Get the free Public disclosure and availability of exempt organizations

Get, Create, Make and Sign public disclosure and availability

Editing public disclosure and availability online

Uncompromising security for your PDF editing and eSignature needs

How to fill out public disclosure and availability

How to fill out public disclosure and availability

Who needs public disclosure and availability?

Understanding the Public Disclosure and Availability Form: A Comprehensive Guide

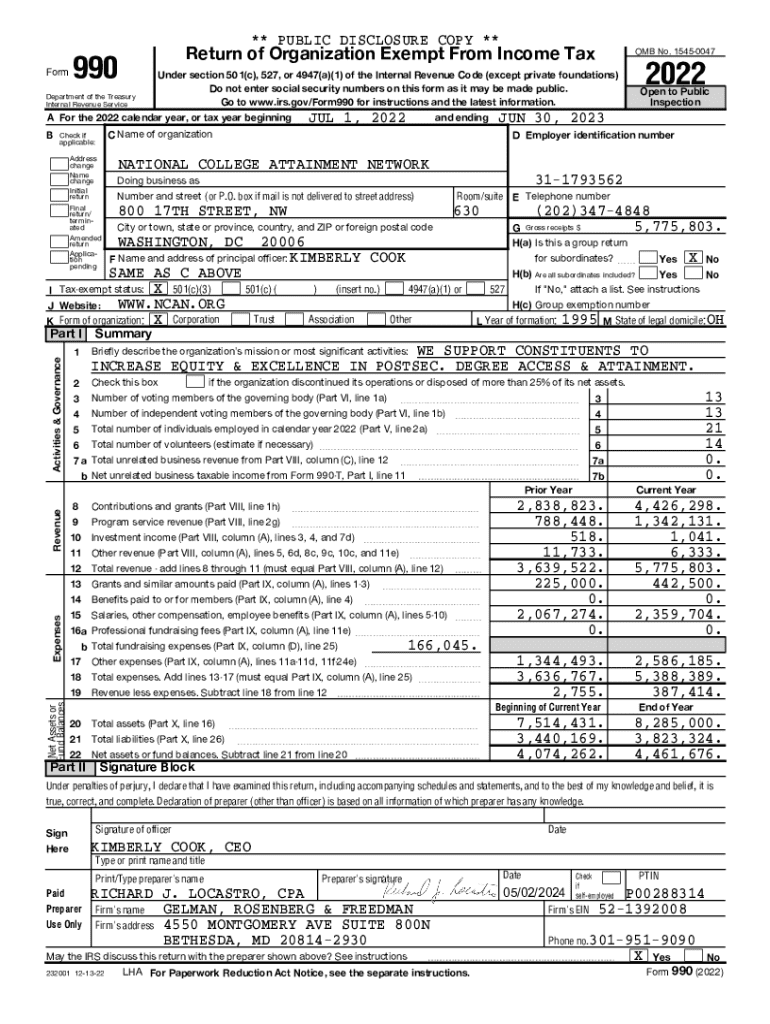

Understanding public disclosure

Public disclosure refers to the policy and practice of making certain information about an organization available to the public. This can include financial statements, funding sources, and operational details. Such transparency fosters trust and accountability, critical components in the relationship between organizations and the communities they serve.

The importance of public disclosure cannot be overstated, as it enhances organizational transparency. It allows stakeholders – from donors to beneficiaries – to assess and verify claims made by organizations. This is particularly vital for nonprofits and tax-exempt organizations that rely on public support, as evidence of responsible management can significantly impact funding opportunities.

The public disclosure and availability form

The public disclosure and availability form is a critical document that organizations must complete to comply with regulatory requirements. Its primary purpose is to ensure that essential organizational information is readily available to the public. This document serves as both a record of disclosures made by the organization and a guide for stakeholders to understand where to find this information.

Key components of the public disclosure and availability form include several essential elements. These elements not only ensure compliance with legal standards but also facilitate easier public access to information. Important components generally include:

