Get the free Form 140A - Resident Personal Income Tax (Short) Form

Get, Create, Make and Sign form 140a - resident

How to edit form 140a - resident online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 140a - resident

How to fill out form 140a - resident

Who needs form 140a - resident?

Form 140A - Resident Form How-to Guide

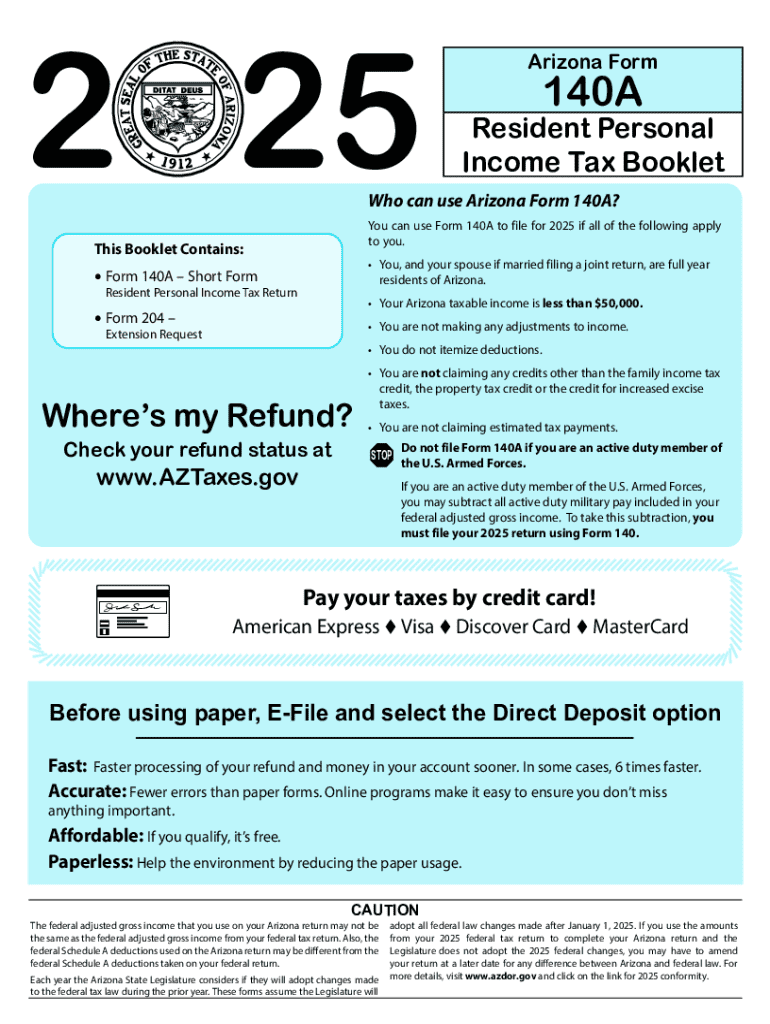

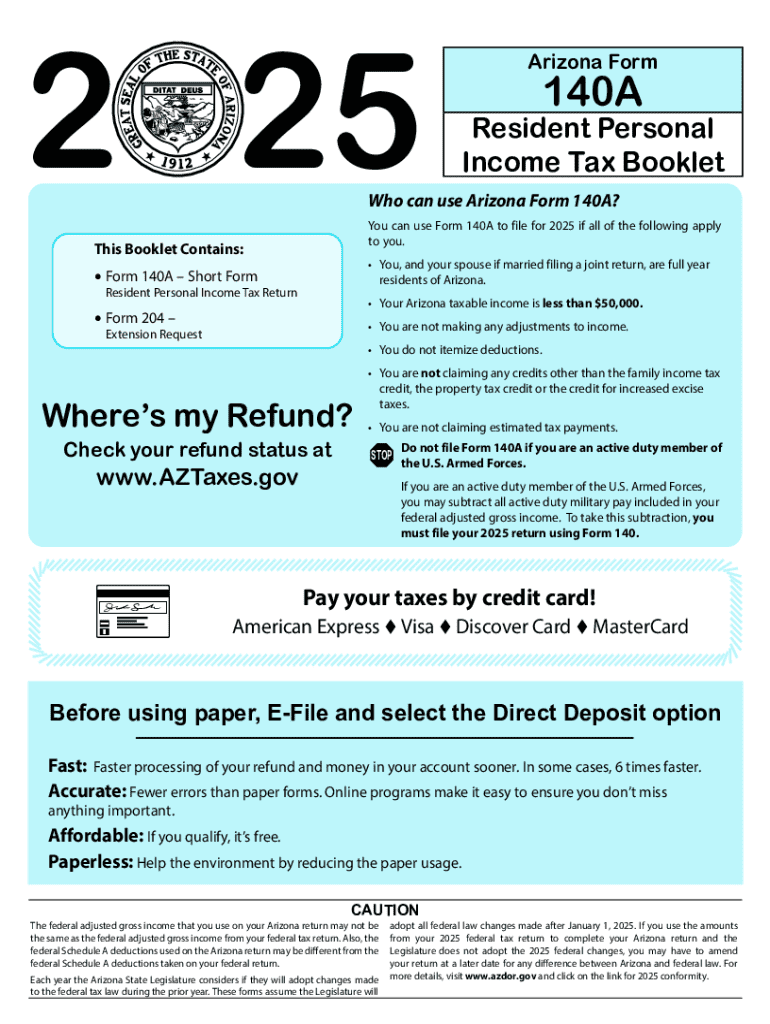

Understanding Form 140A: Overview and Purpose

Form 140A is the Arizona Resident Personal Income Tax Return that allows individuals living in Arizona to report their income and calculate their tax liability for the year. This form is mandated by the Arizona Department of Revenue and plays a crucial role in the state's tax system, ensuring that residents contribute their fair share towards funding public services and infrastructure.

The importance of Form 140A cannot be overstated for Arizona residents. It is not just a legal obligation but also a method to harness tax credits and deductions that can significantly reduce the overall tax liability. For the tax year 2023, individuals must pay attention to key deadlines, which typically fall on April 15th unless extended. Timely submission helps avoid penalties and ensures smooth processing of tax returns.

Who needs to file Form 140A?

Not every Arizona resident is required to file Form 140A; the need to file is primarily determined by income level and age. Specifically, residents with a gross income exceeding certain thresholds set forth by the state must submit the form. For the 2023 tax year, the filing requirement may affect various categories of taxpayers, including single filers, married couples, and heads of household.

Income limits vary by filing status, with specific exemptions available for individuals who are blind, over 65, or are dependents of other taxpayers. For joint filers, both spouses' incomes are combined to determine if the threshold is exceeded. Special considerations must be made for dependents, as their filing requirements differ, often only needing to file if they have substantial earned income.

Step-by-step instructions for completing Form 140A

Filling out Form 140A requires careful attention to detail to ensure accuracy and compliance. The form is divided into sections, each requiring specific information from the taxpayer.

Section 1: Personal Information

This section requires essential personal details such as your name, address, and Social Security Number (SSN). Accuracy is critical here, as even minor errors can lead to processing delays or issues with your tax return. It is advisable to verify your SSN and ensure your name matches the records held by the Social Security Administration.

Section 2: Income Reporting

In this section, you will report various types of income, including wages, dividends, self-employment earnings, and any other taxable income. For self-employed individuals, reporting methods vary; it's essential to gather all business records and document expenses accurately to calculate net income effectively.

Section 3: Deductions and Credits

This crucial section allows residents to reduce their taxable income through available deductions, including personal exemptions and various tax credits such as the Arizona Family Income Tax Credit or the Credit for Contributions to Charitable Organizations. Be sure to utilize any interactive tools available for precise calculations.

Section 4: Calculating Your Tax Liability

After entering income and deductions, you will calculate your tax liability based on Arizona’s tax tables. Familiarity with the current tax rates ensures you can accurately determine what you owe. A strategic approach to deductions may include maximizing contributions to retirement accounts or investing in higher education, ultimately reinforcing financial health.

