Get the free Form 9 0-EZ-'

Get, Create, Make and Sign form 9 0-ez-039

Editing form 9 0-ez-039 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 9 0-ez-039

How to fill out form 9 0-ez-039

Who needs form 9 0-ez-039?

Form 9 0-ez-039 form: A Complete How-to Guide

Understanding the Form 9 0-ez-039: An overview

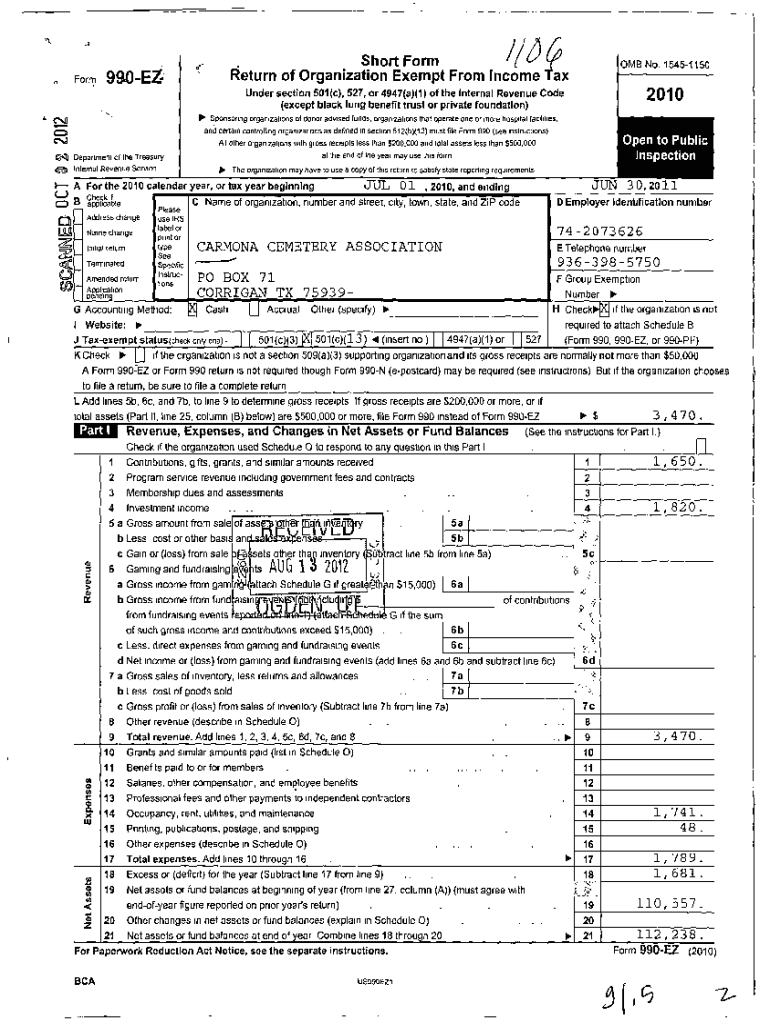

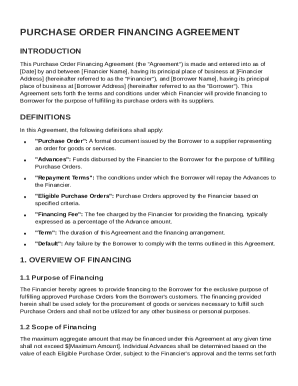

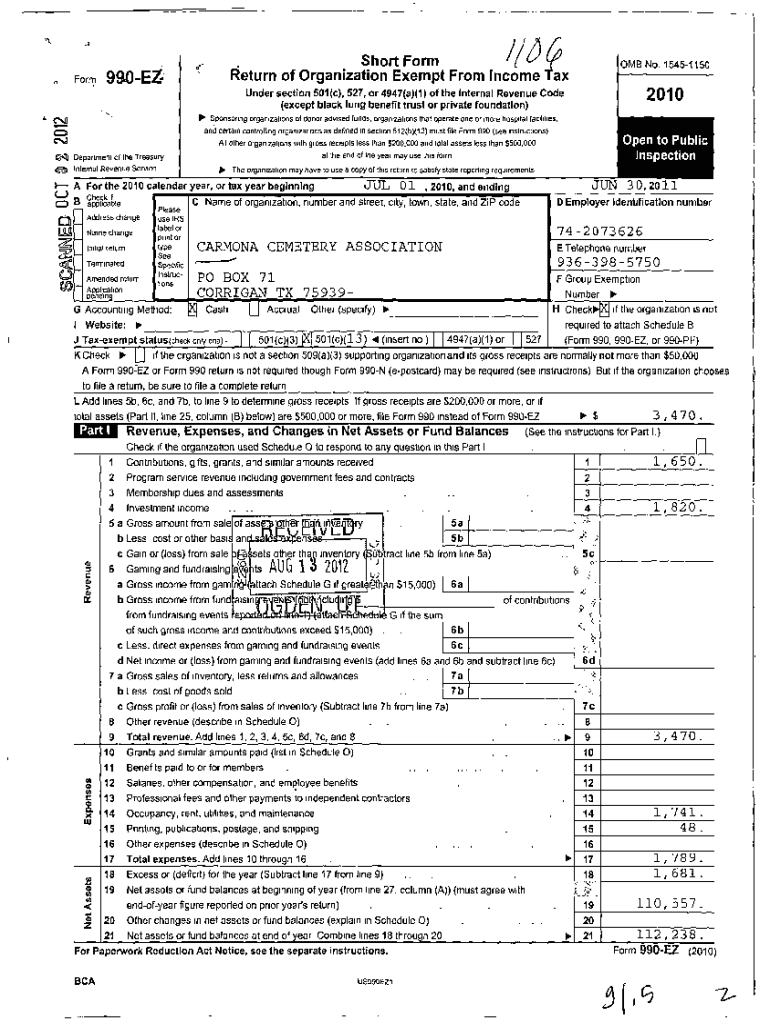

The Form 9 0-ez-039 is an essential document designed to streamline the reporting process for specific financial information, often aligned with income tax returns. This form primarily serves as a simplified way for organizations to report gross receipts, income, and relevant expenditures to tax authorities. Understanding its purpose is crucial for compliance and accuracy in financial reporting.

Organizations, including nonprofits and small businesses, are typically required to use Form 9 0-ez-039 depending on their size and revenue thresholds. Therefore, it is imperative to assess if your organization fits within the criteria outlined by tax regulators. Additionally, specific deadlines dictate when the form must be filed, which usually coincide with the fiscal year-end or the annual income tax return due dates ensuring timely compliance.

Step-by-step instructions for completing Form 9 0-ez-039

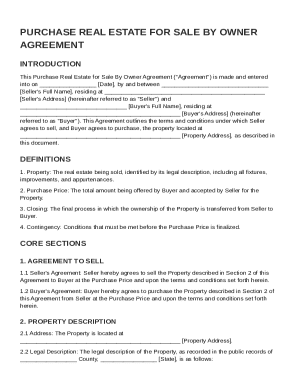

Section 1: Basic information

When completing Section 1 of Form 9 0-ez-039, it is important to provide accurate personal and organizational details. This includes confirming the organization’s name, address, and tax identification number (TIN). These details act as the foundation for all subsequent information, thereby any discrepancies can delay processing or lead to miscommunication with tax authorities.

Common pitfalls in this section include incorrect TIN numbers and misspelling the organization’s name, which can lead to significant issues down the line. Always double-check these entries to ensure you have provided correct information.

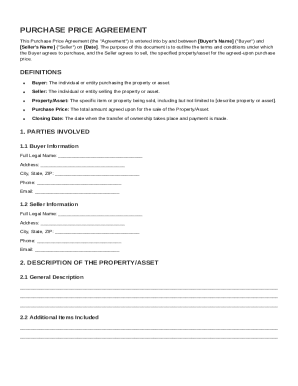

Section 2: Financial details

