Get the free P11D formTolley Tax Glossary

Get, Create, Make and Sign p11d formtolley tax glossary

How to edit p11d formtolley tax glossary online

Uncompromising security for your PDF editing and eSignature needs

How to fill out p11d formtolley tax glossary

How to fill out form p11d for form

Who needs form p11d for form?

Form P11D: A Comprehensive Guide for Employers

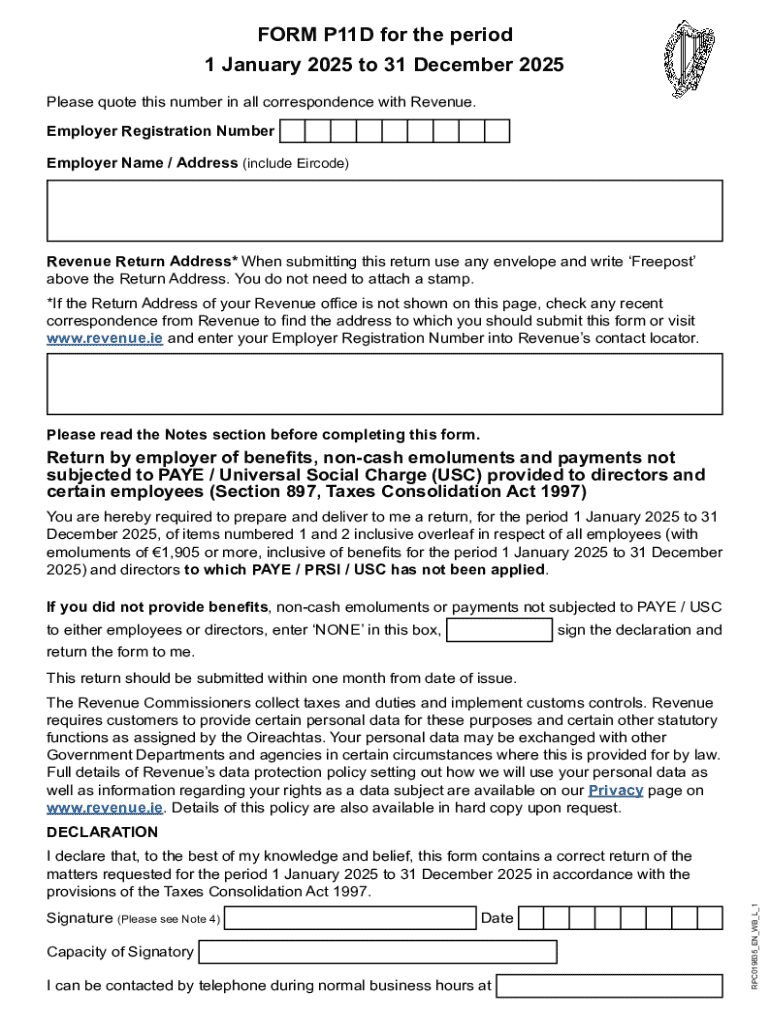

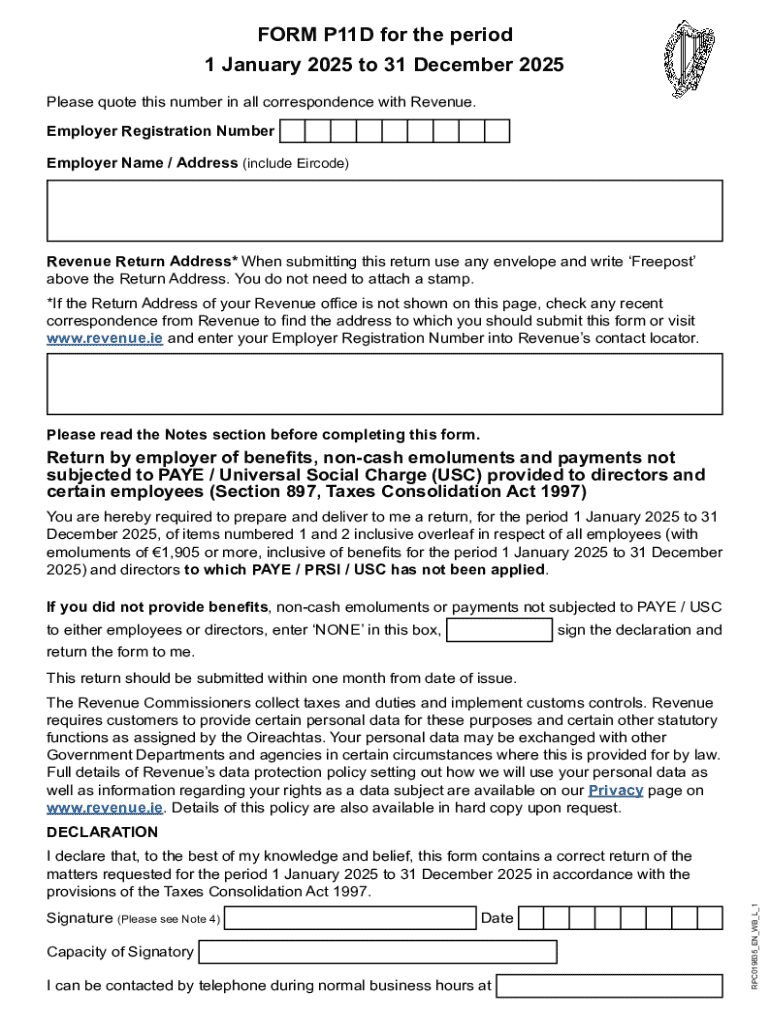

Understanding Form P11D

Form P11D is an essential document for employers in the UK, detailing the benefits and expenses provided to employees. This form is crucial for tax reporting purposes, allowing the HMRC to assess how these benefits impact both employee and employer tax liabilities. By accurately completing Form P11D, employers ensure compliance with tax laws while providing transparency regarding employee remuneration.

Key components of Form P11D include a detailed account of employee benefits, such as company cars, health insurance, or salary sacrifice schemes. Additionally, expenses and reimbursements, like travel costs or professional dues, are itemized to give a comprehensive view of what employees receive beyond their salaries. Understanding each component is vital for employers to navigate the complexities of tax obligations.

The purpose and functionality of Form P11D

Employers are required to file Form P11D annually to report taxable benefits and expenses provided to employees. This filing ensures that the correct tax calculations are made for both employers and employees, reflecting the true value of benefits received. Accurate submission can prevent potential penalties and ensure that employees are aware of their tax liabilities stemming from these benefits.

