Get the free Form 324 Business Employment Incentive Program Tax ...

Get, Create, Make and Sign form 324 business employment

How to edit form 324 business employment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 324 business employment

How to fill out form 324 business employment

Who needs form 324 business employment?

Understanding Form 324 Business Employment Form: A Comprehensive Guide

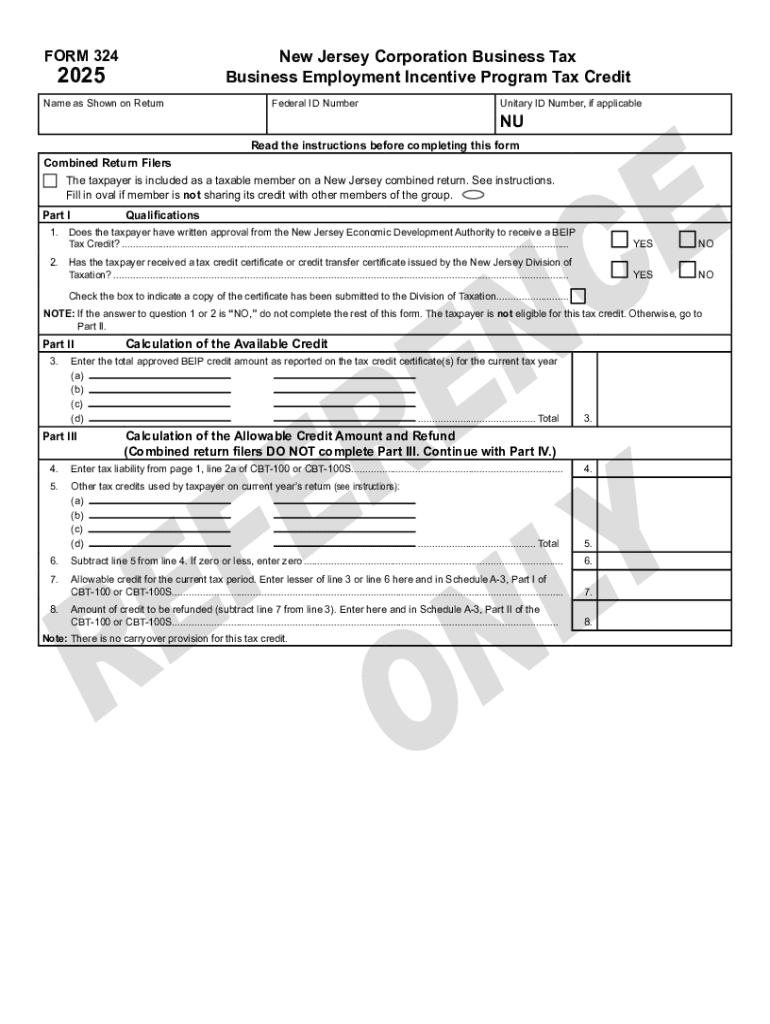

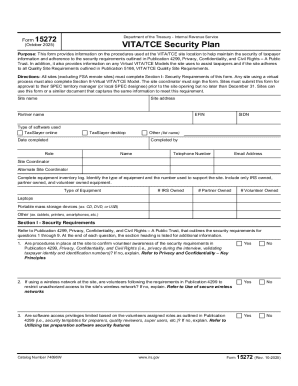

Overview of Form 324

The Form 324 Business Employment Form is a critical document employed by businesses to report employment data and claim tax credits through employment incentives. This form plays an important role in ensuring that businesses not only fulfill their reporting obligations but also gain access to various benefits that can lead to significant financial savings.

Understanding the importance of Form 324 is essential for any business owner. By utilizing this form, businesses can demonstrate compliance with employment regulations while simultaneously positioning themselves to benefit from applicable tax incentives. As such, Form 324 serves as an essential tool for effective business management.

Purpose of the Form 324 Business Employment Form

The primary objective of the Form 324 Business Employment Form revolves around documenting critical employment information for businesses. This includes details about new hires, job roles, and employee classifications. Furthermore, the form serves as a mechanism for businesses to claim eligible tax credits, thus incentivizing compliance and promoting job growth.

Various types of businesses, especially those in sectors such as manufacturing, technology, and healthcare, are encouraged to use Form 324. These sectors often have access to specific tax incentives aimed at fostering job creation and economic growth, making compliance with this form even more vital.

