Get the free Accessing Your Super EarlyHow to Withdraw Super

Get, Create, Make and Sign accessing your super earlyhow

Editing accessing your super earlyhow online

Uncompromising security for your PDF editing and eSignature needs

How to fill out accessing your super earlyhow

How to fill out accessing your super earlyhow

Who needs accessing your super earlyhow?

How to access your super early

Understanding early access to your super

Superannuation, often referred to as 'super', is a long-term savings strategy designed to provide individuals with financial security in retirement. In Australia, super is generally contributed by employers and accumulated over an individual's working life to ensure they have sufficient funds when they retire. Its primary purpose is to encourage consistent saving, ultimately ensuring a comfortable lifestyle during one's retirement years.

The importance of long-term savings cannot be overstated. Having a substantial super balance is vital because it forms the cornerstone of your financial stability in retirement. However, there are circumstances under which individuals might need to access their superannuation funds early, often for pressing financial situations.

Circumstances that allow early access

There are several key circumstances that allow individuals to access their super early. The most common include severe financial hardship, compassionate grounds, and specific other circumstances that significantly impact an individual’s ability to support themselves.

Severe financial hardship is often defined as being unable to meet reasonable and immediate living expenses. This could be due to various factors such as losing a job, unexpected bills, or other financial stressors. To prove such hardship, applicants typically need to provide documentation of their financial situation. A step-by-step guide for applying due to financial hardship is vital for ensuring that all criteria are met.

Applying for early access due to severe financial hardship

To apply for early access to your super on the grounds of severe financial hardship, it’s essential to first confirm your eligibility. This typically includes aspects such as proving that you are experiencing genuine financial difficulty and meeting any relevant conditions set by your superannuation fund.

Gathering necessary documentation is crucial to substantiate your claim. This may involve collecting financial statements, evidence of income loss, and proof of your living expenses. The application process usually involves submitting these documents along with a formal request to your super fund, stating your case for accessing your funds early.

Compassionate grounds for access

Compassionate grounds cover extraordinary situations, such as covering medical expenses not covered by health insurance or funeral costs for a dependant. Each compassionate case, such as accessing super for a significant medical treatment, must be clearly documented and justified. The application process involves detailing the circumstances and providing relevant supporting documents.

It is essential to emphasize that while accessing super for compassionate grounds is permitted, the application process is rigorous. Each case is assessed individually, and applicants must provide compelling evidence to establish the need for early access.

