Get the free Who can use the Brat Stand?

Get, Create, Make and Sign who can use form

Editing who can use form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out who can use form

How to fill out who can use form

Who needs who can use form?

Who can use this form: An in-depth guide

Understanding the purpose of the form

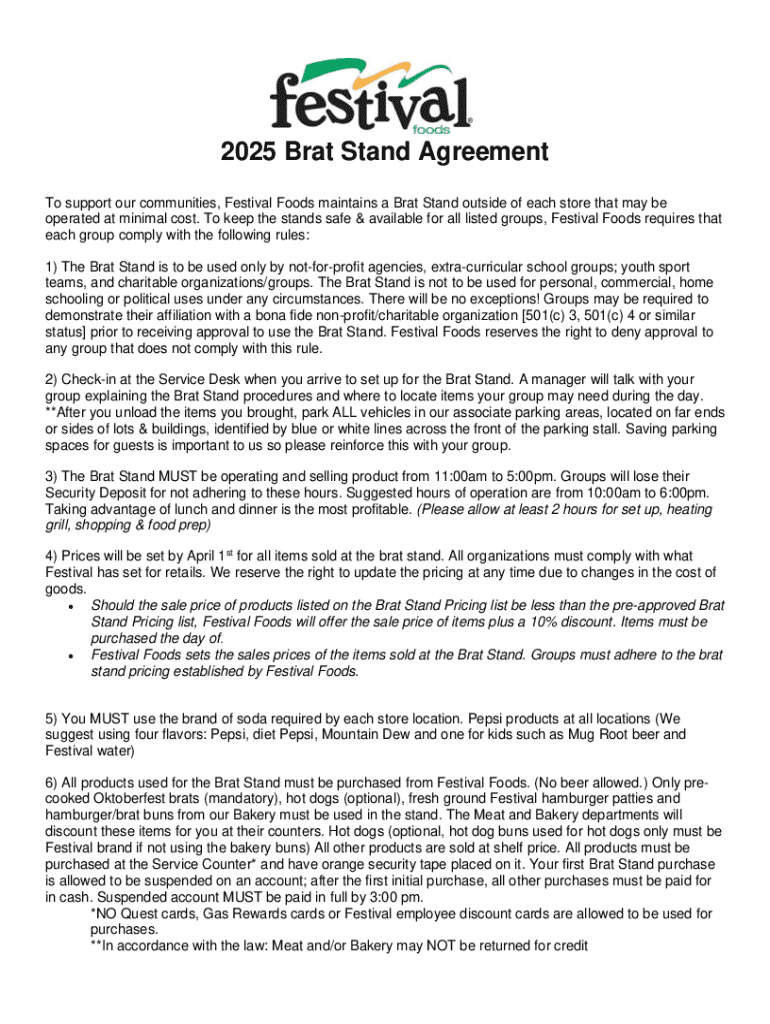

The form in question serves a multitude of purposes tailored for a diverse range of users. Primarily, it acts as a resource for individuals and organizations that need a standardized method for data collection or documentation. For example, this form may be particularly useful in situations such as tax filing, legal applications, or compliance reporting, where precise information is critical.

Key scenarios include filling tax forms for income tax returns or gathering client information for services in California. It caters to various demographics, from individual filers needing to submit financial documents to larger organizations looking to manage internal processes efficiently. Anyone needing to maintain organized records or submit official documentation may benefit from utilizing this form, especially through the streamlined features found on pdfFiller.

Eligibility criteria for using the form

To use the form effectively, specific eligibility criteria must be taken into consideration. For individuals, personal requirements, such as age restrictions, are paramount. Generally, users must be eighteen years or older to fill out forms related to financial matters, including income tax returns.

Legal residency requirements may also apply, especially for forms that pertain to taxation or benefits. Furthermore, organizations can utilize the form as long as they meet specific criteria, such as being registered entities or businesses under relevant state laws. Size or structure constraints might apply as well, with some forms designed explicitly for small businesses or freelancers. Special considerations include making the form accessible for users with disabilities, ensuring everyone can understand and complete it, which is an essential feature offered by pdfFiller.

