Get the free Tax Client Info Sheet

Get, Create, Make and Sign tax client info sheet

Editing tax client info sheet online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax client info sheet

How to fill out tax client info sheet

Who needs tax client info sheet?

Tax Client Info Sheet Form: A How-to Guide

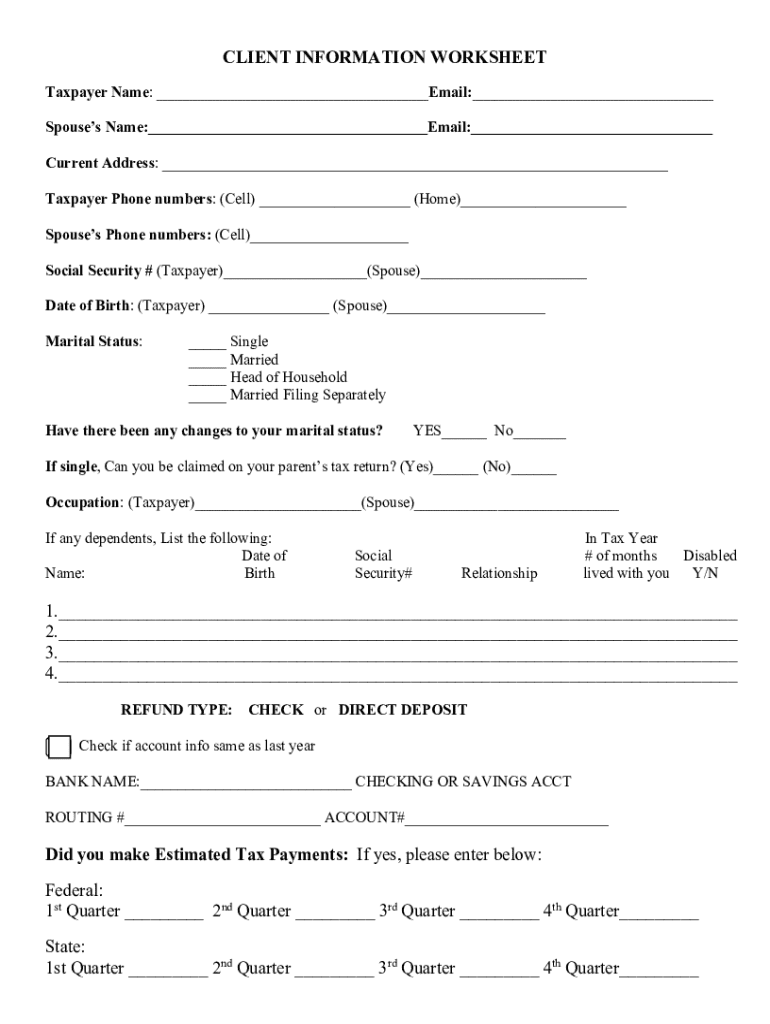

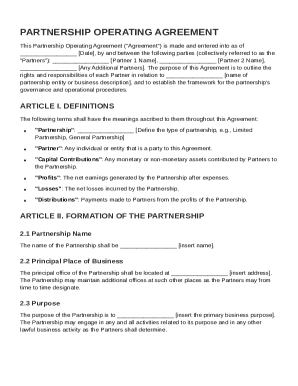

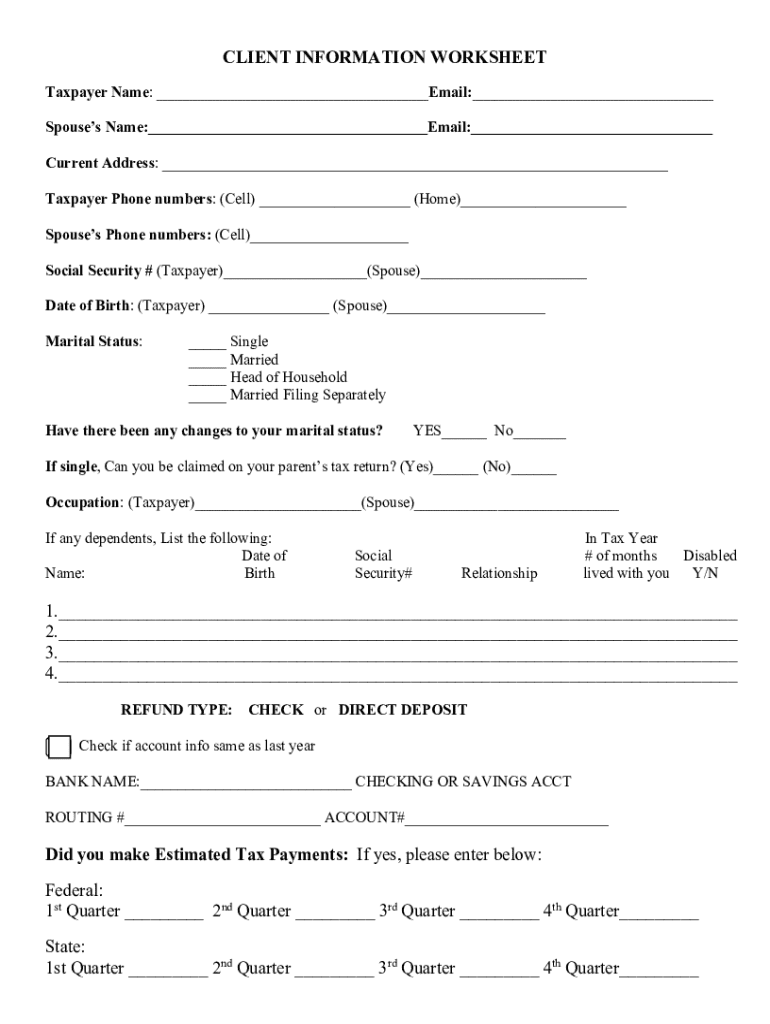

Understanding the tax client info sheet form

A tax client info sheet form is a crucial document utilized by tax preparers to gather essential information from clients. This form acts as a foundational tool that consolidates all relevant details needed to accurately prepare tax returns. By providing clear, structured information, organizers can ensure they capture all necessary data that influences tax calculations, deductions, and credits.

Accurate client information is paramount in the tax preparation process. Misinformation or omissions can lead to filing errors, missed deductions, or even audits. Utilizing a tax client info sheet form significantly reduces the risk of such issues by prompting clients to provide their relevant information systematically.

