Get the free Business tax form help for first year with expenses

Get, Create, Make and Sign business tax form help

How to edit business tax form help online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business tax form help

How to fill out business tax form help

Who needs business tax form help?

Business Tax Form Help Form: Your Comprehensive Guide

Understanding business tax forms

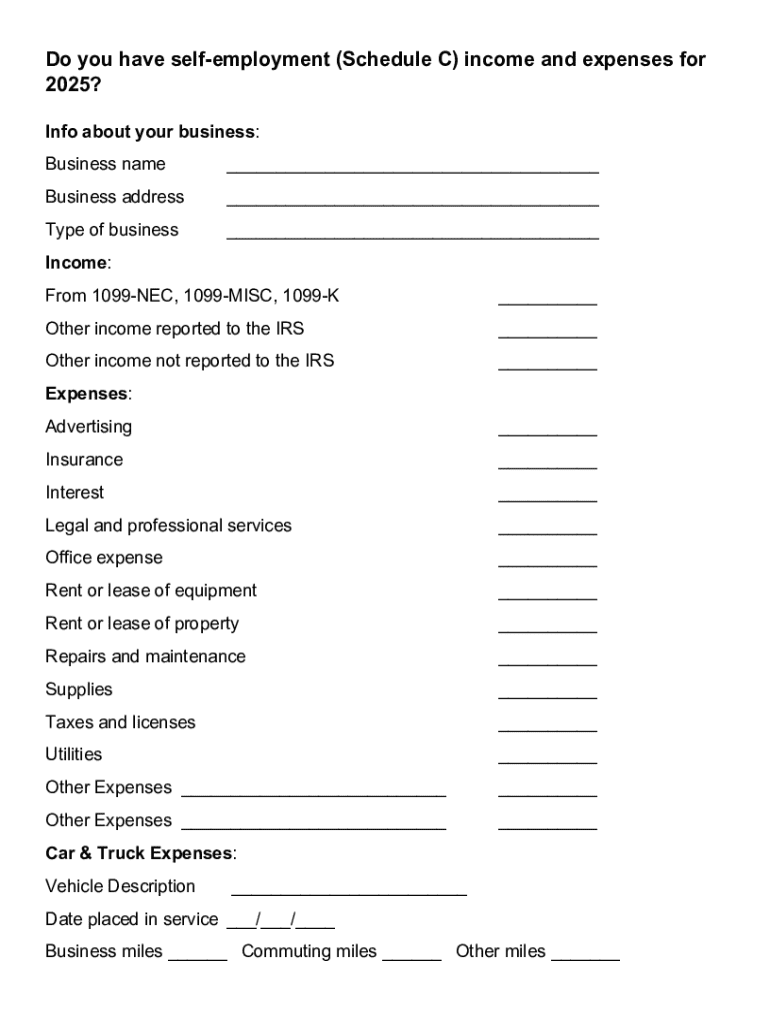

Business tax forms are essential documents required by the federal government and many state authorities to report the income and expenses of various business types. They serve as the primary means through which businesses fulfill their tax obligations, providing a comprehensive view of financial performance for tax assessment purposes. Each form is tailored to a specific business structure, highlighting the need for accurate and timely submissions.

The different types of business tax forms include Sole Proprietorships, Partnerships, Corporations, and S-Corporations, each requiring unique forms like the 1040 Schedule C or 1120s. Understanding these forms will streamline your filing process, ensuring that you accurately report your business's financial activities. Key tax concepts include knowing the difference between the tax year and the filing year, as well as having a clear grasp of deductions and credits that can impact your taxable income.

Identifying the right tax form for your business

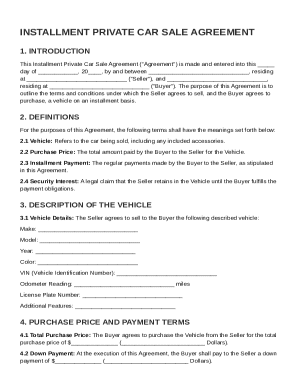

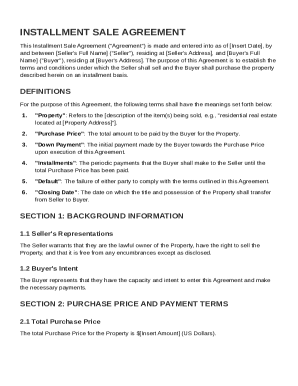

Determining the appropriate tax form hinges on the structure of your business. Different entities have distinct responsibilities and tax obligations, and using the correct form is foundational to compliance and avoiding penalties. For instance, a Sole Proprietorship typically uses Form 1040 Schedule C, while Partnerships use Form 1065, and both Corporations and S-Corporations utilize Forms 1120 and 1120S, respectively.

