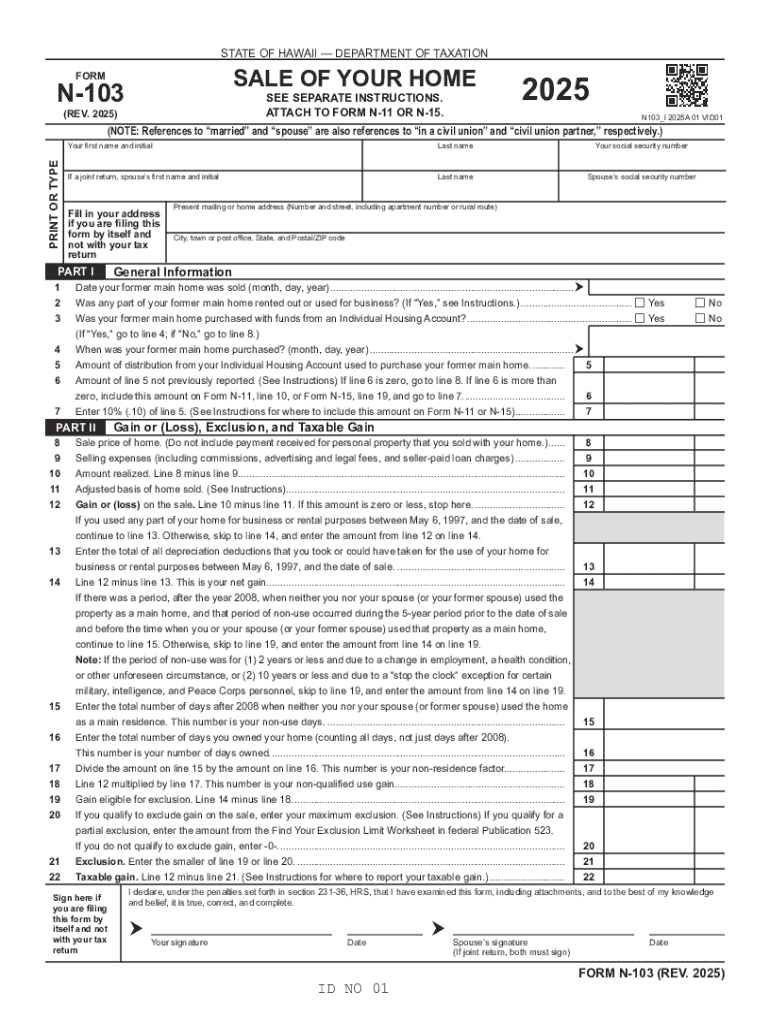

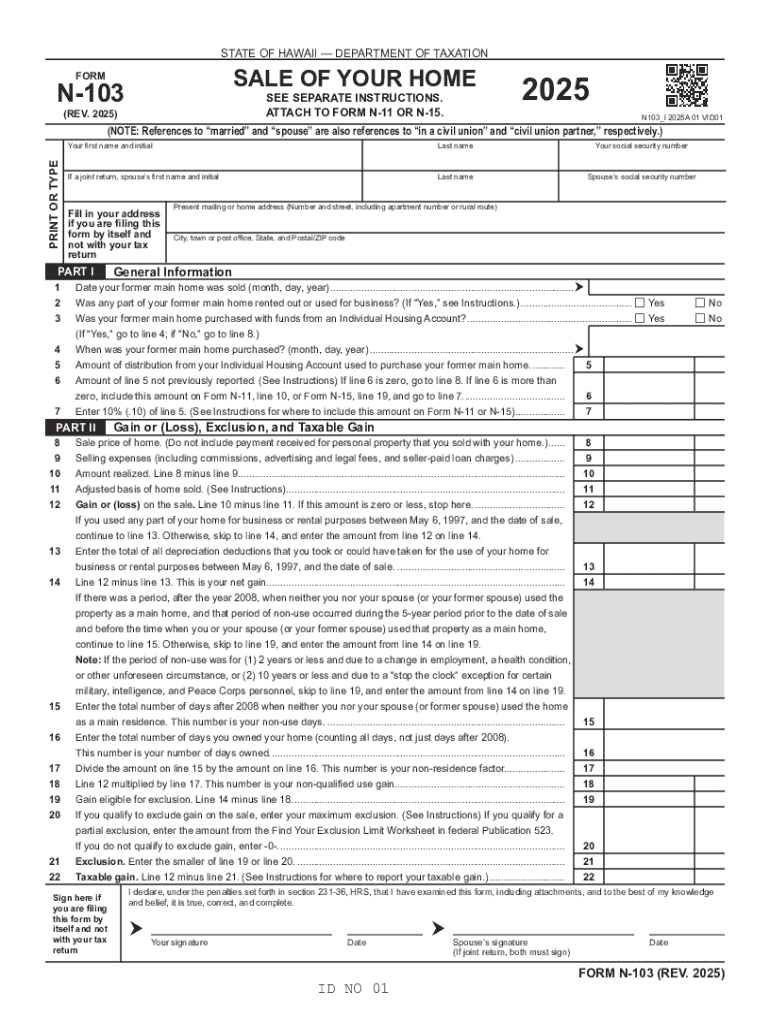

Get the free Form N-103, Rev. 2025, Sale of Your Home. Forms 2025

Get, Create, Make and Sign form n-103 rev 2025

How to edit form n-103 rev 2025 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form n-103 rev 2025

How to fill out form n-103 rev 2025

Who needs form n-103 rev 2025?

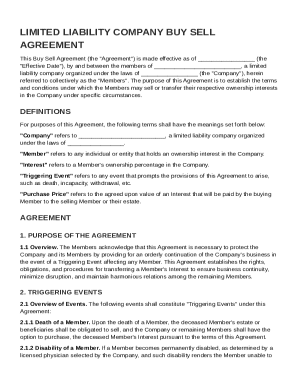

Comprehensive Guide to Form N-103 Rev 2025

Overview of Form N-103 Rev 2025

Form N-103 Rev 2025 is a crucial document that serves various purposes, primarily focused on tax reporting and compliance. This revised form addresses key updates to ensure accuracy and relevance in today’s financial landscape. With particular emphasis on streamlining the filing process, the 2025 revision provides a user-friendly approach to both individual and corporate reporting.

The importance of the 2025 revision lies in its enhanced clarity and efficiency, tailored for a diverse range of users, from taxpayers to small business owners. The updates respond to common user feedback, making the form more intuitive and easier to fill out accurately, thereby reducing errors and potential filing delays.

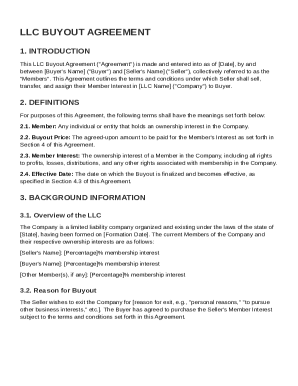

Who needs to complete Form N-103?

To understand who needs to complete Form N-103, it is essential to identify eligibility criteria. Individuals who earn income from various sources, including wages, investments, or self-employment, may find themselves required to fill out this document. Small business owners who need to report earnings from their businesses also fall within the eligible user group.

Specific scenarios where Form N-103 is applicable include changes in income status, starting a new business, or restructuring an existing company. Moreover, corporations and partnerships with financial adjustments will find this form beneficial in ensuring adherence to tax regulations, thus helping prevent legal complications. By engaging with this form, users ensure their compliance and protection from potential penalties.

Key information required on Form N-103

Filling out Form N-103 requires careful attention to various fields that capture essential information. The personal information section demands details such as your name, address, social security number, and filing status. For businesses, details like the entity’s name, EIN, and business structure must be provided. Accurate personal information is vital to ensure the tax return is accepted without complications.

Additionally, the financial information section requests comprehensive data related to income sources, deductions, and credit claims. Users must substantiate their entries; therefore, preparing documentation such as W-2 forms, 1099s, and invoices is critical. Common mistakes often occur in transcribing numbers and not double-checking figures prior to submission, which can lead to unnecessary delays and complications.

Step-by-step guide to filling out Form N-103

Preparing to complete Form N-103 begins with gathering necessary documents related to your income and expenses. Having your Social Security number, financial records, and any prior tax documents at hand can streamline the process significantly. Users may also find it beneficial to create a pdfFiller account, which provides an efficient solution for filling and editing directly online.

