MA DoR M-4868 2025-2026 free printable template

Get, Create, Make and Sign MA DoR M-4868

Editing MA DoR M-4868 online

Uncompromising security for your PDF editing and eSignature needs

MA DoR M-4868 Form Versions

How to fill out MA DoR M-4868

How to fill out 2025 form m-4868

Who needs 2025 form m-4868?

2025 Form -4868: Your Comprehensive Guide to Tax Extensions

Understanding Form -4868: An Essential Guide for Tax Extensions

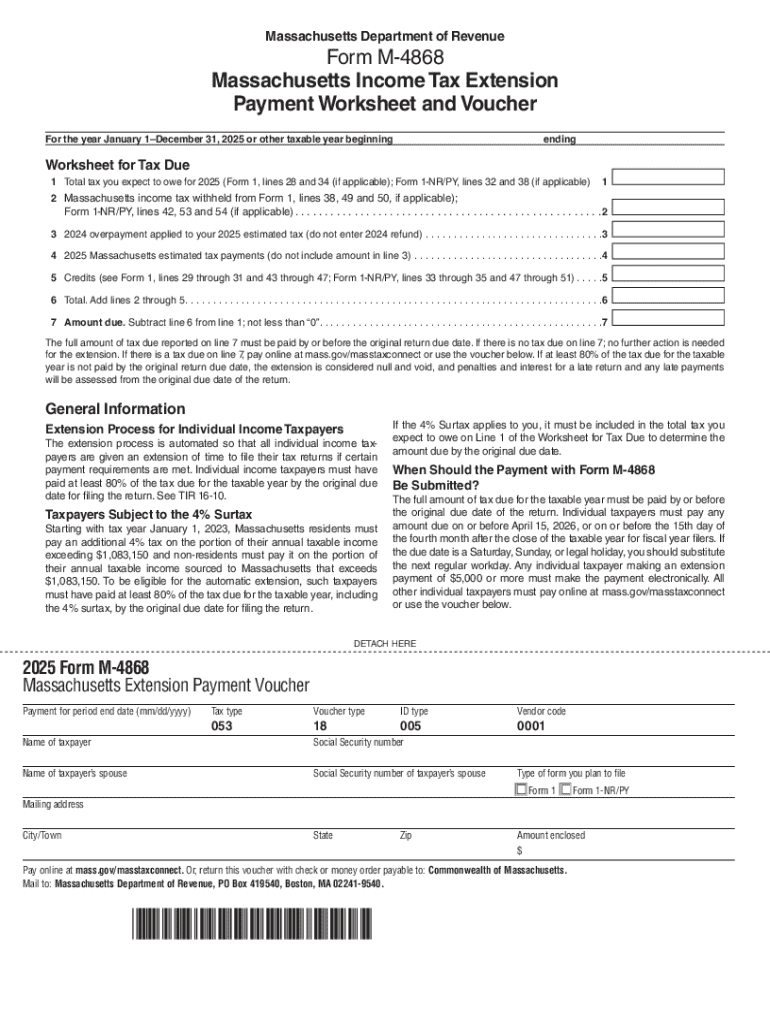

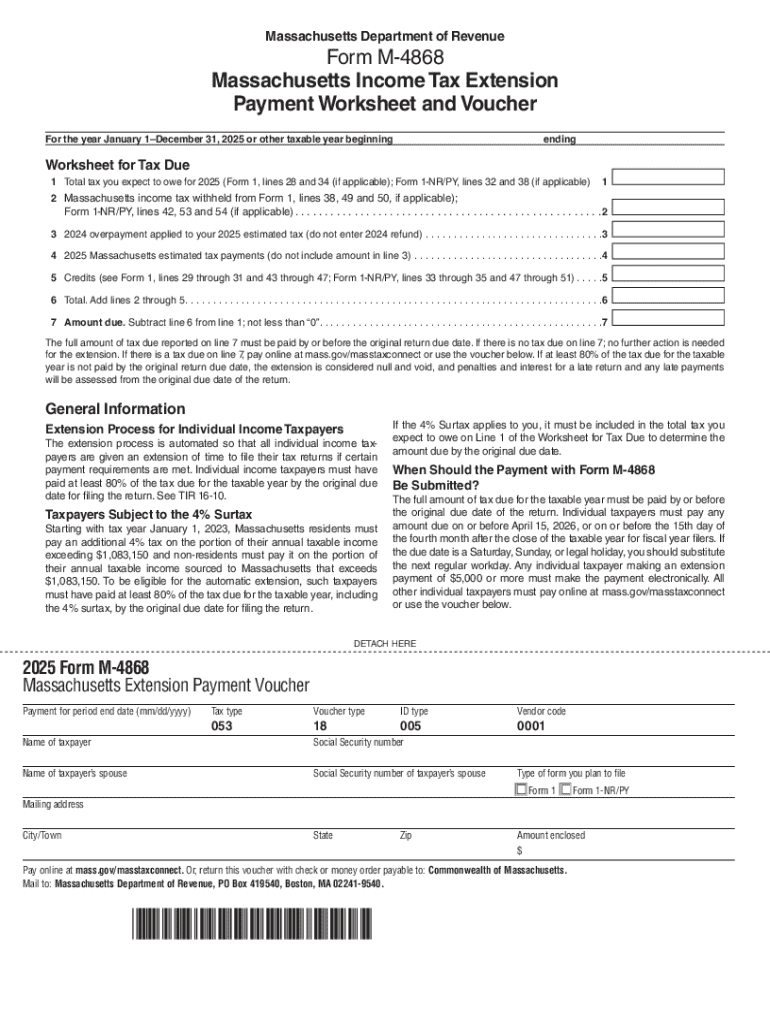

Form M-4868 is the official application for an automatic extension of time to file your declaration of income tax. As we approach the tax season in 2025, understanding this form becomes increasingly essential. The importance of filing for an extension cannot be overstated; it allows taxpayers additional time to complete their returns, ensuring that you can accurately report your financial activities without the stress of a looming deadline.

