Understanding the SSVF Income Eligibility Calculation Form

Understanding the SSVF program

The Supportive Services for Veteran Families (SSVF) program was established to provide vital assistance to veterans and their families facing housing instability. This initiative aims to prevent homelessness among veterans by offering supportive services that help them transition into permanent housing. By focusing on improving housing stability, the program seeks to enhance the overall well-being of veterans, helping them reintegrate into society while ensuring they have the resources necessary to thrive.

Eligibility for the SSVF program is generally based on income limits and the veteran's status. Participants must meet specific criteria, including being a veteran or a member of a veteran's family. The program prioritizes applicants with the lowest incomes and those who are at the greatest risk of homelessness, ensuring that the most vulnerable populations receive the necessary support.

Understanding income eligibility is crucial, as it directly affects access to SSVF services. The income eligibility calculation helps determine who qualifies for assistance, so accurate reporting is vital for ensuring that families can secure necessary resources.

Income eligibility calculation: An in-depth guide

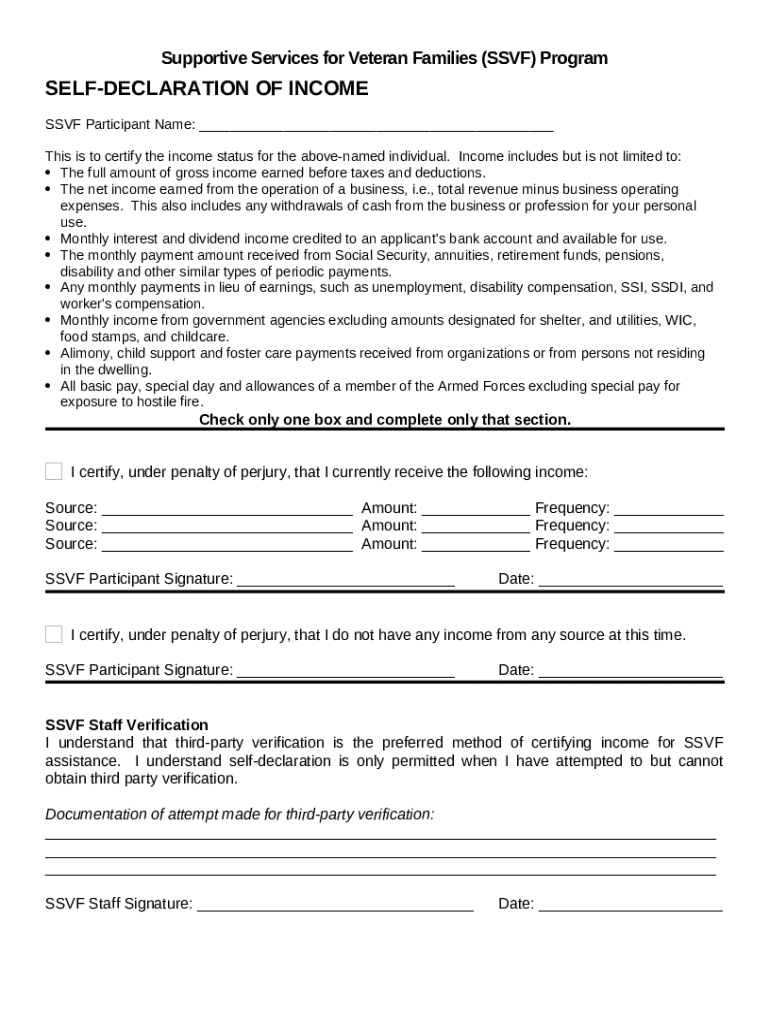

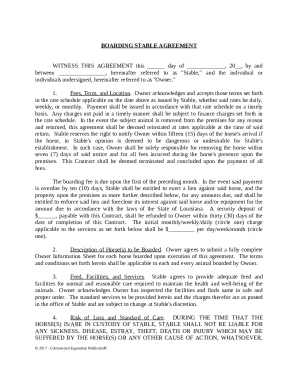

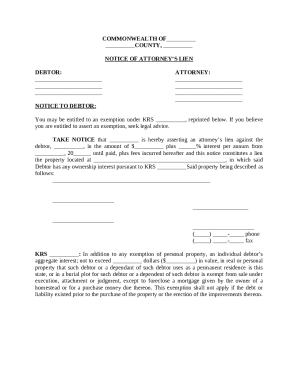

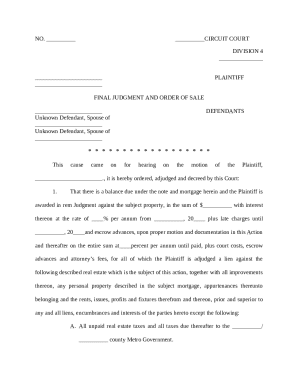

The SSVF Income Eligibility Calculation Form is a critical document that applicants must complete to demonstrate their eligibility for the program. This form serves as a foundational tool in the application process, allowing service providers to assess the financial situation of each household. The accurate completion of this form ensures that correct eligibility determinations are made, ultimately affecting the availability of assistance.