Legal requirements and compliance

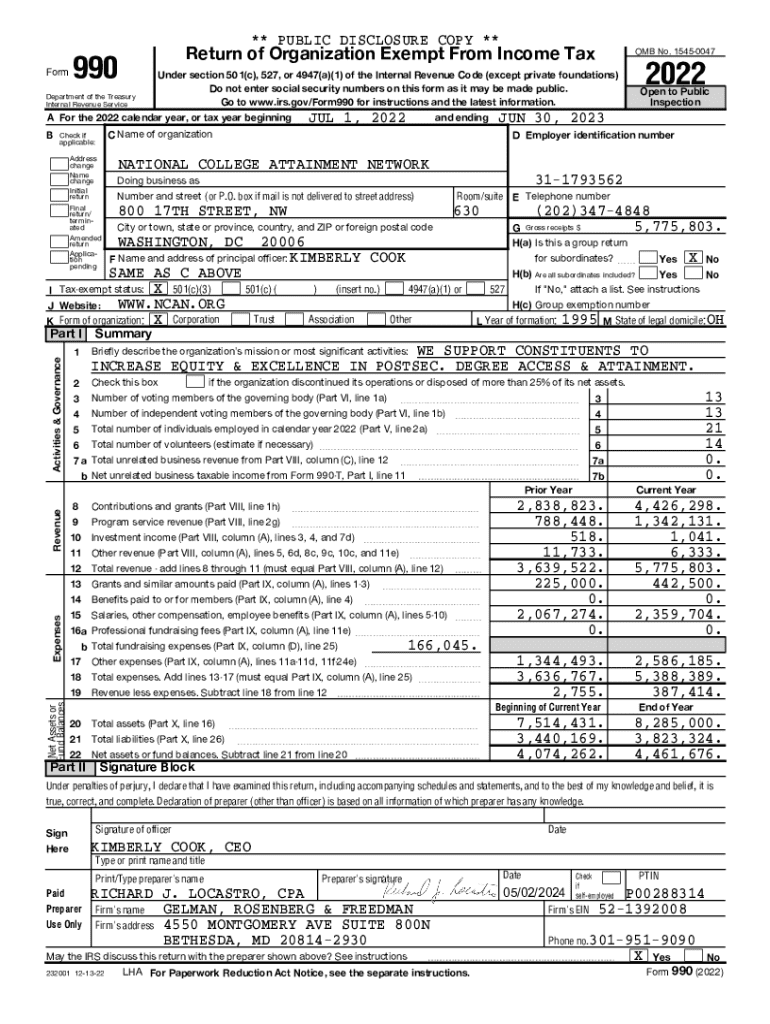

Compliance with public disclosure requirements is governed by a regulatory framework that varies based on jurisdiction. Federally, organizations must adhere to guidelines established by the IRS, particularly for nonprofits. Numerous states also have their own public disclosure laws that organizations must abide by, ensuring that local regulations are followed.

For nonprofits and tax-exempt organizations, some mandatory disclosure requirements include providing copies of Form 990, financial statements, and other supporting documents upon request. Moreover, organizations must operate under the principle of transparency, submitting disclosures on a regular schedule and maintaining an accessible repository of all public-facing documents. This fosters both accountability and builds community trust.

Step-by-step guide to completing the public disclosure form

Completing the public disclosure and availability form can seem like a daunting task. However, by breaking the process down into manageable steps, organizations can ensure thorough and accurate submissions. Follow these steps for seamless completion:

Utilizing pdfFiller for form management

pdfFiller offers a comprehensive platform that empowers users to streamline the completion process of the public disclosure and availability form. With its array of tools, users can not only fill out and edit documents efficiently but also manage them in a cloud-based environment, enhancing accessibility.

One of the standout benefits of using pdfFiller is the interactive tools available for document creation. Users can access form templates to simplify their workflows. Furthermore, pdfFiller allows easy editing of PDFs and the ability to add eSignatures, making it an essential tool for organizations aiming to maintain compliance seamlessly.

Common pitfalls and best practices

Filling out the public disclosure and availability form can present several challenges. Understanding common pitfalls can significantly enhance accuracy and compliance. For instance, organizations often overlook deadlines or misinterpret the required information, leading to errors that could result in penalties or undue scrutiny.

To avoid these common mistakes, organizations should consider the following best practices:

Frequently asked questions (FAQs)

Organizations often have questions regarding the public disclosure and availability form. Some common inquiries include:

Case studies

Exploring real-world scenarios can shed light on how organizations successfully navigate the complexities of public disclosure. For instance, a mid-sized nonprofit recently implemented a comprehensive public disclosure strategy that included regular updates to its financial statements and the acknowledgment of community feedback. This approach not only improved trust within the community but also resulted in increased funding and engagement.

Lessons learned from such case studies often highlight the importance of maintaining transparency, continual training of staff on disclosure requirements, and the integration of comprehensive form management tools like pdfFiller. Best practices observed include having a designated compliance officer to oversee disclosure responsibilities and regular audits to ensure ongoing compliance.

Resources for further assistance

For organizations looking for additional support in managing their public disclosure processes, a variety of resources are available. These include legal advisors specializing in nonprofit regulations, templates from reputable organizations, and specific links to both federal and state regulatory bodies. Engaging with professionals for guidance can alleviate confusion and enhance compliance efforts, ultimately leading to a smoother public disclosure experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find public disclosure and availability?

How do I edit public disclosure and availability on an iOS device?

Can I edit public disclosure and availability on an Android device?

What is public disclosure and availability?

Who is required to file public disclosure and availability?

How to fill out public disclosure and availability?

What is the purpose of public disclosure and availability?

What information must be reported on public disclosure and availability?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.