Get the free Progressive Tax Service - 2 Reviews - Finance in Fenton, MO

Get, Create, Make and Sign progressive tax service

Editing progressive tax service online

Uncompromising security for your PDF editing and eSignature needs

How to fill out progressive tax service

How to fill out progressive tax service

Who needs progressive tax service?

The Comprehensive Guide to the Progressive Tax Service Form

Understanding progressive taxation

Progressive taxation is a system in which the tax rate increases as the taxable income rises. This means that individuals with higher incomes pay a larger percentage in taxes compared to those with lower incomes. The fundamental premise of progressive taxation is to ensure that the tax burden is distributed fairly across different income groups, aiming to reduce income inequality.

Key principles behind progressive tax rates include equity and the benefit principle, which suggests that those who can afford to pay more should contribute a larger share of their income. This is crucial in addressing social equity and funding public services that benefit the broader community. Progressive taxation plays an essential role in income distribution and economic stability.

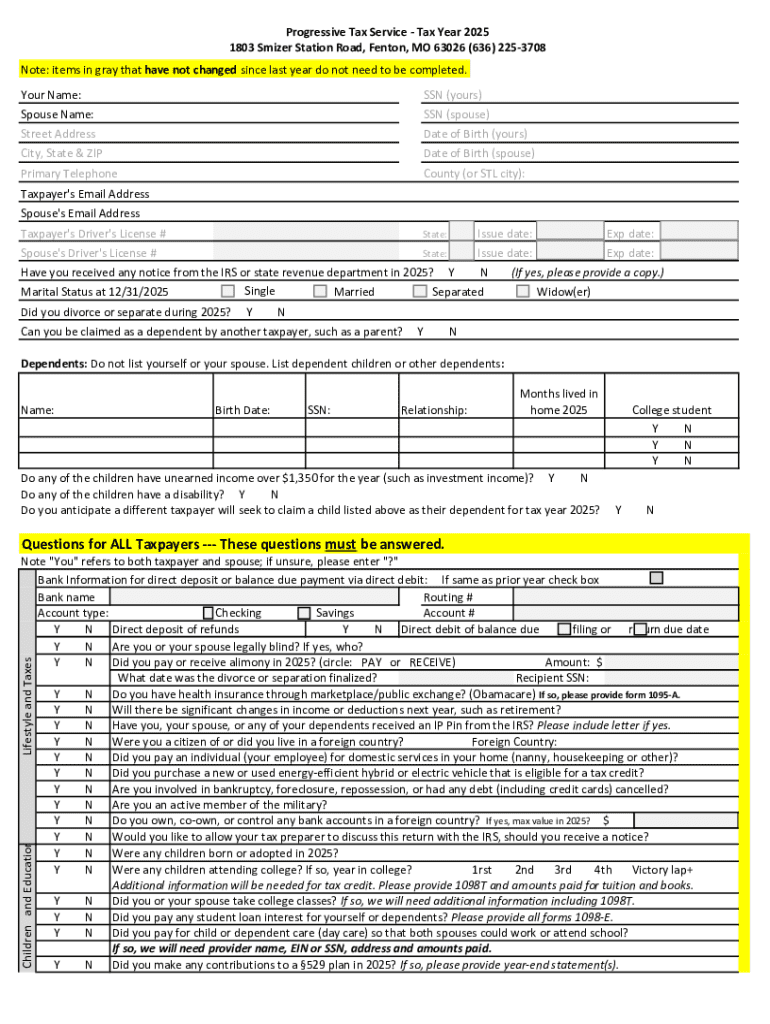

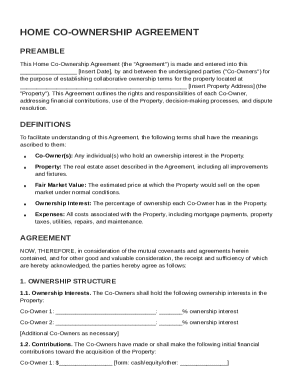

