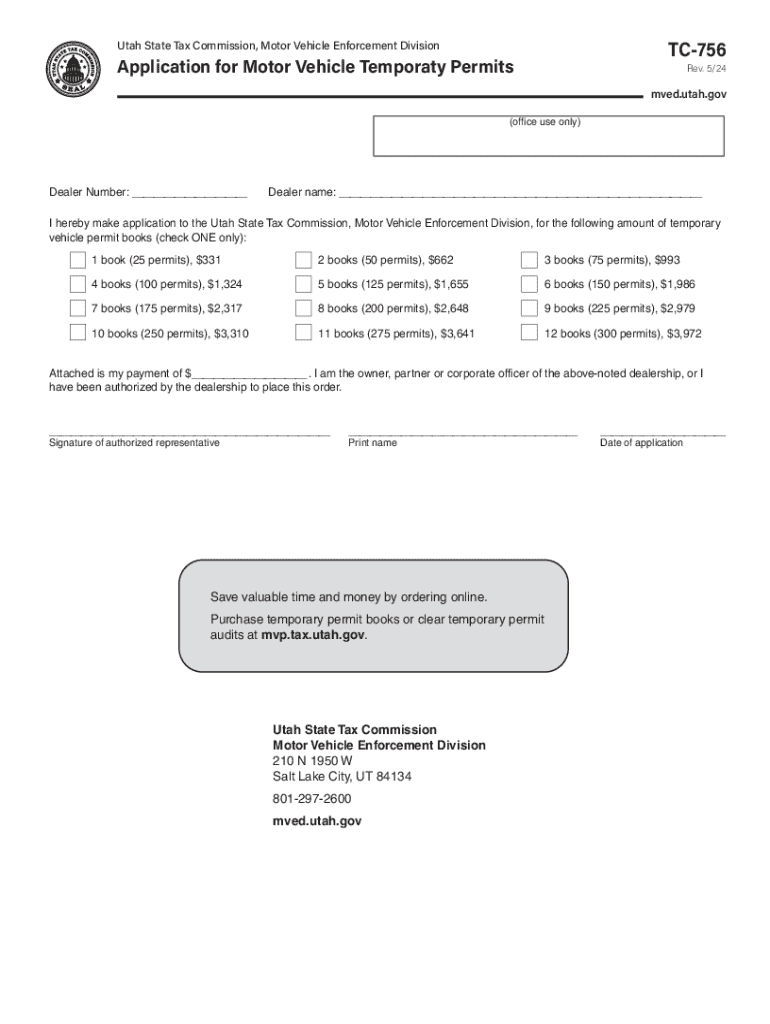

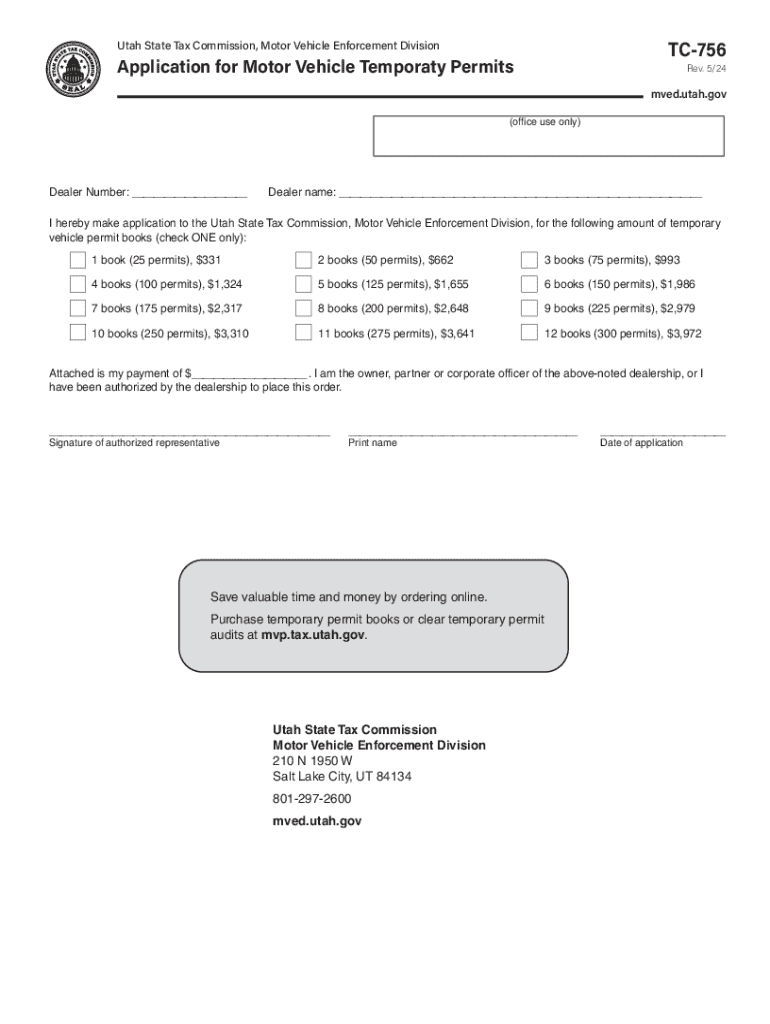

Get the free TC-756, Application for Utah Motor Vehicle Temorary Permits. Forms & Publications

Get, Create, Make and Sign tc-756 application for utah

How to edit tc-756 application for utah online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tc-756 application for utah

How to fill out tc-756 application for utah

Who needs tc-756 application for utah?

TC-756 Application for Utah Form: Your Comprehensive Guide

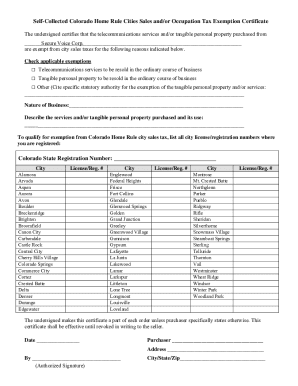

Understanding the TC-756 application for Utah

The TC-756 form, commonly utilized in Utah, serves as an application for refund requests and other tax-related inquiries. Its fundamental purpose is to streamline the communication of taxpayers and the Utah State Tax Commission regarding overpayments or adjustments to tax liabilities. With evolving tax laws, understanding this form's role is crucial for ensuring compliance and maximizing potential returns.

Filing the TC-756 correctly is vital in the state of Utah to facilitate accurate tax processing. Mistakes can result in delays, which may affect taxpayers' finances. Whether you’re a resident of Salt Lake City grappling with local tax intricacies or a business in rural Utah, the TC-756 is an essential element of your tax filing toolkit.