One of the key benefits of using pdfFiller for managing Form M-4868 is the ease of access and editing capabilities provided. With all your tax documents stored securely in the cloud, you can edit, sign, and collaborate on your tax extension form anytime, anywhere. This is especially advantageous as it empowers you to navigate the extension process efficiently.

Who needs to file Form -4868?

Form M-4868 is not just for anyone; it serves specific individuals who need extra time to prepare their tax returns. Anyone who believes they will not be able to meet the regular tax filing deadline should consider filing for an extension. This includes freelancers, self-employed individuals, and small business owners, who often need additional time to gather their financial data.

You may also find it necessary to file Form M-4868 if you have experienced recent life changes, such as moving to a different state or dealing with family emergencies that affect your ability to file on time. pdfFiller is particularly useful for varying user profiles, allowing freelancers to edit and sign documents for multiple clients seamlessly, or helping small businesses gather necessary information through collaborative editing tools.

The process of filing Form -4868

Filing Form M-4868 may seem daunting, but breaking it down into manageable steps can simplify the process significantly. Below is a step-by-step guide to help you through the completion and submission of Form M-4868.

By following these steps, you will navigate the filing process seamlessly. Ensure that your information is accurate, and remember that utilizing tools like pdfFiller can help streamline your experience, reducing potential errors in your submission.

Important deadlines for filing Form -4868 in 2025

The deadlines for filing Form M-4868 in 2025 are crucial to note. Generally, you must file this extension request by the tax return’s due date, which typically falls on April 15. Missing this deadline can lead to penalties, which underscores the importance of timely action.

To avoid complications, setting reminders through pdfFiller’s tools can be beneficial. This way, you will have notifications reminding you of not only the extension deadline but also the final due date for your actual tax return.

Payment options for taxes due with Form -4868

When requesting an extension with Form M-4868, it’s important to note that the IRS expects you to pay any taxes owed with your extension application. Accepted payment methods include credit or debit card payments, electronic funds transfer, or sending a check by mail.

Estimating the taxes due can be daunting, but pdfFiller can help you track what you might owe based on previous filings. Furthermore, keeping an organized record of your payment and its status can prevent last-minute complications during tax season.

Where to mail your Form -4868

Mailing your Form M-4868 should be based on your state of residence. The IRS provides specific addresses for different regions, so it is essential to check these details. Ensuring secure delivery is crucial; consider using certified mail or another trackable method to confirm that your form arrives safely.

Using pdfFiller can greatly enhance this process, as it allows you to submit your Form M-4868 electronically. This method is not just secure but also expedient, reducing possibilities for errors that come with physical submissions.

Frequently asked questions about Form -4868

Common queries regarding Form M-4868 often include questions about eligibility, how long the extension lasts, and the implications of not filing it on time. Taxpayers can find themselves confused about what to do if their circumstances change after filing the form.

Using pdfFiller gives users access to troubleshooting support for issues encountered during the filing process, ensuring that they do not need to face these challenges alone. The platform is designed to guide users at every step, making tax time a little less stressful.

Benefits of using pdfFiller for Form -4868

Utilizing pdfFiller offers a variety of features that enhance user experience, particularly during tax season. The platform provides cloud-based access to documents, making it easy to retrieve and edit forms from virtually anywhere.

Customer testimonials have showcased many success stories about how pdfFiller has simplified the tax filing process for both individuals and teams, solidifying its position as a reliable partner during tax season.

Final tips for a smooth filing experience

To ensure a smooth experience when filing your Form M-4868 and managing your tax documents, consider the following best practices. Keeping organized records of all your financial documents and tax returns will save you time and reduce stress during tax season.

Additionally, leverage pdfFiller’s additional tools such as the document collaboration features and reminders. The key to a successful tax filing experience lies in early preparation, proactive organization, and familiarization with tools that assist in seamless document management.

People Also Ask about

Can Form 4868 be mailed?

Where do I file my 4868 extension?

What is Massachusetts form M 4868?

How do I file an extension on my taxes in Massachusetts?

What is the extended tax deadline for 2022?

Does Ma require a tax extension?

What is form M 4868?

Do you need to file a Massachusetts extension?

How much does it cost to file for an extension for your taxes?

How do I file an extension for taxes in MA?

How does form 4868 work?

What does 4868 mean?

Can I file my own extension for taxes?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send MA DoR M-4868 to be eSigned by others?

How do I execute MA DoR M-4868 online?

How do I edit MA DoR M-4868 on an Android device?

What is 2025 form m-4868?

Who is required to file 2025 form m-4868?

How to fill out 2025 form m-4868?

What is the purpose of 2025 form m-4868?

What information must be reported on 2025 form m-4868?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.