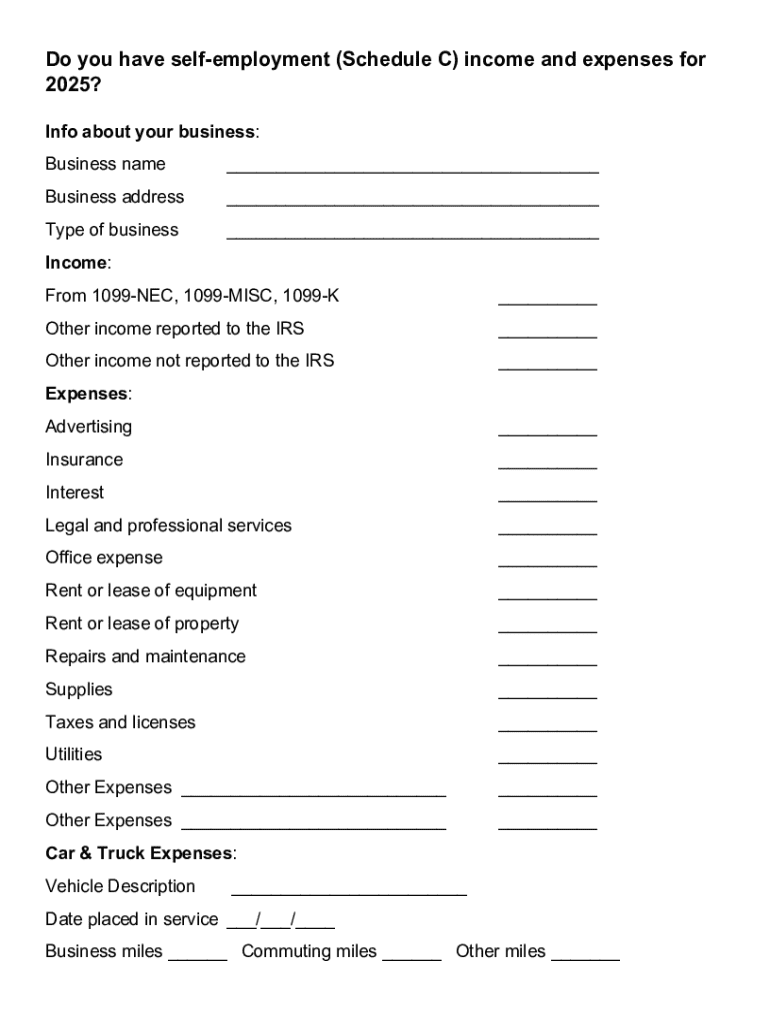

To effectively identify which form you need, consider the following factors: your business structure, the nature of your income, and your total expenses. For example, a Sole Proprietorship will only report on personal income through the Schedule C but needs to track additional details if they have deductible expenses that can reduce their taxable income.

Step-by-step guide to filling out business tax forms

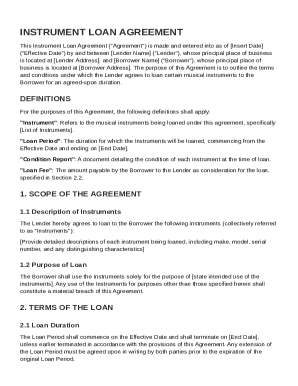

Filling out business tax forms requires thorough preparation and organized documentation. First, gather all necessary records, including income statements from sales and invoices, as well as receipts for all operational and payroll expenses. This information is critical for accurately representing your business's financial status and claiming potential deductions.

Once you have all documentation ready, follow detailed instructions for each business form. For instance, completing Form 1040 Schedule C involves detailing your income, cost of goods sold, and expenses associated with operating your business. Each form, including Form 1065 for Partnerships or Form 1120/1120S for Corporations, has specific guidelines and common pitfalls, such as calculation errors and misreporting income or expenses, which must be avoided.

