Get the free Tax Preparation Checklist: Documents You Need Before ...

Get, Create, Make and Sign tax preparation checklist documents

Editing tax preparation checklist documents online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax preparation checklist documents

How to fill out tax preparation checklist documents

Who needs tax preparation checklist documents?

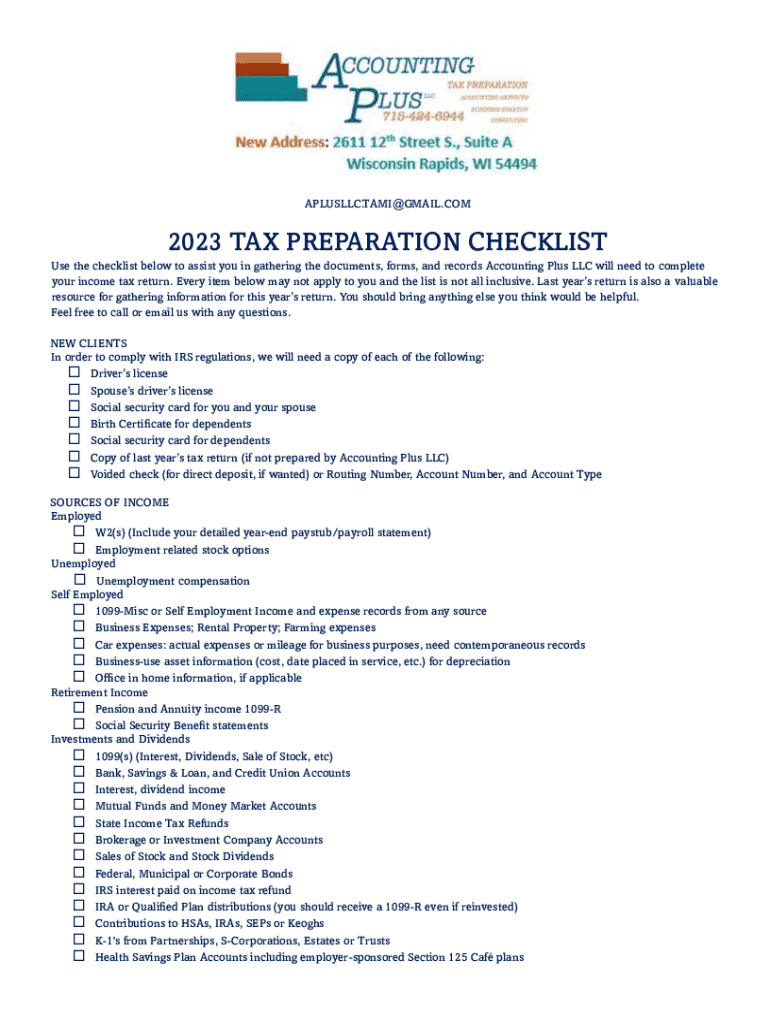

Essential Tax Preparation Checklist Documents Form for 2023

Understanding the importance of a tax preparation checklist

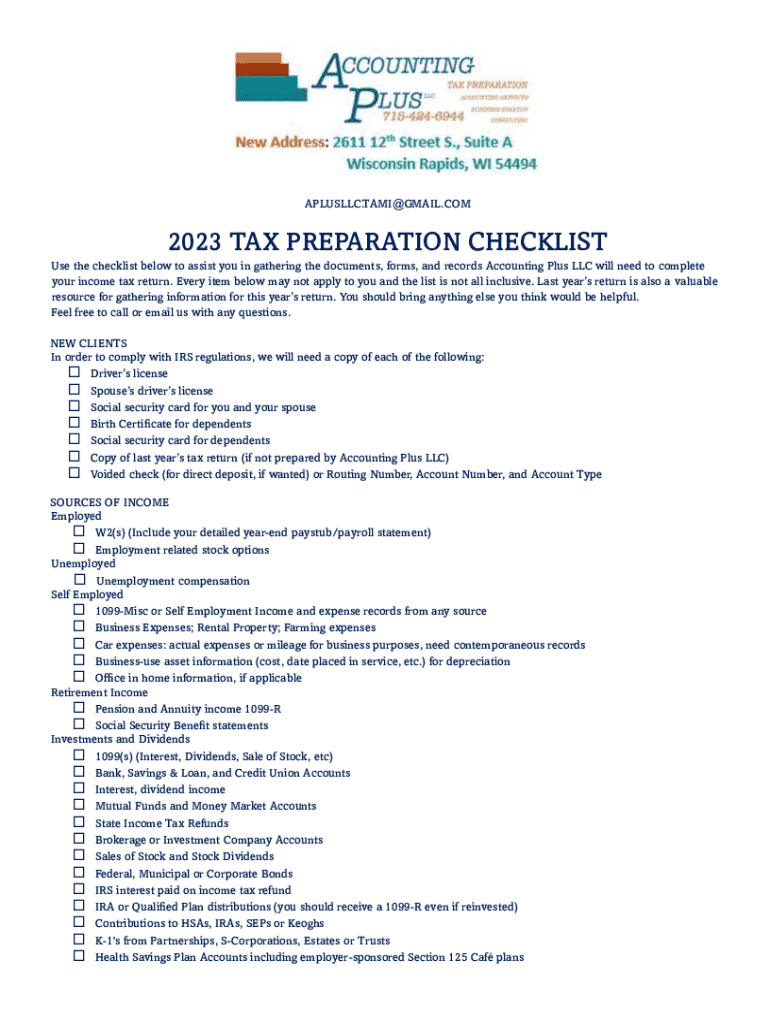

A tax preparation checklist is vital for efficient and organized filing of tax returns. With complexities in tax regulations and numerous documents required, having a checklist helps ensure that nothing is overlooked. This meticulous approach can save time, reduce stress, and potentially maximize deductions and credits.

The benefits of organized document submission cannot be underestimated; it minimizes the chances of missing deadlines and avoids penalties. With a comprehensive tax preparation checklist, you’ll be better equipped to manage your financial records for both personal and business accounts, whether you've received W-2s from employers or 1099s for freelance work.

Overview of key tax preparation documents

Having the right documents on hand is crucial for preparing your taxes accurately. Here's a breakdown of the essential categories of documents you’ll need.

Preparing your tax forms

Once you have all necessary documents, the next step is preparing your tax forms. Depending on your financial situation, the primary forms will typically include IRS Forms 1040 or 1040-SR, along with any additional schedules required for specific deductions or credits.

Selecting the right tax preparation software or service can also be pivotal. Consider factors such as ease of use, support options, and cost. pdfFiller offers a seamless cloud-based solution, enabling users to edit PDFs, eSign documents, and collaborate efficiently on tax forms from anywhere.

Step-by-step tax preparation process

The tax preparation process can be broken down into several manageable steps, which will help ensure that the process is thorough and efficient.

Digital tools for efficient tax preparation

Utilizing digital tools can streamline your tax preparation significantly, enhancing both efficiency and accuracy. Interactive tools, such as those available on pdfFiller, can assist in managing forms and collecting signatures smoothly.

The benefits of editing PDFs online are expansive; options for real-time collaboration enable both teams and individuals to achieve optimal outcomes collaboratively. Furthermore, with eSignature capabilities, signing tax forms digitally becomes a hassle-free experience, eliminating the need for physical paperwork.

Filing your tax return

Once everything is prepared, the next step is to file your tax return. There are various options for submission, each with its pros and cons. E-filing is generally faster and allows for quicker refunds, while mailing your return can be more traditional.

