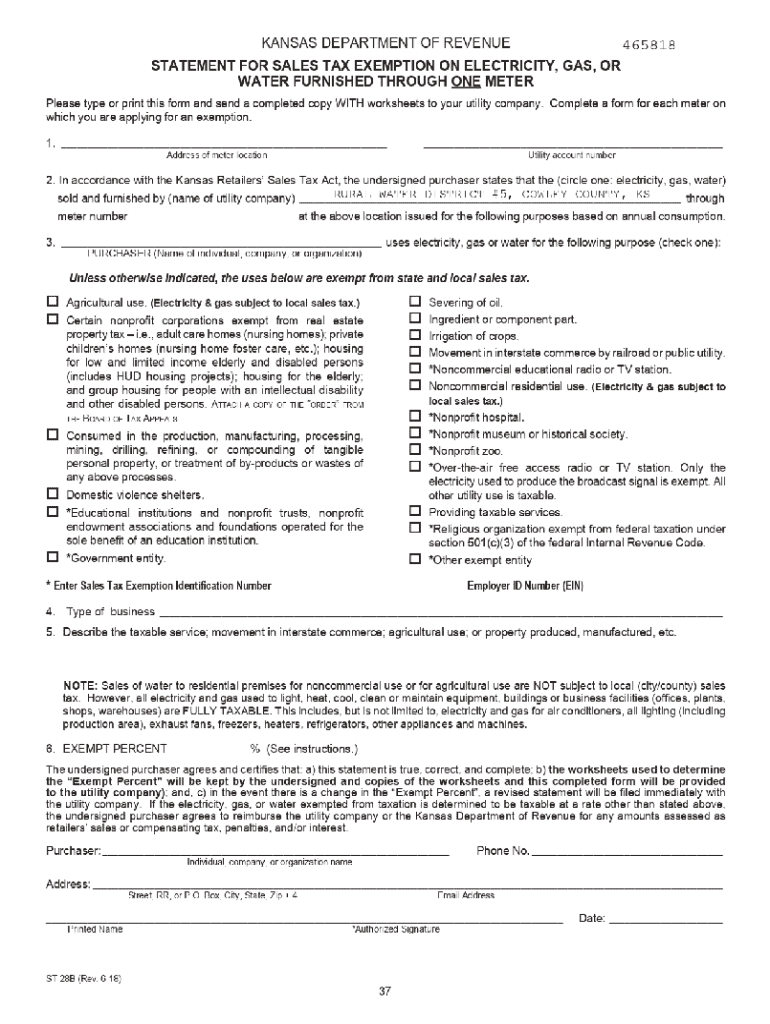

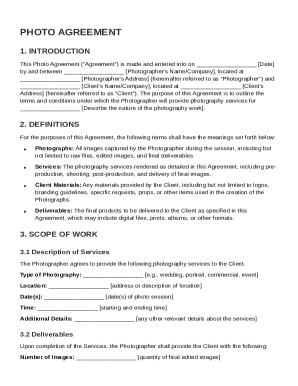

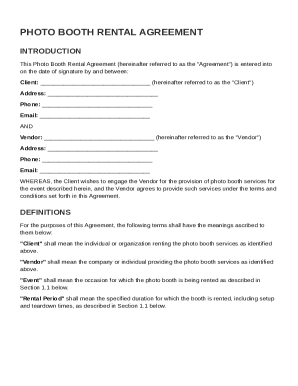

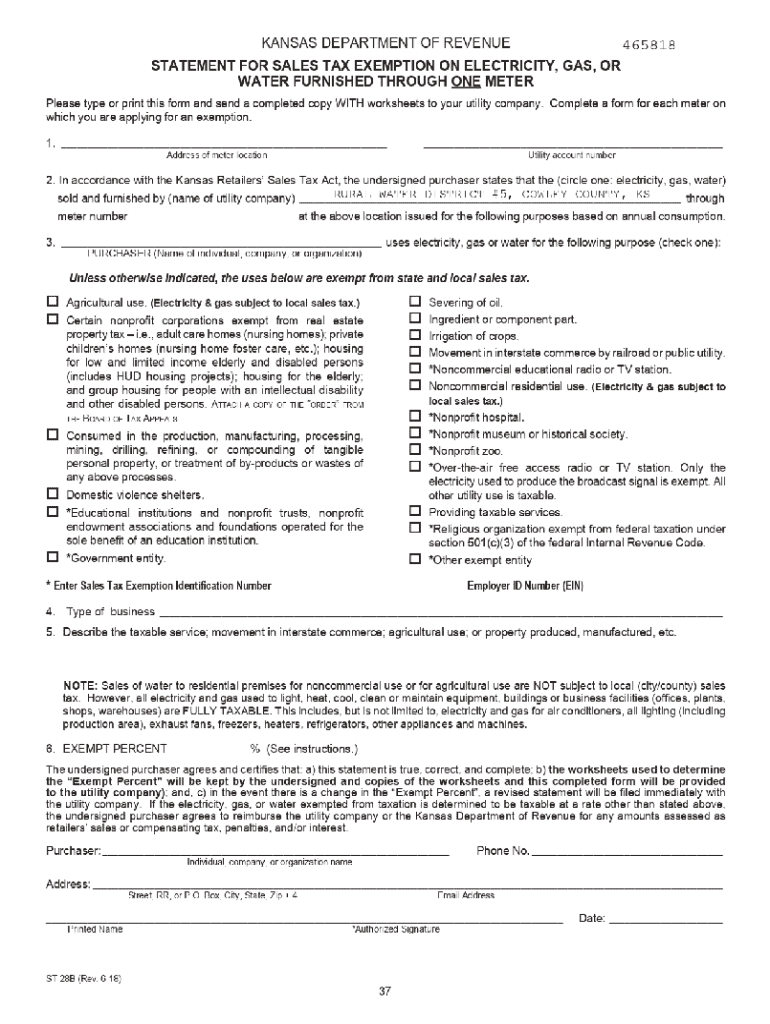

Get the free Kansas Department of revenue 465818 STATEMENT FOR ...

Get, Create, Make and Sign kansas department of revenue

Editing kansas department of revenue online

Uncompromising security for your PDF editing and eSignature needs

How to fill out kansas department of revenue

How to fill out kansas department of revenue

Who needs kansas department of revenue?

Kansas Department of Revenue Form: A Comprehensive How-to Guide

Understanding Kansas Department of Revenue forms

The Kansas Department of Revenue oversees a variety of forms necessary for tax compliance. Each form serves a specific purpose, whether it’s for individual income taxes, business-related tax filings, or specialized income types. Completing these forms accurately is crucial for both compliance with state tax laws and ensuring efficient processing by the Department of Revenue.

Individuals and businesses must navigate several key forms, each designed to capture unique financial information. Incorrect or incomplete forms can lead to delays, audits, or penalties. Therefore, understanding the types of forms available and their respective requirements is crucial for timely and correct submissions.

Key forms related to Kansas revenue

Kansas has established a range of forms that individuals and businesses use to report income and calculate tax owed. Understanding these forms will facilitate smoother interactions with the tax system.

The following key forms are particularly relevant:

Completing these forms correctly is essential to avoid common pitfalls that can include underreporting income or miscalculating deductions.

Navigating Kansas revenue forms online

The Kansas Department of Revenue has a user-friendly website where residents can access all necessary forms. Start navigating by visiting their homepage and locating the 'Forms' section. The forms library is extensive, with resources segmented for individuals, businesses, and other categories, making it easier to locate what you need.

When searching for specific forms, it’s beneficial to utilize the search functionality and to filter by type or category. This not only saves time but ensures you don’t overlook critical documentation.

Step-by-step instructions for completing forms

Preparation is key when filling out tax forms. Before starting, gather all necessary information, including Social Security numbers, income statements, and expenses. Understanding common sections found in forms can significantly ease the process.

Here’s a breakdown of how to fill out common forms:

Utilizing tools like pdfFiller enhances your form management experience, allowing for editing, signing, and collaboration all in one platform.

eSigning and submitting your forms

