Get the free County and Transit Sales and Use Tax Rates For Cities and Towns ...

Get, Create, Make and Sign county and transit sales

Editing county and transit sales online

Uncompromising security for your PDF editing and eSignature needs

How to fill out county and transit sales

How to fill out county and transit sales

Who needs county and transit sales?

County and Transit Sales Form: A Comprehensive How-To Guide

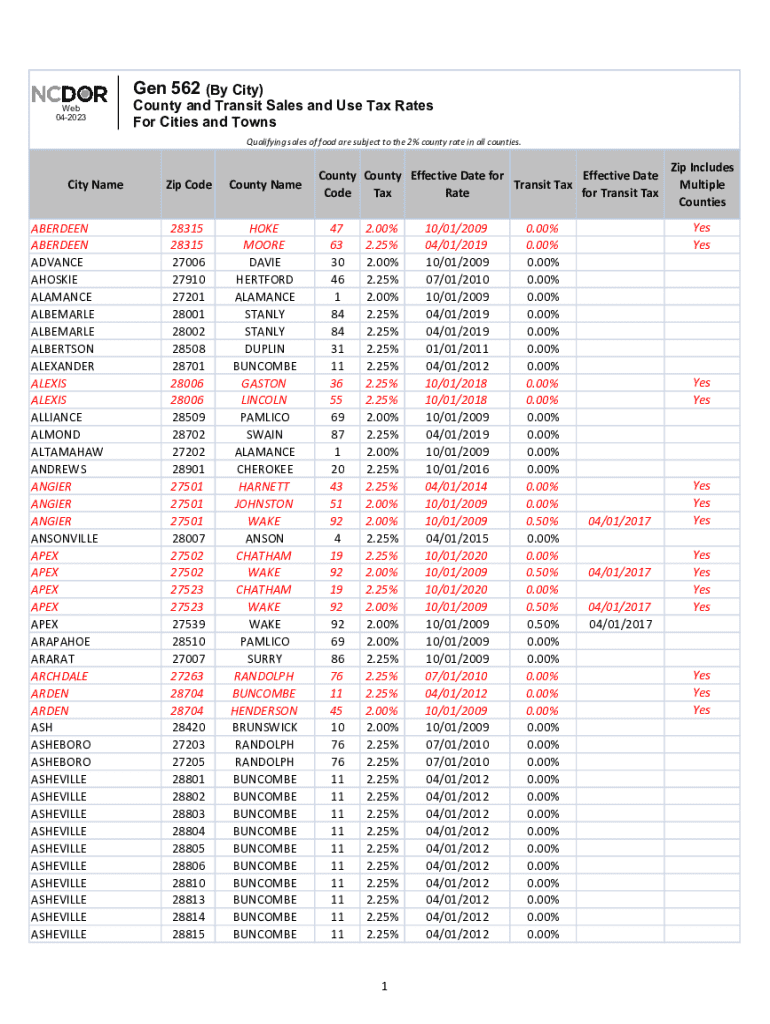

Overview of the county and transit sales form

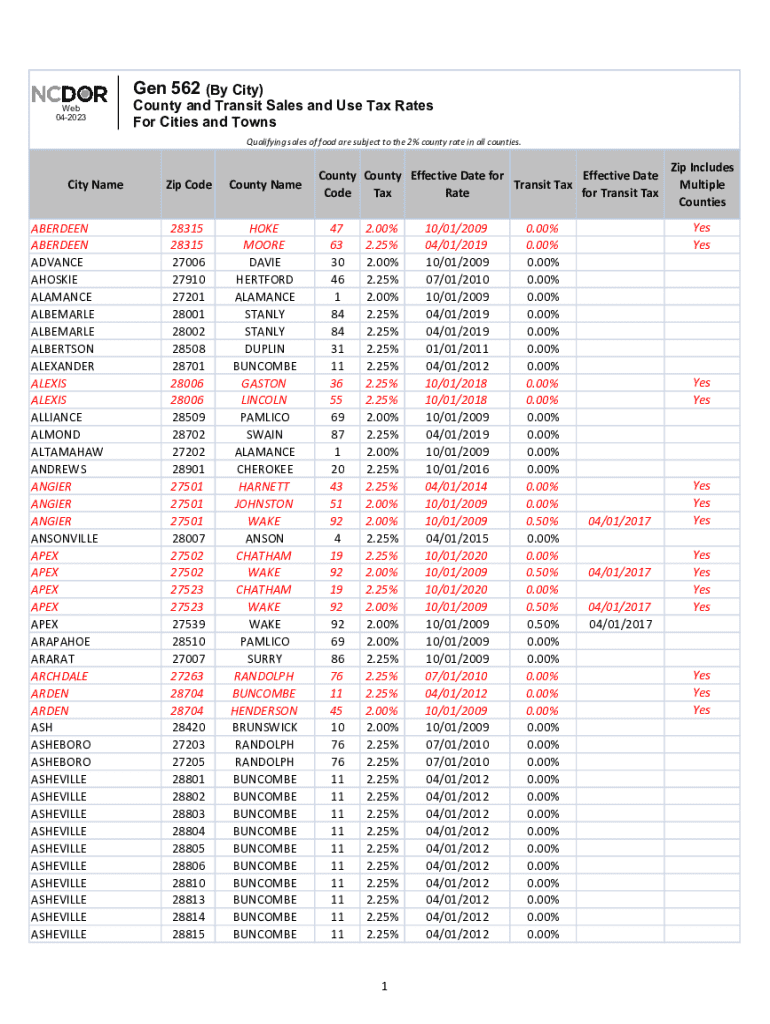

The county and transit sales form is a crucial document used by local governments and businesses to report sales tax collected from various transactions. This form plays a vital role in ensuring that revenue is accurately collected and allocated for public services, including transportation and infrastructure developments.