The timing for submitting Form P11D is essential; forms must be completed and submitted to HMRC by July 6th following the end of the tax year on April 5th. Employers typically encounter scenarios requiring the P11D when they offer employees non-cash benefits, engage in expenses reimbursement, or provide additional perks. Meeting deadlines is critical to maintaining compliance and avoiding unnecessary fines.

Preparing to complete Form P11D

Before filling out Form P11D, employers must gather essential information. This includes details about employees, such as their names, National Insurance numbers, and specific benefits or reimbursements provided throughout the tax year. Accurate records must be maintained to ensure that the data reported reflects the benefits offered.

Employers can organize the necessary data effectively using spreadsheets or specialized payroll software. This helps streamline the collection process and ensures that all benefit categories are accounted for. Furthermore, being familiar with the different calculation methods for valuing employee benefits is crucial, as inaccuracies can lead to incorrect tax reporting.

Step-by-step guide to filling out Form P11D

Completing Form P11D involves a section-by-section breakdown. Employers begin with the employee information section, providing personal details, and then move to the benefits and expenses section. Each benefit and expense must be listed clearly, with accurate values reflecting their monetary worth. Careful attention to detail in each area will prevent errors.

Common pitfalls include misreporting benefit values or failing to include all applicable expenses. To ensure accuracy, it is advisable to cross-check entries with payroll records and existing benefit policies. Additionally, employers should consult HMRC guidelines for current valuation methods and exemptions to avoid misreporting.

