Get the free Purchases of Tangible Personal Property for Rent or Lease ...

Get, Create, Make and Sign purchases of tangible personal

How to edit purchases of tangible personal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out purchases of tangible personal

How to fill out purchases of tangible personal

Who needs purchases of tangible personal?

Comprehensive Guide to Purchases of Tangible Personal Form

Understanding tangible personal property

Tangible personal property refers to physical items that can be touched and moved, as opposed to intangible assets like stocks or patents. This category encompasses a broad range of items, including furniture, vehicles, equipment, and inventory. Understanding tangible personal property is crucial for individuals and businesses, as it impacts both financial planning and tax obligations.

Purchases of tangible personal property play a significant role in both personal and business contexts. For individuals, buying tangible assets such as home furnishings or appliances contributes to the comfort and functionality of their living spaces. In a business setting, tangible assets such as machinery or office supplies are vital for operations and must be managed effectively for financial health.

The role of tax forms in purchases of tangible personal property

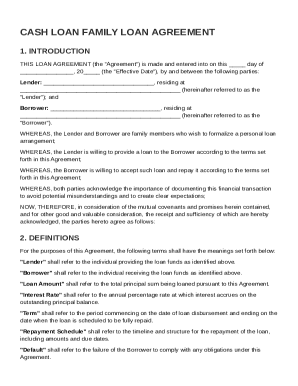

Navigating tax obligations when purchasing tangible personal property is crucial to ensure compliance and avoid penalties. Understanding the various tax forms related to these purchases is essential. Common forms include sales tax exemption certificates and personal property tax returns, which vary by state based on local regulations.

Sales tax exemption certificates allow buyers to purchase items without paying sales tax, provided they meet specific criteria. On the other hand, personal property tax returns are necessary for reporting property owned as of January 1st in the respective tax year. Each state has its specifications for completing these forms, which individuals and businesses should familiarize themselves with to optimize their tax reporting.

Step-by-step guide to purchasing tangible personal property

Purchasing tangible personal property can be a straightforward process when approached methodically. Start by evaluating your needs, which involves assessing your budget and the purpose of your purchase. Knowing exactly what you need prevents impulse buying and ensures you make informed decisions.

Next, identify potential suppliers. This could involve online research, referrals from friends, or checking local businesses. Once you've gathered options, it's important to research the validity of the products offered. Verify the seller's credentials through reviews and ratings and fully understand the specifications to ensure you're making a worthwhile investment.

After selecting your preferred supplier, begin the purchase process. Effective negotiation is key—prepare key questions to clarify any details about warranties, return policies, or delivery options. Finally, ensure you document your purchase meticulously to safeguard your investment through warranties and receipt records, crucial for future reference or potential returns.