Most forms require a signature for submission. Utilizing electronic signature options through platforms like pdfFiller can streamline this process. Signature authentication is essential for compliance with Kansas regulations.

Once your forms are completed and signed, you'll be able to submit them directly through the relevant channels specified on the Kansas Department of Revenue website. Ensure that all information is double-checked and secure to avoid any issues.

Common issues and troubleshooting

Namespaces and common technical problems often lead to rejected forms. Frequent reasons include mismatched information, inaccurate calculations, and missing signatures. Address these issues by carefully reviewing every section of the forms before submission.

Should you find yourself facing filing deadline challenges, Kansas may offer extensions under certain circumstances. Being proactive and aware of deadlines can help you maintain compliance and avoid penalties.

Frequently asked questions (FAQs)

Clarifying common doubts around Kansas Department of Revenue forms can help alleviate confusion during tax season. Common inquiries often revolve around the specifics of estimated payments, extensions available, and the process to amend submitted forms.

For detailed concerns, reach out directly to the Kansas Department of Revenue through their official contact points for dedicated support.

Best practices for managing Kansas revenue forms

Managing tax-related documentation is an essential task for financial health. Organizing all tax documents, whether electronically or in physical form, will ease the filing process.

Maintaining digital records through tools like pdfFiller can support ongoing document management and ensure ease of access when information is needed.

Conclusion and final tips

Filing tax forms requires diligence and accuracy. By following the structured steps outlined throughout this guide, you can ensure compliance with Kansas Department of Revenue regulations. Using cloud-based platforms like pdfFiller not only simplifies the form completion process but also keeps your documents secure and manageable.

Finally, staying informed about potential updates to tax forms and regulations is crucial. Engage regularly with the Kansas Department of Revenue to maintain awareness of any changes that could impact your tax filing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit kansas department of revenue online?

Can I sign the kansas department of revenue electronically in Chrome?

Can I edit kansas department of revenue on an Android device?

What is kansas department of revenue?

Who is required to file kansas department of revenue?

How to fill out kansas department of revenue?

What is the purpose of kansas department of revenue?

What information must be reported on kansas department of revenue?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.