Every individual or business seeking to file taxes, whether a first-time filer or a seasoned taxpayer, will find this form beneficial. Not only does it streamline the information-gathering stage, but it also helps tax accountants and bookkeepers maintain the integrity of their services.

Components of a tax client info sheet form

A tax client info sheet form generally includes several essential components. These components can be categorized into three main areas, each capturing critical data that tax preparers need to ensure a comprehensive understanding of each client's financial situation.

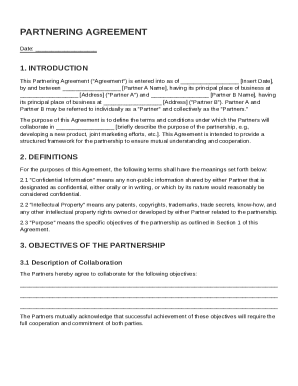

How to fill out the tax client info sheet form

Filling out the tax client info sheet form is straightforward but requires careful attention to detail. Proper preparation involves gathering the necessary documentation that will support the information being provided. This preparation ensures that no relevant detail is overlooked.

Once all supporting documents are in hand, filling out the form involves several steps. Begin by entering personal information, ensuring names and numbers match official documents. Next, disclose all financial information. This includes employment status, income sources, and any deductions or credits the client expects to claim. Listing dependents follows, as with the inclusion of their respective SSNs. Finally, review the form for accuracy before submission, editing any areas that require clarification.