Interactive tools for completing Form P11D

Leveraging online tools can simplify the Form P11D completion process significantly. pdfFiller offers a comprehensive platform that allows for effortless editing of PDF forms and secure electronic signatures. This functionality speeds up the process, making it convenient for employers to manage and submit their forms efficiently.

The collaboration features within pdfFiller also promote teamwork for team-based submissions. Multiple team members can work on the same document simultaneously, ensuring that different perspectives and checks contribute to the accuracy of the filed information. This modern approach mitigates the risk of errors and enhances overall filing efficiency.

Checking your values: ensuring accuracy

As the deadline for Form P11D approaches, verifying all entries becomes crucial to ensure accuracy. Employers should take the time to confirm that the employee benefits listed match the values reported in payroll records. Any discrepancies should be addressed promptly, as inconsistencies can result in audits or fines from HMRC.

Cross-referencing entries with the original benefits agreements and receipts can identify potential errors. Should discrepancies arise, employers should investigate the source—be it clerical mistakes or unreported changes in employment benefits—and correct them before final submission. Such diligence pays off by protecting the company from later scrutiny.

Recalculating values for Form P11D

Recalculating values may be necessary in various scenarios, such as upon the discovery of errors or changes in employee benefits mid-year. For example, if an employee switches from a standard car benefit to an electric vehicle during the year, a recalculation of the benefit value is required. This ensures that the reported values are accurate and reflect the correct taxable income.

Employers can adopt efficient techniques for recalculating benefits, such as utilizing financial software that allows for dynamic calculations based on updated input. pdfFiller supports this process by integrating formulas that adjust figures automatically, making it easier to maintain accuracy throughout the filing process.

Producing and submitting Form P11D

Finalizing Form P11D entails a thorough review of all entries, ensuring that each section is complete and accurate before submission. Once finalized, employers have the option to print the form for physical submission or take advantage of electronic submission processes through pdfFiller. Electronic methods streamline the process significantly, providing assurances against lost paperwork.

Employers must remain informed about their submission protocols, as HMRC provides guidelines for electronic submissions that employers must follow. This can include specific formatting or file type requirements to avoid processing delays. By adhering to the outlined processes, companies ensure their filings are received timely and processed correctly.

Where the benefits appear: understanding tax implications

Form P11D not only serves as a reporting tool but also has significant tax implications for both employees and employers. Understanding the tax relief associated with P11D filings is critical for effective financial planning. For instance, certain employee benefits may qualify for exemptions that reduce overall tax burdens for both parties.

Moreover, adjusting their record-keeping practices allows employers to ensure compliance over the long term. Proper documentation of all benefits and expenses helps safeguard against potential audits and maintains a clear financial picture for future tax years. Employers must be proactive in educating themselves about these implications to leverage tax efficiencies.

Frequently asked questions about Form P11D

Errors on Form P11D can occur, and employers should promptly address any inaccuracies by submitting a correction. If an error is identified post-submission, it's essential to notify HMRC for guidance on the correction process, ensuring that the employee's tax position is amended accordingly.

Responsibility for filing lies primarily with the employer who must ensure that all full-time employees are accounted for in the P11D submissions. Changes in employee benefits should also be incorporated in the filing process, reflecting any adjustments made during the tax year. Staying aware of these responsibilities can prevent unnecessary complications.

Key takeaways and best practices

Completing Form P11D is an important aspect of employer responsibilities within the UK tax system. Ensuring accurate and timely submissions requires an organized approach, with thorough documentation and careful attention to detail. Employers should adopt best practices, such as leveraging tools like pdfFiller for efficient document management.

The key to a successful filing process lies in preparation, tracking changes, and staying informed about tax regulations. By prioritizing these best practices, employers can not only comply with legal obligations but also reduce their overall tax liabilities effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my p11d formtolley tax glossary in Gmail?

How can I edit p11d formtolley tax glossary from Google Drive?

How do I complete p11d formtolley tax glossary online?

What is form P11D for?

Who is required to file form P11D?

How to fill out form P11D?

What is the purpose of form P11D?

What information must be reported on form P11D?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.