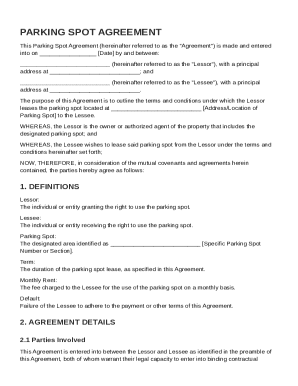

Get the free Income Tax Topics: State Income Tax Addback - Colorado tax

Get, Create, Make and Sign income tax topics state

How to edit income tax topics state online

Uncompromising security for your PDF editing and eSignature needs

How to fill out income tax topics state

How to fill out income tax topics state

Who needs income tax topics state?

A comprehensive guide to income tax topics state form

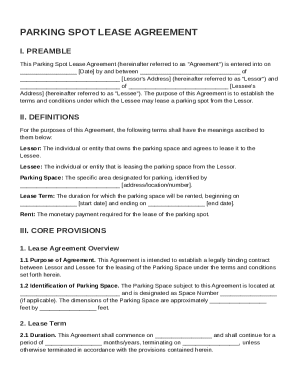

Overview of state income tax forms

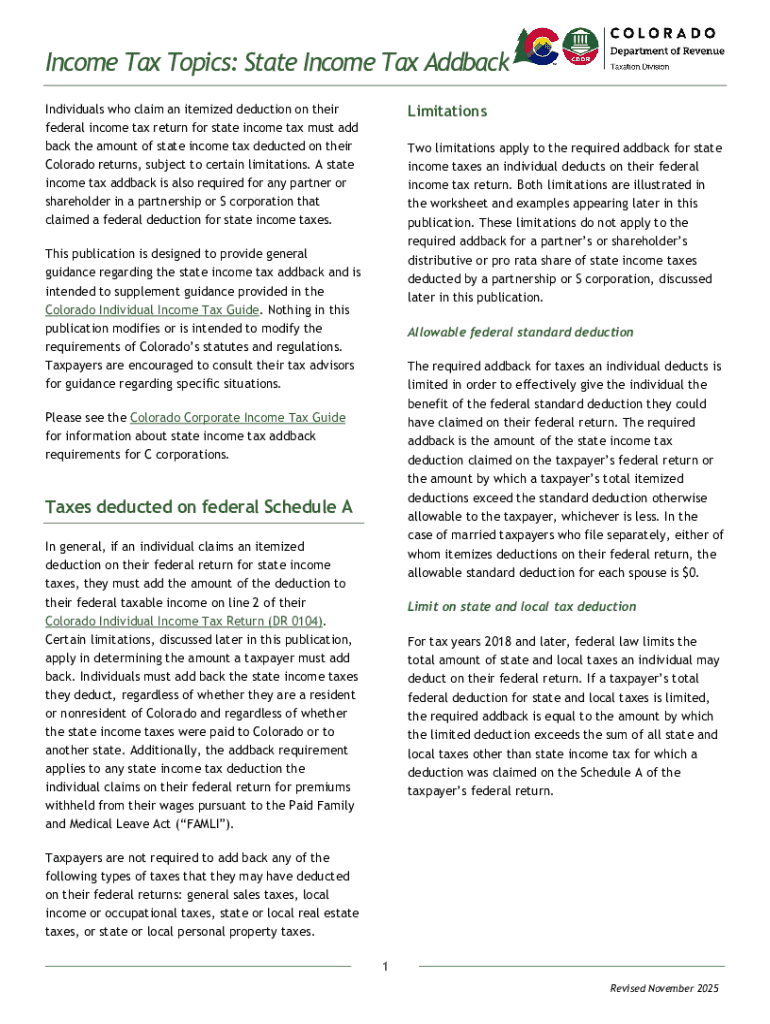

State income tax forms are crucial for complying with individual state regulations, which can vary significantly. Unlike federal income tax regulations, states may impose different tax rates, deductions, and credits, making it essential for taxpayers to understand their specific state requirements. Filing a state tax form correctly is not just about fulfilling a legal obligation but ensuring accurate financial reporting that aligns with state guidelines.

When preparing income tax topics state forms, it's vital to recognize the differences between federal and state tax regulations. For example, certain deductions available federally may not apply at the state level. This dual-system complexity often confuses taxpayers, underlining the necessity of being aware of local tax laws and leveraging resources like pdfFiller for managing your state-specific forms.

Types of state income tax forms

Different states offer a variety of income tax forms tailored to specific filing situations. Common filings include Single Filing Forms for individual taxpayers, Joint Filing Forms for couples, and Non-Resident Forms for those earning income in states where they are not residents. Each state’s Department of Revenue or similar agency typically provides detailed descriptions of each form.