Financial compliance requires accurate reporting of income and expenditures. In Section 2, you will need to break down various financial line items into categories such as income sources and expense categories. This includes not only the total gross receipts but also detailing specific income streams, like grants received or service revenue.

Expense reporting is equally critical. You will be prompted to enumerate various expenditure types, including operational costs, salaries, and other liabilities. Be diligent about categorization as tax authorities often scrutinize these figures closely to assess compliance.

Section 3: Compliance and documentation

Ensuring compliance with all relevant documentation is vital when submitting Form 9 0-ez-039. Required documents may include financial statements, receipts, and proof of income, which must accompany the form upon its submission. This supporting documentation is crucial as it substantiates the figures reported and ensures your claims can withstand any scrutiny by tax authorities.

The importance of thorough and organized documentation cannot be overstated. Failing to provide proper documentation can result in delays, potential penalties, and unnecessary complications with your organization’s financial standing.

Section 4: Signatures and verification

In the final section of the form, validation of information through signatures is essential. Identification of who needs to sign off can differ based on organizational structure, typically requiring signatures from authorized officers or boards. To ensure that your signature is accepted, it’s advisable to check the signature requirements as outlined in the filing instructions.

Making sure the right individuals sign the document not only fulfills legal requirements but also acts as a safeguard against discrepancies. Ensure that any e-signatures used are in compliance with the legal regulations governing electronic documentation.

Interactive tools for filling out Form 9 0-ez-039

PDF editor features

In today's digital age, utilizing tools like pdfFiller can significantly simplify the process of completing Form 9 0-ez-039. These tools come equipped with PDF editing features that allow users to fill, edit, and sign forms online. One of the major advantages of using such a platform is the ability to make real-time adjustments, ensuring your forms are always up to date with the most current information.

