Get the free 2025 Pennsylvania Income Tax Return (PA-40). Forms/Publications

Get, Create, Make and Sign 2025 pennsylvania income tax

Editing 2025 pennsylvania income tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 pennsylvania income tax

How to fill out 2025 pennsylvania income tax

Who needs 2025 pennsylvania income tax?

Navigating the 2025 Pennsylvania Income Tax Form: A Complete Guide

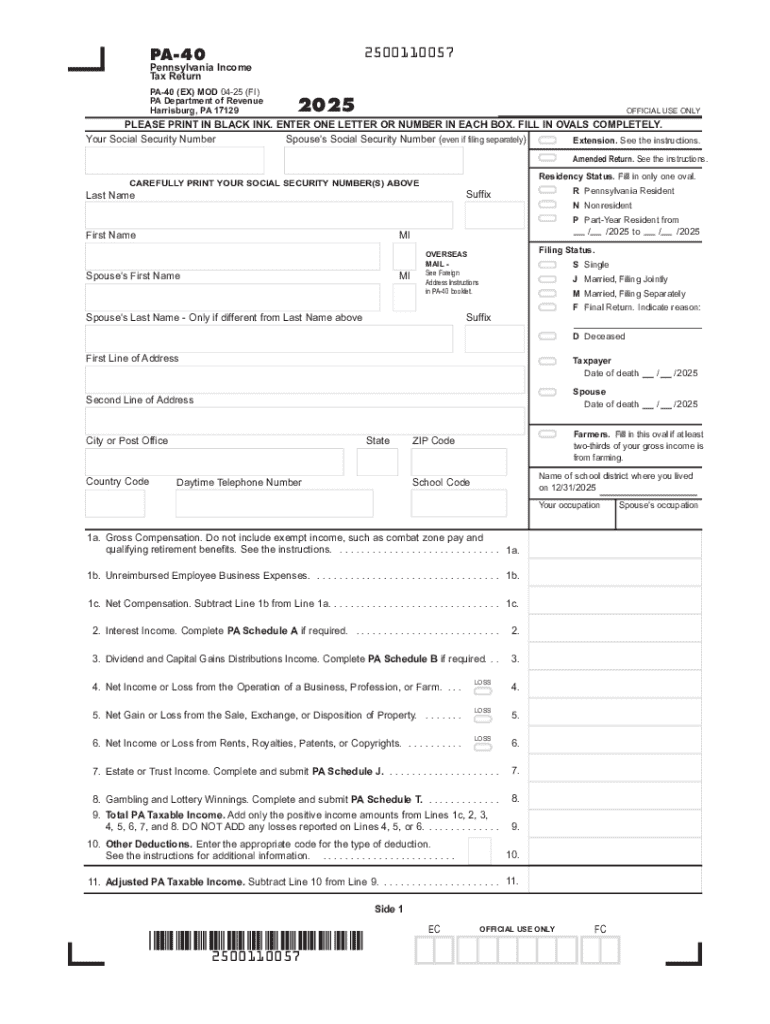

Overview of the 2025 Pennsylvania Income Tax Form

The 2025 Pennsylvania Income Tax Form is essential for individuals and businesses within the state to report their income and calculate the taxes owed. This form serves as a declaration of your earnings and deductions, ensuring compliance with local tax regulations. Filing this form accurately is crucial not only to avoid penalties but also to maximize potential refunds.

Key deadlines play a pivotal role in the filing process. For the tax year 2025, the deadline for submitting your Pennsylvania Income Tax Form typically falls on April 15, 2026. However, if this date falls on a weekend or holiday, it may shift to the next business day. Understanding these deadlines can help in planning your financial year effectively.

Any resident of Pennsylvania, regardless of age, who earns income must file the 2025 Pennsylvania Income Tax Form. This includes wage earners, independent contractors, and those with income from investments or retirement plans. Therefore, it's important for every qualified taxpayer to be aware of their obligations.

