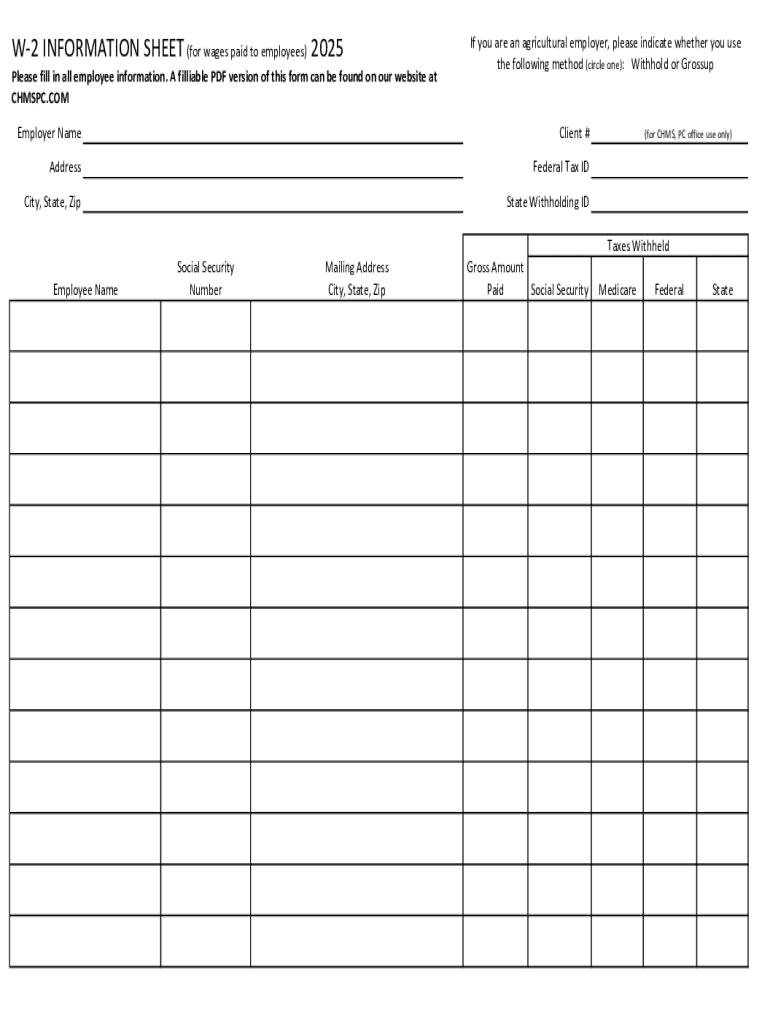

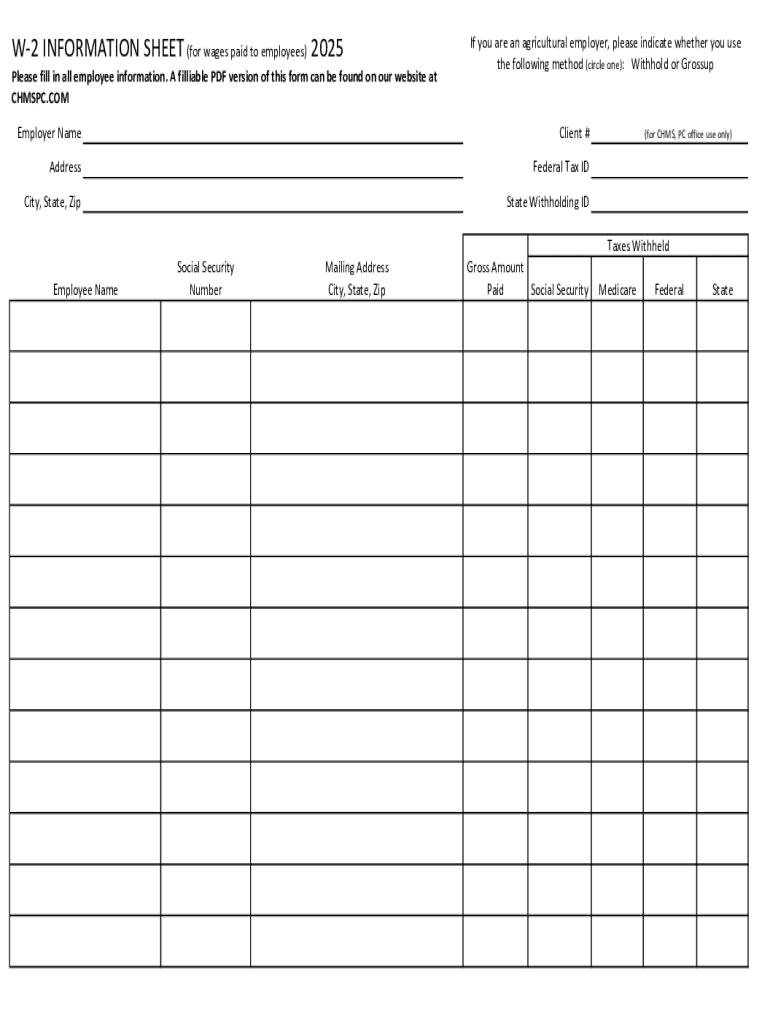

Get the free W-2 INFORMATION SHEET(for wages paid to employees) 2025

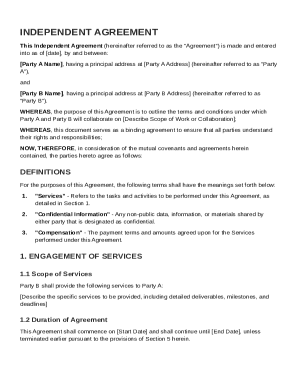

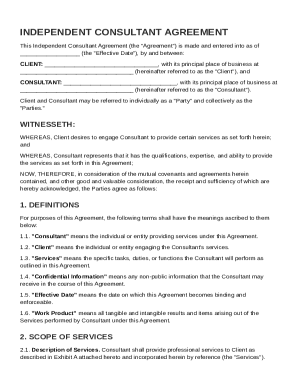

Get, Create, Make and Sign w-2 information sheetfor wages

How to edit w-2 information sheetfor wages online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w-2 information sheetfor wages

How to fill out w-2 information sheetfor wages

Who needs w-2 information sheetfor wages?

