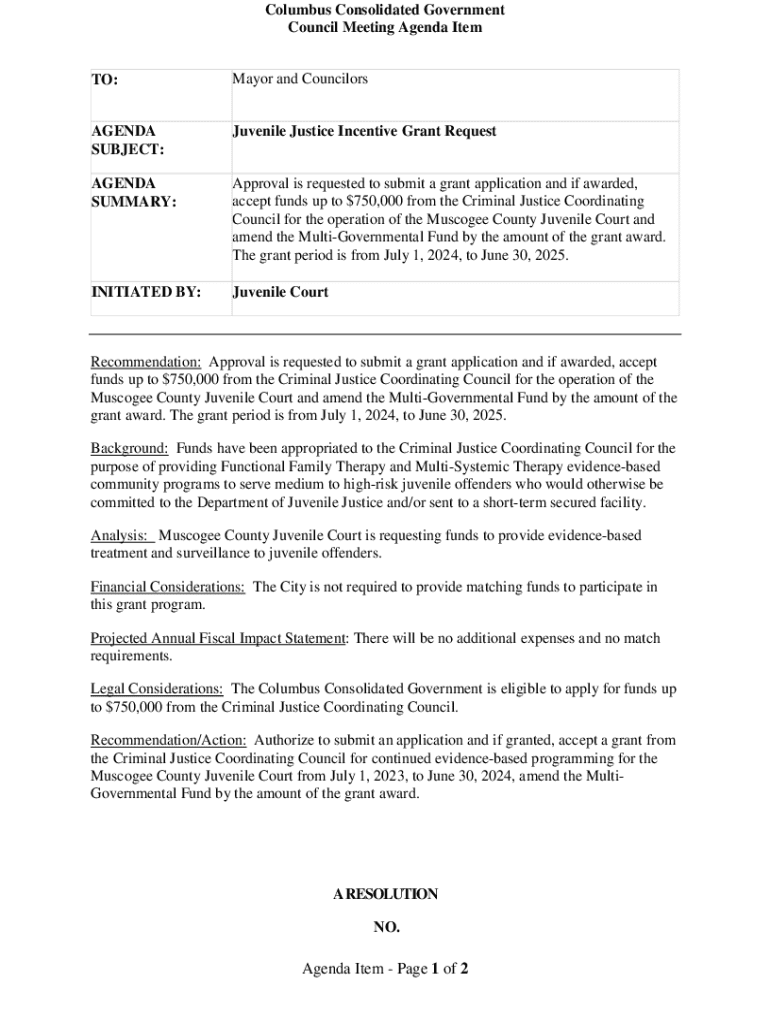

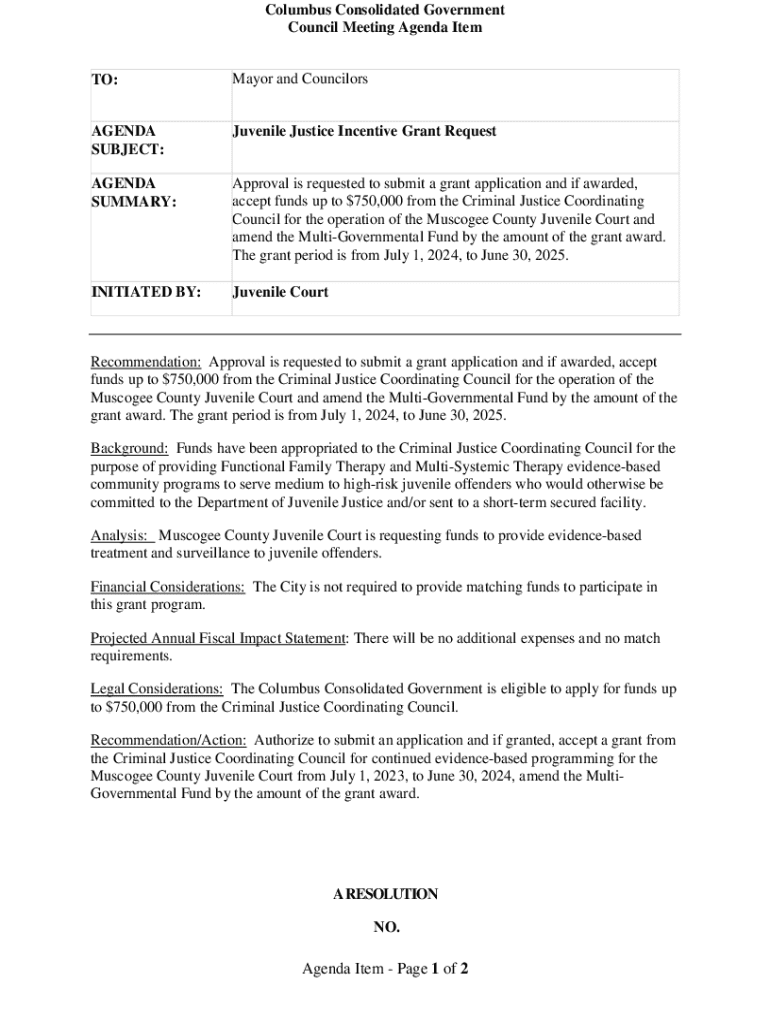

Get the free accept funds up to $750,000 from the Criminal Justice Coordinating

Get, Create, Make and Sign accept funds up to

How to edit accept funds up to online

Uncompromising security for your PDF editing and eSignature needs

How to fill out accept funds up to

How to fill out accept funds up to

Who needs accept funds up to?

Accept funds up to form - How-to Guide

Understanding the concept of accepting funds through forms

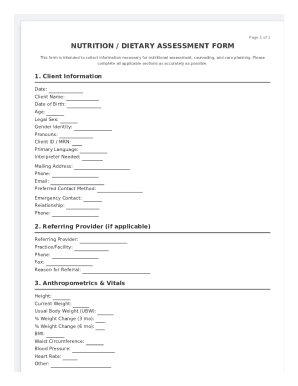

Accepting funds through forms has revolutionized financial transactions for businesses and individuals alike. This method offers a streamlined payment process that reduces friction, allowing users to make payments quickly and efficiently. By integrating payment options directly into forms, organizations can enhance user experience, boosting conversion rates and overall satisfaction.

Digital forms have not only supplanted traditional methods like paper invoices and checks but have also set a new standard for customer interactions. They provide a seamless platform where various payment options, including credit cards and digital wallets, can coexist effortlessly.

Overview of pdfFiller's capabilities

