Get the free spouse exclusion form - Oklahoma.gov

Get, Create, Make and Sign spouse exclusion form

How to edit spouse exclusion form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out spouse exclusion form

How to fill out spouse exclusion form

Who needs spouse exclusion form?

The comprehensive guide to the spouse exclusion form

Understanding the spouse exclusion form

The spouse exclusion form is a critical document used in estate planning that allows a married couple to strategically manage their assets and minimise estate taxes. Essentially, it provides a framework through which spouses can exclude certain assets from consideration in estate tax calculations when one spouse passes away. This ensures that the surviving spouse can inherit the deceased spouse's assets without incurring excessive tax liabilities, which can otherwise diminish their inheritance.

The importance of the spouse exclusion form cannot be overstated, as it plays a vital role in preserving wealth and ensuring a smooth transfer of assets between spouses. This is particularly crucial in jurisdictions where estate taxes can significantly burden the estate. Common scenarios that warrant the use of this form include situations where couples have amassed considerable joint assets or when one spouse has significant standalone assets that they wish to protect.

Who should use the spouse exclusion form?

The spouse exclusion form is primarily designed for married couples who wish to simplify the complexities associated with estate taxes. It targets a diverse audience, from newlyweds starting to build a life together to elderly couples who want to ensure their estates are managed efficiently upon death. Specific situations requiring the form include married couples with substantial joint assets that could trigger estate taxes, and surviving spouses who are tasked with managing estate affairs after the loss of their partner.

For instance, when one spouse passes away, the surviving spouse becomes the executor of their estate, making it imperative to have a clear understanding of what assets are taxable and which can be excluded. The clarity provided by the spouse exclusion form not only aids in navigating these challenges but also ensures that families don’t face unnecessary financial strain during a difficult time.

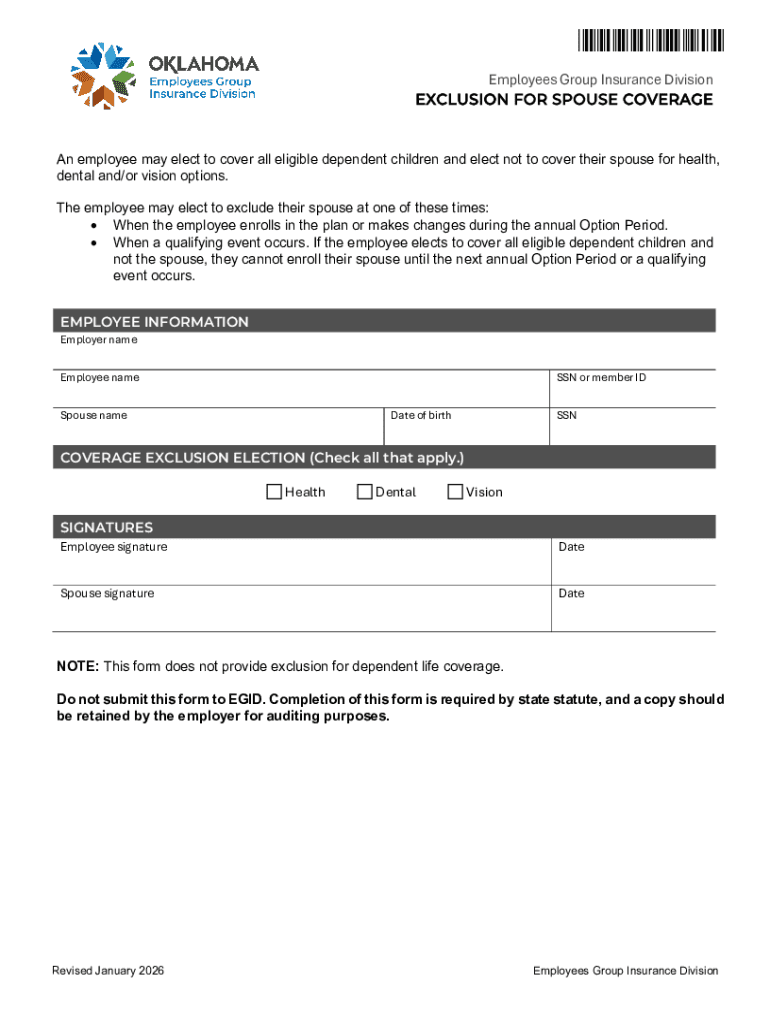

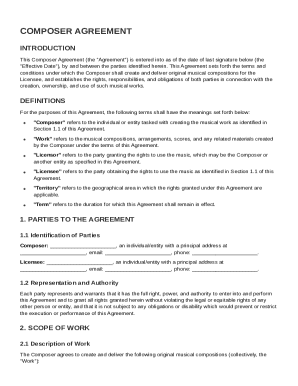

Key components of the spouse exclusion form

A well-structured spouse exclusion form consists of several key sections, each designed to collect important information that will guide tax decisions. Firstly, it includes personal information about both spouses, which is necessary for identifying the parties involved in the estate proceedings. Following this, the form lists asset particulars, detailing the types and values of the assets being addressed under the exclusion clause.

