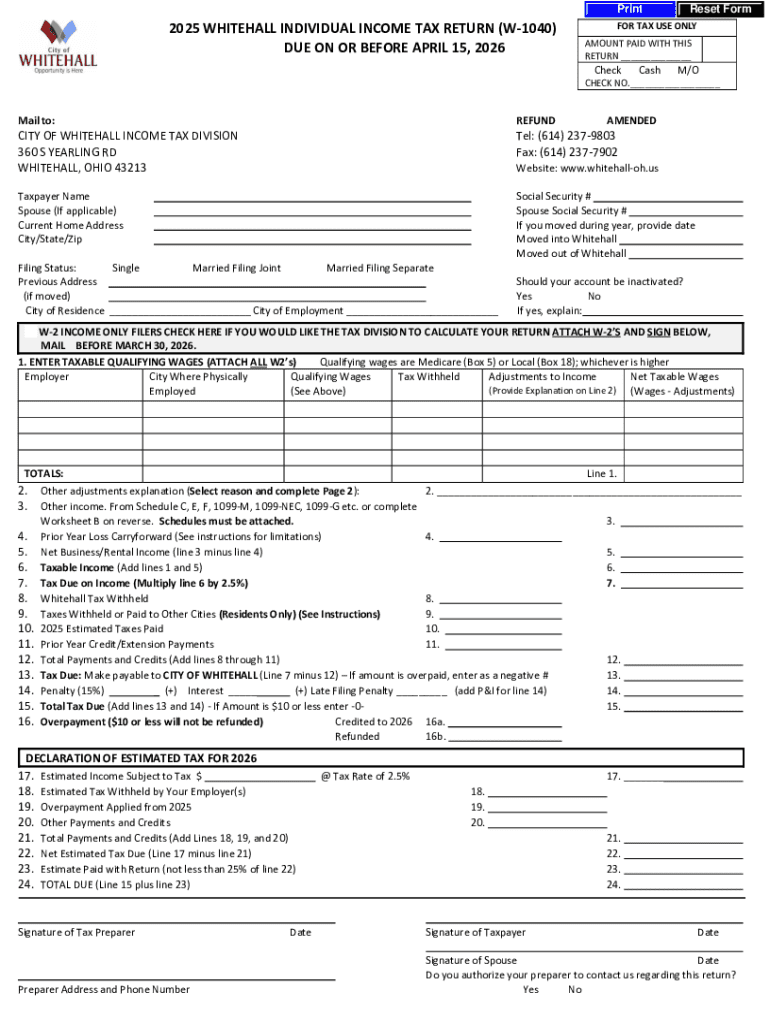

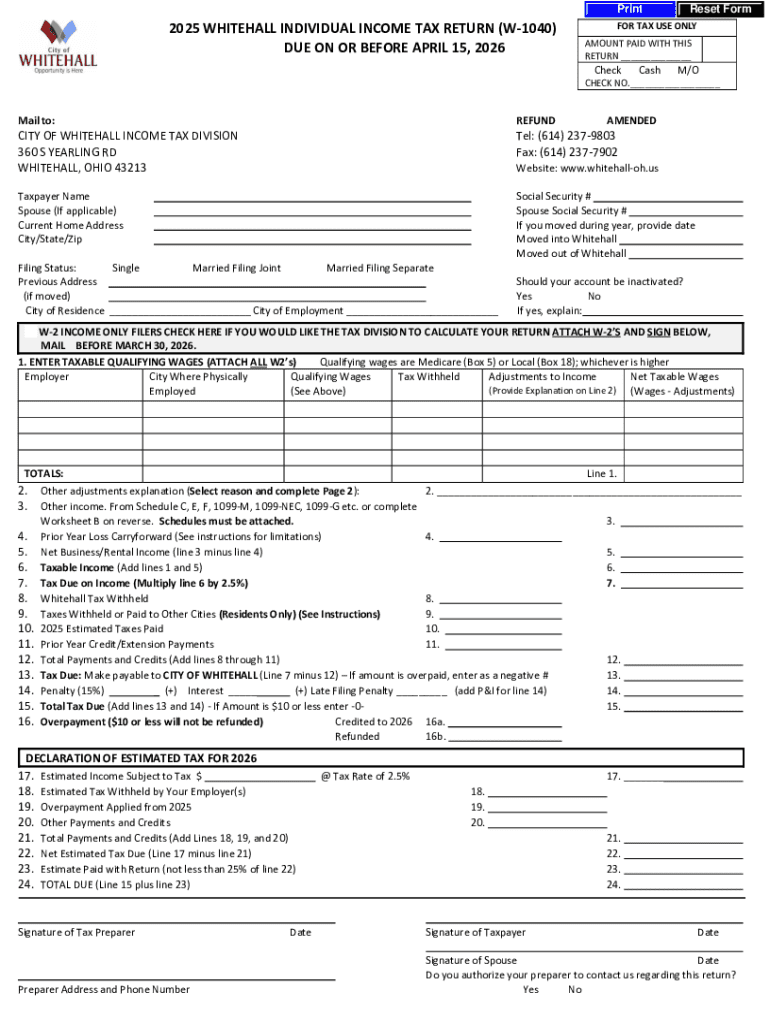

Get the free 2025 W1040 WHITEHALL INDIVIDUAL INCOME TAX RETURN LCK

Get, Create, Make and Sign 2025 w1040 whitehall individual

How to edit 2025 w1040 whitehall individual online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 w1040 whitehall individual

How to fill out 2025 w1040 whitehall individual

Who needs 2025 w1040 whitehall individual?