pdfFiller stands out as a cloud-based document management platform designed for easy document creation and collaboration. Its feature set promotes user-friendly interactions, making it easy for individuals and teams to navigate their document-related tasks. pdfFiller allows users to create, edit, eSign, and manage documents from virtually anywhere, streamlining the entire workflow.

When it comes to accepting funds, pdfFiller simplifies the process with built-in payment integration options that allow users to receive payments seamlessly. Its compatibility with various payment processors ensures that users can choose the option that best fits their needs, making it an ideal choice for those looking to accept funds up to form.

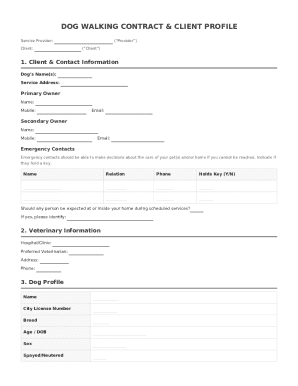

Setting up your form to accept funds

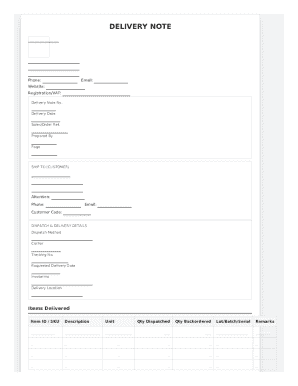

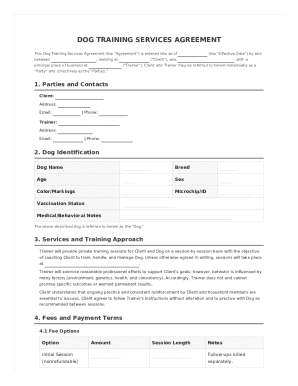

Setting up a form to accept funds involves several critical steps. First, you must choose the right form template that aligns with your goals. pdfFiller offers interactive tools for template selection, allowing you to customize the look and feel of your form to match your brand’s identity.

Next, you'll need to add payment fields. pdfFiller supports various types of payment fields, such as credit card options, PayPal, and more. This process can be accomplished seamlessly within the form editor, making it simple even for users with no technical background. Finally, it's essential to configure your payment settings effectively. Consider setting the currency, pricing structures, and any other vital settings to ensure smooth transactions.

