Get the free 2026 IRS Form W-4

Get, Create, Make and Sign 2026 irs form w-4

How to edit 2026 irs form w-4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2026 irs form w-4

How to fill out 2026 irs form w-4

Who needs 2026 irs form w-4?

2026 IRS Form W-4: Your Complete Guide

Overview of the 2026 IRS Form W-4

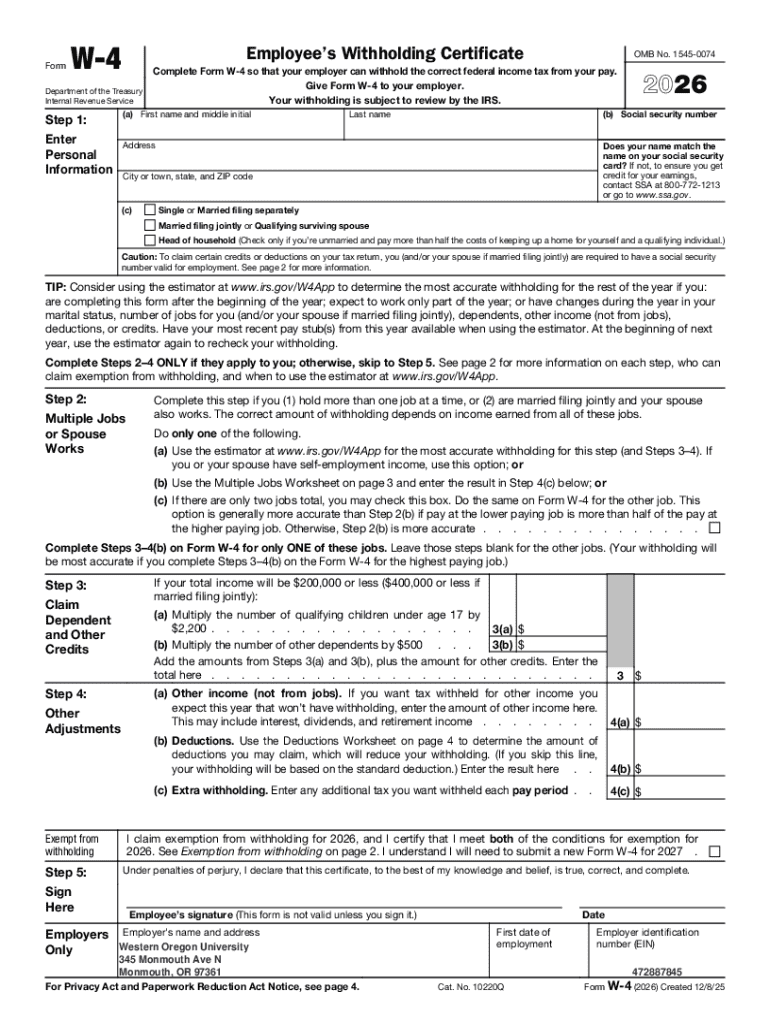

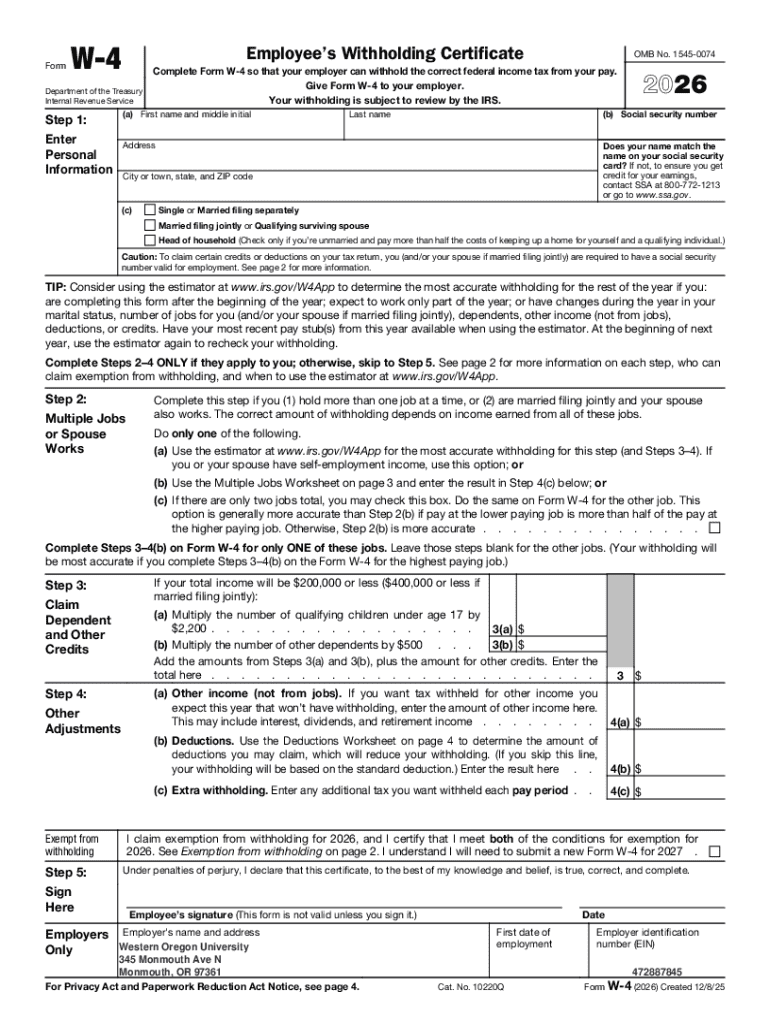

The 2026 IRS Form W-4, also known as the Employee's Withholding Certificate, is an essential document for employees in the United States as it determines how much federal income tax should be withheld from their paychecks. Having an accurate W-4 helps ensure that your withholding aligns with your tax liability, which can prevent surprises during tax season. The form effectively serves as the foundation for your paycheck deductions, making it crucial for your financial planning.

