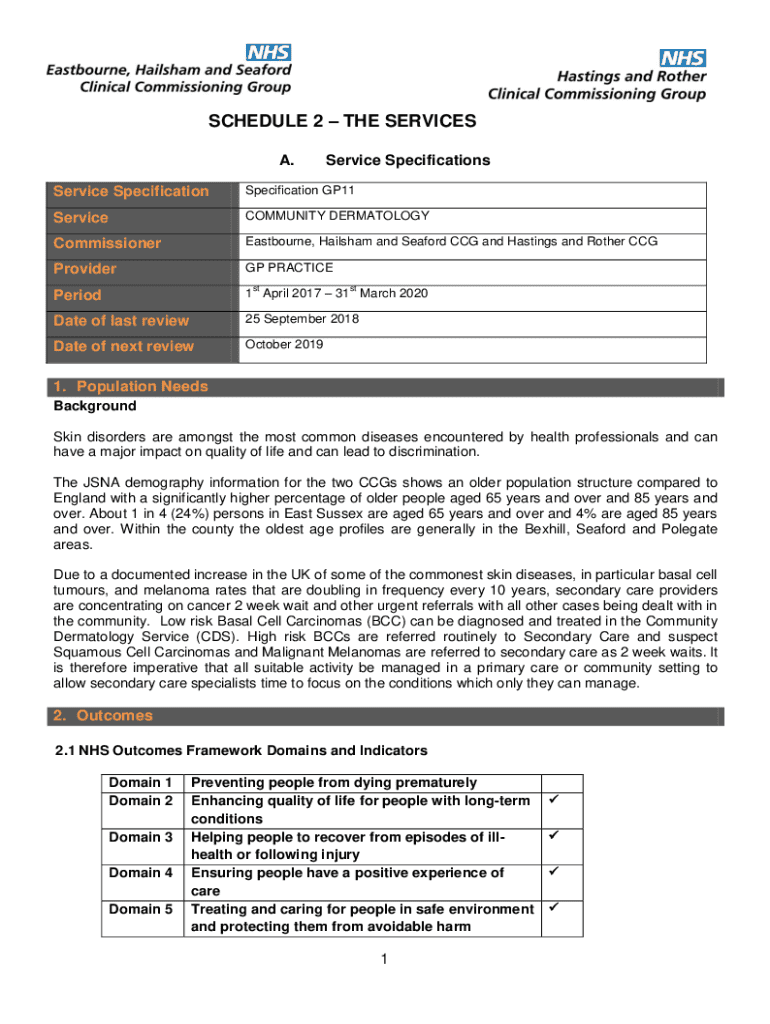

Get the free SCHEDULE 2 THE SERVICES - NHS Sussex

Get, Create, Make and Sign schedule 2 form services

Editing schedule 2 form services online

Uncompromising security for your PDF editing and eSignature needs

How to fill out schedule 2 form services

How to fill out schedule 2 form services

Who needs schedule 2 form services?

Understanding Schedule 2 Form Services Form for Effective Tax Management

Understanding Schedule 2: Essential information

Schedule 2, formally known as the Supplemental Income and Loss form, plays a crucial role in the federal tax filing process. This form is vital for taxpayers who are reporting additional income or claiming specific tax deductions that are not included on the standard 1040 form. By accurately completing Schedule 2, taxpayers can ensure their tax returns accurately reflect their total income and potential tax liabilities.

The importance of completing Schedule 2 accurately cannot be overstated. Errors or omissions may result in increased tax liabilities or delays in tax return processing. Thus, it’s essential for filers to take the time to thoroughly understand each section of the form. Checks and balances within the documentation process help to prevent common mistakes that could lead to complications with tax authorities.

Who needs to submit Schedule 2? Generally, individuals with additional income, such as capital gains, rental income, or certain credits, need to fill out this form to report their earnings accurately. Self-employed individual taxpayers must also complete this form to detail their self-employment income and any applicable deductions. Moreover, taxpayers qualifying for specific credits or deductions must ensure they report these correctly on Schedule 2 to minimize tax liabilities.

Key features of PDFfiller’s Schedule 2 form services

PDFfiller provides an extensive range of document solutions, including an intuitive platform to manage Schedule 2 form services. Leveraging PDFfiller's features allows users to simplify the process of preparing their taxes, from filling out necessary forms to obtaining electronic signatures and sharing documents for collaboration.

Using PDFfiller for Schedule 2 form services offers numerous benefits for users. Its cloud-based accessibility means that you can manage your taxes from anywhere, utilizing any device with internet access. Furthermore, PDFfiller integrates seamlessly with eSignature and collaboration tools, allowing users to finalize their forms quickly and efficiently. The platform is designed for easy editing and document management, making it a comprehensive solution for taxpayers.

Step-by-step guide: Creating your Schedule 2 form

Creating your Schedule 2 form on PDFfiller is straightforward. Start by accessing the Schedule 2 form on the PDFfiller platform. Users can locate the template in the document library by searching or browsing through categories dedicated to tax documents. Once selected, you'll have the option to customize and complete your form as needed.