Other specific circumstances for early access

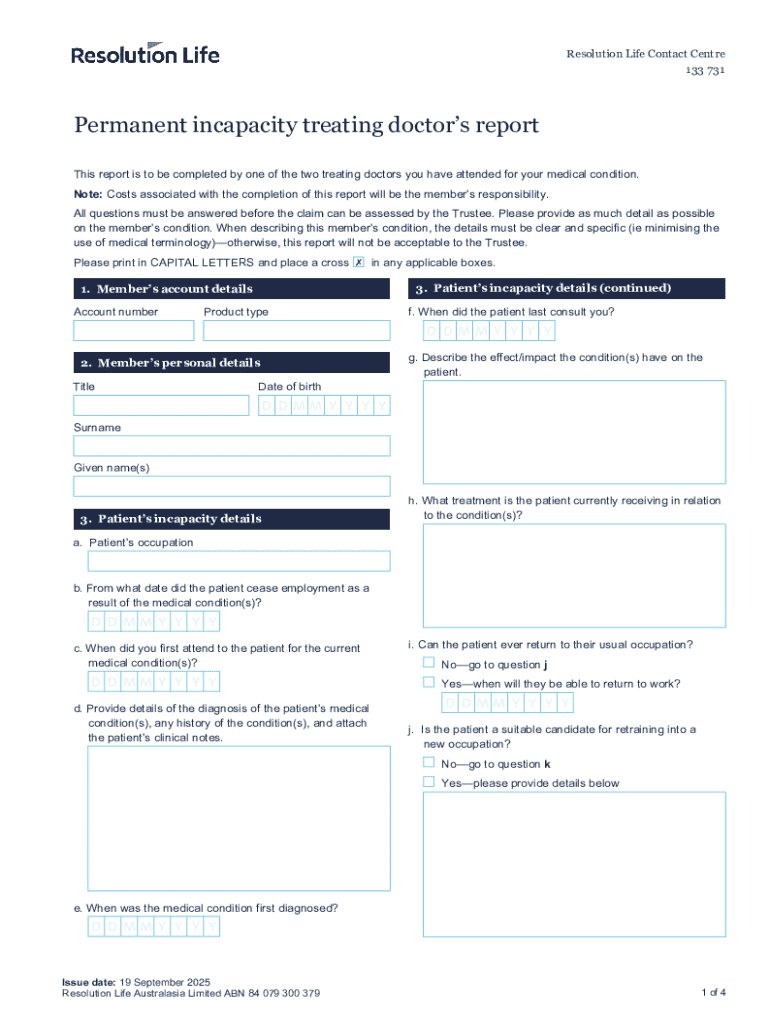

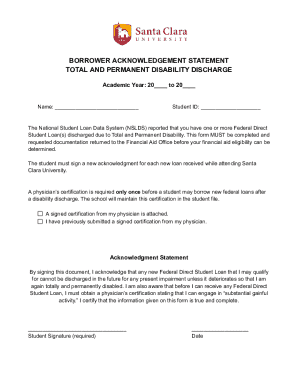

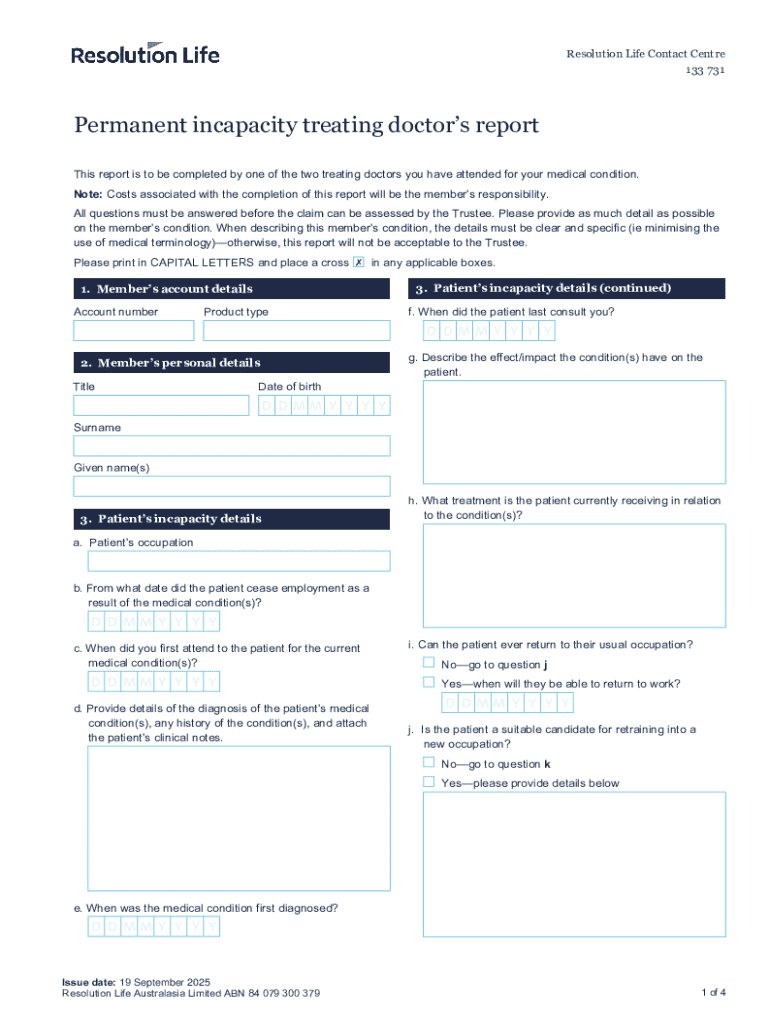

In addition to severe financial hardship and compassionate grounds, several other specific circumstances exist that might allow early access to your super. These include temporary incapacity, where you cannot work due to a significant injury or illness, and permanent disability, where you are unable to return to your job.