Spousal information is also crucial, as it helps delineate rights and obligations concerning the excluded assets. A line-by-line breakdown often sheds light on potential misunderstandings. For instance, many people assume that only specific asset types can be excluded, whereas the form allows broader inclusions depending on the jurisdiction's tax laws.

Step-by-step guide to completing the spouse exclusion form

Completing the spouse exclusion form requires careful attention to detail. Before you begin filling it out, creating a pre-completion checklist is crucial. Firstly, gather all necessary documents, including previous tax returns, asset valuations, and any other supporting documentation that can substantiate your claims on the form. Understanding relevant tax laws is also vital as these can significantly affect how you fill out the form.

Once you're prepared, start filling out the form by providing personal information for both spouses, including full names and Social Security numbers. In the asset declaration section, accurately list each asset alongside its estimated value to ensure transparency. Lastly, adhere to signature and date protocols, ensuring both spouses sign where required to validate the document. Be wary of common mistakes such as leaving fields incomplete or underestimating asset values, as these errors could lead to complications down the line.

Digital tools for editing and managing your form

Utilising digital tools can greatly simplify the process of managing your spouse exclusion form. Platforms like pdfFiller excel in providing users with powerful capabilities to edit PDF documents effortlessly. This cloud-based solution allows for real-time collaboration, enabling multiple individuals to input information, comment, or suggest changes without hassle.

With pdfFiller, users can also save their progress and return to the form at any time, ensuring no detail is overlooked. Furthermore, eSigning is made simple; spouses can sign the document electronically, expediting the process significantly while still ensuring legality and formality.

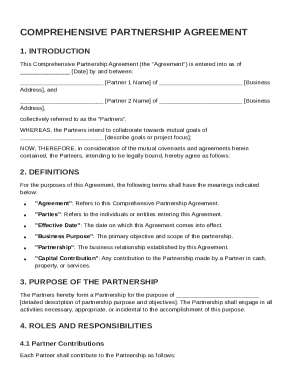

Collaborating on the form with trusted advisors

Having the input of financial advisors or estate planners can be invaluable when filling out the spouse exclusion form. Their expertise can guide you in making the best decisions concerning asset exclusions and tax strategies. Sharing the form with advisors can be done seamlessly via cloud-based features, where you can set specific permissions and access levels for each advisor involved.

This collaborative effort ensures your estate plan incorporates professional advice tailored to your unique situation, offering peace of mind that your assets will be optimally managed and protected for future transfers. As you work with professionals, ensuring everyone's viewpoints are considered can lead to a more comprehensive and effective estate plan.

Frequently asked questions about the spouse exclusion form

Understanding the spouse exclusion form may prompt several critical questions. One common inquiry is, 'What happens if the form is not submitted?' Failure to submit the form could result in assets being included in the decedent's gross estate, potentially leading to significant estate tax liabilities. Moreover, many individuals wonder if the form can be re-submitted or revised. The answer is generally yes, as long as changes are made before the estate tax return is filed.

Another prevalent concern revolves around the impact of the spouse exclusion on estate taxes. Properly utilizing the exclusion can lead to a marked reduction in estate tax liability, enabling more assets to pass on tax-free to the surviving spouse. However, it's crucial to navigate these intricacies correctly to fully realise the benefits.

Additional considerations

When dealing with estate planning and the spouse exclusion form, it's essential to observe state-specific variations. Different states may have unique rules and exclusions that can affect how the form is filled out and its overall effectiveness. Additionally, potential legislative changes can impact the applicability of the spouse exclusion form. Staying abreast of these changes can save considerable stress during the estate planning process.

Regular updates to your estate plan should be a priority, especially after significant life events such as the acquisition of new assets, marriage, divorce, or the death of a spouse. Each shift can necessitate alterations in how you approach your estate planning and whether adjustments to the spouse exclusion form are needed.

Expert insights and tips for maximizing the spouse exclusion

Expert estate planners frequently suggest several strategies to maximise the benefits derived from the spouse exclusion form. One tip is to actively engage in discussions about how assets are distributed prior to one spouse's passing. Having these conversations can lead to strategic decisions on which assets should be excluded from estate taxation, ensuring the surviving spouse retains more wealth.

Furthermore, planners often advocate for regular reviews of your estate plan in light of changing tax laws. Strategic adjustments can provide substantial long-term benefits, safeguarding your family's financial security. Ultimately, the goal of utilizing the spouse exclusion is to create a more favourable estate environment for surviving spouses, paving the way for secure and efficient wealth transfer.

