Get the free TC-65 Utah Partnership/Liited Liability Partnership/Limited Liability Company Return...

Get, Create, Make and Sign tc-65 utah partnershipliited liability

How to edit tc-65 utah partnershipliited liability online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tc-65 utah partnershipliited liability

How to fill out tc-65 utah partnershipliited liability

Who needs tc-65 utah partnershipliited liability?

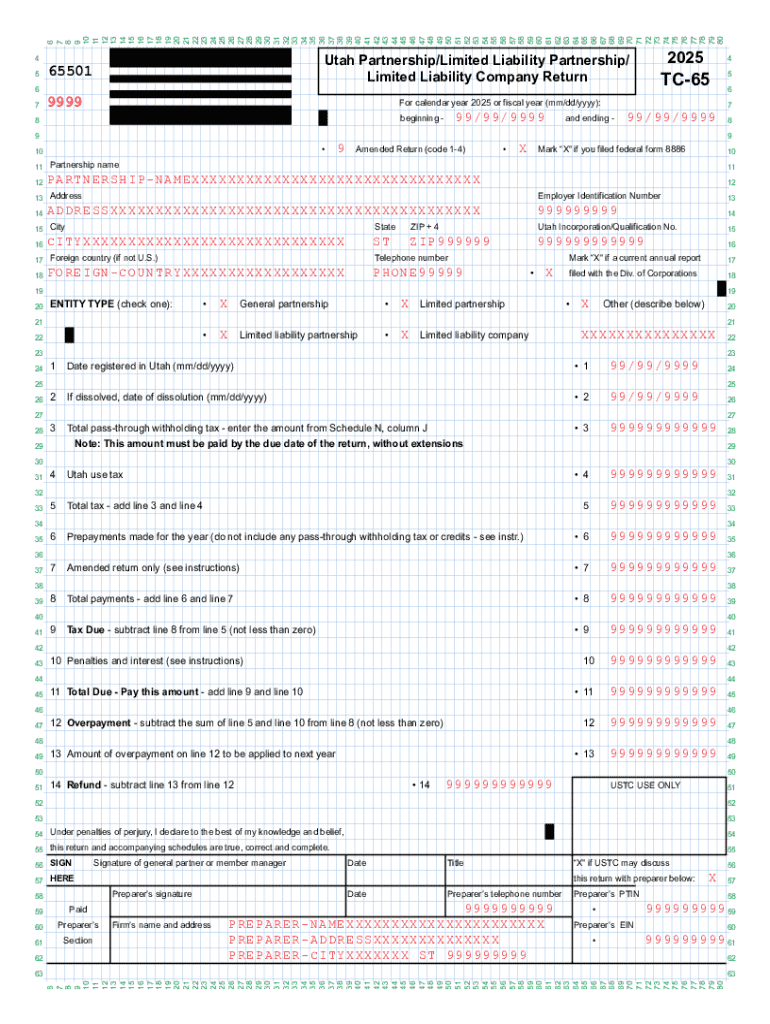

A Comprehensive Guide to the TC-65 Utah Partnership Limited Liability Form

Understanding the TC-65 Utah Partnership Limited Liability Form

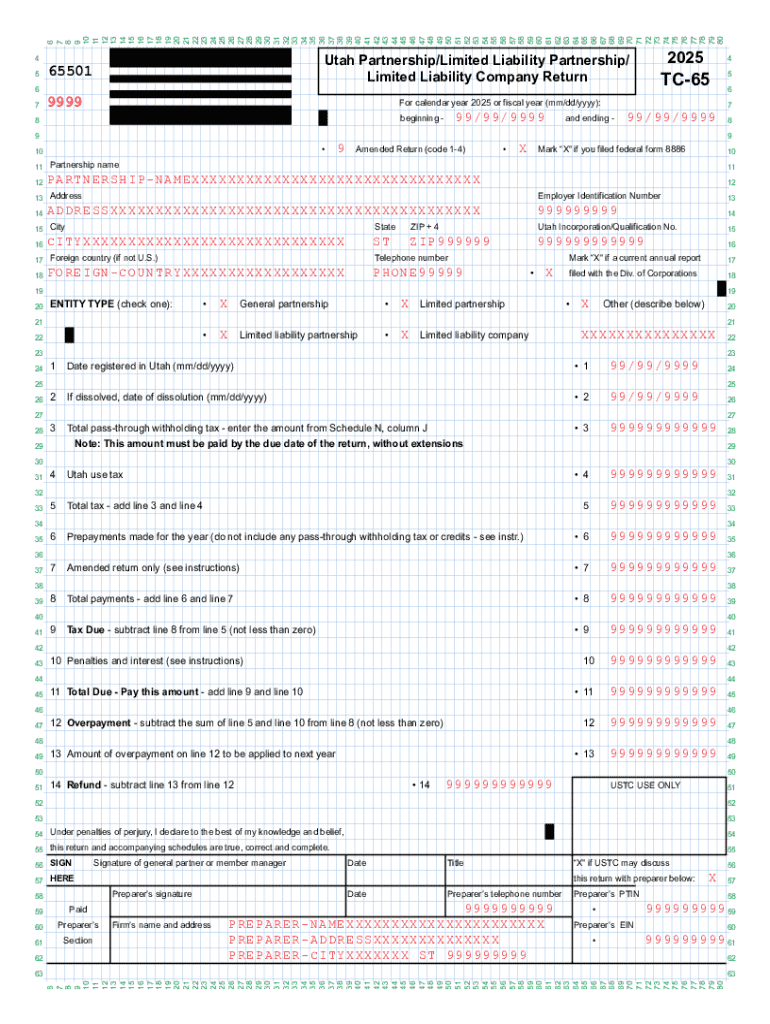

The TC-65 form is a critical document for partnerships in Utah, specifically designed to manage limited liabilities among partners. Its primary purpose is to facilitate the declaration of partnership status to state tax authorities and formalize the partnership structure. By filing the TC-65 form, partners can delineate their roles, responsibilities, and share in profits and losses clearly, thus avoiding potential legal complications.

Particularly for limited liability partnerships (LLPs), the TC-65 form is essential. It establishes the partnership as a separate entity for tax purposes, which can lead to significant tax advantages when handled correctly. Understanding the legal basis of this form ensures that partnerships comply with state laws, safeguarding the interests of all parties involved.

Who needs to complete the TC-65 form?

The TC-65 form is aimed at partnerships operating as either general or limited forms. A general partnership involves all partners sharing equally in the management and profits, while a limited partnership includes at least one general partner and one or more limited partners who typically invest but do not manage the business. To determine if you qualify to file the TC-65 form, assess your partnership's structure and the nature of your operations. If you're unsure about your eligibility, consulting a tax professional is advised.