Editing and customizing your tax client info sheet form with pdfFiller

One of the standout features of using pdfFiller is the ability to edit and customize the tax client info sheet form. This flexibility enables tax preparers to tailor the form to suit specific client needs or state requirements, ensuring compliance and enhancing user experience.

Incorporating interactive tools allows for enhanced customization. Utilizing templates within pdfFiller can save time and guarantee that all necessary fields are included. Adding checkboxes and dropdowns simplifies choices for clients, ensuring comprehensive answers which is vital when filing tax returns.

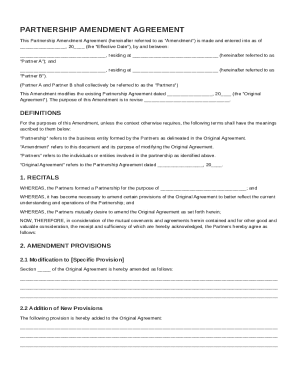

eSigning the tax client info sheet form

eSigning is an essential step in the tax documentation process. It ensures the integrity of the client's data and provides a legally binding signature that confirms the accuracy of the information provided. This step is crucial in maintaining transparency and accountability between the client and the tax preparer.

Secure eSigning not only protects sensitive information but also expedites the overall process, making it convenient for both the client and the preparer.

Managing and storing your tax client info sheet form

After the tax client info sheet form is completed and signed, proper management and storage become important. Effective organization prevents data loss and simplifies future tax preparation activities. A digital filing system can enhance efficiency, reducing time spent searching for documents later.

Frequently asked questions about the tax client info sheet form

Clients often have questions regarding the tax client info sheet form, particularly about its purpose and requirements. Addressing these questions is vital for ensuring clients are thoroughly informed and comfortable throughout the filing process.

By anticipating these questions, tax preparers can provide further guidance, enriching the client experience and increasing satisfaction.

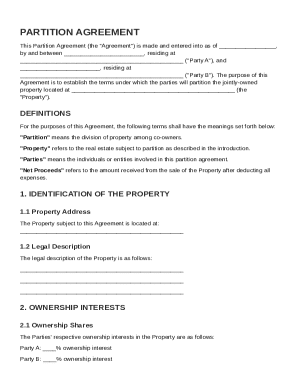

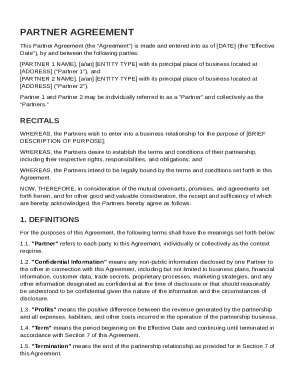

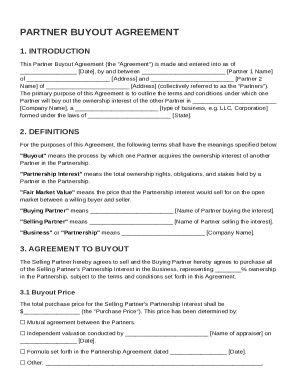

Related forms you might need

In addition to the tax client info sheet form, various other forms and documents may be necessary for a comprehensive tax filing process. Tax preparers should be familiar with related forms that can help streamline preparations for their clients.

User insights and experience

Gathering user feedback on the tax client info sheet form enhances its overall usability and effectiveness. By understanding what users value and what challenges they face, continuous improvements can be made to optimize the experience.

Getting started with pdfFiller

First-time users of pdfFiller can navigate the platform with ease, thanks to its intuitive design. The straightforward account creation process allows users to start benefiting from the platform's features swiftly. After establishing an account, users can explore all available templates, including tax client info sheets.

By taking these steps, individuals and teams can truly harness the power of pdfFiller for effective document creation and management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit tax client info sheet in Chrome?

Can I sign the tax client info sheet electronically in Chrome?

Can I create an electronic signature for signing my tax client info sheet in Gmail?

What is tax client info sheet?

Who is required to file tax client info sheet?

How to fill out tax client info sheet?

What is the purpose of tax client info sheet?

What information must be reported on tax client info sheet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.