Each circumstance comes with specific eligibility criteria to meet and documentation requirements. Therefore, it's crucial to prepare your application with thorough details and validate your claims with appropriate evidence, such as medical reports or statements from health professionals.

Step-by-step guide to applying for early access

Applying for early access to your superannuation fund involves several essential steps. First, confirm your eligibility based on the circumstances you are claiming under. It is critical to thoroughly review the criteria that define your eligibility before proceeding to application forms.

Next, gather all necessary documentation meticulously. This process often entails collecting financial statements, medical records, and any other relevant documents that can support your claim. Organizing these documents effectively can streamline the application process significantly.

Understanding tax implications

One crucial aspect of accessing your super early is understanding the tax implications involved. Early withdrawals from your superannuation account can lead to differing tax obligations, primarily depending on whether you are withdrawing due to financial hardship, compassionate grounds, or other circumstances. Generally, money taken out prematurely may be taxed at a higher rate than if you accessed it during retirement.

Additionally, understanding how an early withdrawal affects your retirement fund is vital. This realization can highlight the importance of careful planning, ensuring that accessing these funds does not overly compromise your financial future.

Rebuilding your superannuation post-withdrawal

Rebuilding your superannuation after an early withdrawal is essential for your long-term financial security. Strategies to replenish funds may include increasing your contributions when financially feasible, utilizing bonuses or tax refunds to boost your super, and researching options for government co-contributions that may further strengthen your savings.

Long-term financial planning is also vital after accessing these funds. Consider speaking with financial advisors who can help craft a retirement strategy that aligns with your goals and assists in recovering from the effects of withdrawing super.

Interactive tools and resources

To aid in your journey of accessing your super early, various interactive tools are available for users. Platforms like pdfFiller offer superannuation calculators that help determine your future super balance based on various scenarios and contribute to informed decision-making.

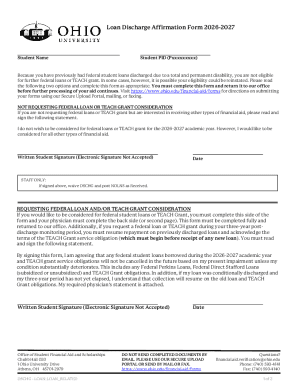

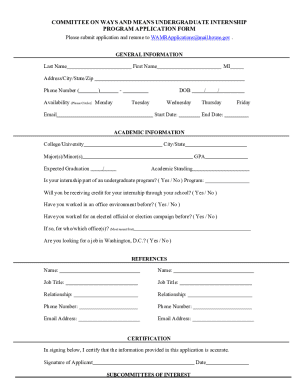

Additionally, pdfFiller provides document templates designed for applications regarding early super access. These templates can be easily edited and customized to suit your unique situation, ensuring that your applications are submitted correctly and comprehensively.

Frequently asked questions (FAQs)

Many individuals wonder if anyone can access their super early. The answer is that specific eligibility criteria must be met, often dependent on the financial situation of the applicant. It’s crucial to thoroughly review these criteria to determine if you qualify.

Another common question revolves around the fate of an application if denied. In these cases, applicants should take a step back to review the reasons for denial and may consider appealing or reapplying with additional documentation. Finally, average processing times for super access applications can vary, but most can expect a turnaround based on the efficiency of their super funds and the completeness of their submission.

The importance of planning ahead

Understanding the long-term impact of early withdrawal from your super is essential for maintaining financial security. While accessing super early may provide immediate relief, it's critical to consider how this withdrawal can affect your savings and lifestyle in retirement. Engaging in proactive planning and regular assessments of your financial situation can help minimize these impacts.

Consulting with financial advisors can provide invaluable insights into your retirement strategy, especially after an early withdrawal. Professional guidance can help tailor your approach, allowing you to make the most informed decisions about all aspects of your superannuation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send accessing your super earlyhow to be eSigned by others?

How do I complete accessing your super earlyhow online?

Can I edit accessing your super earlyhow on an Android device?

What is accessing your super earlyhow?

Who is required to file accessing your super earlyhow?

How to fill out accessing your super earlyhow?

What is the purpose of accessing your super earlyhow?

What information must be reported on accessing your super earlyhow?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.