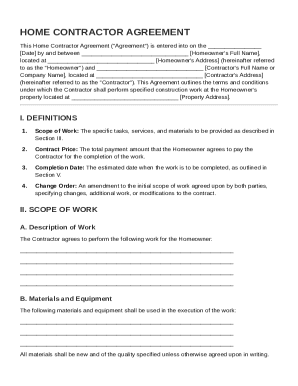

Overview of the progressive tax service form

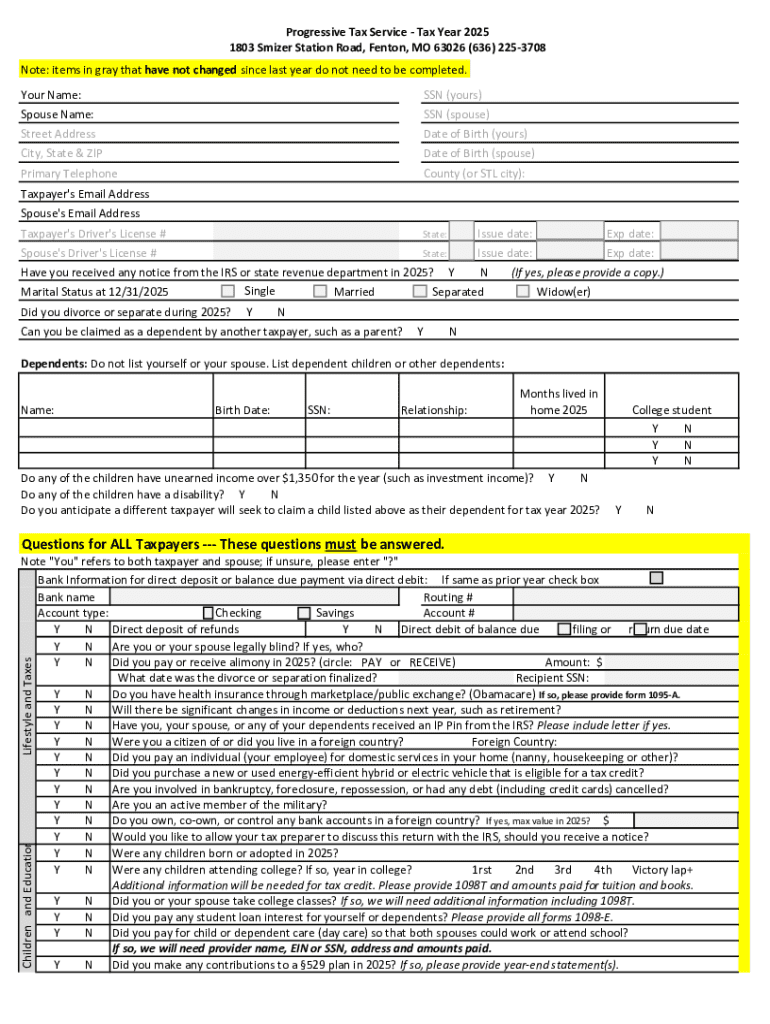

The progressive tax service form is a specific document used by taxpayers to report their income and calculate their tax liability under a progressive tax system. This form not only serves as a declaration of income but also provides a structured way to claim allowable deductions and credits. Understanding this form is critical for accurate tax reporting and compliance.

Typically, the form covers various types of income such as wages, dividends, and rental income, along with numerous deductions like mortgage interest and student loan interest. Eligibility for using this form generally extends to individual taxpayers, including sole proprietors and those filing jointly or separately, depending on their circumstances.

Preparing to fill out the form

Before beginning to fill out the progressive tax service form, it's vital to gather all necessary documents and information. This includes income statements like W-2s and 1099s as well as deduction records such as receipts and previous tax returns. Having these in hand will facilitate a smoother, more accurate form-filling process, allowing for effective reporting of income and claims for eligible deductions.