Related forms and templates

In addition to the spouse exclusion form, other relevant documents can support your estate planning efforts. Will templates, for example, are essential for ensuring that your wishes regarding asset distribution after death are appropriately documented. Additionally, power of attorney forms can grant someone the authority to make decisions on your behalf if you become incapacitated. Having these documents in order complements the absence of liability or disputes when you are no longer able to manage your estate.

Accessing tailored templates through pdfFiller simplifies this process, allowing users to create, edit, and download legal documents that align with their estate planning needs seamlessly.

Help and support for completing your form

For users navigating the spouse exclusion form, support is readily available. pdfFiller offers customer support to assist users with any questions or concerns during the completion process. Comprehensive user guides and tutorials are also provided, ensuring that you fully understand every step involved in filling out the form correctly.

Additionally, community forums and discussion boards allow users to connect and share experiences, offering further insights and tips from peers who have faced similar situations. This support network can be invaluable, providing real-world advice and fostering a collaborative environment for those looking to streamline their estate planning journey.

Stay updated on tax laws and related changes

The landscape of tax regulations is fluid, making it essential for individuals involved in estate planning to remain informed. This includes changes to laws affecting the spouse exclusion form and its implications on estate taxes. Staying updated not only aids in making informed decisions but also enhances planning strategies to minimize tax burdens.

Subscribing to newsletters or updates from pdfFiller can keep you in the loop regarding significant developments in tax laws. Educational resources and continuing education opportunities in tax laws are also valuable for those looking to deepen their understanding of estate planning and tax implications. Armed with the right knowledge, you can navigate the complexities of estate planning more effectively, protecting your loved ones' financial futures.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit spouse exclusion form straight from my smartphone?

Can I edit spouse exclusion form on an iOS device?

How do I fill out spouse exclusion form on an Android device?

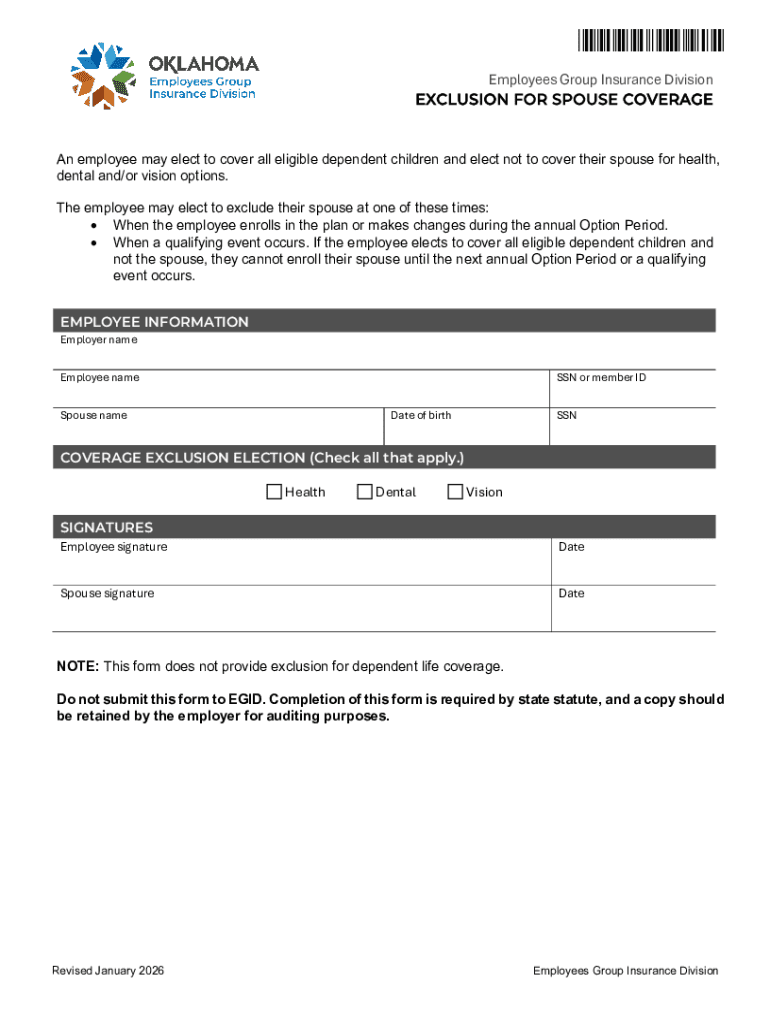

What is spouse exclusion form?

Who is required to file spouse exclusion form?

How to fill out spouse exclusion form?

What is the purpose of spouse exclusion form?

What information must be reported on spouse exclusion form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.