LLP Partnership Agreement Template free printable template

Show details

This document serves as an agreement to establish and govern a Limited Liability Partnership (LLP), outlining the rights and responsibilities of partners, procedures for operation, and definitions

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is LLP Partnership Agreement Template

An LLP Partnership Agreement Template is a legal document that outlines the terms and conditions of a limited liability partnership.

pdfFiller scores top ratings on review platforms

it has been a good experience so far.

New to this style of pdffiller but like it so far.

fast and easy

not surevthisbiscorrect form also had problem withn using dates

This is the best and user-friendly to complete forms.

My experience is very good. keep up the good work.

Who needs LLP Partnership Agreement Template?

Explore how professionals across industries use pdfFiller.

LLP Partnership Agreement Template Guide on pdfFiller

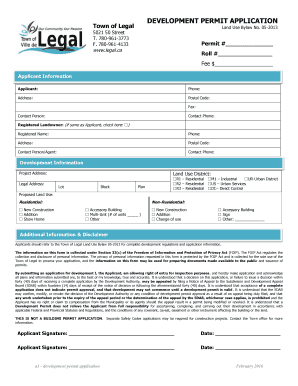

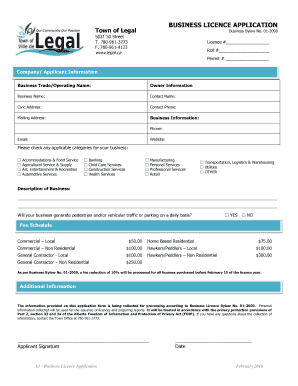

If you're looking to create an LLP Partnership Agreement Template form, understanding the structure and requirements is crucial. This guide will provide detailed insights into drafting your agreement using pdfFiller's user-friendly platform.

What is a Limited Liability Partnership Agreement?

A Limited Liability Partnership (LLP) Agreement is a legal document that outlines the terms of a partnership among its members. It is structured to protect each partner’s individual assets from the liabilities incurred by the business. This means that in the event of legal action or debt, only the assets of the LLP are at risk.

-

An LLP combines the flexibility of a partnership with the limited liability of a corporation.

-

An LLP provides partners with protection against personal liability while allowing for collaboration in management.

-

Choosing an LLP structure offers tax benefits and protects personal assets, making it an attractive option for many businesses.

What are the key components of an LLP Partnership Agreement?

An effective LLP Partnership Agreement consists of several essential clauses that govern the actions and responsibilities of each partner. These clauses ensure clarity and legal protection for everyone involved.

-

Include sections on profit sharing, responsibilities, and a procedure for resolving disputes.

-

Make sure to complete fields like the partners' names, the principal office address, and the partnership duration.

-

Clarify the roles of each partner, their capital contributions, and how profits and losses will be shared.

How to draft your LLP Agreement using pdfFiller?

pdfFiller offers an efficient way to fill out your LLP Partnership Agreement Template. By using its interactive tools, you can easily create, edit, and manage your document all in one place.

-

Visit pdfFiller's site and search for the LLP Partnership Agreement template to get started.

-

Follow the prompts to fill out the agreement, ensuring you include all necessary information.

-

Take advantage of features like eSigning and document sharing to streamline the agreement process.

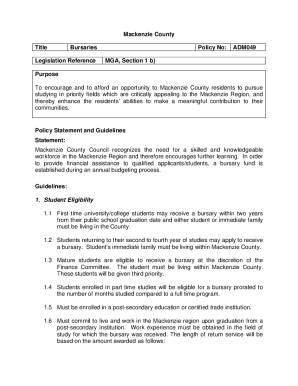

What are the legal requirements for LLPs?

Establishing an LLP requires adherence to certain legal regulations. Understanding these requirements can help ensure your partnership is formed correctly and remains compliant.

-

File your partnership agreement and other required documents with the appropriate state agency.

-

Ensure your LLP adheres to specific local and state laws, as these can vary significantly.

-

Be aware of important filing deadlines to avoid penalties and ensure your LLP is officially recognized.

How do LLPs compare to other business structures?

When considering business structures, it's vital to understand the differences between LLPs and other options like Limited Partnerships or Corporations.

-

LLPs offer personal liability protection to all partners, while Limited Partnerships have at least one general partner who is personally liable.

-

While LLPs offer flexibility and tax benefits, they may also come with higher compliance costs.

-

Criteria for deciding between an LLP and other business types include the number of partners, investment needs, and desired liability protection.

What additional considerations should partners in an LLP keep in mind?

Partners in an LLP should understand specific terms and procedures outlined in the agreement to avoid potential disputes.

-

Terms concerning how partners are admitted and their capital contributions should be clearly defined.

-

Detail each partner's responsibilities, rights, and the decision-making process.

-

Establish clear procedures for how partners can be added or removed from the LLP to prevent conflicts.

How can you utilize pdfFiller for managing your LLP agreement?

pdfFiller’s platform is designed for easy document management, allowing you to not only create but also efficiently manage your LLP agreement.

-

Easily edit your LLP agreement as needed and securely sign it online.

-

Use pdfFiller's collaboration features to work with partners in real-time on document revisions.

-

With cloud-based solutions, you can access your LLP agreement from any device, ensuring you’re always prepared.

Conclusion

In summary, utilizing the LLP Partnership Agreement Template on pdfFiller not only streamlines the drafting process but also ensures compliance with legal requirements. The versatile editing and collaborative features empower users to create customized agreements while maintaining the integrity and security of their documents.

How to fill out the LLP Partnership Agreement Template

-

1.Access the pdfFiller platform and locate the LLP Partnership Agreement Template.

-

2.Download or open the template within the pdfFiller editor.

-

3.Begin by filling in the names and addresses of all partners in the designated fields.

-

4.Specify the nature of the business and its principal activities in the relevant section.

-

5.Outline the capital contributions of each partner, ensuring clarity on cash, property, or services contributed.

-

6.Define the profit and loss sharing arrangement, indicating percentages or specific amounts for each partner.

-

7.Include terms regarding the management of the partnership and decision-making processes.

-

8.Establish guidelines for adding new partners or handling partner withdrawals.

-

9.Review the sections on dispute resolution and termination of the partnership for completion.

-

10.Once all information is filled out accurately, save the document and either print it for signatures or send it electronically for signatures via pdfFiller.

Do LLPs have a partnership agreement?

When setting up a limited liability partnership, it's common to put in place a limited liability partnership agreement. You might also see this document referred to as a members' agreement, LLP agreement, partnership agreement or deed of partnership. Most limited liability partnerships set up an LLP agreement.

How to draft an LLP agreement?

Format of a LLP Agreement Name and Address of the LLP: Name and Address of Partners: Capital Contribution: Profit and Loss Sharing: Management of Partners: Rights and Duties of Partners: Extent of Liability of the LLP: Dispute Resolution:

What is the difference between LLP and partnership?

Both LLPs and partnership firms have their own advantages and limitations. While an LLP offers the benefit of limited liability and a flexible management structure, a partnership firm provides simplicity in decision-making. Choosing the right structure depends on the specific needs and goals of the business.

What is an example of an LLP partnership?

What Is an Example of an LLP? LLPs are often formed by professional offices, such as doctors, accountants, or law offices. Some states limit LLPs so that they can only be set up for specific professions, such as lawyers and physicians.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.