Moving onto filling out the Schedule 2 form, it’s critical to gather all necessary financial information before starting. Ensure you include complete disclosures of income, along with deductions and credits you intend to claim. Common areas to scrutinize include self-employment income, rental income, and eligibility for credits that might reduce your overall tax burden. Taking the time to input these amounts correctly is essential for an accurate tax filing.

The next step is reviewing and editing your form. Utilize PDFfiller’s editing tools to make any necessary amendments. Look out for common mistakes, such as transposing numbers or omitting minor forms of income, which can lead to complications later. After verification, you can proceed to electronically sign your Schedule 2 form using PDFfiller’s eSignature feature. This simplifies the process compared to traditional paper methods.

Finally, saving and submitting your completed form is key. Users have various options for exporting their document, including printing or sharing it directly with tax authorities. Ensure you adhere to the outlined filing procedures to avoid any delays in your processing, which could impact your tax situation.

Filing Schedule 2: When and how to submit

Important deadlines for Schedule 2 submission usually align with the overall tax filing deadlines. For most taxpayers, this means submitting by April 15th annually. However, it’s critical to keep track of any changes to tax laws or dates, as these can impact filing requirements.

Schedule 2 is required annually, and taxpayers should stay proactive about tax obligations. To ensure timely submission, individuals should consider starting their tax preparation processes early in the year. This early approach can significantly mitigate last-minute stress often associated with tax season.

To confirm submission and maintain organized records, consider making use of digital systems like PDFfiller to document all filings and edited forms, which can ease any follow-up questions from the IRS or other tax authorities.

Consequences of late submission

Submitting Schedule 2 after the deadline can result in penalties imposed by the IRS. Depending on the delay, penalties can accrue annually, adding unwanted financial burden to any unpaid taxes. Delinquent filing may cost you not only in terms of direct penalties but also in potential interest accrued on any outstanding amounts.

Additionally, late submission can impact your tax return processing times. The IRS may flag your return for further examination, which could prolong the resolution of any refunds owed. To alleviate these concerns, make sure you stay on track with the due dates and utilize PDFfiller's calendaring features to remind you of crucial submission dates.

If you miss the deadline, it's advisable to file as soon as possible and pay any owed taxes promptly. This can help to mitigate some of the penalties and demonstrate responsibility to tax authorities, which could benefit you in future filings.

Additional considerations

As you navigate the complexities of your tax filings, it's helpful to be aware of related forms and schedules such as Schedule A, which deals with itemized deductions, or Schedule C for reporting self-employment income. These forms may intersect with how you complete Schedule 2 and can provide a more comprehensive view of your tax situation.

FAQs about Schedule 2 frequently arise, especially regarding filing requirements and eligibility for deductions or credits. It’s essential to research thoroughly or consult with a tax professional. PDFfiller’s resources also include direct links to related forms, allowing users to maintain an organized approach to tax preparation and documentation.

Furthermore, utilizing PDFfiller to manage other forms beyond Schedule 2 can significantly streamline tax season. Its flexibility and robust features will make navigating tax obligations smoother, while keeping all necessary documents in one accessible cloud-based space.

User success stories: How PDFfiller streamlines tax preparation

Testimonials from users showcase how PDFfiller has transformed their tax preparation processes. Many individuals and teams report a marked reduction in the time spent on filling out forms and managing documents, with one user noting their tax filing took 'half the time' compared to previous years due to the platform's efficiency.

Case studies further illuminate the benefits, detailing instances where businesses actively collaborated on the same Schedule 2 form through PDFfiller, enhancing accuracy and saving time. Visuals highlighting the before and after scenarios illustrate the stark contrast in document management ease experienced by users transitioning to PDFfiller’s services.

Advanced tools: Enhancing your experience with PDFfiller

PDFfiller’s advanced tools are designed to enhance user experience significantly. Interactive features empower teams to collaborate in real-time, allowing multiple users to work on the Schedule 2 form simultaneously. This feature is particularly advantageous for teams filing joint returns or individuals preparing taxes with family members.

Document tracking capabilities further streamline workflows, providing users with the ability to trace changes made to documents and keep a record of interactions. Understanding PDFfiller’s subscription plans also allows users to select the tier that best suits their needs, ensuring that you have access to all the necessary services for effective tax preparation without overspending.

Support and resources

Accessing help and customer support is easily done through the PDFfiller platform. Their dedicated support team is available for users experiencing challenges or seeking guidance on form completion. Additionally, the intuitive nature of the platform reduces the need for extensive support, as many features are user-friendly and straightforward.

To further enhance your knowledge, PDFfiller offers tutorials and guides on using the platform effectively for Schedule 2 and other forms. Regular webinars also provide valuable learning opportunities, ensuring that users are proficient with all aspects of digital tax filing and document management. This emphasis on user education promotes confidence and efficiency within the tax preparation process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my schedule 2 form services in Gmail?

How do I complete schedule 2 form services online?

How can I edit schedule 2 form services on a smartphone?

What is schedule 2 form services?

Who is required to file schedule 2 form services?

How to fill out schedule 2 form services?

What is the purpose of schedule 2 form services?

What information must be reported on schedule 2 form services?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.