Furthermore, cloud-based editing inherently provides benefits such as increased efficiency in task completion and the ability for multiple team members to collaborate in real-time, allowing for a seamless workflow. This collaborative environment ensures that everyone is on the same page and can contribute efficiently.

Template options

When it comes to efficiency, accessing pre-filled templates for Form 9 0-ez-039 can save time and reduce errors. These templates can be tailored to meet your organization’s unique specifications, facilitating a smoother filling process. Utilizing templates known for their user-friendliness helps ensure consistency across various submissions.

Customization options allow you to adjust templates specifically for your organization's needs, which is especially useful for frequent submissions or when special modifications are necessary. This function enhances efficiency and can simplify the otherwise tedious process.

Common Q&As about Form 9 0-ez-039

Can submit the form electronically?

Many organizations wonder whether electronic submission of Form 9 0-ez-039 is permitted. The answer is typically yes, provided that the submission adheres to stipulated guidelines. Electronic filing is not only permissible but also encouraged for its speed and efficiency. Ensure that the electronic submission portal is secure and legitimate.

When submitting electronically, confirm that your e-signatures are valid. The regulations surrounding e-signatures may vary, so ensuring compliance with local laws is essential to avoid submitting documents that could be contested.

What to do if make a mistake?

Mistakes happen, even in meticulous documentation. If you find an error post-submission, it’s essential to act quickly. Typically, there are procedures in place to amend any incorrect entries or claims on Form 9 0-ez-039. This may involve submitting a corrected form indicating the changes made.

Tools like pdfFiller can facilitate this correction process, allowing you to easily edit your submitted documents, redefine entries, and quickly correct any inaccuracies. Having a record of corrections is equally important to maintain transparency with tax authorities.

Understanding tax implications

Completing Form 9 0-ez-039 accurately is not just a matter of compliance; it can directly influence your organization's financial health. Misreporting can lead to penalties, and tax implications stemming from reported gross receipts and revenues can differ significantly based on accuracy. It's wise to consult with financial advisors who can provide tailored advice specific to your financial structure.

Moreover, taking the time to understand potential tax impacts can assist with strategic planning and budgeting for future fiscal periods. An ounce of prevention is worth a pound of cure, especially when it comes to financial reporting.

Best practices for managing Form 9 0-ez-039

Document management tips

Effective document management techniques are key to ensuring compliance while handling Form 9 0-ez-039. Utilize digital storage solutions to securely store forms and supporting documents, reducing the risks associated with paper-based systems, including loss and damage. Implementing a systematic approach to document organization can streamline access and retrieval when needed.

Employing a checklist for document organization, which may include items like verifying completeness, updating financial records before filing, or backing up submissions, can serve you well in your document management efforts.

Collaboration techniques

Collaboration is paramount in ensuring that Form 9 0-ez-039 is filled out thoroughly and correctly. Teams should implement collaborative platforms that provide commenting and approval features, allowing for seamless communication during the completion process. This fosters collective ownership of the document, increasing the likelihood of accuracy and compliance.

By utilizing tools within pdfFiller for team collaboration, stakeholders can make comments and suggestions directly on the form, which can then be addressed in real-time. This fluid exchange helps eliminate confusion and ensures everyone involved is aligned on the reported data.

Additional considerations for teams and organizations

For teams and organizations, adapting Form 9 0-ez-039 to fit varying organizational structures is crucial for compliance and efficiency. Nonprofits, for instance, may have different reporting requirements compared to for-profit entities, impacting how the form is filled out. Tailored strategies addressing these differences can effectively streamline the filing process.

Regular training and updates for team members about Form 9 0-ez-039 ensure all stakeholders are well-versed in filing requirements, promoting an organizational culture that values compliance and fiscal responsibility. Investing time in educating team members about the form's implications can mitigate errors and enhance overall financial clarity.

Leveraging pdfFiller for ongoing document management

In today’s fast-paced business environment, leveraging pdfFiller for ongoing document management of Form 9 0-ez-039 and other forms provides numerous benefits that extend beyond mere filing. The platform supports enhanced organization of all documents, ensuring files are easily accessible and up to date across various departments.

pdfFiller’s additional features—like comprehensive data storage, advanced editing tools, and integrated workflows—ensure that documentation processes are future-proofed. This makes it easier for organizations to navigate changing compliance regulations and adapt to evolving operational needs, minimizing stress and increasing overall productivity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form 9 0-ez-039 in Gmail?

How do I make changes in form 9 0-ez-039?

Can I create an eSignature for the form 9 0-ez-039 in Gmail?

What is form 9 0-ez-039?

Who is required to file form 9 0-ez-039?

How to fill out form 9 0-ez-039?

What is the purpose of form 9 0-ez-039?

What information must be reported on form 9 0-ez-039?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.