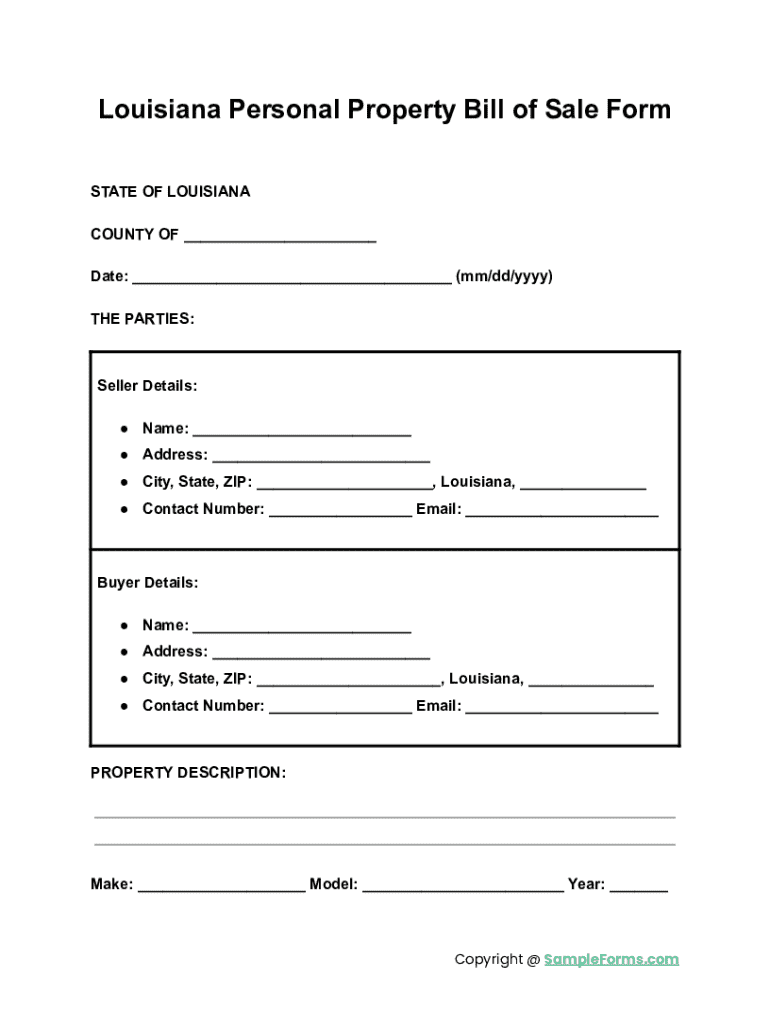

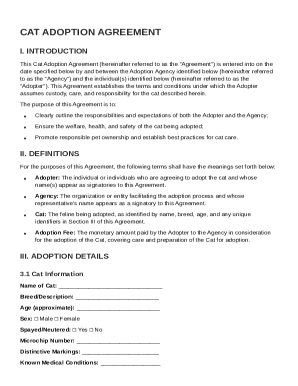

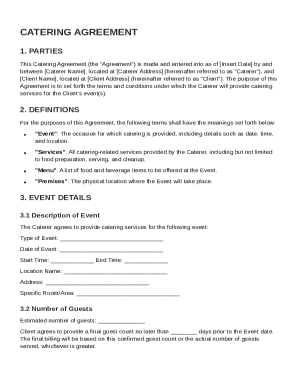

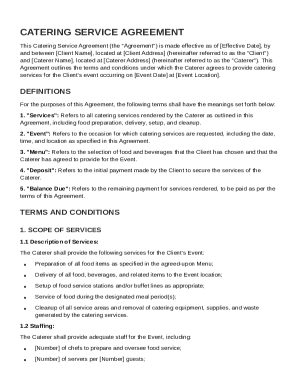

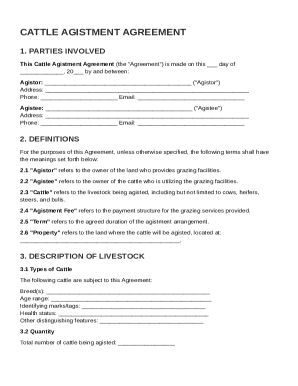

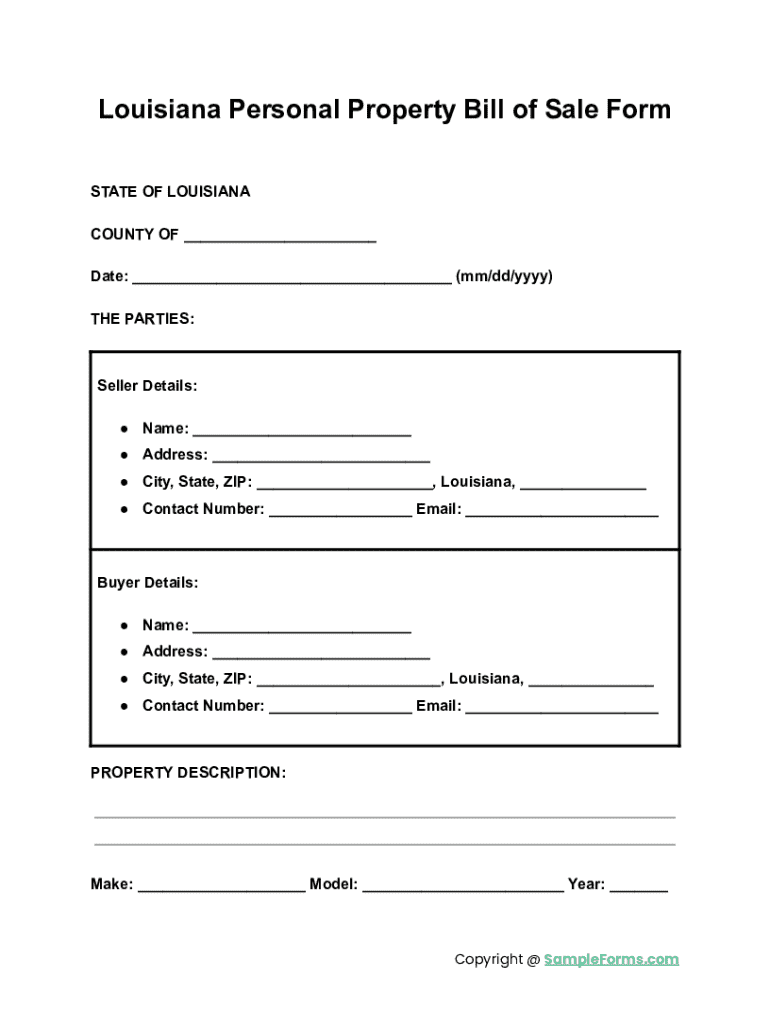

Completing the tangible personal property purchase form

When finalizing your purchase of tangible personal property, completing the related forms accurately is critical. Most forms will require you to provide detailed information such as the buyer information, seller information, and a thorough description of the item(s) purchased. Ensure that all fields are filled out correctly to avoid delays or complications.

Common mistakes include failing to include necessary information or submitting the form incorrectly. To mitigate this, double-check entries against your purchase receipts and guide you through completing fields. Utilizing tools like pdfFiller can simplify the process, making it easier to maintain clarity and accuracy throughout.

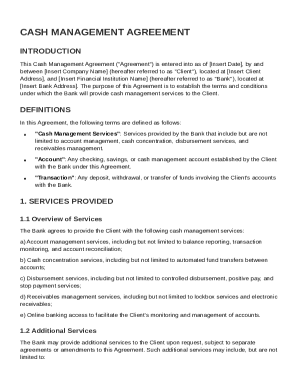

Editing and managing your purchase documents

After obtaining your purchase documents, managing them efficiently is critical for effective bookkeeping. pdfFiller offers robust editing features that allow you to refine your documents as needed. You can add comments, markups, or adjustments to highlight important information or clarify details.

Moreover, collaborating on purchase documents with team members or stakeholders is seamless with pdfFiller. The platform's real-time collaboration tools let multiple users interact with the document, making feedback and edits possible simultaneously, which enhances productivity and promotes transparency.

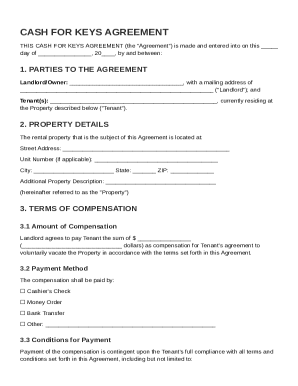

Digital signatures for tangible personal property forms

In an increasingly digital world, eSigning documents related to tangible personal property is essential for ensuring legality and compliance. Using pdfFiller’s eSigning tools is a straightforward process, allowing you to sign forms quickly and securely from anywhere.

To eSign documents, simply upload the document into pdfFiller, select the signing option, and follow the step-by-step prompts. This ensures the signature is legally binding. Moreover, maintaining compliance with federal and state regulations regarding digital signatures provides peace of mind and smooth transaction processes.

Compliance and record-keeping for tangible personal property purchases