Ensuring security and compliance

Security is paramount when it comes to online payments. Using pdfFiller, your data is protected with robust encryption measures that ensure secure transactions. Customers need reassurance that their financial information is safeguarded, as breaches can lead to significant reputational damage and loss of trust.

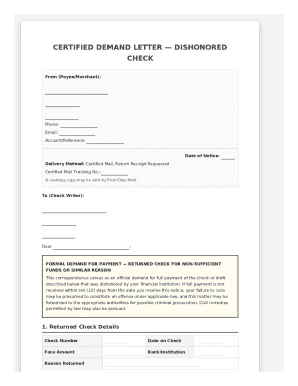

Additionally, compliance with financial regulations is crucial. Understanding and adhering to key regulations helps mitigate risks associated with accepting payments. Users must be aware of laws related to privacy, spending limits, and other governance to avoid potential penalties.

Testing your form

Testing your form before launch is essential to identify any potential issues. Running a set of tests allows you to check if your payment integrations work correctly and confirm that users can complete transactions smoothly. It’s advisable to conduct end-to-end testing for effective results.

User testing can be invaluable. By collecting feedback from test users, you can gain insights into their experience and make adjustments as needed before going live. This proactive approach not only helps in enhancing the form's functionality but also prepares you to handle actual users’ needs more effectively.

Managing transactions through pdfFiller

Once your form goes live, managing transactions becomes crucial. pdfFiller provides tools for tracking payments and records, enabling you to keep tabs on incoming funds efficiently. This tracking feature helps in reconciling accounts and ensuring that all transactions are accounted for.

In scenarios where refunds or cancellations are necessary, pdfFiller allows users to process these efficiently. The platform provides clear step-by-step instructions for managing refunds, ensuring that your operations stay hassle-free and customer grievances are handled swiftly.

Optimizing your form for better conversion rates

Design plays a crucial role in the effectiveness of your forms. To increase conversion rates, ensure your forms are user-friendly, visually appealing, and straightforward. A well-structured form should highlight call-to-action buttons and use a clean layout that guides the user towards payment.

In addition, utilizing analytics can be highly beneficial. pdfFiller’s analytics tools allow you to track user engagement and identify bottlenecks in the payment process. By using data-driven insights, you can make informed adjustments to optimize the form further.

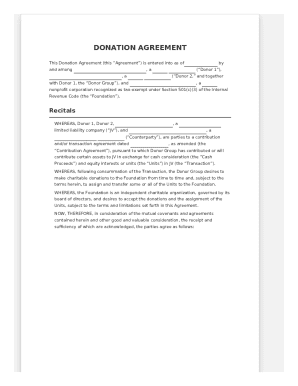

Case studies: Successful use cases of accepting funds via pdfFiller

Organizations across diverse industries have successfully adopted pdfFiller for their payment forms. For example, non-profits utilize pdfFiller to facilitate donations quickly, using easily customizable forms that align with their branding. Businesses in e-commerce leverage pdfFiller to create checks out forms that reduce cart abandonment by providing a smooth payment process.

In the education sector, institutions implement pdfFiller to manage tuition payments, allowing students to use various payment methods, ensuring accessibility and convenience. These examples highlight how accepting funds through forms can be tailored to meet specific organizational needs, enhancing overall operational efficiency.

Frequently asked questions (FAQs)

Many users face challenges when accepting funds through forms, particularly concerning payment integration issues. Common questions revolve around how to troubleshoot these integrations effectively. It's crucial to step through integration settings carefully and ensure all information is accurate to legally accept funds.

Security concerns are also prevalent among users. Addressing uncertainties surrounding data protection and encryption practices is vital while implementing payment forms. Communicating these measures transparently can significantly enhance user confidence.

Best practices for keeping your forms up-to-date

Regular updates and maintenance of your forms are crucial for ensuring compliance with changing regulations and adapting to user feedback. A proactive approach helps in addressing any security vulnerabilities timely and keeps your payment processes smooth.

pdfFiller facilitates easy updates to forms, making it simple to implement changes as needed. Whether you need to adjust pricing, add new features, or enhance compliance measures, keeping your forms current ensures a positive user experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send accept funds up to to be eSigned by others?

How do I execute accept funds up to online?

Can I create an electronic signature for the accept funds up to in Chrome?

What is accept funds up to?

Who is required to file accept funds up to?

How to fill out accept funds up to?

What is the purpose of accept funds up to?

What information must be reported on accept funds up to?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.