Accurate withholding is vital for employees. If too little tax is withheld, you might face a large tax bill at the end of the year, possibly even penalties. Conversely, if too much tax is withheld, you may be giving the government an interest-free loan, receiving a refund instead of extra cash flow throughout the year. The 2026 version of the W-4 introduces several updates aimed at simplifying the process and improving accuracy.

Key updates for the 2026 W-4

For 2026, the IRS has made significant changes to the W-4 form, reflecting the changes outlined in the One Big Beautiful Bill Act. One of the most notable updates is the revision of the filing status options available, which now provides clearer categories for employees. This shift aims to streamline the form-filling process and maximize withholding accuracy.

Along with updated filing statuses, new calculation methods for withholding have been introduced. These methods are designed to accommodate a broader range of financial situations, offering a more personalized experience. Another key enhancement is the expanded Deductions Worksheet found on page four of the W-4, which assists employees in identifying potential deductions and credits that apply to them. These updates will impact employees by providing better tools for discerning how much they should withhold, thereby alleviating over- or under-withholding issues for employers as well.

Filling out the 2026 W-4: Step-by-step instructions

Filling out the 2026 W-4 is straightforward if you follow this step-by-step guide. The form is divided into distinct sections, allowing you to provide the necessary information with ease.

Common mistakes when completing the W-4

Many employees make mistakes when filing their W-4, which can lead to inconvenient tax situations. One of the most common errors is miscalculating the number of allowances claimed, which can skew your withholding. Failing to update your W-4 after significant life changes—such as marriage, divorce, or the birth of a child—can also lead to incorrect withholding amounts. It is essential to review your W-4 following any major life event.

In addition, employees should not overlook state-specific requirements. While the W-4 is for federal tax purposes, many states have their own equivalent forms with different requirements. Be sure to check your state's rules to ensure compliance and accuracy.

Employer responsibilities and checklist

Employers play a crucial role in processing the W-4s submitted by their employees. First, it's essential to ensure that W-4s are filed correctly and stored securely for compliance purposes. Employers must keep accurate records, as they may be required for audits or if an employee questions their withholding amounts during tax season.

It's also vital to communicate with employees about the W-4 process. Provide clear instructions for filling out the form and remind employees to review their withholding, especially after significant life events.

The implications of incorrect withholding

Incorrect withholding can have serious repercussions for employees. Under-withholding can result in significant tax liabilities, leading to a bill during tax season, while over-withholding returns funds that the employee could have used throughout the year. Both scenarios can impact financial planning and cash flow.

If you discover that your withholding is incorrect, you can amend your W-4 at any time. Simply submit a new W-4 to your employer. This action enables you to correct your withholding and align it more closely with your financial situation.

Tools and resources for managing your W-4

Managing your W-4 can become easier with the right tools and resources. Today, there are several interactive tools available online, including tax withholding calculators that gauge your appropriate withholding allowances based on your financial health.

Additionally, cloud-based solutions can streamline document management, allowing you to save, edit, and share your W-4s conveniently. Consult the IRS's official website and local tax offices when seeking further assistance regarding compliance, exemptions, or specific state guidelines.

Employee perspectives: What to know

As an employee, being proactive about your W-4 is crucial. It is recommended to review your W-4 annually or whenever your financial circumstances change, such as starting or losing a job, getting married, or having a child. Each of these life events can significantly influence your tax situation.

Understanding these implications helps you maintain a healthy financial situation. Moreover, open communication with your HR or payroll department can ensure your withholding aligns with your expectations and needs.

Key takeaways at a glance

Navigating the complexities of the 2026 IRS Form W-4 does not have to be overwhelming. Save yourself from tax season stress by ensuring timely and accurate completion of your W-4. Remember to examine your withholdings regularly and adjust as needed to reflect your current financial situation.

Understanding these components empowers you to make informed decisions, avoiding future tax inconveniences. Remaining aware of changes in tax regulations will further enhance your financial preparedness.

Stay connected with pdfFiller

For those seeking a reliable document management solution, pdfFiller offers comprehensive capabilities to facilitate your W-4 management. By signing up for regular tax updates and newsletters, individuals can easily stay abreast of changes that may influence their obligations.

Engagement with our community through social media platforms will provide ongoing support. Our tools are designed for seamless collaboration and efficient management of documents, helping you focus on what truly matters.

About pdfFiller

At pdfFiller, our mission focuses on simplifying document management for individuals and teams. Our platform empowers users to edit PDFs, eSign, collaborate, and manage documents efficiently, all from a single, cloud-based platform.

Join our community and learn why thousands have chosen pdfFiller as their go-to document management solution. Explore success stories and testimonials that highlight the effectiveness of our tools in streamlining processes for users like you.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 2026 irs form w-4 without leaving Google Drive?

How can I get 2026 irs form w-4?

Can I edit 2026 irs form w-4 on an iOS device?

What is 2026 IRS Form W-4?

Who is required to file 2026 IRS Form W-4?

How to fill out 2026 IRS Form W-4?

What is the purpose of 2026 IRS Form W-4?

What information must be reported on 2026 IRS Form W-4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.