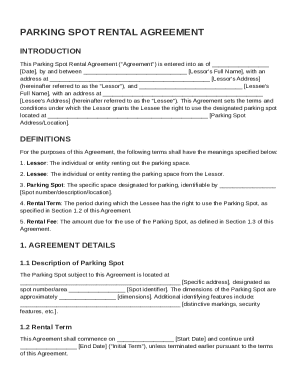

Special situations also necessitate specific forms. Freelancers and self-employed individuals often require additional documentation, like Schedule C, to report their business earnings and claim their expenses. Students may qualify for unique tax benefits related to educational expenses, which means they need state forms that account for these deductions. Understanding these nuances is essential for effective tax management.

Detailed guide to filing state income tax forms

Filing state income tax forms can seem daunting, but following a methodical approach can simplify the process. Start by gathering necessary documentation such as W-2 forms from employers and 1099 forms for any freelance work. Next, ensure you choose the correct form based on your state’s guidelines. Each state provides its specific guidelines ranging from different tax rates to qualifying deductions and credits.

When filling out the form, pay attention to common sections such as personal information, income reporting, and deductions. If you encounter confusing areas, consult state-specific FAQs for clarification. After completing the form, it's critical to review all entered data to avoid common mistakes such as misreporting income or overlooking deductible expenses.

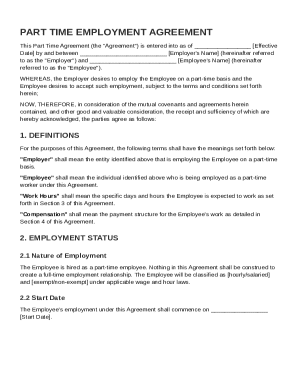

Interactive tools for document management

Utilizing tools like pdfFiller significantly enhances the ability to manage state income tax forms. With features that allow for interactive filling and editing, users can easily complete and submit their documents. The platform supports eSignature capabilities, making it easier to submit forms electronically, especially as deadlines approach.

Collaboration is also streamlined with pdfFiller. Users can share documents with their teams, facilitating comments and ensuring everyone involved is on the same page. Moreover, role-based access means that sensitive financial information can be securely shared without compromising personal data.

Managing tax documentation

Properly managing your tax documentation can save time and reduce stress during tax season. Best practices include organizing both digital and physical documents. Digital storage solutions enhance accessibility, allowing users to retrieve documents from anywhere, which is especially advantageous as many taxpayers now embrace remote work.

Preparation for future tax seasons starts with maintaining accurate records year-round. Track deductible expenses, such as those related to child care contributions or educational expenses, to make filing easier. Additionally, retaining records for a longer duration can prove beneficial if you need to provide documentation during a state tax audit.

Common challenges and solutions

Navigating the complexities of state-specific tax laws can be a challenge. Local deductions and credits vary by state, making it imperative to research what is available in your region. Changes in regulations can also affect filing requirements, so it is important to keep abreast of new updates, potentially via email alerts or the newsletters from your state’s Department of Revenue.

If your submission is rejected, don’t panic. Each state typically provides guidelines on how to rectify mistakes. Being proactive in understanding your state's taxpayer services and help sections can streamline this process. If you face a state tax audit or inquiry, ensure you have all documentation at hand and consider consulting a tax professional for assistance.

Frequently asked questions (FAQs)

State income tax forms often bring up common misunderstandings. A frequent issue is regarding which deductions are permissible. Certain expenses, such as contributions to conservation easements or home office deductions, might vary by state, leading to confusion for taxpayers. Clarifying these points through state-specific resources or platforms like pdfFiller can help demystify the process.

Moreover, individuals with unique financial situations, such as freelancers, students, or retirees, have specific queries regarding tax liability and available credits. Resources provided by state departments, alongside user-friendly and accessible platforms, offer significant guidance on navigating these intricate topics.

Final tips for successful tax filing

Before pressing the submit button on your state income tax form, double-check all entered information and ensure accuracy. Essential reminders include being aware of filing deadlines, as many states adhere to similar due date guides. Leveraging tools like pdfFiller can significantly streamline your filing process, offering features for digital signing and easy document management.

Continuously learning and staying updated on changes in tax laws is critical not only for compliance but also for optimizing your returns. Engaging with educational resources, tax-focused webinars, and state-provided materials enhances your knowledge, making the process more manageable and less stressful.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete income tax topics state online?

How do I edit income tax topics state online?

How do I complete income tax topics state on an iOS device?

What is income tax topics state?

Who is required to file income tax topics state?

How to fill out income tax topics state?

What is the purpose of income tax topics state?

What information must be reported on income tax topics state?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.