Reviewing your Form 140A before submission

Before submitting Form 140A, it's imperative to conduct a thorough review of your entries. Ensuring accuracy can prevent costly processing delays and potential audits by the Arizona Department of Revenue. Errors in taxpayer handwriting or details can lead to unnecessary complications. To help with this process, create a checklist of common mistakes to avoid.

Common pitfalls include mishandling of Social Security Numbers, incorrectly calculating tax liabilities, and failing to include all forms of income. Utilizing tools such as pdfFiller can enhance this review process, offering editing capabilities to make necessary adjustments seamlessly.

Submitting your Form 140A

Once your form is completed and reviewed, the next step is submission. Form 140A can be submitted electronically through the Arizona Department of Revenue's e-filing system or sent by traditional mail. It's vital to be aware of the differing deadlines for electronic filing versus paper submissions to avoid any penalties.

When filing online, you can receive instant confirmation, allowing you to track your status directly through your user account menu. For mailed forms, consider using a tracking service to ensure your submission is safely delivered and received.

How to amend a filed Form 140A

If you discover an error after submitting your Form 140A, it is critical to take action promptly. Amending a filed return can often be necessary if there are discrepancies in reported income, deductions, or tax credits. To amend your form, you must fill out a new Form 140A, indicating that it is an amended return.

When filing an amendment, attach any relevant documents that support the changes you're making. If money was incorrectly reported, the Arizona Department of Revenue expects that any owed balances are paid promptly to avoid additional interest or penalties. Ensuring clarity during this process is essential to maintaining compliance.

Frequently asked questions (FAQs) about Form 140A

Taxpayers often have questions regarding the intricacies of filing Form 140A. Common inquiries include what happens if mistakes are made, how long it takes to receive a refund, and where to find assistance during the filing process. Understanding these FAQs can smooth out the complexities of tax season.

For more specific assistance, taxpayers are encouraged to refer to the Arizona Department of Revenue’s resources or consult with tax professionals for personalized help. Online forums and communities can also be valuable for shared experiences and tips that enrich the filing journey.

Utilizing pdfFiller for your document management needs

pdfFiller offers an effective platform for managing tax documents, including Form 140A. Users can take advantage of pdfFiller’s editing and eSigning capabilities, making it easier to prepare accurate filings. The platform ensures that all necessary forms can be accessed and handled from anywhere, with cloud storage providing security and convenience.

In an increasingly digital environment, the collaboration features of pdfFiller become highly beneficial for teams handling multiple forms. Teams can coordinate and communicate efficiently, ensuring all documents are up to date and complete throughout the tax filing process.

Understanding your rights and responsibilities as a taxpayer

As a taxpayer in Arizona, it's essential to know your rights. Taxpayers have the right to receive assistance, be treated fairly and respectfully, and expect confidentiality and privacy concerning their financial information. Additionally, maintaining accurate records of all income and deductions is a responsibility every taxpayer must uphold.

pdfFiller supports you in staying compliant and informed through its organized document management tools. By accurately storing records and having easy access to your files, you can confidently ensure that you are meeting all your obligations.

Additional tools and services from pdfFiller

In addition to document management, pdfFiller provides interactive calculators that can assist users in estimating their tax liabilities. The platform also includes templates for related forms, streamlining the filing process further. An active customer support team is available to address any issues or concerns users may encounter during their experience with the service.

Engaging with the pdfFiller community offers added benefits, with insights and tips shared among users enhancing your experience in preparing and filing forms. Utilizing these tools means less stress during tax season and greater confidence when submitting your Form 140A.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the form 140a - resident in Gmail?

How do I edit form 140a - resident on an iOS device?

How do I complete form 140a - resident on an Android device?

What is form 140a - resident?

Who is required to file form 140a - resident?

How to fill out form 140a - resident?

What is the purpose of form 140a - resident?

What information must be reported on form 140a - resident?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.