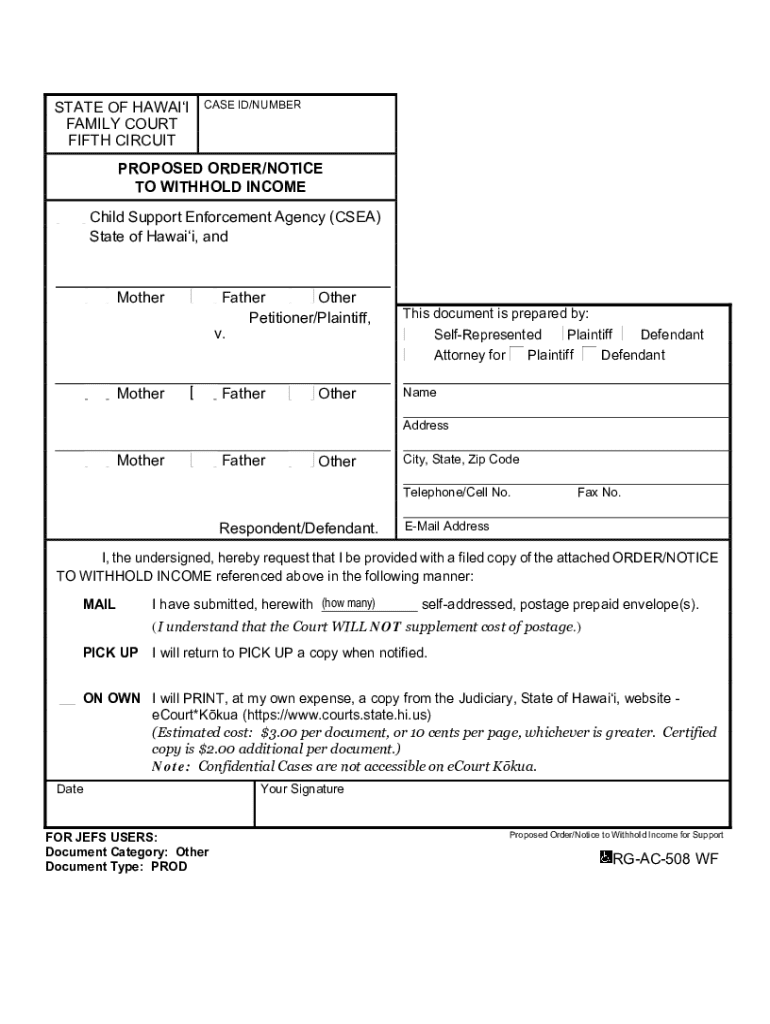

Get the free Order/Notice to Withhold Income for Support

Get, Create, Make and Sign ordernotice to withhold income

How to edit ordernotice to withhold income online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ordernotice to withhold income

How to fill out ordernotice to withhold income

Who needs ordernotice to withhold income?

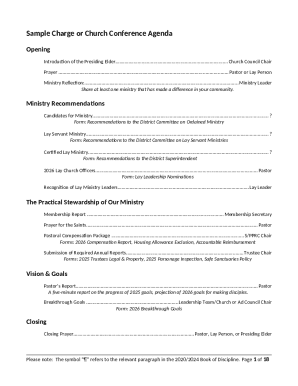

Order Notice to Withhold Income Form - A Comprehensive Guide

Understanding the Order Notice to Withhold Income Form

The Order Notice to Withhold Income Form is a legal document issued by a court or government organization that requires an employer to withhold a portion of an employee's income to satisfy debts owed, commonly for child support or tax obligations. This form serves a crucial function in enforcing financial responsibilities, particularly in cases where individuals fail to meet their payment obligations voluntarily.

The purpose of this form is to ensure that funds are automatically deducted from the employee’s paycheck, thus simplifying the process of debt repayment. Its importance in financial management cannot be understated, as it helps maintain compliance with court orders and protects the rights of the obligee, which can be a parent, tax authority, or other creditor.

Key components of the form

Understanding the structure of the Order Notice to Withhold Income Form is essential for effective completion. Each form typically includes specified sections dedicated to various types of information required to process the withholdings properly. These sections include personal details about the obligor and obligee, financial identifiers, and instructions for employers.

How to complete the Order Notice to Withhold Income Form

Filling out the Order Notice to Withhold Income Form requires careful attention to detail. Begin by gathering all necessary information related to the debtor's financial and personal details. This includes names, addresses, Social Security numbers, and specific financial obligations.

To avoid common mistakes, double-check that all information is correctly entered and that the form adheres to specific state requirements, as they may vary. An accurate and complete form not only facilitates timely processing but also ensures compliance with legal and financial obligations.

Submitting the form

After completing the Order Notice to Withhold Income Form, the next crucial step is submission. The form should be submitted to the obligor's employer or the appropriate state agency. Depending on your location and circumstances, submission methods may vary.

Ensure to keep copies of the submitted forms for your records, as they can be important for any future inquiries or disputes. It’s also critical to adhere to deadlines associated with the submission, as delays can affect the enforcement of the withholding order.