Step-by-step guide to completing the TC-756 form

Filing the TC-756 involves a systematic approach for ensuring all information is accurate and compliant with Utah tax laws. Below, we break down the necessary steps involved in completing this form.

Preparation before filling

First and foremost, you’ll want to gather essential documents. This may include your previous tax returns, documentation of income, and records of any tax credits you’ve claimed. Reviewing the eligibility requirements specified by the Utah State Tax Commission can help avoid costly mistakes.

Section-by-section breakdown

Filling out the TC-756 requires attention to detail across several sections.

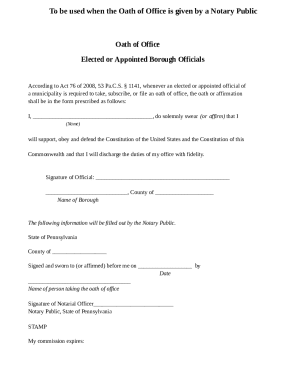

Personal information

In this section, include your name, address, Social Security number, and any other identifying information. Inaccuracies in personal data can lead to processing delays, so ensure every detail is correct.

Income and deductions

When reporting income, ensure that all forms of income are accurately represented, including wages, self-employment earnings, and interest income. Familiarize yourself with common deductions applicable in Utah, such as those for mortgage interest and qualified educational expenses.