Benefits of using the form via pdfFiller

Using the form through pdfFiller offers numerous benefits that enhance usability and efficiency. This platform is particularly designed to save users significant time, allowing seamless form completion from any device, be it a smartphone, tablet, or desktop computer. Individuals and teams alike appreciate the opportunity to collaborate on forms in real-time, which can significantly speed up the process.

Additionally, pdfFiller's robust editing and e-signing capabilities make it ideal for both individuals needing to submit income tax returns and organizations preparing contracts. For example, teams can work together on inter-departmental submissions or client contracts, which simplifies operations dramatically. The platform's user-friendly interface provides interactive tools that guide users in filling out the forms correctly.

Step-by-step instructions for using the form

To begin using the form, start by navigating to the specific form page on pdfFiller. Here, users can easily locate the required document and choose whether to download it or fill it out directly online. If opting to fill out the form online, users can take advantage of interactive features like autofill and guided prompts that simplify the process.

pdfFiller offers a comprehensive set of interactive tools designed to facilitate form completion, such as drag-and-drop capabilities for uploading additional documents, and easy-to-use text fields for direct typing. One critical feature is the eSignature tool, which allows users to legally sign documents without printing them. This enables individuals and teams to expedite their transactions securely and efficiently.

Common use cases for this form

Individuals frequently use this form for personal applications such as income tax returns and various legal documents. For instance, California residents must submit specific forms for annual tax submissions, which can easily be handled using pdfFiller's platform. The software assists users not only in organizing their documents but also in tracking their submission processes, alleviating common taxpayer frustrations.

Teams and organizations utilize the form for inter-departmental communication and client-facing requirements, such as contracts or service agreements. Case studies demonstrate how a small marketing firm efficiently manages their client contracts via the platform, significantly reducing turnaround time. Various sectors, including healthcare and education, have reported similar efficiencies through effective form use.

Key features of pdfFiller that enhance form use

pdfFiller boasts robust editing tools that cater to customization, allowing users to modify forms as necessary. This capability is particularly beneficial for those adapting templates to fit specific needs, such as varied financial submissions or bespoke client contracts. Cloud-based storage ensures that all documents are easily accessible from anywhere, facilitating a smooth workflow.

Collaboration features enable multiple users to work on the same document simultaneously, promoting a cooperative environment. Security measures, including encryption and access controls, protect sensitive information during the entire process. These features make pdfFiller an essential tool for anyone working with documents requiring confidentiality and efficient handling.

Frequently asked questions (FAQs) about the form

One common question is, 'Who is eligible to fill out this form?' The answer varies based on the specific form; however, most are designed for individuals aged eighteen and older, alongside competent organizations. Another frequent inquiry regards collaboration: 'How can multiple users collaborate on the same form?' Users can share forms through pdfFiller and work collectively in real-time, a feature that enhances productivity.

'What should I do if I need to make changes after submission?' Users can access their submitted forms for revisions, preventing common mishaps associated with traditional paper submissions. Lastly, for those wondering about support, pdfFiller offers extensive customer service channels including chat, email, and phone assistance, ensuring help is readily available for any inquiries.

Learn more about related forms

Understanding other forms can enhance users' experiences and provide additional solutions. Many individuals and organizations frequently utilize forms such as the W-2 Income Tax Reporting forms or various applications for legal proceedings. Each of these forms carries its specific requirements and parameters, which pdfFiller outlines in detailed resources on their website.

For users looking to optimize form usage, pdfFiller offers tutorials and tips readily available. Familiarity with different templates can significantly streamline the overall document handling process, allowing users to navigate legal and tax systems with ease.

Contact us for personalized assistance

For users needing support with form-related inquiries, pdfFiller provides personalized assistance tailored to individual needs. Customers can reach out via chat, email, or phone, ensuring they have multiple touchpoints for help. Additionally, links to various help centers and resources are readily available on the website, providing users with an extensive support network whenever they face challenges during their form-filling journeys.

Whether users require guidance on specific forms or seek clarification on processes like e-signing, pdfFiller's customer service team is dedicated to providing timely and effective solutions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send who can use form to be eSigned by others?

Can I create an electronic signature for the who can use form in Chrome?

How do I fill out who can use form using my mobile device?

What is who can use form?

Who is required to file who can use form?

How to fill out who can use form?

What is the purpose of who can use form?

What information must be reported on who can use form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.