Get the free 1023 Instructions for Form 1023 - OMB 1545-0047

Get, Create, Make and Sign 1023 instructions for form

Editing 1023 instructions for form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 1023 instructions for form

How to fill out 1023 instructions for form

Who needs 1023 instructions for form?

Comprehensive Guide to 1023 Instructions for Form

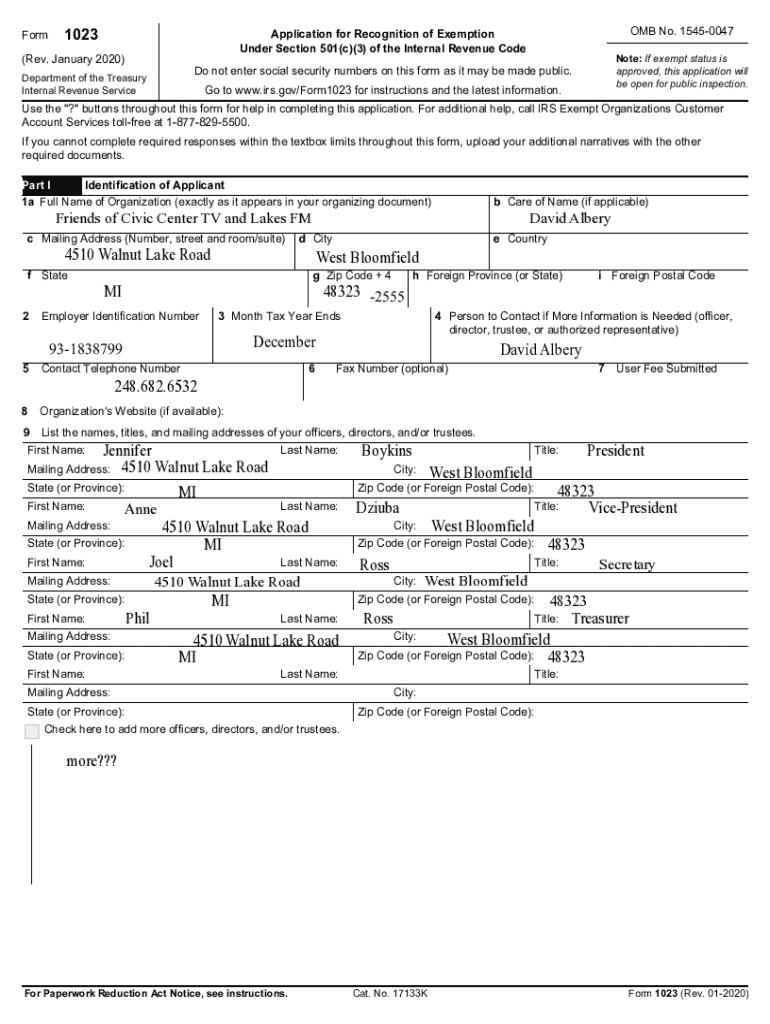

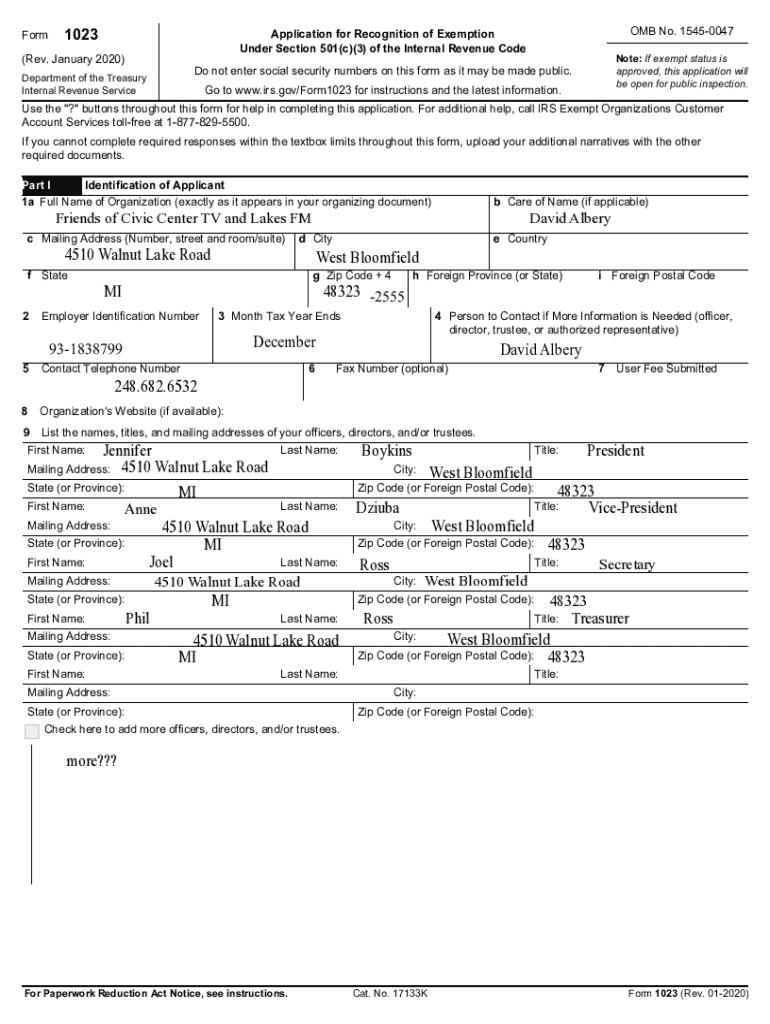

Understanding Form 1023

Form 1023 is the application used by organizations seeking federal tax-exempt status under section 501(c)(3) of the Internal Revenue Code. This designation allows nonprofits to operate without paying federal income tax and enables donors to deduct contributions on their tax returns. Understanding the nuances of Form 1023 is essential because it lays the foundation for the credibility and longevity of your nonprofit organization.

The importance of Form 1023 cannot be overstated. It serves as a formal request to the IRS for recognition as a tax-exempt entity. By securing this status, organizations can attract funding, grant options, and support from the community, which are crucial for sustainability. Key terms related to Form 1023 include 'nonprofit organization,' 'public charity,' and 'tax-exempt status.'

Who should use Form 1023?

Organizations established for charitable, educational, religious, or scientific purposes should consider filing Form 1023. However, not every group qualifies; eligibility criteria dictate that the organization must not be organized for profit and must not attempt to influence legislation substantially or participate in political campaigns.

Common misconceptions about Form 1023 applications include the belief that all nonprofits automatically qualify for tax-exempt status or that the process is straightforward. It's essential to realize that a thorough understanding and careful preparation are mandatory for a successful filing.

Preparing to fill out Form 1023

Before initiating your Form 1023 application, gather necessary information and documentation. This may include your organization's formation documents, bylaws, mission statement, and financial data. The IRS requires comprehensive details to process your application efficiently. Having this information readily available can prevent delays.

Common mistakes to avoid include omitting required details, using vague descriptions, and failing to provide financial projections. To collect and organize your data efficiently, tools like pdfFiller can be invaluable. With pdfFiller, you can store essential documents, collaborate with team members, and ensure all required materials are aligned before submission.

Step-by-step instructions for completing Form 1023

Completing Form 1023 can be a complex process, and breaking it down into sections can facilitate understanding. Here are detailed instructions for each major segment of the form:

Interactive tools for form completion

Utilizing digital tools can streamline the Form 1023 completion process. pdfFiller offers numerous features designed to simplify filing, making it easier to manage and navigate the application.

These features are especially beneficial for teams working on the document together, ensuring that everyone can contribute effectively and make real-time progress.

Common challenges in filling out Form 1023

Filing Form 1023 can be challenging due to the complexity of questions and the required details. Common questions often arise during application submission, particularly regarding organizational structure and financial information.

Recognizing warning signs, such as requests for more information from the IRS, can help applicants proactively address issues that may impede their approval timeline.

After submitting your Form 1023

Once you submit your Form 1023, the waiting game begins. The IRS generally takes 3 to 6 months to process applications, but this timeline may vary based on application volume and complexity.

Following submission, it's crucial to keep an eye on your organization's expectations. Prepare for any inquiries from the IRS regarding your application, and stay ready to provide additional information if needed. Address FAQs about processing time and approval can also help manage expectations effectively.

Alternative to Form 1023: Form 1023-EZ

For smaller organizations or those with simpler structures, Form 1023-EZ offers a streamlined application process. This shorter version of the form is easier to complete and can significantly reduce the filing time.

Resources for additional support

Starting and maintaining a nonprofit can be daunting, but many resources are available. Engaging with nonprofit support services can provide crucial insights and assistance.

These resources can significantly ease the journey, providing tools and support to navigate the complexities of managing a nonprofit.

Expert insights on filing and maintaining nonprofit status

Gathering insights from nonprofit experts and IRS agents can illuminate best practices for filing Form 1023 and maintaining your organization’s status thereafter. Active engagement with such professionals can enhance your understanding and approach.

Implementing best practices, continuous learning, and community engagement form the bedrock of a thriving nonprofit organization.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the 1023 instructions for form electronically in Chrome?

How do I fill out the 1023 instructions for form form on my smartphone?

How do I complete 1023 instructions for form on an iOS device?

What is 1023 instructions for form?

Who is required to file 1023 instructions for form?

How to fill out 1023 instructions for form?

What is the purpose of 1023 instructions for form?

What information must be reported on 1023 instructions for form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.