Editing and managing your forms with pdfFiller

pdfFiller makes editing tax forms straightforward and efficient. You can easily upload your completed forms directly to the platform. Once uploaded, utilize the editing features. You can add or modify text effortlessly, ensuring that all information is accurate. Highlighting and annotating key sections is another great way to emphasize essential details on your forms, making it easier for both you and any partners to review.

In addition to editing, pdfFiller's eSignature features allow you to sign your tax forms digitally. This not only saves time but also simplifies the process of collecting signatures from partners or co-owners, enabling smoother collaboration. Utilizing these tools can significantly streamline your tax preparation process.

Collaborative tools for teams with pdfFiller

With pdfFiller, collaboration among team members is both efficient and straightforward, allowing businesses to streamline their tax filing process. You can easily share forms with your team, taking advantage of real-time collaboration features. These capabilities enable team members to comment directly on documents, facilitating a robust approval process. This is especially useful for ensuring accuracy and compliance before submission.

Managing permissions and access levels is crucial for protecting sensitive information related to your business finances. pdfFiller allows you to set specific viewing or editing rights for different team members, ensuring that only authorized personnel have access to critical documents. This layered approach to document security helps maintain the integrity of your business tax filings.

Filing your business tax forms

Filing business tax forms can be done electronically or on paper. E-filing is highly recommended due to its various benefits, including faster processing times and immediate confirmation of receipt by the IRS. Additionally, e-filing helps reduce the likelihood of errors, thus minimizing the chances of audits or inquiries from the IRS.

Each filing method comes with its deadlines and requirements. To ensure compliance, businesses should track their submission status using IRS online services, which provide real-time updates on the progress of submitted tax returns. pdfFiller also offers tracking features that assist users in managing their filings more efficiently.

Handling post-filing tasks

After filing your forms, it’s crucial to handle any errors promptly. Should you discover a mistake post-filing, amending your return using Form 1040X is essential. This form provides the IRS with the necessary updates to your original submission, helping to correct any misstatements that could otherwise lead to penalties.

Managing communications from the IRS is another vital aspect of the post-filing process. Understanding audits and requests for additional information ensures you are prepared and organized. Utilizing pdfFiller to keep all documents related to your filings and correspondence organized allows you to respond promptly and effectively to any inquiries.

Tips for future tax filing success

Successful tax filing for your business extends beyond the annual process; it involves diligent record-keeping throughout the year. Best practices for document organization include categorizing receipts and income records consistently, as well as using digital tools to maintain and backup your files. Structured storage of your financial documents will facilitate a smoother filing experience when tax season arrives.

Leveraging pdfFiller for year-round document management can tremendously aid your tax responsibilities. Creating templates for business financials and continuously updating them ensures that you’re never caught off guard during tax season. Utilizing the platform’s features for document management will empower you to stay organized and prepared throughout the year.

Frequently asked questions (FAQs)

Navigating business tax forms can raise numerous questions. One common inquiry is, 'What should I do if I miss the deadline?' Penalties can be costly; thus, it's essential to address any late filings immediately by submitting your return as soon as possible and outlining your reasons for the delay in correspondence with the IRS. Another frequent question is how to reduce business tax liability. Engaging in strategic tax planning and utilizing deductions and credits available can effectively minimize your tax burden.

For further assistance, explore resources available on government websites and consider engaging with local tax advisors or consultants who possess expertise tailored to your specific situation, offering insights that direct solutions for your business.

Using pdfFiller's interactive tools

pdfFiller provides a suite of interactive features to assist you in navigating the complexities of business tax forms. With calculators available for estimating potential deductions and credits, you can prepare more effectively and with greater precision. Interactive checklists for filing preparation ensure you cover all necessary aspects before submitting your forms.

Real-life case studies showcase how businesses have successfully maneuvered through complicated tax situations by utilizing pdfFiller’s resources. These success stories provide practical insights into how to manage forms and maintain compliance, serving as inspiration for teams looking to streamline their own processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit business tax form help from Google Drive?

How can I send business tax form help for eSignature?

How can I get business tax form help?

What is business tax form help?

Who is required to file business tax form help?

How to fill out business tax form help?

What is the purpose of business tax form help?

What information must be reported on business tax form help?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.