Understanding the 2025 W1040 Whitehall Individual Form: A Comprehensive Guide

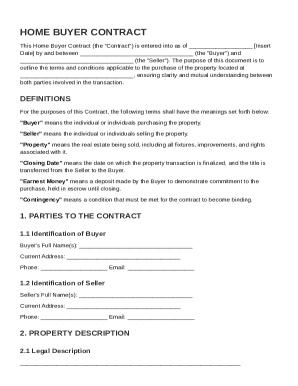

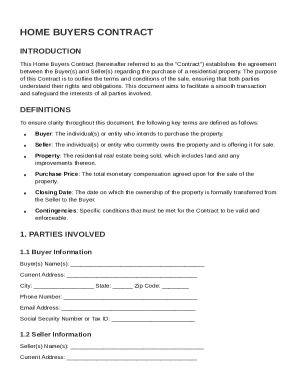

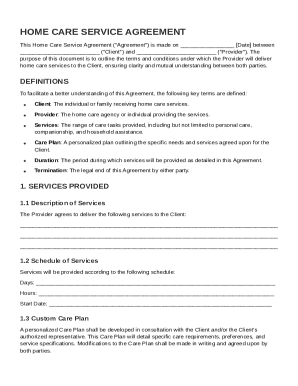

Overview of the 2025 W1040 Whitehall Individual Form

The 2025 W1040 Whitehall Individual Form serves as a crucial document in the annual tax filing process for individuals. This form is designed for taxpayers who must accurately report their income and claim deductions and credits, ensuring compliance with tax laws. In 2025, there are several key changes to this form that may affect the filing process.

These changes include revised income thresholds and updates to deductions which reflect the ongoing adjustments to the tax code. Understanding the specifics of the 2025 W1040 is imperative for taxpayers to avoid penalties and maximize potential refunds. As tax obligations become increasingly complex, especially for individual filers, the W1040 form remains an essential tool for successful navigation through the tax year.

Essential components of the 2025 W1040 form

The 2025 W1040 form consists of various sections, each integral to the complete tax filing process. The major components include:

Step-by-step guide to filling out the 2025 W1040 form

Filling out the 2025 W1040 form can appear daunting. However, with proper preparation and guidance, individuals can efficiently complete it. Here’s a structured approach:

Editing and managing the 2025 W1040 form

pdfFiller offers an array of tools to simplify the management and editing of your 2025 W1040 form. Users can upload their forms and efficiently edit as needed. For instance, if you need to adjust your deductions or update personal details, pdfFiller allows immediate modifications.

Additionally, adding eSignatures is a breeze with pdfFiller, facilitating a smooth review process alongside collaborators. Whether you are working with a tax professional or a family member, collaboration becomes seamless. Furthermore, optimal document storage within the platform ensures secure and easy access from anywhere.

Frequently asked questions (FAQs) about the W1040 form

Many individuals have questions surrounding the W1040 form, particularly regarding their personal obligations. Here are a few common queries:

Resources for additional help and support

For individuals seeking further assistance, a wealth of resources is available. The IRS website offers comprehensive guidelines regarding the W1040 form, as well as tips on how to maximize deductions and credits.

Moreover, utilizing tax planning tools and calculators can provide deeper insights into your tax situation. Engaging with online forums or communities allows individuals to connect with others who may have faced similar challenges, fostering a supportive network.

Important tax due dates for 2025

Marking key deadlines is crucial for ensuring timely tax filing. Here are important dates to keep in mind for the 2025 tax year:

Missing these deadlines can result in penalties or interest on unpaid taxes, making awareness of these due dates critical.

Utilizing pdfFiller for your tax needs

pdfFiller enhances the process of managing your 2025 W1040 Individual Form. Users can easily create, edit, and sign documents all from a central cloud-based platform.

Numerous success stories demonstrate individuals leveraging pdfFiller to streamline their tax preparation process. With features like collaboration and cloud storage, users benefit from improved efficiency and effectiveness in handling their tax documents.

Featured articles related to tax and financial planning

Enhancing financial literacy is pivotal for effective tax management. Articles addressing strategic tax planning, compliance with evolving regulations, and tips for maximizing deductions and credits can offer valuable insights.

Resources discussing the importance of financial literacy can further empower individuals with the knowledge to navigate taxes more effectively in 2025 and beyond.

Getting in touch with tax professionals

Finding a qualified tax advisor can significantly ease the burdens of tax filing. Professionals can provide tailored advice for complex financial situations, allowing individuals to maximize their opportunities and minimize liabilities.

When selecting tax preparation services, consider factors such as expertise, reputation, and compatibility with your financial goals to ensure a successful partnership.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2025 w1040 whitehall individual to be eSigned by others?

Where do I find 2025 w1040 whitehall individual?

Can I edit 2025 w1040 whitehall individual on an iOS device?

What is 2025 w1040 whitehall individual?

Who is required to file 2025 w1040 whitehall individual?

How to fill out 2025 w1040 whitehall individual?

What is the purpose of 2025 w1040 whitehall individual?

What information must be reported on 2025 w1040 whitehall individual?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.