Choosing the right time to file the form is also crucial. Generally, tax returns must be filed by April 15th of the following year. Additionally, determining your filing status—whether single, married filing jointly, married filing separately, or head of household—will significantly influence your tax rates and deductions available. Considerations for choosing the filing status should therefore be given serious attention.

Step-by-step instructions for filling out the progressive tax service form

Filling out the progressive tax service form can be intimidating, but breaking it down into sections makes it manageable. The first section generally requires personal information including your name, address, and social security number. It's essential to ensure this information is accurate to avoid delays or issues.

When you move on to the income details section, report all sources of income, including wages, tips, and other compensations, as well as any additional income from investments or rentals. Following that, you will enter deductions. You can choose between standard deductions, which are predetermined amounts, or itemized deductions, which are based on your specific expenses. Make sure to accurately list all deductible expenses to maximize your tax benefit.

Ultimately, you will calculate your tax liability by understanding tax brackets and applying any available credits. After ensuring all entries are accurate, finalize your return by signing and dating the form.

Common mistakes to avoid

Mistakes in tax reporting can lead to delayed refunds, additional taxes owed, or even audits. One common error is incorrectly reporting income, which can occur when income from contractors is not included. It's crucial to ensure all sources of income are accounted for to avoid complications.

Another frequent pitfall lies in misunderstanding deductions and credits. Taxpayers often confuse which deductions they can claim or overlook eligible expenses. Therefore, it's essential to familiarize yourself with what is deductible. Lastly, failing to keep proper records can lead to difficulties in the event of an audit. Maintaining comprehensive documentation of expenses and incomes will protect you in case the IRS requires further verification.

Utilizing interactive tools for enhanced accuracy

Leveraging interactive tools when completing the progressive tax service form can significantly boost accuracy. One such tool is pdfFiller, which streamlines the document completion process. This platform allows users to edit PDFs easily, correcting mistakes with its editing features, ensuring that everything is accurate before submission.

Collaboration tools offered by pdfFiller make it easier for teams to work together on submissions; team members can share notes and insights directly on the document. Additionally, eSigning options facilitate swift filing by allowing you to finalize your form digitally. Lastly, using cloud storage for document management ensures that your tax records are organized and easily accessible whenever needed.

Managing your completed progressive tax service form

After you have filled out the progressive tax service form, managing its submission is critical. You have options for submission, including e-filing, which is often faster and could offer immediate confirmation, or mailing in your form, which can take longer to process. Understanding the confirmation status after submission is important; keep an eye out for any notifications confirming receipt.

Furthermore, organizing your tax records for future reference can provide peace of mind. Utilize storage solutions to maintain all necessary documents, such as copies of submitted forms, supporting records, and any correspondence with the IRS. This organization is key for both future filings and any potential audits.

FAQs about the progressive tax service form

Navigating tax forms can lead to several questions. One of the most common inquiries involves what to do if you miss your filing deadline. If you miss the deadline, it's important to file as soon as possible to mitigate penalties. You can also file an extension if necessary.

Additionally, individuals often ask how to amend a submitted return. It's crucial to file an amended return using Form 1040-X if you need to correct any information post-submission. Lastly, receiving an audit notice can be unsettling; if that happens, it’s essential to respond promptly and provide any requested documentation to the IRS.

Additional tips for efficient tax management

To streamline your tax season experience, establishing a tax schedule for future filings can be highly beneficial. This involves designating specific periods throughout the year for gathering documents and preparing for returns, reducing last-minute stress. Staying informed about tax law changes is equally important, as these can affect your obligations and potential deductions.

Moreover, utilizing pdfFiller for comprehensive document solutions can simplify your approach to tax management. From editing and eSigning forms to effective document organization, this platform can provide an effective means of maintaining control over your tax documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit progressive tax service from Google Drive?

How do I execute progressive tax service online?

How do I complete progressive tax service on an iOS device?

What is progressive tax service?

Who is required to file progressive tax service?

How to fill out progressive tax service?

What is the purpose of progressive tax service?

What information must be reported on progressive tax service?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.