The importance of this form cannot be understated, as it directly impacts funding for public programs and services that benefit residents. Understanding how to properly fill out this form is essential for compliance and contributes to the overall financial health of the community.

Key features of the county and transit sales form

The county and transit sales form addresses various types of transactions, including sales at retail, wholesale, and service levels. Whenever a sale is made that includes a state-imposed sales tax, this form is applicable, which makes it essential for both businesses and local agencies.

Understanding applicable tax rates is also important. Generally, these rates can vary by county or transit district, and exemptions may apply in certain situations. For example, non-profit purchases and specific exemptions for essentials like groceries might not require tax reporting on some transactions.

Step-by-step instructions for completing the form

Completing the county and transit sales form requires careful attention to detail. Following a structured approach can help prevent mistakes and ensure accuracy.

Gathering necessary information

The first step is to gather all necessary information. This includes your personal information, such as your name, address, and contact details. Additionally, documentation like proof of residency and sales receipts will assist in accurately reporting the required data.

Filling out the form

Breaking down the form into sections can make the process manageable. Generally, you’ll see sections for personal information, sales information, and tax calculations. Each part needs to be filled out completely and accurately, so reviewing how to approach each section is beneficial.

Common mistakes to avoid

Common pitfalls include incorrect math calculations and missing sections. Double-checking figures against your sales documentation is crucial to avoid discrepancies.

Reviewing your submission

Once you've filled out the form, a thorough review is essential. Ensure you double-check all entered data against your original resources to verify accuracy. It's helpful to take a moment to ensure that all calculations and figures align before submitting.

Interactive tools and resources

Utilizing digital tools can streamline the process of filling out the county and transit sales form. Various platforms and applications facilitate this task effectively.

PDF form filling tools

Tools like pdfFiller enable users to fill out forms online efficiently. The platform offers intuitive features that aid in the completion of forms with precision and convenience.

Benefits of using template features

Using preset templates can save time and streamline the information entry process. Users can enter their data in a structured format that is already aligned with local form requirements, allowing for quicker and easier submission.

eSignature options

Many platforms now offer eSignature functionality, allowing you to sign forms electronically. This method is not only convenient but is also legally valid in most jurisdictions, making it easier to finalize documents quickly.

Managing submitted forms

Once the county and transit sales form is submitted, understanding how to manage your documentation is key. Keeping track of submitted forms ensures accountability and transparency in local tax reporting.

Tracking your submission

Confirming receipt of your submission by your county office is vital. Many tax authorities provide a confirmation number or email as proof of submission. Checking processing times is also important to plan your next steps appropriately.

Making corrections post-submission

If you realize a mistake after submission, reaching out to local tax authorities for guidance is essential. Most forms can be amended, but knowing the correct steps to take can save time and frustration.

Frequently asked questions (FAQs)

Understanding common queries regarding the county and transit sales form can alleviate confusion. Many individuals have similar concerns that recur throughout the process.

Clarifications on tax obligations are also essential. Understanding applicable regulations helps improve compliance and encourages timely submissions.

Tips for successful document management

Proper document management of the county and transit sales form facilitates smooth operations. Ensuring that all filed forms are readily accessible can prevent future hassles.

Storing your documents safely

Utilizing cloud storage solutions such as pdfFiller allows for organized and secure storage of important documents. This approach not only keeps records safe but also allows access to forms from anywhere, enhancing flexibility.

Collaborating with others on form completion

When multiple individuals are involved in filling out the county and transit sales form, collaboration tools can help. Sharing documents for team input leads to more accurate and comprehensive submissions.

Additional considerations for specific groups

Different groups may have unique needs when completing the county and transit sales form. Acknowledging their distinct requirements can simplify the process.

Residential vs. business transactions

Individuals might have different tax obligations compared to businesses. Tailored guidance that considers the nuances of both scenarios is beneficial in ensuring compliance with local tax laws.

Seasonal and temporary considerations

Events such as seasonal businesses or pop-up stores may have specific sales tax considerations that differ from permanent establishments. Making the necessary adjustments when completing the form is essential to account for unique circumstances.

The role of technology in simplifying form management

The integration of technology in document management has transformed the way forms like the county and transit sales form are completed and submitted. Streamlined processes offer tremendous benefits in time and resource management.

With cloud-based platforms such as pdfFiller, ease of access and reliability are enhanced. Users can handle their documents efficiently regardless of their location, thus improving workflow for both individuals and businesses.

Looking forward, trends indicate an increasing reliance on digital solutions for tax compliance. Advancements in technology will continue to shape how local governments manage forms, leading towards simpler and more efficient processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find county and transit sales?

How do I execute county and transit sales online?

Can I edit county and transit sales on an Android device?

What is county and transit sales?

Who is required to file county and transit sales?

How to fill out county and transit sales?

What is the purpose of county and transit sales?

What information must be reported on county and transit sales?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.