Managing the order after submission

Tracking the status of the Order Notice to Withhold Income Form after submission is essential for maintaining oversight of the withholding process. Depending on the local government organization or employer, you may receive confirmation of receipt or an update regarding when the withholding will commence.

In case any issues or inquiries arise regarding the order, it is advisable to address them promptly. Having documented communications regarding the order’s status or any disputes is crucial for ensuring adherence to legal agreements.

Modifying or canceling the order

Circumstances may change, necessitating modifications to the Order Notice to Withhold Income Form. If you need to update your information, including changes in the withheld amount, follow the same detailed procedure as filling out the original form.

If you find yourself in a situation where the order needs to be revoked entirely, follow protocol as per your state guidelines for canceling the withholding order. Ensure that you maintain proof of this cancelation for your records.

Best practices for using the Order Notice to Withhold Income Form

To optimize your experience with the Order Notice to Withhold Income Form, it is essential to adopt best practices that safeguard your interests and facilitate smooth operations. Keeping thorough records is paramount. All correspondence, submitted forms, and any notifications received regarding the order should be documented meticulously.

Interactive tools for document management

Utilizing digital solutions, such as pdfFiller, can greatly simplify the process of managing your Order Notice to Withhold Income Form. Features offered by pdfFiller include easy editing options, eSigning capabilities, and collaborative tools that enable various stakeholders to manage documents efficiently.

Through pdfFiller, users can take charge of their document management by ensuring they have the latest tools at their disposal to handle the complexities of income withholding orders.

Related forms and templates

Understanding the Order Notice to Withhold Income Form is crucial, but it is also helpful to familiarize yourself with other related documents. In addition to the withholding order, other income-related documents can be integral, including child support forms and tax forms.

Familiarizing oneself with these documents aids in navigating the financial obligations effectively and prevents oversight.

Frequently asked questions (FAQs)

The Order Notice to Withhold Income Form often raises several questions among users, especially regarding its implications and processing.

Addressing these common queries will empower users to navigate the intricacies of the Order Notice to Withhold Income Form with greater confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my ordernotice to withhold income in Gmail?

How can I fill out ordernotice to withhold income on an iOS device?

How do I fill out ordernotice to withhold income on an Android device?

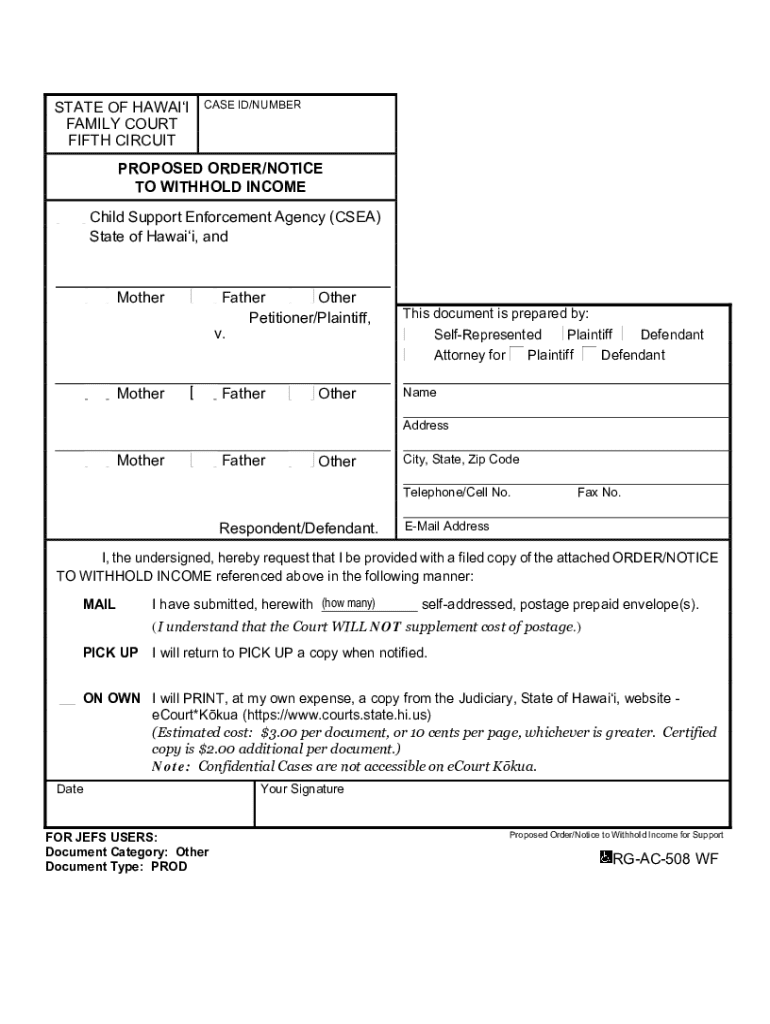

What is ordernotice to withhold income?

Who is required to file ordernotice to withhold income?

How to fill out ordernotice to withhold income?

What is the purpose of ordernotice to withhold income?

What information must be reported on ordernotice to withhold income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.