The form includes various sections that require a breakdown of income sources, which may encompass salary, disability benefits, pensions, unemployment compensation, and any additional income received. Applicants must also consider other factors, such as monthly expenses, that can influence eligibility. These include rent or mortgage payments, utilities, medical expenses, and child care costs, which may act as deductions that can increase the chances of meeting income limits.

Pension or retirement income

Other monthly income sources

Step-by-step instructions for completing the form

Before filling out the SSVF Income Eligibility Calculation Form, it is essential to gather all necessary documentation and information. This may include recent pay stubs, benefit letters, tax returns, and any documentation related to ongoing expenses. Having these documents readily available simplifies the process and ensures no detail is overlooked.

When filling out the form, it's crucial to approach it step-by-step. Start with the personal information section, ensuring that names, addresses, and contact details are entered correctly. Next, meticulously report all income sources and amounts. Be sure to use the most accurate figures, as discrepancies can lead to delays or denial of assistance. Following this, document your expenses, including housing costs and other monthly obligations.

Double-check your personal information for accuracy.

Use gross income figures, not net income, for reporting.

List all relevant expenses that could impact your eligibility.

Seek clarification on any confusing terms or sections before submission.

Common mistakes to avoid include overlooking minor income sources or expenses that can affect eligibility. Failing to provide complete documentation can also cause delays or denials, so be thorough in the reporting process. If uncertainties arise, asking for guidance from SSVF program representatives can clarify any questions.

Editing and managing your form with pdfFiller

pdfFiller offers seamless online editing capabilities, enabling users to manage their SSVF Income Eligibility Calculation Form with ease. By uploading a blank or previously filled template, users can modify any part of the document directly within the platform. This flexibility allows for quick updates in case of changes in income or circumstances that need to be reflected before submission.

Several features enhance the editing experience within pdfFiller. Users can insert text boxes, highlight important sections, and annotate the document to ensure clarity and communication when working with case managers or support teams. In addition, the platform supports file saving in various formats, allowing users to export their completed forms for sharing.

Electronic signature options available through pdfFiller also simplify the submission process. Signing the form electronically is not only convenient but can expedite the review process, reducing turnaround times significantly. By accessing the eSignature feature, users can follow guided steps to ensure their form is properly signed and ready for submission.

Submitting your income eligibility calculation form

For best practices when submitting the SSVF Income Eligibility Calculation Form, adherence to timelines is paramount. It’s essential to understand the preferred methods of submission, whether online, via email, or through traditional mail. Consult with your local SSVF program office for specific instructions on their preferred submission methods.

After submission, applicants can expect a confirmation of receipt from the SSVF program. This confirmation is crucial for tracking progress and follow-ups. Generally, the review process includes an assessment of provided information, verification of income, and determination of eligibility. Knowing this can ease anxiety about the application status while waiting for assistance.

Resources and tools for success

In addition to the SSVF guidelines, pdfFiller offers interactive calculators and tools that simplify the income estimation process. These tools allow users to input financial data and assess their eligibility proactively, providing better insights into their household situation before completing the Income Eligibility Calculation Form.

Moreover, hearing success stories and testimonials from fellow veterans can serve as motivation. Many have found that accurately completing the SSVF Income Eligibility Calculation Form has played a pivotal role in securing vital assistance, enabling them to improve their housing stability and quality of life significantly.

Frequently asked questions (FAQs)

Many individuals have common queries regarding the SSVF Income Eligibility Calculation Form. Specific concerns often arise about income calculation. For instance, clarifications about what constitutes income or how to report irregular income sources are frequent topics during consultations. Additionally, eligibility-related questions can arise, such as determining if certain deductions apply or how to report shared household income.

It is advisable to reach out to SSVF program representatives with these questions, as they can provide tailored guidance to ensure that all applicants understand their qualifications and maximize their assistance opportunities.

Conclusion: maximizing your access to SSVF services

Accurate reporting of income and expenses using the SSVF Income Eligibility Calculation Form is essential in unlocking the necessary resources and assistance for veterans and their families. Misrepresentations or errors in this form can lead to missed opportunities for critical aid, which can change a family's life.

Utilizing pdfFiller not only streamlines the process of managing forms but also enhances your document management experience. By ensuring your submission is correct and complete, you can focus more on the support you need to secure a stable housing situation.