Get the free small business declaration - Alameda Superior Court

Get, Create, Make and Sign small business declaration

Editing small business declaration online

Uncompromising security for your PDF editing and eSignature needs

How to fill out small business declaration

How to fill out small business declaration

Who needs small business declaration?

Small Business Declaration Form - How-to Guide Long-Read

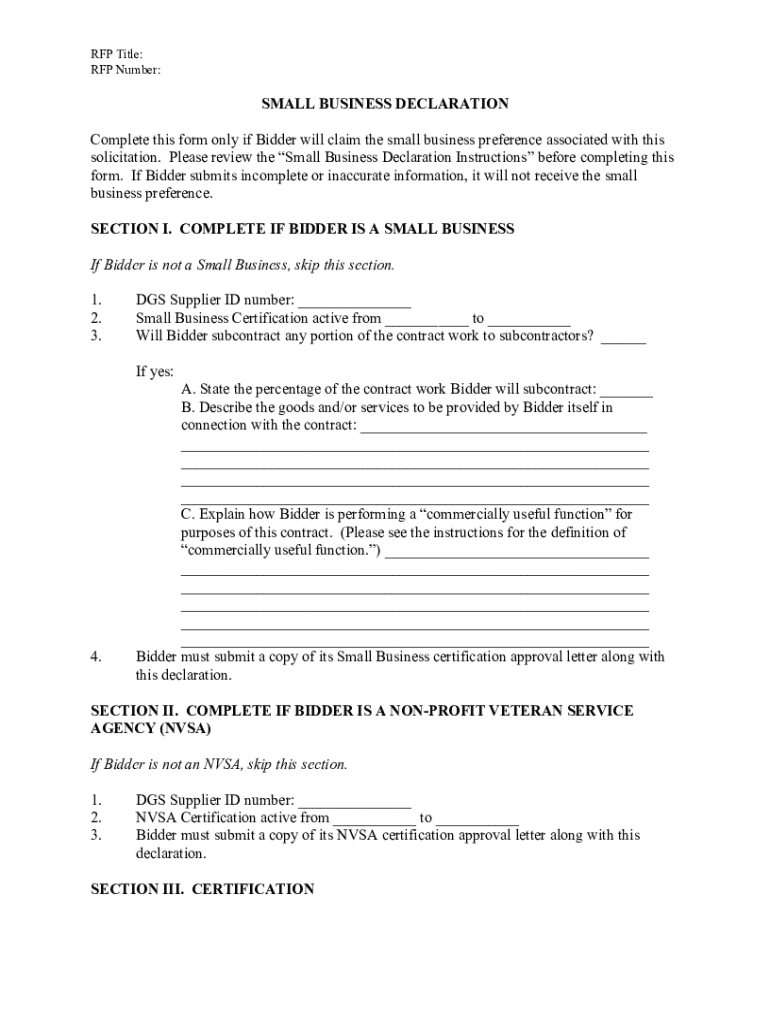

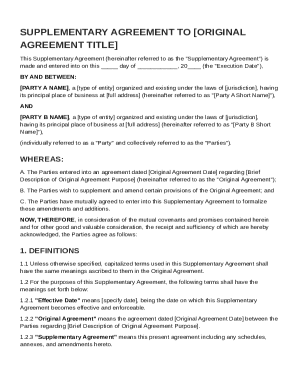

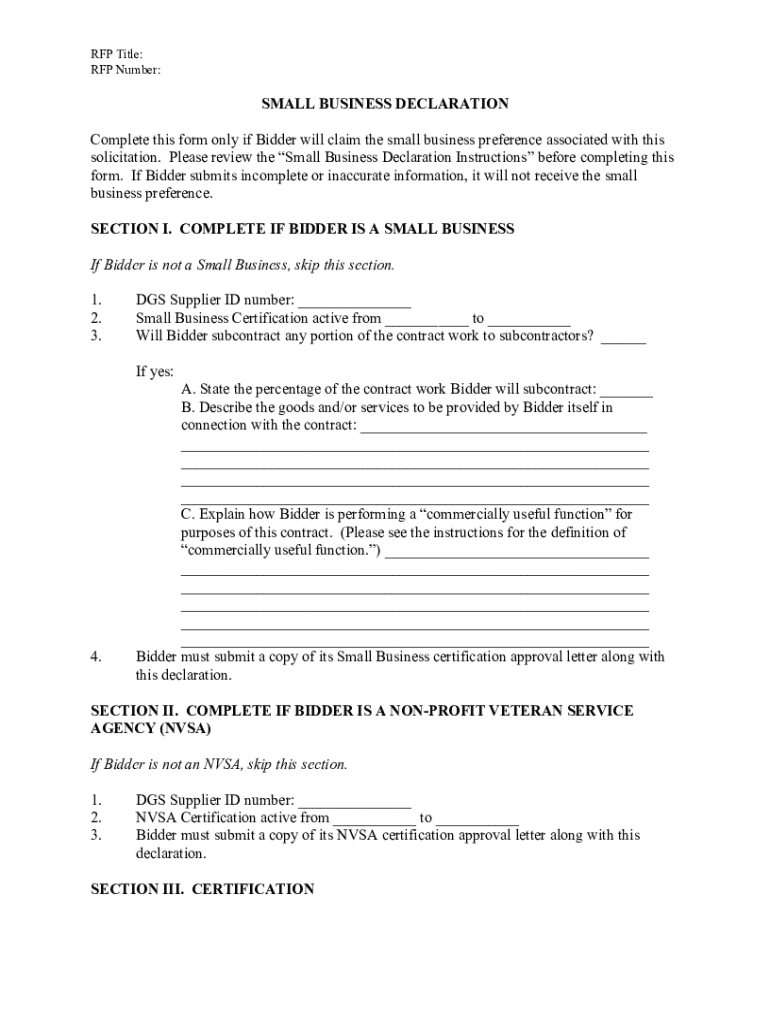

Understanding the small business declaration form

A Small Business Declaration Form is an essential document that verifies the details of a small business. It establishes the business's existence, outlines its operations, and confirms its compliance with local regulations. In the United States, local and state governments often require this form for various operational, financial, and legal purposes. Beyond mere compliance, this document serves as a cornerstone for trust and credibility in business dealings, particularly for those seeking government contracts or funding.

The importance of this form cannot be overstated for small business owners since it offers a formalized means to assert their claims and rights in the marketplace. It effectively communicates to government organizations, potential investors, and partners the legitimacy and operational framework of the business. By properly filling out this form, small business owners establish a clear picture of their operations while safeguarding their interests against potential liabilities.

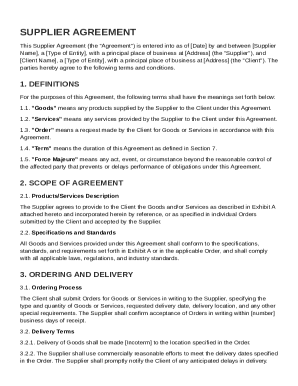

Elements of the small business declaration form

When preparing your Small Business Declaration Form, it’s crucial to include specific elements to ensure compliance and clarity. Essential information should encompass the business name and physical address, as well as the owner’s personal details such as name, contact information, and tax identification number. Furthermore, it should accurately reflect the nature of the business activities—detail whether it is a service industry, retail, or manufacturing.

Common sections found within the declaration form include a segment on business structure, which distinguishes between sole proprietorships, partnerships, and corporations. It’s equally critical to include sections for financial disclosures, where you might need to provide data related to revenue and expenses. Lastly, a vital component is the declaration of compliance with local laws, confirming that the business adheres to regulations set forth by governing bodies, which often plays a role in funding and grants.

Steps to fill out the small business declaration form

Successfully completing your Small Business Declaration Form involves several straightforward steps. The first step is gathering all necessary information. This includes documentation such as your business license, tax ID number, and financial records. Ensuring you have these documents organized can save time and prevent frustrating delays when filling out the form.

Next, take your time completing the form accurately. Each section should be filled out with care to ensure it reflects your business operations correctly. Be especially cautious with your financial data, as inaccuracies here may lead to compliance issues. It’s common to make mistakes when rushing through the process; therefore, familiarizing yourself with each section and understanding what information is required is crucial.