Understanding the structure of the 2025 Pennsylvania Income Tax Form

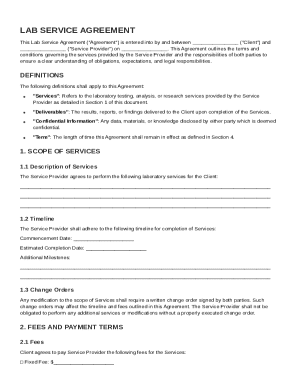

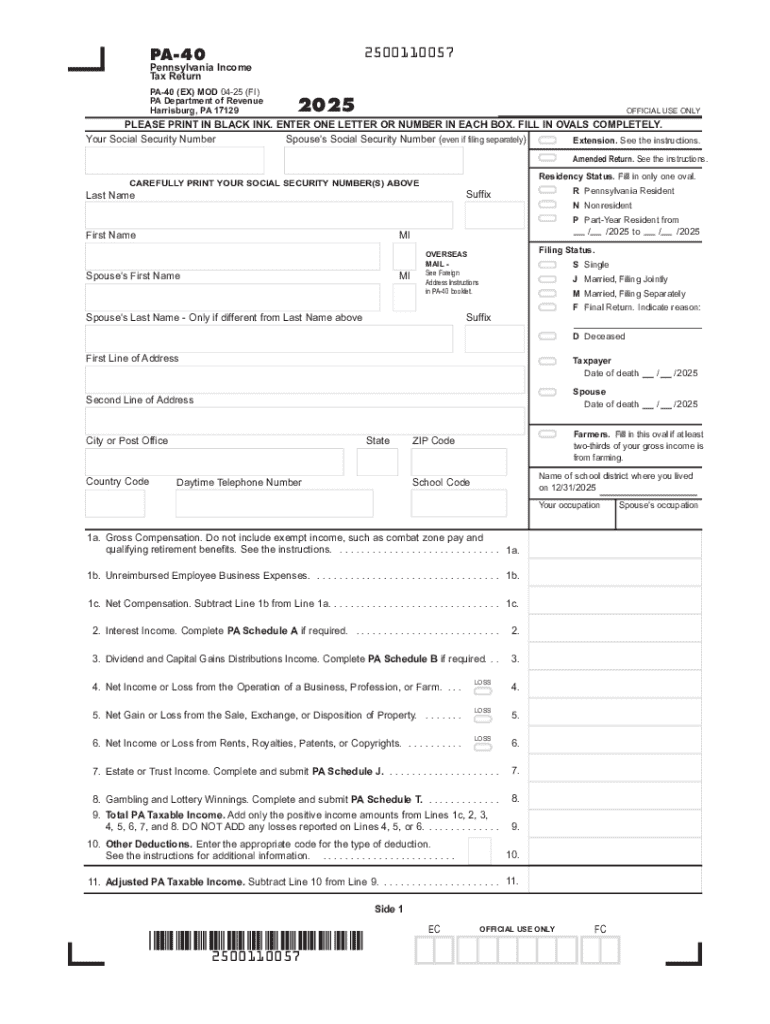

The 2025 Pennsylvania Income Tax Form consists of several key sections that guide you in detailing your financial information. The form typically includes Personal Information at the top, where you will provide details like your name, address, and Social Security number.

Next, the Income Reporting section allows you to declare all income sources to calculate your gross income. Following this is the Deductions and Credits section, which outlines potential reductions in taxable income and applicable credits. Lastly, a Signature Section is included for validating your submission.

Familiarizing yourself with the terminology used in these sections can also ease the filing process and help you better understand your tax obligations.

Preparing to complete your 2025 Pennsylvania Income Tax Form

Preparation is a critical phase in filing your income tax form. Begin by gathering all necessary documentation to ensure that you have the most accurate information available. Common documents include W-2 forms from employers, 1099s for freelance work, and other income statements that reflect earnings.

Additionally, organize receipts and records substantiating deductions, such as medical expenses, property taxes, or charitable contributions. Having these documents at hand will streamline the process and reduce the chances of errors.

Preparing a checklist can greatly enhance your efficiency. Steps might include reviewing your income summary, tallying up deductible expenses, and ensuring all necessary forms and receipts are ready for submission.