W-2 Information Sheet for Wages Form: A Comprehensive Guide

Understanding the W-2 form

The W-2 form is a crucial document for anyone earning wages in the United States. It is officially known as the Wage and Tax Statement and serves as a record of an employee’s annual earnings and tax withholdings. Each year, employers must provide a W-2 to every employee detailing the income earned and the amounts withheld for federal, state, and other taxes. This form not only aids employees in filing their income tax returns, but it also plays a vital role in tax reporting for the IRS. Individuals who fail to provide accurate W-2 information could face penalties, making understanding this form imperative.

The W-2 form also reflects various benefits tied to employment, such as Social Security and Medicare contributions. Each employee uses this form to ensure accurate reporting of wages, which directly impacts their yearly tax obligations and any refunds owed. Missing or erroneous W-2 information can complicate or delay tax filings, leading to potential issues with the IRS. Thus, it is essential for employees and employers to treat this document with utmost care and diligence.

Key components of the W-2 form

Understanding the specifics of each box on the W-2 form is vital for both employees and employers. This form is divided into several boxes, each representing different types of information regarding wages and taxes.

Understanding the information reported in these boxes can prevent confusion and help ensure individual tax filings are accurate. Each year-end statement on the W-2 details the time period for which the wages were earned, aligning with the employee's filing status for total income taxes.

Steps to obtain your W-2 information sheet

Obtaining your W-2 information sheet can vary depending on whether you are the employee or the employer. For employees, typically, employers must provide this document by the end of January following the tax year. If you have not received yours, there are steps you can take to obtain it.

Employers should ensure they distribute W-2s in a timely manner, as this is not only a compliance obligation but also a good practice to facilitate their employees' tax filings. It is important to keep a close track of these distributions to avoid issues arising from lost or misdirected W-2s.

The process of filing taxes with your W-2

Using your W-2 information when filing taxes is essential to ensure a smooth process and accurate returns. To begin, gather your W-2 forms, as they are required to report your income accurately. When filling your tax return, the income reported in Box 1 from your W-2 should be entered into your tax software or paper tax forms.

Be mindful of the common mistakes that can occur while using a W-2, such as transposing numbers or neglecting to input all sources of income. Correctly totaling and checking the amounts in Box 1 and Box 2 for federal taxes withheld can help prevent discrepancies with the IRS. Consider reviewing your enterered data against the W-2 form to ensure accuracy, as accuracy is paramount while filing taxes.

Sending W-2s electronically under new IRS regulations

Recent IRS regulations have facilitated the process of sending W-2 forms electronically. Employers now have the option to provide W-2s in digital format, which can speed up the process and simplify record-keeping for employees. However, certain guidelines must be adhered to ensure compliance with IRS requirements.

Employers must inform employees about this electronic distribution method, and ensure the format is secure, such as through a password-protected system. Improving the delivery of W-2s electronically not only streamlines administrative processes but also contributes to a greener approach by reducing paper consumption.

Special considerations for remote workers

The rise of remote work introduces unique tax implications for remote employees, particularly when they work across state lines. Different states may impose varying wage taxes, affecting how W-2 forms are structured. As a result, remote employees must be diligent in understanding how their work location impacts their tax liabilities.

For employers, handling W-2s for distributed teams can pose challenges, particularly with varying tax regulations. Ensuring that W-2s reflect the proper state income tax withheld is crucial. Keeping track of which state each employee works in, along with their associated tax rates, can streamline the W-2 preparation process.

Navigating issues with your W-2

If you do not receive your W-2, your immediate step should be to check with your employer or payroll department. Regulations mandate that W-2s should be sent out by the end of January, but delays can happen. If you have still not received your form after early February, reaching out directly can help expedite the process.

In the event of mistakes on your W-2 form, such as incorrect amounts or erroneous information, it is critical to address these issues promptly. Employers are required to issue corrected forms, known as W-2c, to remedy any errors found. Keeping documentation of any discrepancies will bolster your case with the employer or the IRS if you face audit issues.

Additional resources for W-2 management

Managing your W-2s effectively can be enhanced through various online tools available on the pdfFiller platform. These interactive tools allow users to edit, sign, and manage W-2 forms securely and efficiently. The convenience of having access to your W-2 forms on the cloud simplifies the document management process while ensuring the integrity of sensitive information.

Utilizing tools from pdfFiller can make adjustments easy. The ability to eSign documents allows for quick completion and submission of forms, further streamlining tax preparation. Ensuring that W-2 documents are completed accurately is both vital for compliance and beneficial for personal financial management.

Frequently asked questions about the W-2 form

Here are some common questions regarding the W-2 form that many may find useful. Understanding these common queries can clarify the role of the W-2 in tax preparation, enhancing overall efficiency when filing taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send w-2 information sheetfor wages to be eSigned by others?

How do I edit w-2 information sheetfor wages online?

Can I create an electronic signature for the w-2 information sheetfor wages in Chrome?

What is w-2 information sheet for wages?

Who is required to file w-2 information sheet for wages?

How to fill out w-2 information sheet for wages?

What is the purpose of w-2 information sheet for wages?

What information must be reported on w-2 information sheet for wages?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.