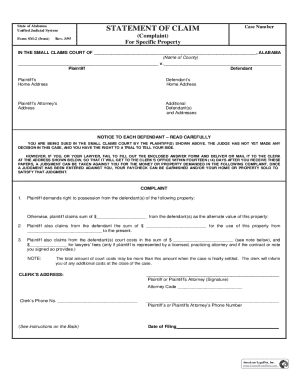

Detailed instructions for filling out Form 324

Filling out the Form 324 requires careful attention to detail. This section provides a step-by-step guide to ensure accurate completion of the form and compliance with necessary regulations.

1. **Gather Required Information:** Start by collecting essential details such as the business name, address, and employee data including Social Security numbers and job titles. This foundational information is critical for accurate reporting.

2. **Complete Each Section of the Form:** Carefully fill out each section of the form according to the provided instructions. Be mindful of any specific guidelines that apply to your business's sector.

3. **Review and Double-check Information:** Before submission, meticulously review the completed form for any errors or omissions. Common mistakes include incorrect Social Security numbers or missing job titles. Taking the time to double-check can prevent delays in processing.

4. **Submit the Form:** Finally, submit the completed Form 324 either online through authorized platforms or via traditional mailing methods. Opting for online submission often ensures faster processing and confirmation.

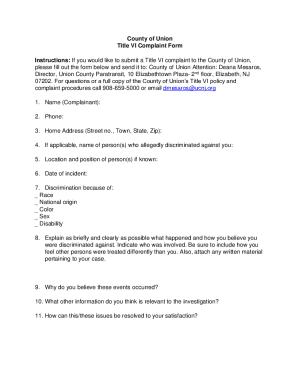

Editing and managing the Form 324

Effective document management is crucial in today's fast-paced business environment. Utilizing tools like pdfFiller can greatly enhance your ability to edit, sign, and manage Form 324.

pdfFiller offers an array of features that streamline the form editing process, such as fillable fields, text editing options, and eSignature capabilities. These features make it easy to ensure that your Form 324 is both accurate and compliant.

Furthermore, the platform allows businesses to save forms in cloud-based storage, ensuring easy access from any device. Collaboration tools also enable teams to work together efficiently; multiple users can input data and edit the form in real-time.

Interactive tools for Form 324

To simplify the process of filling out Form 324, various online templates and resources are available. pdfFiller provides editable templates that can be customized to meet specific business needs, ensuring that each submission is tailored to the unique requirements of your organization.

Additionally, the platform integrates seamlessly with a wide range of other business applications. This interoperability allows users to sync Form 324 data with accounting software and HR systems, creating a more efficient workflow and minimizing data entry errors.

Common questions about Form 324

As businesses engage with Form 324, various questions may arise. Understanding the answers to these common queries can ease the submission process.

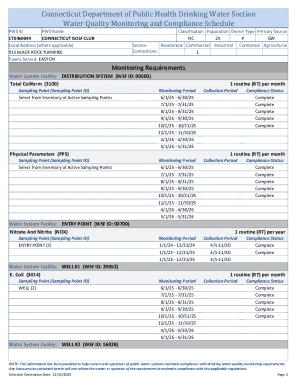

Related topics and documentation

Beyond Form 324, there are various other forms that businesses may need, depending on their specific operational framework and tax strategies. Understanding these related forms can help in establishing a comprehensive documentation approach.

Forms such as the IRS Form W-2 and the Employer's Quarterly Federal Tax Return may also intersect with the information reported in Form 324. Being knowledgeable about these connections allows businesses to streamline their reporting practices.

Additional considerations

Staying informed about recent changes to the Form 324 is vital for businesses to ensure compliance. Changes and revisions can come from the IRS or local authorities and may affect the structure or requirements of the form.

Additionally, businesses should retain copies of submitted forms and relevant documentation for their records. pdfFiller simplifies this process by providing cloud-based storage solutions that ensure easy access and reliable documentation management.

Testimonials and case studies

Numerous businesses have experienced significant improvements by utilizing Form 324 efficiently. For instance, a small manufacturing firm reported a 25% reduction in time spent on tax-related paperwork since integrating pdfFiller into their operations.

Case studies reveal that businesses leveraging pdfFiller for Form 324 management witness not only enhanced efficiency but also improved accuracy in their submissions, leading to lower incidences of audits and quicker access to tax credits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in form 324 business employment?

How do I fill out form 324 business employment using my mobile device?

How do I complete form 324 business employment on an iOS device?

What is form 324 business employment?

Who is required to file form 324 business employment?

How to fill out form 324 business employment?

What is the purpose of form 324 business employment?

What information must be reported on form 324 business employment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.