Completing the TC-65 form becomes necessary in specific situations, including when forming a new partnership, changing existing partnership dynamics, or filing for certain tax benefits. Recognizing these requirements early can help you avoid complications with your tax accounts and ensure compliance with Utah's partnership regulations.

Key components of the TC-65 form

Understanding the key components of the TC-65 form is essential for successful completion. The document typically requires specific required information, including the basic partnership details such as name, address, and formation date, along with details about each partner. This includes partner identification information and their corresponding financial contributions.

Moreover, the TC-65 form addresses the profit and loss allocations that each partner is entitled to. This section is crucial; it clearly delineates how income generated by the partnership is distributed among partners, which directly impacts individual income tax returns. Additionally, outlining tax obligations accurately in this document is fundamental for each partner's financial accountability and responsibilities.

Step-by-step instructions for filling out the TC-65 form

Successfully completing the TC-65 form is a straightforward process if approached methodically. Start by preparing: gather all necessary documentation, including existing partnership agreements, partner identification details, and financial statements. This preparation ensures you have all relevant information at your fingertips, making the process smoother.

When you begin filling out the TC-65, start with Section 1: Partnership Information. Here, provide details about your partnership, including its legal name and address. Move on to Section 2: Partner Details, where you’ll list each partner’s name and percentage of ownership. Finally, in Section 3: Financial Information, itemize each partner’s financial contributions and outline how profits and losses will be shared. Be vigilant about common pitfalls, such as misreporting partner contributions or neglecting to verify partner details, which can lead to legal woes.