Be mindful of deadlines and important dates to avoid penalties, and keep track of what to do after filing, such as checking your refund status and maintaining records for future reference. Proper documentation will make things easier during your next tax cycle.

Troubleshooting common tax preparation issues

Even with the best preparation, issues may arise during the tax filing process. If you find mistakes on your tax return, understanding how to rectify them is essential. Consulting resources on the IRS website can guide you through the correction process.

Additionally, if you are faced with IRS inquiries or audits, having organized documentation will be your best defense. Utilizing pdfFiller can also aid in managing document organization post-filing, ensuring you have everything you need readily accessible.

Tips for future tax preparation

Maintaining organized records year-round is critical for an efficient tax preparation process. Best practices include categorizing receipts and documents monthly, storing electronic copies securely on your computer, or using a cloud-based solution.

Keep yourself informed on tax law changes, as this knowledge can impact your tax filings significantly. Engaging with tax professionals or utilizing e-learning tools will help keep your skills and knowledge sharp.

Utilizing pdfFiller for ongoing document management

pdfFiller enhances your document handling capabilities, offering features that support unlimited storage and accessibility to your vital data. With a cloud-based platform, teams can collaborate from different locations effortlessly.

The benefits of using pdfFiller extend beyond tax season, helping you manage various types of documentation with ease. Its user-friendly interface and robust functionalities make it an essential tool for individuals and businesses alike.

Conclusion: Streamlining your tax preparation journey

In summary, utilizing a tax preparation checklist documents form is crucial for successful and timely tax filing. With organized documentation and available digital tools like those offered by pdfFiller, you can streamline the entire preparation process, allowing for a more stress-free experience. Ensuring everything is in order not only enhances accuracy but can also maximize potential tax refunds, making your tax season a lot less daunting.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in tax preparation checklist documents without leaving Chrome?

How do I edit tax preparation checklist documents straight from my smartphone?

How do I complete tax preparation checklist documents on an iOS device?

What is tax preparation checklist documents?

Who is required to file tax preparation checklist documents?

How to fill out tax preparation checklist documents?

What is the purpose of tax preparation checklist documents?

What information must be reported on tax preparation checklist documents?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.