Maintaining compliance and accurate records for tangible personal property purchases is essential, especially as tax obligations can vary significantly by state. Familiarize yourself with local requirements to ensure you’re abiding by regulations. For instance, in California, accurately reporting personal property can influence tax assessments, making knowledge of state laws vital.

Best practices for record-keeping include retaining purchase receipts for a recommended period, often three to seven years. Organizing records by year and category can simplify future tax preparations and audits. Digitizing documents using platforms like pdfFiller can also provide backup and ease of access, promoting better management of your purchase history.

Additional tools and resources

To enhance your document management experience, pdfFiller offers a suite of interactive tools designed to streamline the process of form creation, filling, and editing. From templates to advanced editing features, users can fully customize their documents to suit specific needs effectively.

If you encounter issues or have questions, pdfFiller's support services provide comprehensive resources, including FAQs and direct contact options for professional assistance. This ensures you have all the necessary tools and support to navigate your purchases of tangible personal form with confidence and ease.

Keeping up-to-date with changes

Staying informed about regulations related to tangible personal property purchases is crucial for avoiding compliance issues. Understanding the importance of keeping abreast of legislation changes in your state can help you maintain compliance, especially regarding tax forms and reporting requirements.

Utilizing resources like state government websites or professional associations can provide valuable updates. Moreover, subscribing to newsletters or alerts specific to tax regulations can ensure you are aware of any critical changes that may affect your tangible personal property purchases.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete purchases of tangible personal online?

How do I edit purchases of tangible personal in Chrome?

Can I create an electronic signature for signing my purchases of tangible personal in Gmail?

What is purchases of tangible personal?

Who is required to file purchases of tangible personal?

How to fill out purchases of tangible personal?

What is the purpose of purchases of tangible personal?

What information must be reported on purchases of tangible personal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.