Finalizing and submitting your TC-65 form

Once you have meticulously completed the TC-65 form, the next crucial step is to review the document for accuracy and completeness. It's advisable to cross-check figures and ensure that all partners have agreed on the profit and loss allocations documented. Failing to conduct this review could lead to frustrating delays in processing or potential rejections from state tax authorities.

When you're satisfied with the form, you can submit it through various methods. Online submission options are available, facilitating a swift filing process. Alternatively, you can choose traditional mail submission, but this may take longer. Ensure you meet the necessary deadlines to avoid filing penalties related to income taxes or future partnership disputes.

Managing your TC-65 form with pdfFiller

Utilizing pdfFiller for managing the TC-65 Utah Partnership Limited Liability Form enhances efficiency. The platform's editing features allow users to input and modify the text dynamically, ensuring that the document is always up-to-date with the necessary information. Furthermore, eSigning capabilities make it easy for partners to provide their consent without the need for printing or scanning, greatly expediting the approval process.

Collaborating on the TC-65 form through pdfFiller is seamless, especially for teams. Users can share the document with partner access, enabling real-time reviews and updates. By managing permissions effectively, you can control who makes changes, thereby minimizing the risk of unauthorized alterations.

FAQs about the TC-65 form and partnerships in Utah

Navigating the TC-65 form can lead to many questions among users. A common concern is what happens if mistakes are made on the form. It's crucial to rectify errors as soon as they are identified, as inaccuracies can lead to complications in your tax accounts. A straightforward approach is usually to contact the appropriate state tax office for guidance on correcting submitted forms.

Another prevalent query involves changes in partnership structure. As partners enter or exit the partnership, the TC-65 form may need to be updated to reflect these changes. This is important because shifts in structure can directly impact not just profit sharing but also tax implications that affect individual income tax returns.

Last but not least, users often inquire about the tax implications and filing status questions related to the TC-65. Each partner should remain informed about their obligations to ensure compliance with both state and federal tax laws, particularly concerning income taxes.

Additional tips for partnership formation compliance

Maintaining accurate records is vital for any partnership. Best practices include organizing all partnership-related documents in a secure place, which aids in account management and prepares you for any future financial or tax audits. Digital platforms like pdfFiller support efficient document management and archival processes.

Understanding your ongoing compliance requirements is equally critical. Partnerships in Utah must adhere to annual filing obligations, including updates to any changes in partnership information, tax accounts, and financial contributions. Regular audits of your partnership structure will enhance transparency and accountability, crucial for long-term success.

Real-world examples of TC-65 form usage

Examining real-world examples simplifies understanding of how the TC-65 form operates in practice. For instance, consider a partnership formed for a tech startup. They filed the TC-65 form to delineate the ownership structure and profit-sharing, clearly indicating that one partner contributes more capital while another brings in necessary technical expertise. This clarity facilitated smoother operation and clearer income tax filings.

Conversely, partnerships that failed to adequately document changes in partner contributions often encountered disputes. These case studies highlight that proper use of the TC-65 form not only ensures compliance but also prevents common partnership pitfalls.

Interactive resources and tools available on pdfFiller

To enhance user experience, pdfFiller offers a variety of interactive resources and tools for the TC-65 form. Users can access online templates tailored for different types of partnerships, streamlining the filing process significantly. These templates are designed to meet specific Arizona filing requirements, making it easier than ever to ensure accuracy.

Additionally, interactive checklists guide users through the process of completing the TC-65, from preparation to submission. Support and guidance on pdfFiller are readily accessible, ensuring that users have the help they need as they navigate through partnership filings and compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get tc-65 utah partnershipliited liability?

How do I make changes in tc-65 utah partnershipliited liability?

Can I sign the tc-65 utah partnershipliited liability electronically in Chrome?

What is tc-65 utah partnershipliited liability?

Who is required to file tc-65 utah partnershipliited liability?

How to fill out tc-65 utah partnershipliited liability?

What is the purpose of tc-65 utah partnershipliited liability?

What information must be reported on tc-65 utah partnershipliited liability?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.