Tax credits

Utah offers various tax credits, including those for low-income earners, families with children, and energy efficiency-related deductions. Understanding the eligibility criteria is crucial to maximize benefits.

Final review of your TC-756

Before submission, double-check all sections for completeness and accuracy. Look for typical errors such as incorrect Social Security numbers or omission of required signatures. A thorough review can save you time and prevent potential issues.

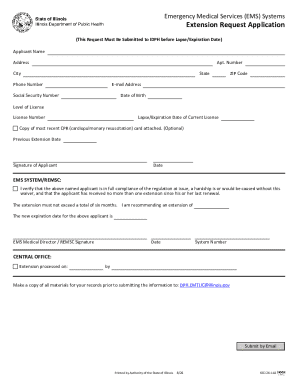

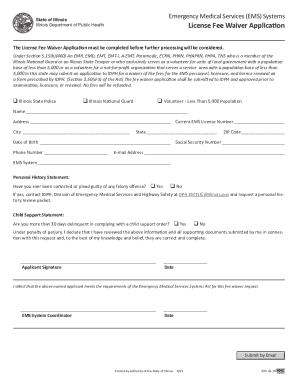

Interactive tools for filling the TC-756 application

Navigating the TC-756 doesn’t have to be cumbersome. With tools like pdfFiller’s form editor, users can efficiently edit documents on the cloud. This platform allows you to fill forms seamlessly, ensuring accessibility anytime and anywhere.

eSignature features are available to expedite the signing process. This is beneficial for individuals and teams managing multiple filings. Collaboration tools within pdfFiller can enable multiple users to work together on the TC-756 application, enhancing productivity and efficiency.

Common mistakes to avoid when filing the TC-756

Filing taxes comes with its share of pitfalls. Common mistakes include failing to attach necessary documentation, incorrect calculations, and neglecting to sign the form. Being mindful of these errors can not only expedite the processing of your application but also avert potential penalties.

To ensure accuracy, it’s advisable to review completed forms with a fine-tooth comb. Use checklists to confirm that all sections are filled out correctly. Remember, if using pdfFiller, the platform assists users by providing prompts and suggestions during the completion process.

Frequently asked questions about the TC-756 application

Navigating the TC-756 application can lead to several questions. Here are answers to some frequently asked questions that may arise:

Managing your TC-756 document with pdfFiller

pdfFiller empowers users by providing a secure platform for storing and organizing significant tax documents, including the TC-756. This digital management aids in retrieval and safeguarding sensitive information that may be needed for future tax filings.

By managing your TC-756 and related documents digitally, you avoid the clutter associated with paper forms. Cloud storage offers peace of mind, as it allows secure access from anywhere, which is especially useful during tax season when deadlines loom.

Staying updated: Changes to the TC-756 form

Tax laws and forms evolve; thus, it's paramount to stay informed about annual updates to the TC-756. Such changes can impact eligibility, required attachments, and filing procedures. Regularly check the Utah State Tax Commission’s website for updates and information regarding modifications in tax rules.

Additionally, be proactive in utilizing e-services provided by the state, which can offer guidance on new laws or amendments affecting your TC-756 filing. Staying informed helps ensure compliance and maximizes your potential tax benefits.

User testimonials and success stories

Users across Utah have shared positive experiences regarding their TC-756 applications using pdfFiller. One Salt Lake City resident noted how the ease of use and collaborative features streamlined the process, significantly reducing the time spent on completing tax forms.

Another user shared a success story on how pdfFiller's cloud management allowed them to effortlessly retrieve previous applications, helping them prepare for their current filing. These testimonials showcase the tangible benefits of utilizing modern, digital solutions for tax-related document management, particularly in a state as diverse as Utah.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit tc-756 application for utah from Google Drive?

How can I send tc-756 application for utah for eSignature?

How do I execute tc-756 application for utah online?

What is tc-756 application for utah?

Who is required to file tc-756 application for utah?

How to fill out tc-756 application for utah?

What is the purpose of tc-756 application for utah?

What information must be reported on tc-756 application for utah?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.