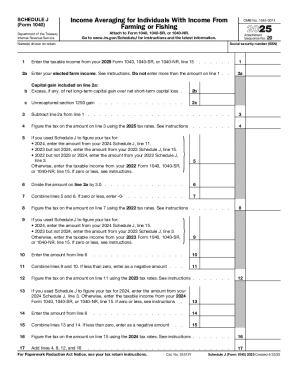

Detailed instructions for completing the form

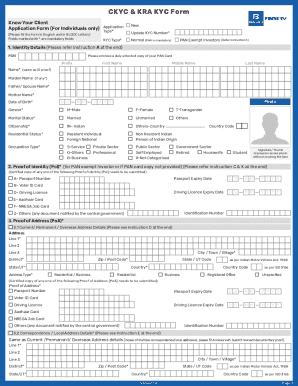

Filling out this booklet contains form requires clarity and attention to detail. To facilitate this, we provide a step-by-step guide that streamlines the process.

Step-by-step guide to filling out the form

Common challenges and solutions

Common issues when completing the form may include misunderstanding what constitutes taxable income or failing to accurately report deductions. Additionally, residents might mistakenly rely on outdated filing statuses or overlook recent regulatory changes that impact how they fill out their forms.

Practical solutions include always referring to the latest IRS guidelines and utilizing resources like tax preparation software. Additionally, engaging a tax professional can help clarify complex areas.

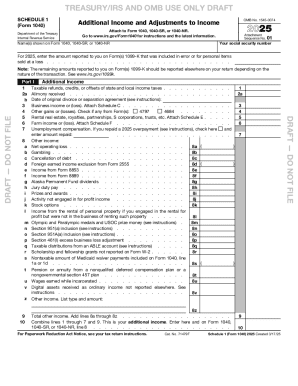

Editing and modifying the form

After filling out the form, you may find that edits are necessary. With pdfFiller's versatile tools, editing becomes user-friendly and efficient. You can correct mistakes, update information, or adapt responses without starting over.

For instance, if you need to correct an amount reported on your form or add new data regarding your filing status, simply open the document in pdfFiller, navigate to the necessary section, and make your changes. Using the 'undo' or 'redo' buttons can also help manage your edits seamlessly.

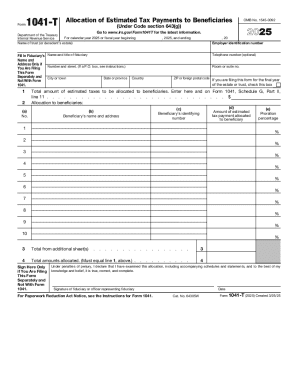

Signing and finalizing the form

Another vital aspect of completing this booklet contains form involves understanding the signature requirements. Often, both the filer and a witness or representative must sign the document, affirming that the information provided is accurate based on their knowledge.

How to eSign the form

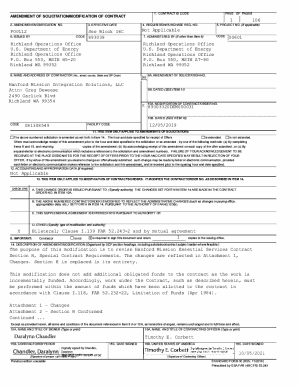

Submitting the form

Once finished, you must submit your completed form correctly. This entails knowing where and how to submit—traditionally, this can be done via mail or electronically. Each method has its pros and cons.

Check for filing deadlines—failing to comply may result in penalties or processing issues.

Confirmation of submission

Once submitted, tracking confirmation can help put your mind at ease. If submitted electronically, you should receive an email notification—ensure you keep this confirmation for your records. For paper submissions, tracking may require following up via the filing agency's dedicated channels.

Managing your form after submission

Managing your completed form does not end once it's submitted. Depending on the agency or entity to which you're submitting, you may need to track your submission's progress. Utilizing pdfFiller can significantly enhance your ability to stay organized.

It's essential to check the status periodically; if updates or amendments are needed, you can usually do so promptly through their online portal. Keeping abreast of any communications from the relevant authorities can often provide early insights into potential issues or further requirements.

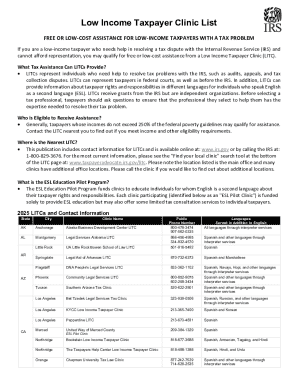

Resources and tools available

pdfFiller is equipped with several interactive tools to aid in form completion, allowing users to efficiently manage their documents. The platform offers templates for a variety of documents and a range of editing options, making it easier than ever to fill out forms accurately.

User support is an integral part of utilizing these tools effectively. Users can access a wealth of resources, including tutorials, FAQs, and dedicated support teams ready to assist with technical or procedural inquiries regarding forms.

Success stories

The effective use of this booklet contains form has proven beneficial for numerous users. For instance, a small business owner reported significant time savings in preparing tax returns using pdfFiller, which streamlined her document management process.

Testimonials highlight the ease of navigating electronic submissions and the management of essential documents, showcasing how our platform has empowered users to focus on their core tasks rather than getting bogged down by administrative processes.

Frequently asked questions (FAQs)

Many users often have similar questions regarding this booklet contains form. For example, what do I do if I realize I made a mistake after submitting? The best practice is to follow the guidelines for updating submissions outlined by the relevant agency and maintain communication to rectify any errors.

Other commonly asked questions pertain to how to ensure compliance with tax laws when completing forms. Familiarize yourself with current law changes and consider consulting a tax professional to enhance your understanding and confidence in the process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get this booklet contains form?

How do I complete this booklet contains form online?

How do I edit this booklet contains form straight from my smartphone?

What is this booklet contains form?

Who is required to file this booklet contains form?

How to fill out this booklet contains form?

What is the purpose of this booklet contains form?

What information must be reported on this booklet contains form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.