When starting the form, follow the detailed instructions divided into each section. Begin with personal information, ensuring accuracy in every field. Next, accurately input your financial data, double-checking for accuracy. Finally, move on to additional information, which may include any relevant disclosures or notes regarding your submission. Incorporating checks for completeness at every step can enhance the overall effectiveness of your submission.

Editing and customizing Form N-103 using pdfFiller

pdfFiller offers robust editing tools that simplify the process of modifying Form N-103 before you submit it. Users can upload the form effortlessly into the platform where various editing features become available. From adding text boxes to highlighting essential fields, the platform creates an interactive experience that significantly enhances the traditional filling process.

To effectively edit Form N-103, first, upload the completed form to pdfFiller. Utilize the editing tools offered by the platform, such as striking through outdated information and adding comments for clarifications. Once editing is complete, saving the changes and exporting the form in multiple formats is straightforward, allowing flexibility in how you finalize your document.

eSigning your Form N-103

The use of electronic signatures has transformed document signing, enhancing both efficiency and security. For Form N-103, applying an eSignature is a crucial step, ensuring the authenticity of the form. pdfFiller’s platform allows users to seamlessly add their electronic signatures, making this process straightforward and legally accepted.

To eSign your Form N-103 using pdfFiller, navigate to the eSignature tool within the interface. Simply follow the prompts to create your signature or upload an existing one. This tool ensures your signature is applied securely, preserving the integrity of the document. This compliance with electronic signature laws enhances convenience without compromising legal requirements.

Collaborating on Form N-103 with teams

Collaboration is vital in modern document management, particularly for team-based projects. pdfFiller provides functionalities aimed at enhancing teamwork when completing Form N-103. Users can share forms easily, which allows multiple team members to contribute and provide input effortlessly. This feature vastly improves the flow of information, enabling better decision-making and timeliness in submissions.

Through the platform, team members can engage in discussions directly on the document, utilizing comment sections to clarify intentions or raise queries. Common workflows for signature collection and document management can be established, allowing teams to manage their submissions collectively and efficiently. The integration of collaborative tools ensures that users experience a unified approach to completing Form N-103.

Managing your completed Form N-103

After completing and submitting Form N-103, managing your document is essential for future reference and audits. pdfFiller provides an organized structure for storing completed forms securely. Users can retrieve their forms easily, ensuring they remain accessible whenever needed, including for tax audits or personal records.

Understanding data security and privacy is critical when storing forms. pdfFiller uses robust encryption to maintain the confidentiality of your information. This security extends to how forms are stored and accessed, giving users confidence in their document management. Such measures ensure users can manage their forms efficiently while safeguarding their sensitive data.

Troubleshooting common issues

While using Form N-103, users may encounter various challenges that could impede their completion processes. Common issues often involve filling out the form incorrectly or misunderstanding specific sections. To assist users, pdfFiller hosts a comprehensive FAQ section detailing frequent inquiries, which provides clarity for common confusion points.

For users facing more complex issues, additional support can be found through professional advice. Engaging tax professionals or consulting guides specific to your situation can offer personalized solutions to roadblocks. Knowing when to seek assistance ensures correct and efficient form submission, preventing unnecessary delays.

Related forms and templates

In conjunction with Form N-103, users may find other forms useful for their ongoing tax reporting needs. Understanding the differences between these forms can aid in determining which is suitable for specific situations. Forms like the Schedule C for sole proprietorships or the Form 1040 for individual filings might intersect with or complement the use of Form N-103.

Finding these forms on pdfFiller is straightforward, enriched through the search functionality that directs users to similar templates. Understanding when to use each form allows for better financial management, ensuring compliance with regulatory requirements while also maximizing tax deductions where applicable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the form n-103 rev 2025 in Chrome?

How do I fill out form n-103 rev 2025 using my mobile device?

How do I edit form n-103 rev 2025 on an Android device?

What is form n-103 rev 2025?

Who is required to file form n-103 rev 2025?

How to fill out form n-103 rev 2025?

What is the purpose of form n-103 rev 2025?

What information must be reported on form n-103 rev 2025?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.