Finally, upon completing the form, review it meticulously. Check against a checklist that ensures you haven’t missed anything crucial, such as signatures or important disclosures. Accuracy and honesty in the information provided are vital, as discrepancies could result in complications with government agencies or other stakeholders.

Editing and customizing your form

Editing and customizing your Small Business Declaration Form can be a seamless process with online tools like pdfFiller. This cloud-based solution allows you to upload your form easily, making modifications simple and intuitive. Users find it particularly helpful due to its user-friendly interface, which speeds up the editing process considerably.

After uploading the form, you can adjust text, add or remove sections, and incorporate any additional information needed. Furthermore, pdfFiller facilitates secure electronic signatures, ensuring that sensitive information remains protected while allowing for quick approvals and collaboration. You can invite team members to review and edit the document, fostering a collaborative approach to document management that is especially beneficial to small teams.

Submitting the small business declaration form

Once your Small Business Declaration Form is complete and customized, the next step is submission. Depending on local requirements, you typically have various options for submission, including in-person or online submissions. Many government organizations now encourage online submissions, providing a more efficient way to ensure your application is processed without delays.

Understanding submission deadlines is crucial as well. Failing to submit before the cutoff can lead to complications that may affect your business operation. After submission, it's important to know what to expect. Typically, you will receive a confirmation of receipt from the government organization, and it's wise to keep a record of this confirmation for future reference. Monitoring the progress post-submission can help catch issues early on.

Managing your small business declaration form

Once submitted, managing your Small Business Declaration Form becomes an essential task. First, ensure your form is stored securely. Utilizing cloud storage solutions like pdfFiller provides an efficient and safe method for document management. This not only allows you to access your form anytime from anywhere but also serves to protect your business’s sensitive information against unexpected data loss.

When business circumstances change, it may become necessary to update your declaration. In most cases, a straightforward process exists for revising your declaration to reflect these changes accurately. Regularly reviewing and revising your declaration helps keep your business information current, directly impacting your ability to meet requirements for grants, loans, or compliance with bonded contracts.

Frequently asked questions (FAQs)

As the landscape for small business evolves, many questions arise surrounding the Small Business Declaration Form. A common concern is, 'What if my business changes?' Changes in ownership, structure, or operational scope mandate revisiting the declaration form to keep it accurate and in compliance with local regulations.

Additionally, many small business owners question whether legal assistance is necessary when dealing with these forms. Consulting with a lawyer can be invaluable, especially if your business is navigating compliance issues or complex regulations. Lastly, submitting the form can sometimes yield common issues, such as delays or errors in processing. Being aware of potential problems and having justification for your submissions can help mitigate these situations.

Success stories

Real-life success stories can illustrate the significance of the Small Business Declaration Form in action. For instance, a local food truck owner in Texas initiated their business with a proper declaration and successfully secured government funding to expand their operation, citing their strong compliance with all local regulations as a pivotal factor in gaining support. Testimonials reveal how a well-prepared declaration facilitated partnerships with larger corporations in their supply chain, proving critical for business growth.

Another example is a tech startup in California that used its Small Business Declaration Form to establish credibility when applying for grants. They received valuable feedback about their operational structure that enabled them to refine their business model and subsequently resulted in faster scaling. These success stories highlight the direct impact of thorough and compliant declarations on small businesses' prospects and viability.

Additional tools for small business management

In addition to the Small Business Declaration Form, pdfFiller offers a suite of complementary forms and templates specifically designed for small business operations. These include various financial disclosures, partner agreements, and tax forms that streamline compliance and operational management. Utilizing these tools saves time and ensures that all necessary documents are standardized and up-to-date.

Moreover, pdfFiller provides interactive tools that allow small business owners to reassess and adjust their forms as needed continuously. Features include collaborative editing, version control, and easy sharing capabilities that empower users to manage their documentation efficiently, ensuring alignment with regulatory changes and business evolution.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit small business declaration in Chrome?

Can I create an electronic signature for signing my small business declaration in Gmail?

Can I edit small business declaration on an Android device?

What is small business declaration?

Who is required to file small business declaration?

How to fill out small business declaration?

What is the purpose of small business declaration?

What information must be reported on small business declaration?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.