Step-by-step guide to filling out the 2025 Pennsylvania Income Tax Form

Section 1: Personal information

Begin by accurately entering your name, current address, and Social Security number in this section. Make sure that your details match those on your official identifications to avoid any discrepancies that may lead to delays or issues.

Section 2: Reporting your income

In this section, list all income sources, including wage earnings, unemployment benefits, and income from rental properties. Ensure both gross and adjusted figures are included, and take special care to calculate totals accurately by cross-checking against the documentation you assembled earlier.

Section 3: Claiming deductions and credits

Claiming eligible deductions can significantly reduce the amount of taxable income. Common deductions may include those for mortgage interest, medical expenses exceeding a set percentage of your income, and contributions to 401(k) plans. Be sure to also explore available tax credits which may further benefit your tax situation.

Section 4: Final review and submission steps

Once you've completed the form, it's imperative to conduct a thorough review for accuracy. Mistakes in figures or personal details can lead to penalties or delays in processing. Look for simple oversights like transposed numbers. After your final check, sign the form electronically using pdfFiller's intuitive eSignature functionality, which complies with state regulations.

Interactive tools for filling and managing your 2025 Pennsylvania Income Tax Form

pdfFiller offers a suite of tools designed for efficient tax form management. Users can utilize editing capabilities that allow for real-time form adjustments directly in PDF format. This feature is beneficial when correcting errors or clarifying information before final submission. Additionally, the platform's eSignature functionalities ensure that your submission is legally binding and secure.

With pdfFiller, you can also collaborate with others, simplifying the review process by allowing trusted individuals to assess and suggest changes if needed. This collaborative aspect can be invaluable, especially if tax situations become complex.

Navigating potential errors and common challenges

While filling out the 2025 Pennsylvania Income Tax Form, be prepared for common pitfalls like miscalculating totals or failing to report all income sources. These mistakes can lead to complications down the road, including penalties from the state Department of Revenue.

If you realize that you've made an error after submission, it’s crucial to act quickly to amend your return. You can file an amended form—which is a separate procedure—to rectify any inaccuracies. The Pennsylvania Department of Revenue provides detailed instructions on how to proceed in such cases.

Post-filing procedures

After submitting your 2025 Pennsylvania Income Tax Form, you can track the status of your refund through the Pennsylvania Department of Revenue's online portal. Having your tax identification number handy will streamline this process.

It's equally important to establish a robust record-keeping system for all related documents. Utilizing cloud services like pdfFiller ensures that all the tax files, documents, and receipts are stored securely and can be accessed anytime, offering peace of mind.

Frequently asked questions (FAQs)

Many taxpayers often have queries regarding their Pennsylvania income tax responsibilities. For instance, if you do not receive your W-2 form on time, you should reach out to your employer, as you still need this documentation to file accurately. Failure to do so may lead to extended deadlines for submission.

Amending your return is permissible; however, it involves submitting another form specifically for this situation. It's crucial to do this promptly to minimize potential penalties. Speaking of penalties, timely filing and payment are essential to evade additional charges—which can add up quickly.

Conclusion

Navigating the 2025 Pennsylvania Income Tax Form need not be a daunting task. With the right guidance and the intuitive tools provided by pdfFiller, taxpayers can feel confident in managing their documents effectively. Utilizing pdfFiller not only enhances the filing experience but also ensures that all aspects of tax management—from editing to eSigning—are accessible and straightforward.

Equipped with this guide, you'll have the insights needed to complete your Pennsylvania tax obligations with ease and precision. The resources available through pdfFiller help ensure a seamless and efficient filing process that caters to your document management needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the 2025 pennsylvania income tax in Chrome?

How do I edit 2025 pennsylvania income tax on an iOS device?

How do I edit 2025 pennsylvania income tax on an Android device?

What is 2025 Pennsylvania income tax?

Who is required to file 2025 Pennsylvania income tax?

How to fill out 2025 Pennsylvania income tax?

What is the purpose of 2025 Pennsylvania income tax?

What information must be reported on 2025 Pennsylvania income tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.